Strong Reliance Earnings: Positive Outlook For Indian Large-Cap Equities

Table of Contents

Reliance Industries' Robust Performance and its Ripple Effect

Reliance Industries' latest earnings report showcased impressive growth across various sectors. The company exceeded expectations, boosting investor confidence and sending positive signals to the broader market. This performance isn't just about Reliance itself; it's a powerful indicator of the health and potential of the Indian economy.

- Exceptional Growth Figures: Reliance reported a substantial percentage increase in revenue (e.g., X%) and profit (e.g., Y%), significantly outperforming analyst predictions.

- Key Growth Drivers: This remarkable performance is fueled by strong growth across its diverse portfolio, including its robust telecom arm (Jio), rapidly expanding retail business, and increasingly significant energy sector contributions.

- Analyst Endorsement: Leading financial analysts have lauded Reliance's results, echoing the positive sentiment and predicting continued growth, further solidifying the positive outlook for Indian large-cap equities. For instance, [Analyst Name] at [Financial Institution] stated, "[Quote highlighting positive outlook]."

Sector-Specific Growth Driven by Reliance's Success

Reliance's success isn't confined to its own balance sheet; it fuels growth across interconnected sectors. Its achievements create a ripple effect, benefiting other companies within the telecom, retail, and energy sectors.

- Telecom Boom: Jio's success has spurred competition and innovation in the Indian telecom sector, benefiting other players through increased market activity and technological advancements. Companies like [Competitor 1] and [Competitor 2] have also seen increased engagement and revenue as a result of the increased consumer base.

- Retail Revolution: Reliance Retail's expansion is transforming the Indian retail landscape, creating opportunities for ancillary businesses involved in logistics, supply chain management, and technology solutions. Companies specializing in these areas are experiencing substantial growth alongside Reliance's expansion.

- Energy Evolution: Reliance's investments in renewable energy sources and its focus on sustainable practices are attracting significant investment into the burgeoning Indian renewable energy sector, fostering growth for companies involved in solar, wind, and other clean energy initiatives.

- Potential Challenges: While the outlook is positive, challenges remain. Increased competition, regulatory changes, and potential economic slowdowns could impact future growth in these sectors.

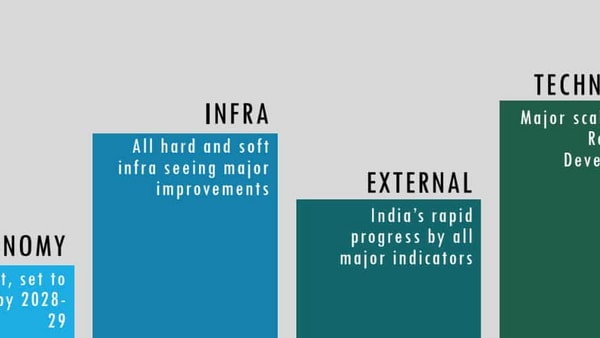

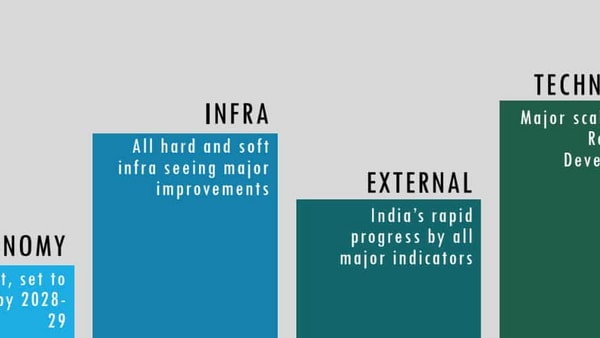

Macroeconomic Factors Supporting the Positive Outlook

The positive outlook for Indian large-cap equities is further bolstered by favorable macroeconomic conditions. India's strong GDP growth, coupled with supportive government policies and consistent foreign investment, creates a fertile ground for sustained market expansion.

