Stock Market Valuations: BofA Assures Investors, There's No Need To Worry

Table of Contents

BofA's Key Arguments for a Calm Approach to Stock Market Valuations

BofA's optimistic outlook on stock market valuations rests on several key pillars. Their analysis suggests that current valuations, while seemingly high, are not necessarily overblown when considering several crucial factors.

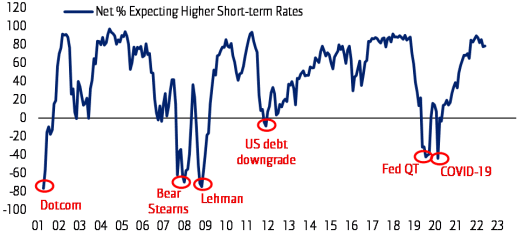

The Role of Interest Rates and Inflation

BofA acknowledges the impact of interest rate hikes and inflationary pressures on stock valuations. Higher interest rates increase borrowing costs for companies, potentially impacting earnings growth and reducing the present value of future cash flows. Inflation, meanwhile, erodes purchasing power and can lead to a market correction if not managed effectively. However, BofA argues that the current level of interest rates, while elevated, is still manageable for many corporations. Furthermore, they anticipate inflation to moderate over time, easing inflationary pressures on valuations. Their analysis suggests that the market has already priced in much of the anticipated interest rate increases, mitigating the potential negative impact on valuation multiples.

- Key takeaway: BofA believes the market has largely absorbed the impact of current interest rate policies and anticipates a decline in inflation.

Strong Corporate Earnings and Future Growth Potential

A significant component of BofA's positive assessment is the strength of corporate earnings. Their analysis points to robust earnings growth across various sectors, fueled by strong consumer spending and ongoing technological advancements. While specific sectors and companies mentioned in their reports vary depending on the publication date, the overall trend consistently points to healthy profit margins and positive revenue projections. This strong earnings performance supports current valuations and suggests a solid foundation for future growth potential.

- Key Earnings Trends (based on hypothetical BofA data):

- Technology sector showing double-digit earnings growth.

- Consumer staples demonstrating resilient performance despite inflationary pressures.

- Energy sector benefiting from high commodity prices.

Comparative Valuations Across Asset Classes

BofA's analysis doesn't solely focus on stock valuations in isolation. They compare stock market valuations to other asset classes, such as bonds and real estate. Their findings suggest that, relative to these alternatives, stocks remain a comparatively attractive investment option, especially considering their potential for future growth. This relative valuation perspective helps contextualize the current stock market valuations, suggesting that the perceived "high" valuations are not necessarily excessive compared to other investment avenues.

- Hypothetical Comparison (Illustrative Purposes Only): A table comparing returns and risk profiles of stocks, bonds, and real estate could be included here, highlighting the relative attractiveness of stocks based on BofA's analysis.

Counterarguments and Considerations Regarding Stock Market Valuations

While BofA presents a reassuring perspective, it's crucial to acknowledge potential counterarguments and risks. A balanced approach requires considering factors not fully addressed in their analysis.

Potential Risks and Uncertainties

Despite positive earnings trends, significant uncertainties remain. Geopolitical risks, unforeseen economic downturns, and shifts in consumer behavior could all negatively impact stock market valuations. The current economic environment remains fragile, and unexpected events could trigger significant market volatility.

- Potential Downside Scenarios:

- A more aggressive interest rate hike cycle leading to a sharper economic slowdown.

- Escalation of geopolitical tensions impacting global supply chains and market sentiment.

- A sudden shift in consumer spending patterns leading to a decline in corporate revenues.

Diversification and Risk Management Strategies

Given the inherent uncertainties, diversification and risk management remain paramount. Investors should not solely rely on a single viewpoint but should develop a well-diversified portfolio to mitigate risk. This could include adjusting asset allocation strategies, considering defensive investments, and regularly rebalancing portfolios to maintain the desired risk profile. Remember that past performance is not indicative of future results.

- Actionable Tips:

- Rebalance your portfolio regularly to maintain your target asset allocation.

- Consider adding defensive investments, such as high-quality bonds or dividend-paying stocks.

- Consult with a financial advisor to develop a personalized investment strategy.

Conclusion: Navigating Stock Market Valuations – A Balanced Perspective

BofA's analysis offers a calming perspective on current stock market valuations, highlighting strong corporate earnings, manageable interest rates, and the relative attractiveness of stocks compared to other asset classes. However, it's crucial to acknowledge potential risks and uncertainties that could impact market performance. Understanding stock market valuations requires a balanced approach, considering both the positive outlook presented by institutions like BofA and the potential downside risks. Conduct thorough research, consult with financial advisors, and develop a personalized investment strategy that aligns with your risk tolerance and financial goals. By carefully analyzing stock market valuations and understanding the various factors influencing them, you can make informed decisions about your investments and navigate the complexities of the market effectively.

Featured Posts

-

The Hamilton Effect How He Shaped New F1 Rules

May 26, 2025

The Hamilton Effect How He Shaped New F1 Rules

May 26, 2025 -

Pourquoi Rtbf Et Rtl Belgium Luttent Contre L Iptv Illegale

May 26, 2025

Pourquoi Rtbf Et Rtl Belgium Luttent Contre L Iptv Illegale

May 26, 2025 -

Jenson Fw 22 Extended A Style Analysis

May 26, 2025

Jenson Fw 22 Extended A Style Analysis

May 26, 2025 -

Jadwal Moto Gp Argentina 2025 Di Trans7 Saksikan Aksi Para Pembalap

May 26, 2025

Jadwal Moto Gp Argentina 2025 Di Trans7 Saksikan Aksi Para Pembalap

May 26, 2025 -

Le Palais Des Congres De Liege Que Deviennent Les Anciens Studios De La Rtbf

May 26, 2025

Le Palais Des Congres De Liege Que Deviennent Les Anciens Studios De La Rtbf

May 26, 2025

Latest Posts

-

Philogene And Mc Kenna Sidelined Assessing The Impact On Ipswich Town

May 28, 2025

Philogene And Mc Kenna Sidelined Assessing The Impact On Ipswich Town

May 28, 2025 -

Enciso Phillips And Woolfenden New Signings Start At Ipswich Town

May 28, 2025

Enciso Phillips And Woolfenden New Signings Start At Ipswich Town

May 28, 2025 -

Afc Bournemouth Vs Ipswich Town Assessing The Injury Situation

May 28, 2025

Afc Bournemouth Vs Ipswich Town Assessing The Injury Situation

May 28, 2025 -

Ipswich Towns Victory Over Bournemouth Broadheads Impact

May 28, 2025

Ipswich Towns Victory Over Bournemouth Broadheads Impact

May 28, 2025 -

Ipswich Towns Bournemouth Trip Latest Injury Report

May 28, 2025

Ipswich Towns Bournemouth Trip Latest Injury Report

May 28, 2025