Stock Market Valuations: BofA's Case For Calm Amidst High Prices

Table of Contents

Keywords: Stock market valuations, BofA, high stock prices, market analysis, investment strategy, valuation metrics, economic outlook, market volatility, stock market outlook, calm amidst high prices

The current climate in the stock market is marked by high valuations, leaving many investors feeling anxious. However, Bank of America (BofA) offers a more nuanced perspective, maintaining a cautiously optimistic outlook despite the seemingly elevated prices. This article delves into BofA's reasoning, exploring their analysis of key valuation metrics, the impact of interest rates, and potential market risks. Understanding their approach can provide valuable insights for navigating the complexities of stock market valuations.

BofA's Rationale for a Cautiously Optimistic Outlook

BofA's stance isn't simply bullish; it's a carefully considered "cautiously optimistic" position. They acknowledge the high valuations but believe other factors outweigh the immediate risks of a significant market correction. Their analysis incorporates a long-term view, acknowledging short-term volatility as a normal part of market cycles.

-

Long-Term Economic Growth: BofA's outlook is anchored in their belief in sustained, albeit potentially slower, economic growth over the long term. This expectation underpins their assessment of corporate earnings and future profitability.

-

Interest Rate Hikes and Valuations: While acknowledging the impact of interest rate hikes on valuations – generally causing a contraction – BofA believes the current level of hikes is largely priced into the market. Their analysis suggests the current rates are not drastically overshooting expectations, and the market has adapted accordingly.

-

Sector-Specific Analysis: BofA's analysis isn't a blanket assessment; they identify specific sectors they see as potentially overvalued (e.g., certain technology sub-sectors) and others that remain undervalued (e.g., energy or specific financials), offering investors opportunities for targeted investment.

-

No Major Correction Predicted: BofA's assessment doesn't predict an immediate and drastic market correction. They foresee periods of volatility, but their long-term forecast remains relatively upbeat, factoring in the potential for gradual adjustments rather than a sudden crash.

Analyzing Key Valuation Metrics

BofA's cautiously optimistic view is supported by their analysis of several key valuation metrics. They likely utilize a combination of these indicators to create a holistic picture of the market's overall health.

-

Price-to-Earnings Ratio (P/E): This metric compares a company's stock price to its earnings per share. A high P/E ratio may suggest the market is overvaluing a company's future earnings potential. BofA's analysis likely considers the P/E ratios across various sectors and compares them to historical averages and industry benchmarks.

-

Price-to-Sales Ratio (P/S): This metric compares a company's market capitalization to its revenue. It's particularly useful for evaluating companies with negative earnings. BofA's assessment likely uses P/S ratios to complement the P/E analysis, providing a broader perspective on valuation.

