Strategy's $555.8 Million Bitcoin Acquisition: Key Details And Implications

Table of Contents

The Significance of MicroStrategy's Bitcoin Investment

Why did MicroStrategy buy so much Bitcoin?

MicroStrategy's massive Bitcoin purchase wasn't a spur-of-the-moment decision. It reflects a long-term strategic vision spearheaded by CEO Michael Saylor, a vocal Bitcoin advocate. The company cited several key reasons for its investment:

- Inflation Hedge: Bitcoin's limited supply and decentralized nature are seen as a hedge against inflation, protecting the company's assets from potential devaluation.

- Long-Term Investment Strategy: MicroStrategy views Bitcoin as a store of value, believing its price will appreciate significantly over time. This represents a departure from traditional investment strategies for corporate treasuries.

- Technological Advancement: MicroStrategy recognizes Bitcoin's underlying technology, blockchain, as transformative and potentially disruptive across various industries.

Michael Saylor's unwavering belief in Bitcoin's potential as a revolutionary asset has been instrumental in driving this significant MicroStrategy Bitcoin investment. He consistently emphasizes Bitcoin's superior characteristics compared to traditional fiat currencies.

Market Reaction to the Acquisition

The market reacted to MicroStrategy's Bitcoin acquisition with a mix of surprise, skepticism, and excitement.

- Initial Stock Price Dip: Initially, some investors were apprehensive about the significant allocation of funds to a volatile asset like Bitcoin, leading to a temporary dip in MicroStrategy's stock price.

- Long-Term Price Appreciation: However, as Bitcoin's price continued its upward trajectory, MicroStrategy's bold move was largely seen as a shrewd investment, and its stock price eventually recovered and even exceeded pre-acquisition levels. (Note: Charts and graphs visualizing the stock price correlation with Bitcoin price would be inserted here).

- Increased Market Sentiment: MicroStrategy's substantial Bitcoin investment influenced broader market sentiment, signaling to other companies that Bitcoin is a viable asset for large-scale investments.

Key Details of the Acquisition

Timeline of the Purchases

MicroStrategy's acquisition of Bitcoin wasn't a single event; it unfolded in stages. (Note: A detailed timeline with dates and amounts of each purchase would be included here, citing sources). Funding for the acquisition came from the company's existing cash reserves and debt financing.

Legal and Regulatory Aspects

MicroStrategy's Bitcoin holdings have raised questions about the legal and regulatory landscape surrounding corporate cryptocurrency investments.

- Accounting Standards: The company has had to grapple with the complexities of accounting for Bitcoin on its balance sheet, navigating evolving accounting standards.

- Tax Implications: Tax implications of Bitcoin holdings are another key area of consideration, and remain subject to ongoing regulatory clarifications.

- Securities Regulations: MicroStrategy's actions have prompted discussion regarding securities regulations and potential future compliance requirements for companies holding significant cryptocurrency assets. (Note: A bullet-point list of potential future regulatory hurdles could be added here).

Implications for Corporate Bitcoin Adoption

The Precedent Set by MicroStrategy

MicroStrategy's decision to invest heavily in Bitcoin set a significant precedent, influencing other corporations to consider similar strategies. Several publicly traded companies have since followed suit, adopting Bitcoin as part of their treasury reserves or investment portfolios. (Note: Examples of other companies adopting a similar strategy would be mentioned here).

The Future of Corporate Treasury Management

MicroStrategy's Bitcoin strategy suggests a potential shift in the way corporations manage their treasury assets.

- Diversification: Bitcoin offers a unique opportunity for diversification, reducing reliance on traditional, often less volatile, investments.

- Long-Term Growth: Many believe Bitcoin's long-term growth potential outweighs its short-term volatility.

- Risk Management: However, it's crucial to acknowledge the inherent risks associated with Bitcoin's price fluctuations. Proper risk management strategies are essential for companies considering similar investments. (Note: Bullet points outlining potential future trends in corporate cryptocurrency adoption, such as increased institutional investment, development of specialized Bitcoin custody solutions, and clearer regulatory frameworks, could be added here).

Conclusion

MicroStrategy's $555.8 million Bitcoin acquisition represents a pivotal moment in the history of corporate cryptocurrency adoption. This significant MicroStrategy Bitcoin investment highlights the growing recognition of Bitcoin as a viable asset class for large organizations, despite inherent volatility. The move has spurred discussion surrounding regulatory clarity, accounting standards, and the evolving landscape of corporate treasury management. The long-term implications of this bold strategy remain to be seen, but it undoubtedly marks a significant step towards wider acceptance of Bitcoin in the corporate world. Stay informed about the future of corporate Bitcoin adoption by following our blog for further insights on MicroStrategy's Bitcoin strategy and its impact on the wider financial market. Understanding MicroStrategy's Bitcoin investment and its repercussions is crucial for anyone interested in the future of finance and cryptocurrency.