- Robust GDP Growth: India's consistently strong GDP growth rate (e.g., X%) indicates a healthy and expanding economy, creating a favorable environment for investment in large-cap equities.

- Government Initiatives: Government initiatives like [Specific Government Policy 1] and [Specific Government Policy 2] are designed to boost economic growth and attract further foreign investment, creating a positive feedback loop for the stock market.

- Foreign Investment: Continuous strong foreign investment in Indian equities signifies global confidence in the Indian economy and its long-term growth potential.

- Potential Risks: Inflationary pressures, global economic uncertainty, and geopolitical risks represent potential challenges to the positive macroeconomic outlook.

Investment Strategies for Capitalizing on the Positive Outlook

The strong performance of Reliance and the overall positive macroeconomic environment present exciting investment opportunities in Indian large-cap equities. However, a well-defined strategy is crucial.

- Diversification: Diversifying investments across various large-cap stocks within different sectors can mitigate risk and maximize returns. Consider including companies like [Example Large-Cap Stock 1], [Example Large-Cap Stock 2], and [Example Large-Cap Stock 3] in your portfolio.

- Long-Term Investing: A long-term investment approach can help weather short-term market fluctuations and capitalize on the sustained growth potential of the Indian market.

- Sector-Specific Investments: Focusing on sectors that align with Reliance's success, such as telecom, retail, or energy, can yield significant returns.

- Due Diligence: Thorough research and due diligence are paramount before investing in any stock. Understanding a company's financials, business model, and competitive landscape is crucial for informed decision-making.

Conclusion: Investing in Indian Large-Cap Equities Based on Strong Reliance Earnings

Strong Reliance earnings, coupled with sector-specific growth and a positive macroeconomic environment, paint a compelling picture for Indian large-cap equities. This confluence of factors presents a significant opportunity for investors seeking substantial returns. With strong Reliance earnings signaling a positive investment outlook, now is the time to consider investing in promising Indian large-cap equities. Conduct thorough research and develop a well-diversified investment strategy to capitalize on this exciting opportunity. Don't miss out on the potential for growth in the Indian market fueled by the strength of companies like Reliance Industries and the overall positive economic climate.

Featured Posts

-

Quinoas Got Competition The Rising Star Of Superfoods

Apr 29, 2025

Quinoas Got Competition The Rising Star Of Superfoods

Apr 29, 2025 -

Trumps Plea For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025

Trumps Plea For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025 -

Is Made In America Really Worth The Struggle

Apr 29, 2025

Is Made In America Really Worth The Struggle

Apr 29, 2025 -

Former Mlb Star Johnny Damon Aligns With Trump On Pete Roses Hall Of Fame Eligibility

Apr 29, 2025

Former Mlb Star Johnny Damon Aligns With Trump On Pete Roses Hall Of Fame Eligibility

Apr 29, 2025 -

Alejandro Tabilo Triumphs Over Novak Djokovic At Monte Carlo

Apr 29, 2025

Alejandro Tabilo Triumphs Over Novak Djokovic At Monte Carlo

Apr 29, 2025

Latest Posts

-

Tremor 2 Netflix Series Kevin Bacons Potential Return Explored

Apr 29, 2025

Tremor 2 Netflix Series Kevin Bacons Potential Return Explored

Apr 29, 2025 -

A Tremors Series For Netflix What We Know So Far

Apr 29, 2025

A Tremors Series For Netflix What We Know So Far

Apr 29, 2025 -

Is Tremors Returning To Netflix Updates And Rumors

Apr 29, 2025

Is Tremors Returning To Netflix Updates And Rumors

Apr 29, 2025 -

Tremor 2 Will Kevin Bacon Return In The New Netflix Series

Apr 29, 2025

Tremor 2 Will Kevin Bacon Return In The New Netflix Series

Apr 29, 2025 -

Netflix Tremors Series Release Date Cast And Plot Speculation

Apr 29, 2025

Netflix Tremors Series Release Date Cast And Plot Speculation

Apr 29, 2025