-

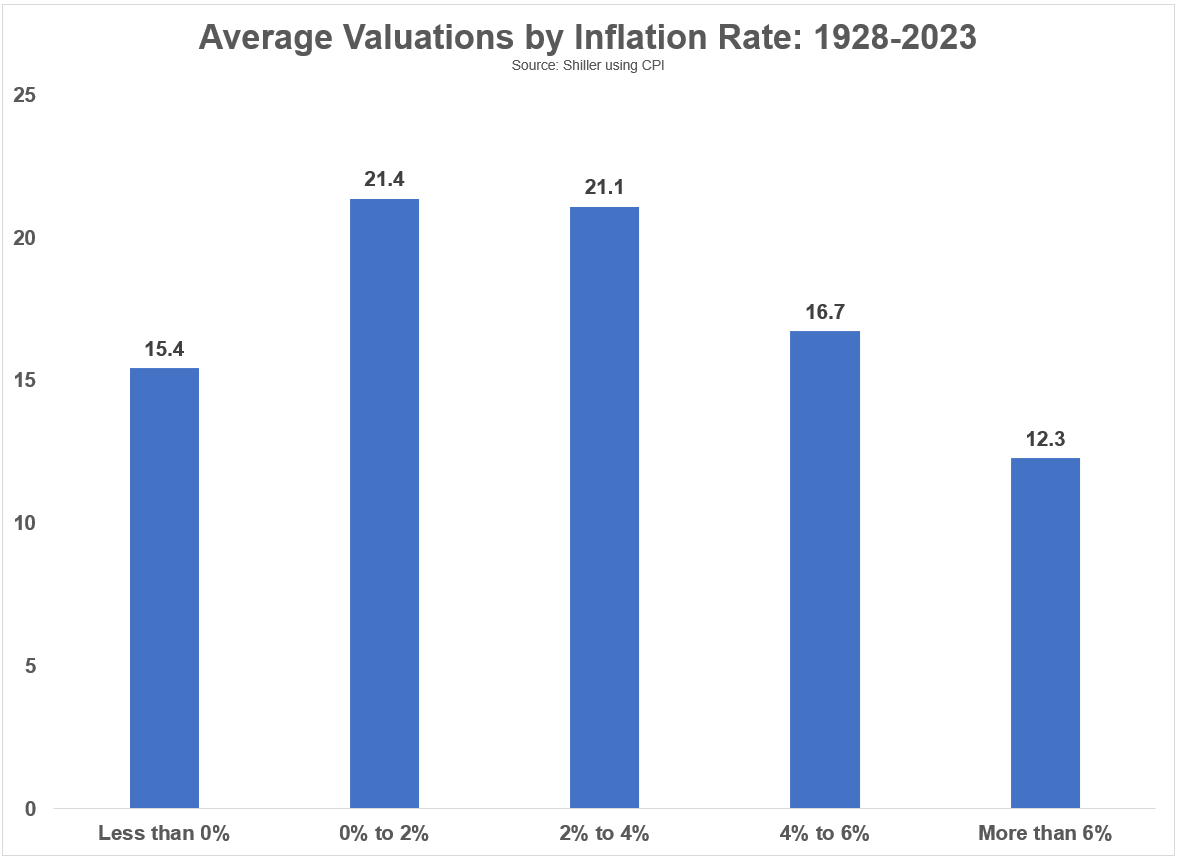

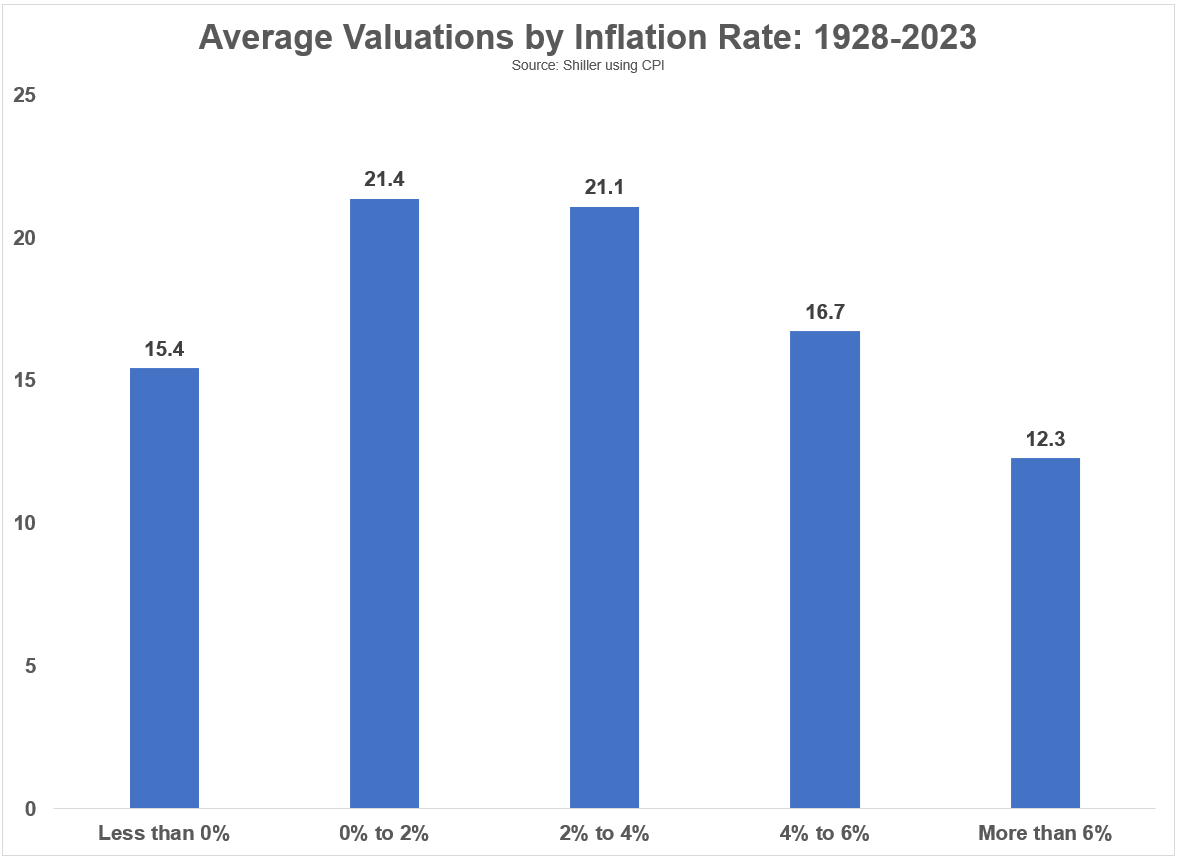

Cyclically Adjusted Price-to-Earnings Ratio (CAPE): The CAPE ratio, also known as the Shiller P/E ratio, smooths out short-term earnings fluctuations by using a 10-year average of inflation-adjusted earnings. This provides a longer-term perspective on valuation, helping mitigate the impact of short-term market cycles. BofA likely considers the CAPE ratio to provide a more stable measure of valuation compared to the standard P/E ratio.

