Strengthening Regional Bonds: Trilateral Capital Market Agreement Between Pakistan, Sri Lanka, And Bangladesh

Table of Contents

Economic Rationale for a Trilateral Capital Market Agreement

The economic rationale behind a Trilateral Capital Market Agreement is compelling. Each country—Pakistan, Sri Lanka, and Bangladesh—possesses unique economic strengths. Pakistan's burgeoning manufacturing sector, Sri Lanka's tourism and services industries, and Bangladesh's robust ready-made garment exports, when combined, present a powerful synergy. A trilateral agreement leverages these strengths, creating a larger, more diversified market and attracting significant foreign direct investment (FDI).

This integrated market offers several key benefits:

- Increased foreign direct investment (FDI) inflows: A larger, more stable regional market is significantly more attractive to foreign investors seeking diversified investment opportunities.

- Improved access to capital for businesses: Companies in all three countries gain access to a wider pool of capital, fostering growth and innovation.

- Reduced reliance on individual national markets: Diversifying investment reduces vulnerability to shocks affecting a single national economy.

- Enhanced financial stability through risk diversification: A larger, more integrated market naturally mitigates risks associated with individual national market fluctuations.

- Stimulus for regional trade and economic integration: The agreement fosters increased trade and economic cooperation, accelerating regional development.

Key Features and Provisions of the Proposed Agreement

The success of the Trilateral Capital Market Agreement hinges on a well-defined regulatory framework and clear provisions. Key features of the proposed agreement should include:

- Harmonization of securities regulations and listing requirements: Streamlining regulations across the three countries simplifies cross-border investment.

- Establishment of a framework for cross-border trading and settlement: This includes efficient and secure systems for trading securities and settling transactions.

- Mechanisms for investor protection and dispute resolution: Robust mechanisms are crucial to build investor confidence and ensure fair treatment.

- Provisions for information sharing and transparency: Open and transparent information exchange builds trust and promotes market efficiency.

- Potential for a dedicated regional regulatory body or collaboration between existing bodies: A coordinated approach to regulation is vital for efficient market operation.

Challenges and Opportunities for Implementation

Despite the significant potential, implementing the Trilateral Capital Market Agreement faces certain challenges:

- Addressing political and economic uncertainties in the region: Political stability and economic predictability are essential for attracting foreign investment.

- Overcoming regulatory differences and harmonizing standards: Significant effort will be required to align regulations across the three countries.

- Investing in robust technological infrastructure to support cross-border transactions: Reliable and secure technology is crucial for efficient cross-border trading.

- Raising public awareness and building investor confidence: Promoting understanding of the agreement and its benefits is vital for its success.

- Securing international support and funding for implementation: External support can play a crucial role in facilitating the agreement's implementation.

