Stock Market Valuations: BofA's Arguments Against Investor Concern

Table of Contents

BofA's Focus on Earnings Growth

BofA emphasizes the critical importance of focusing on future earnings growth, rather than solely relying on current price-to-earnings (P/E) ratios to gauge stock market valuations. They argue that high valuations can be entirely justified if companies demonstrate strong and sustainable earnings growth. A high P/E ratio, often cited as a sign of overvaluation, can be perfectly reasonable if future earnings are projected to significantly outpace current levels.

-

BofA's research highlights projected EPS (earnings per share) growth for the coming years. Their analysts predict robust growth across several key sectors, suggesting that current valuations are indeed supported by strong future earnings potential. This forward-looking approach is crucial for understanding the true picture of market valuation.

-

Specific sectors showing strong earnings growth potential further bolster BofA's optimistic outlook. For example, the technology sector, fueled by ongoing innovation and digital transformation, is frequently cited as an area of significant future growth. Similarly, certain areas within the healthcare and renewable energy sectors are also expected to deliver substantial earnings increases.

-

BofA's analysis of profit margins plays a crucial role in their valuation assessments. Strong and expanding profit margins indicate improved operational efficiency and pricing power, providing a further justification for potentially higher valuations. This is particularly important in an inflationary environment where companies need to demonstrate their ability to maintain profitability.

The Role of Interest Rates and Monetary Policy

BofA's comprehensive analysis considers the significant influence of interest rates and monetary policy on stock valuations. Lower interest rates generally support higher valuations in the equity market. This is because lower interest rates reduce the opportunity cost of investing in equities, making them a more attractive investment compared to bonds or other fixed-income securities.

-

The current interest rate environment, while fluctuating, remains relatively low in historical context. This low-rate environment, influenced by the Federal Reserve's monetary policy, continues to contribute to a supportive backdrop for higher stock valuations.

-

The Federal Reserve's monetary policy decisions play a pivotal role in shaping market sentiment and influencing stock prices. BofA carefully monitors the Fed's actions and statements, assessing their potential effects on inflation, interest rates, and ultimately, the attractiveness of equities.

-

A comparison of current bond yields to historical levels provides valuable context for equity valuations. When bond yields are low, the relative attractiveness of stocks, which offer the potential for higher returns, increases, potentially justifying higher valuations.

Addressing Specific Valuation Metrics

BofA directly addresses concerns surrounding specific valuation metrics, moving beyond simply looking at P/E ratios. They acknowledge the limitations of using a single metric like the P/E ratio to determine whether the market is overvalued or undervalued.

-

BofA's interpretation of the P/E ratio emphasizes its limitations as a sole indicator of overvaluation. They advocate for a more holistic approach, incorporating other crucial metrics.

-

The analysis extends to other key valuation metrics, including price-to-sales ratio (P/S) and price-to-book ratio (P/B). These metrics provide a broader picture of valuation, mitigating the potential biases inherent in relying solely on the P/E ratio.

-

BofA compares current valuation multiples to historical averages and industry benchmarks. This comparative analysis provides context and helps determine whether current valuations are exceptionally high or fall within a reasonable range given historical trends and sector-specific factors.

Long-Term Growth Potential and Sector Analysis

BofA highlights specific sectors with strong long-term growth prospects, suggesting that the overall market valuation is supported by these underlying growth drivers. This long-term perspective is crucial in mitigating short-term market fluctuations and focusing on sustainable value creation.

-

The identification of high-growth sectors, such as technology and renewable energy, is a key part of BofA's analysis. These sectors are expected to drive significant growth in the coming years, supporting higher valuations for the overall market.

-

The impact of technological innovation on future earnings and valuations is a significant focus. Continued technological advancements are anticipated to disrupt various industries, creating new growth opportunities and driving future earnings.

-

The role of emerging markets in driving long-term market growth is also acknowledged. The expanding middle class and growing economies in these markets represent significant opportunities for long-term investment and growth.

Conclusion

This article explored BofA's arguments against excessive investor concern regarding current stock market valuations. BofA's analysis moves beyond simplistic price-to-earnings ratios, emphasizing future earnings growth, interest rate environments, and the long-term potential of specific sectors. They suggest that focusing solely on short-term volatility and single valuation metrics can lead to inaccurate conclusions.

While acknowledging market volatility, understanding BofA's perspective on stock market valuations is crucial for informed investment decisions. Conduct your own thorough research, consider BofA's insights into stock market valuations, and develop a well-informed investment strategy. Remember, evaluating stock market valuations requires a nuanced understanding of multiple factors, and BofA's analysis provides valuable insights into this complex landscape.

Featured Posts

-

Tres Toros Uruguayos Regalo Presidencial Para Xi Jinping En China

May 11, 2025

Tres Toros Uruguayos Regalo Presidencial Para Xi Jinping En China

May 11, 2025 -

Thomas Muellers Farewell His Most Frequent Playing Partners At Bayern Munich

May 11, 2025

Thomas Muellers Farewell His Most Frequent Playing Partners At Bayern Munich

May 11, 2025 -

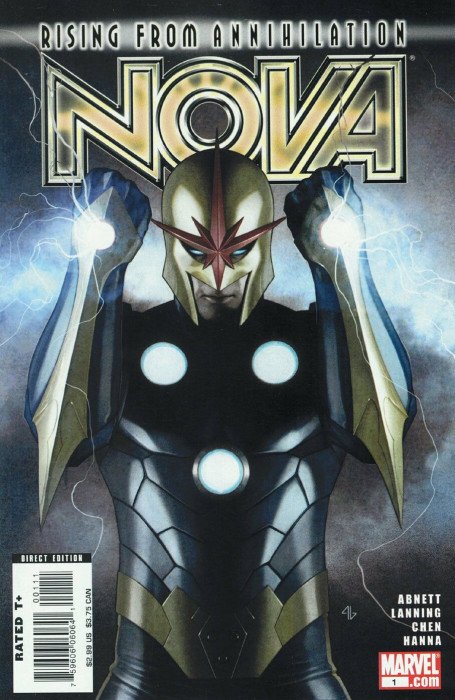

Is Henry Cavill The Next Nova Analyzing The Latest Marvel Rumors

May 11, 2025

Is Henry Cavill The Next Nova Analyzing The Latest Marvel Rumors

May 11, 2025 -

Magic Johnson Predicts The Winner Knicks Vs Pistons

May 11, 2025

Magic Johnson Predicts The Winner Knicks Vs Pistons

May 11, 2025 -

Juan Soto Increased Performance Following Questionable Loyalty Comments

May 11, 2025

Juan Soto Increased Performance Following Questionable Loyalty Comments

May 11, 2025