Featured Posts

-

150 Bet Mgm Bonus Use Code Rotobg 150 For Nba Playoffs Betting

Apr 30, 2025

150 Bet Mgm Bonus Use Code Rotobg 150 For Nba Playoffs Betting

Apr 30, 2025 -

Becciu Vaticano Le Chat Segrete Le Accuse E Il Processo

Apr 30, 2025

Becciu Vaticano Le Chat Segrete Le Accuse E Il Processo

Apr 30, 2025 -

Schneider Electrics Global Ai Ecosystem Partner Opportunities

Apr 30, 2025

Schneider Electrics Global Ai Ecosystem Partner Opportunities

Apr 30, 2025 -

France Sanctions Apple E162 Million Penalty For Alleged Privacy Violations

Apr 30, 2025

France Sanctions Apple E162 Million Penalty For Alleged Privacy Violations

Apr 30, 2025 -

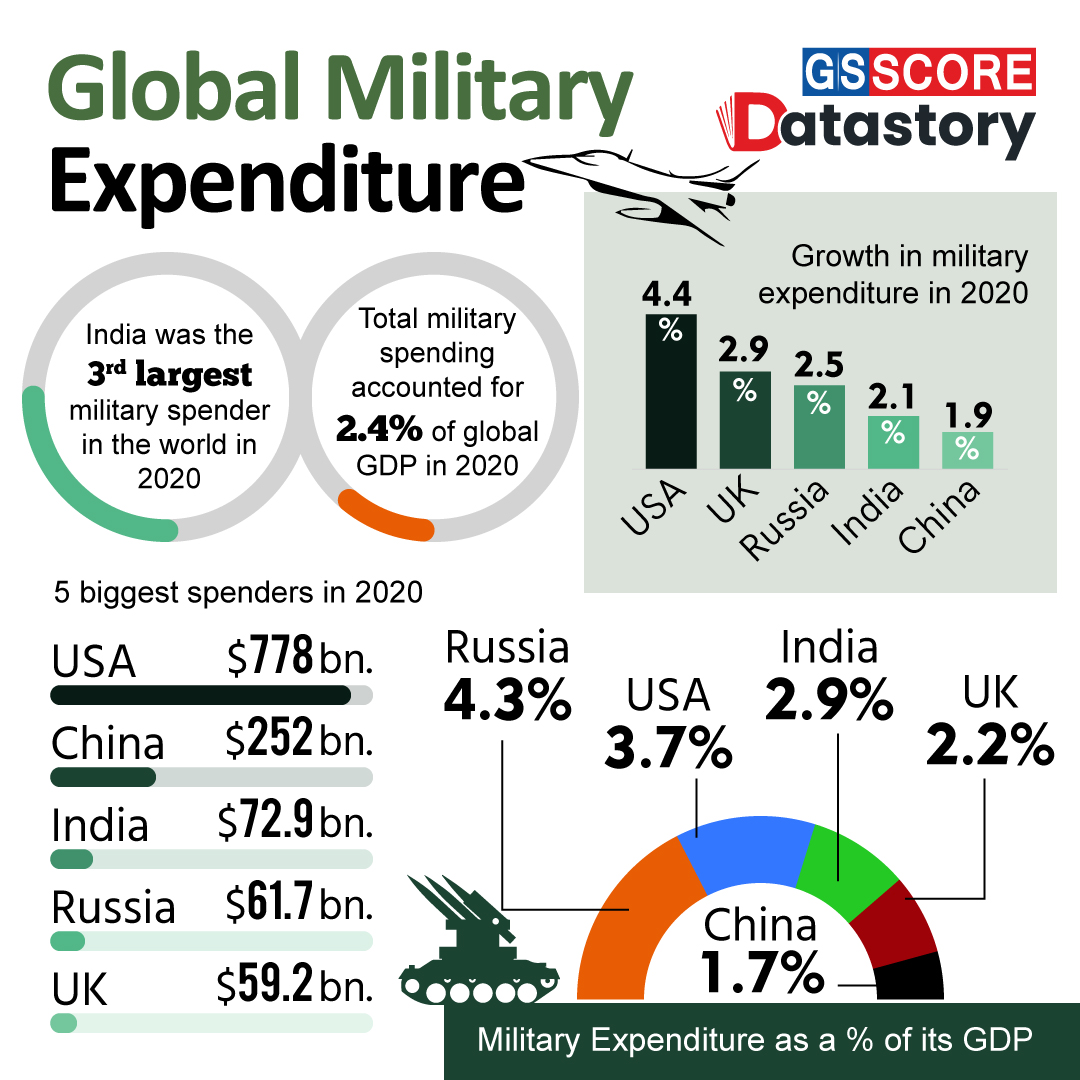

Surge In Global Military Expenditure The European Security Dilemma

Apr 30, 2025

Surge In Global Military Expenditure The European Security Dilemma

Apr 30, 2025