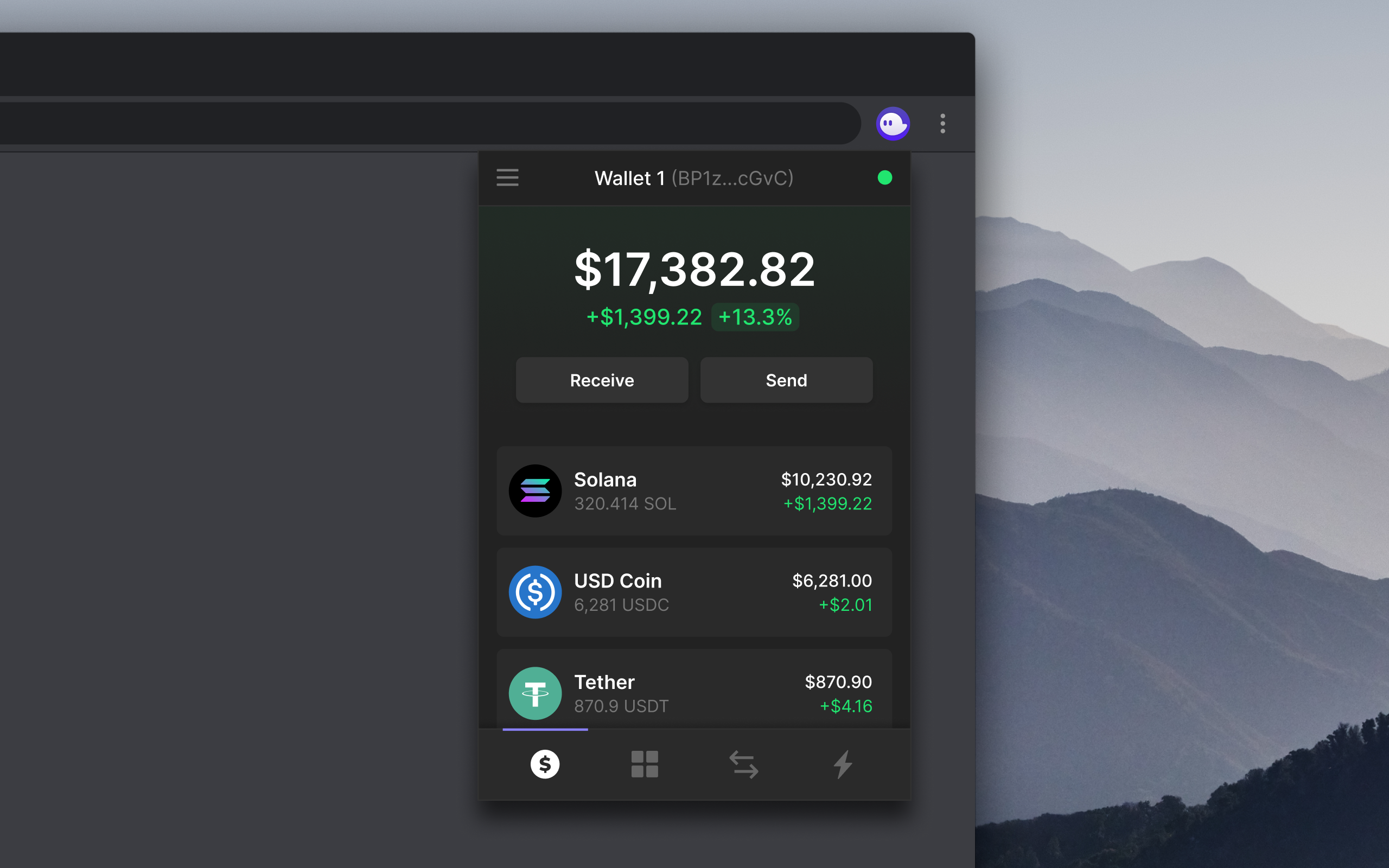

The Role of Technology in Facilitating the Agreement

Technology plays a pivotal role in overcoming these challenges. The application of fintech solutions, including e-trading platforms and blockchain technology, can streamline processes, enhance transparency, and reduce transaction costs. Secure and efficient digital systems are crucial for fostering trust and confidence in cross-border transactions. Furthermore, robust cybersecurity measures are essential to protect the integrity of the system.

Conclusion

The Trilateral Capital Market Agreement presents a unique opportunity to strengthen regional bonds between Pakistan, Sri Lanka, and Bangladesh, fostering economic growth and prosperity. By leveraging individual economic strengths and overcoming implementation challenges through collaboration and technological advancements, this agreement holds the potential to transform the South Asian economic landscape. The benefits—increased FDI, improved access to capital, and enhanced financial stability—are significant and far-reaching.

To realize this potential, continued dialogue, collaboration, and proactive engagement are essential. We must actively advocate for the successful implementation of this vital agreement. Let us work together to build a stronger Trilateral Capital Market Agreement and unlock the immense economic potential of the South Asian region. Let's foster a more integrated and prosperous future through this impactful initiative.

Featured Posts

-

Dealers Double Down Renewed Fight Against Ev Sales Requirements

May 10, 2025

Dealers Double Down Renewed Fight Against Ev Sales Requirements

May 10, 2025 -

I Enjoyed The Monkey But Kings Other 2024 Films Look Even Better

May 10, 2025

I Enjoyed The Monkey But Kings Other 2024 Films Look Even Better

May 10, 2025 -

Stock Market Today Sensex Nifty 50 Flat Amidst Bajaj Twins Losses And Geopolitical Tensions

May 10, 2025

Stock Market Today Sensex Nifty 50 Flat Amidst Bajaj Twins Losses And Geopolitical Tensions

