Stocks Up Over 10%: Sensex Rally Highlights Top Performers On BSE

Table of Contents

Sensex Rally: A Deep Dive into Market Performance

Today's market saw a remarkable upswing, signifying a positive shift in investor sentiment and economic indicators. The Sensex closed at [Insert Closing Sensex Value] representing a [Insert Percentage Change]% increase. This substantial gain reflects a significant surge in trading volume, indicating heightened investor activity and confidence. The sheer magnitude of this rally is noteworthy, surpassing expectations and marking a potentially significant turning point in the market.

- Total points gained by Sensex: [Insert Number] points

- Percentage increase compared to the previous day/week: [Insert Percentage]%

- Nifty 50 mirrored the trend: The Nifty 50, another key Indian market index, also experienced a substantial increase, reflecting the broad-based nature of this positive market sentiment.

Top Performing Stocks on BSE: Breaking Down the Winners

Several stocks on the BSE significantly outperformed the market, with gains exceeding 10%. Here are some of the top performers:

-

Stock Name (with ticker symbol): [Stock 1 Name] ([Ticker Symbol])

- Percentage increase: [Percentage]%

- Closing price: [Price]

- Sector: [Sector]

- Reason for surge: [Brief explanation, e.g., Strong Q3 earnings]

-

Stock Name (with ticker symbol): [Stock 2 Name] ([Ticker Symbol])

- Percentage increase: [Percentage]%

- Closing price: [Price]

- Sector: [Sector]

- Reason for surge: [Brief explanation, e.g., Positive industry outlook]

-

Stock Name (with ticker symbol): [Stock 3 Name] ([Ticker Symbol])

- Percentage increase: [Percentage]%

- Closing price: [Price]

- Sector: [Sector]

- Reason for surge: [Brief explanation, e.g., New product launch]

[Repeat for other top-performing stocks]

Factors Driving the Sensex Rally: Understanding the Market Dynamics

The remarkable Sensex rally is attributable to a confluence of factors, both domestic and global.

- Global market trends: Positive global cues, such as encouraging economic data from major economies and a stable geopolitical landscape, contributed to improved investor sentiment.

- Domestic economic news: Positive economic indicators within India, such as [mention specific data, e.g., strong GDP growth projections, reduced inflation], boosted investor confidence.

- Specific industry events: Significant developments within specific sectors, such as [mention specific examples, e.g., positive regulatory changes, technological breakthroughs], propelled certain stocks.

- Investor sentiment: A general increase in optimism and risk appetite among investors played a crucial role in driving the rally. This positive sentiment was further fueled by [mention factors, e.g., successful government initiatives, positive corporate announcements].

Analyzing the Implications of the Sensex Surge: What’s Next?

The implications of this significant Sensex surge are multifaceted. While the short-term outlook appears positive, careful consideration of potential risks is crucial.

- Potential for further growth: The rally could continue if positive economic trends persist and investor confidence remains high.

- Factors that could trigger a reversal: Unexpected negative economic news, geopolitical instability, or profit-booking by investors could lead to a market correction.

- Recommendations for investors: Investors should maintain a diversified portfolio and employ risk management strategies. This market rally should be viewed within a broader investment strategy.

Conclusion: Sensex Rally: Capitalizing on Stock Market Opportunities

Today's Sensex rally, with numerous stocks experiencing gains exceeding 10%, represents a significant market event. The surge was driven by a combination of global and domestic factors, creating a positive environment for many BSE-listed companies. While the sustainability of these gains needs careful monitoring, the rally presents opportunities for investors. Stay updated on future Sensex rallies and capitalize on potential stock market opportunities by following our analysis regularly. Remember to conduct thorough research and consider professional financial advice before making any investment decisions.

Featured Posts

-

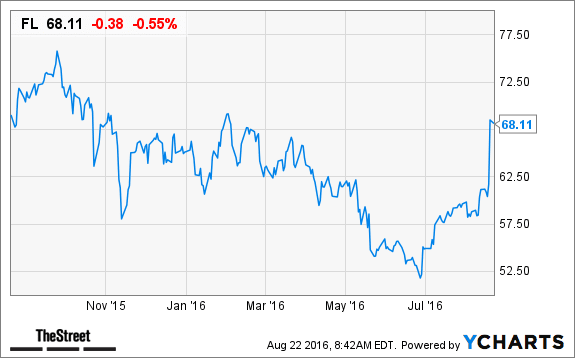

Foot Locker Stock Outlook Jefferies Weighs In On Nike Q3 Impact

May 15, 2025

Foot Locker Stock Outlook Jefferies Weighs In On Nike Q3 Impact

May 15, 2025 -

Dpr Dorong Pembangunan Giant Sea Wall Untuk Lindungi Warga Pesisir

May 15, 2025

Dpr Dorong Pembangunan Giant Sea Wall Untuk Lindungi Warga Pesisir

May 15, 2025 -

Temel Gida Ve Temizlik Ueruenlerinde Indirim Tarim Kredi Koop Ciftci Marketleri Kampanyasi 2 4 Mayis 2025

May 15, 2025

Temel Gida Ve Temizlik Ueruenlerinde Indirim Tarim Kredi Koop Ciftci Marketleri Kampanyasi 2 4 Mayis 2025

May 15, 2025 -

Gear Up For The Finals Find All Your Boston Celtics Merchandise At Fanatics

May 15, 2025

Gear Up For The Finals Find All Your Boston Celtics Merchandise At Fanatics

May 15, 2025 -

Hamer Bruins En Npo Moeten Over Leeflang Praten

May 15, 2025

Hamer Bruins En Npo Moeten Over Leeflang Praten

May 15, 2025