[Insert a chart here comparing current P/E, P/S, and CAPE ratios to historical averages.]

The Role of Interest Rates in Stock Market Valuations

Interest rates play a crucial role in shaping stock market valuations. BofA's analysis considers this interplay extensively.

-

Impact on Investor Behavior: Rising interest rates often lead investors to shift their allocations towards fixed-income investments, which offer relatively higher returns compared to stocks. This can lead to a decrease in demand for stocks, impacting their prices.

-

BofA's Interest Rate Predictions: BofA's forecast for future interest rate movements is critical to their valuation assessment. Their predictions influence their projections for future corporate earnings and discount rates used in valuation models.

-

Interest Rate Expectations: Market participants' expectations regarding future interest rates are already factored into current stock prices. BofA's analysis likely takes these expectations into account, assessing whether the market is accurately pricing in the potential impact of future rate adjustments.

Addressing Potential Market Risks and Uncertainties

Despite their cautiously optimistic outlook, BofA acknowledges several potential risks and uncertainties.

-

Inflation: Persistent high inflation can erode corporate profits and investor confidence, impacting stock valuations. BofA likely incorporates various inflation scenarios into their models to understand the potential impact on their forecasts.

-

Geopolitical Events: Global geopolitical instability and conflicts can create market uncertainty and volatility, affecting investor sentiment and stock prices. BofA's risk assessment incorporates potential geopolitical risks and their likely impact on various sectors.

-

Supply Chain Issues: Supply chain disruptions can negatively affect corporate profitability, impacting stock prices. BofA likely incorporates potential supply chain risks into their valuation models, assessing the potential impact on different sectors.

BofA's approach involves incorporating these risks into their models, running various scenarios to assess the potential impact on their overall valuation projections. Their contingency plans involve a balanced portfolio strategy, allowing for flexibility in adapting to shifting market conditions.

Conclusion

BofA's analysis presents a balanced view of the current stock market. While acknowledging the high valuations and inherent market risks – including inflation, geopolitical factors, and supply chain issues – their long-term outlook remains cautiously optimistic. Their assessment is underpinned by their analysis of key valuation metrics, a considered view on interest rate impacts, and the incorporation of potential risks into their forecast models. While their analysis suggests a degree of calm amidst currently high stock market valuations, remember that this is just one perspective.

Call to Action: While BofA's analysis provides valuable insights, it's crucial to conduct your own thorough research and develop a well-informed investment strategy based on your personal risk tolerance and financial goals. Learn more about understanding and managing stock market valuations by exploring [link to relevant resource]. Don't let high stock prices paralyze you – understand the nuances of stock market valuations and make informed decisions.

Featured Posts

-

Tory Wifes Jail Sentence Stands After Anti Migrant Remarks In Southport

May 22, 2025

Tory Wifes Jail Sentence Stands After Anti Migrant Remarks In Southport

May 22, 2025 -

Macrons Call To Eu Buy European Not American

May 22, 2025

Macrons Call To Eu Buy European Not American

May 22, 2025 -

Abn Amro Rapporteert Forse Groei In Occasionverkopen

May 22, 2025

Abn Amro Rapporteert Forse Groei In Occasionverkopen

May 22, 2025 -

Could A New Record Be Set In The Trans Australia Run

May 22, 2025

Could A New Record Be Set In The Trans Australia Run

May 22, 2025 -

Peppa Pigs Mum Reveals Babys Gender At Famous London Spot

May 22, 2025

Peppa Pigs Mum Reveals Babys Gender At Famous London Spot

May 22, 2025

Latest Posts

-

Blake Lively Faces Legal Trouble Details Of The Justin Baldoni Lawsuit

May 22, 2025

Blake Lively Faces Legal Trouble Details Of The Justin Baldoni Lawsuit

May 22, 2025 -

Blake Lively Isolated Sisters Rally After Reported Fallout With A List Pals

May 22, 2025

Blake Lively Isolated Sisters Rally After Reported Fallout With A List Pals

May 22, 2025 -

Latest Updates Blake Lively Justin Baldoni Lawsuit And Celebrity Subpoenas

May 22, 2025

Latest Updates Blake Lively Justin Baldoni Lawsuit And Celebrity Subpoenas

May 22, 2025 -

Blake Lively Film Controversy The Justin Baldoni Lawsuit Explained

May 22, 2025

Blake Lively Film Controversy The Justin Baldoni Lawsuit Explained

May 22, 2025 -

Blake Lively Film Controversy Lawsuit Subpoenas And All The Details

May 22, 2025

Blake Lively Film Controversy Lawsuit Subpoenas And All The Details

May 22, 2025