May 10, 2025 -

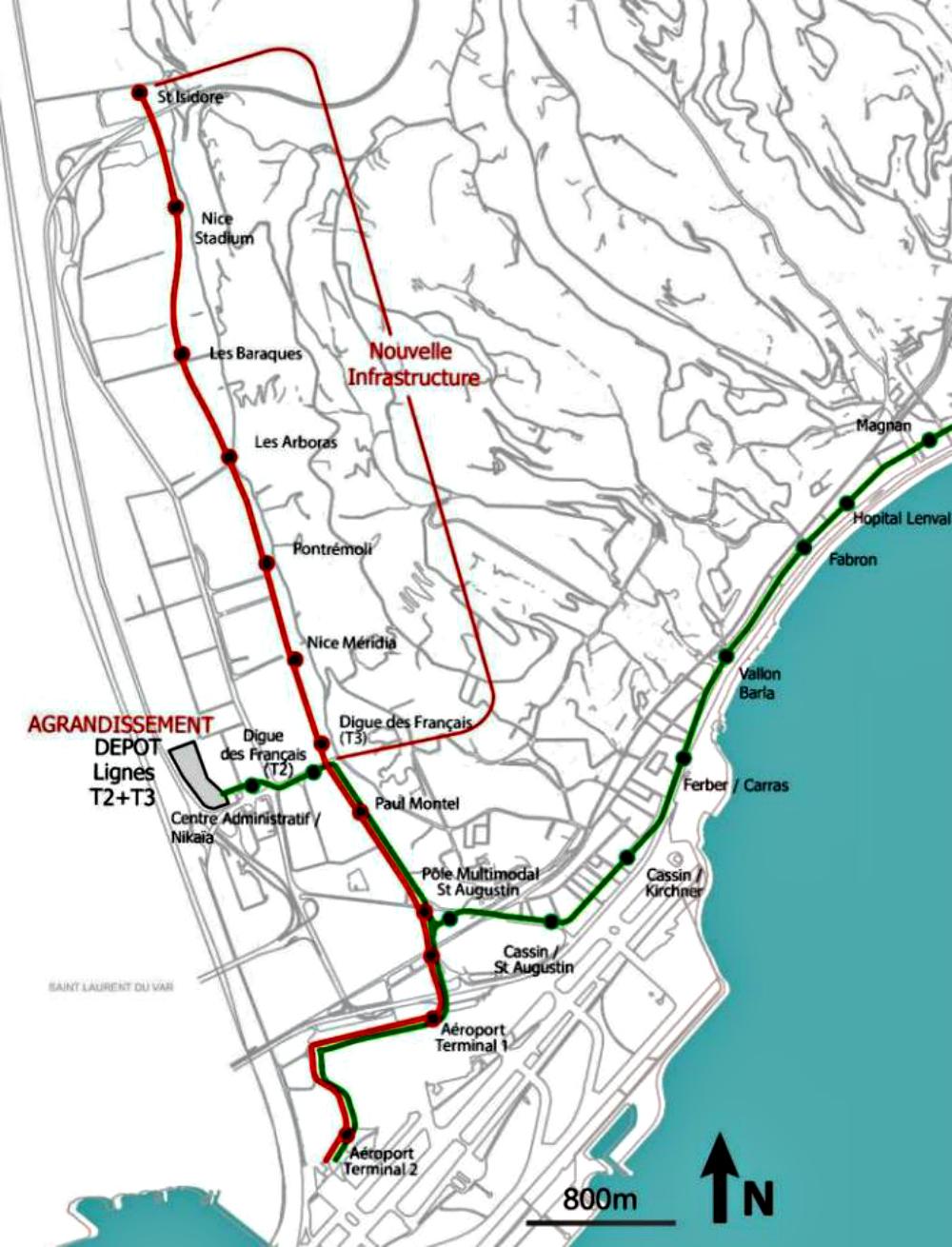

Dijon La Ligne 3 De Tram Un Projet En Concertation

May 10, 2025

Dijon La Ligne 3 De Tram Un Projet En Concertation

May 10, 2025 -

Us Ipo Filing Omada Health And Its Andreessen Horowitz Investment

May 10, 2025

Us Ipo Filing Omada Health And Its Andreessen Horowitz Investment

May 10, 2025