Stock Market Valuation Concerns? BofA Offers Reassurance

Table of Contents

BofA's Perspective on Current Market Valuations

BofA generally maintains a cautiously optimistic stance on current market valuations. While acknowledging the elevated levels of certain valuation metrics, they emphasize the influence of various macroeconomic factors and believe that the market isn't drastically overvalued. Their analysis suggests a nuanced picture, urging investors to avoid knee-jerk reactions and instead focus on a long-term investment strategy.

Key Valuation Metrics Analyzed by BofA

BofA employs a range of valuation metrics to assess the market's health. Their analysis typically incorporates:

- Price-to-Earnings ratio (P/E): BofA analyzes the P/E ratio across different sectors and compares it to historical averages and industry benchmarks. Elevated P/E ratios in certain sectors might signal potential overvaluation, but BofA considers future earnings growth potential when interpreting these figures.

- Price-to-Sales ratio (P/S): This metric provides a valuation perspective even for companies with negative earnings. BofA uses P/S ratios to evaluate companies in high-growth sectors or those experiencing temporary earnings dips.

- Cyclically Adjusted Price-to-Earnings ratio (CAPE): The CAPE ratio smooths out short-term earnings fluctuations, providing a longer-term view of market valuation. BofA uses this metric to assess whether the market is historically expensive or cheap.

BofA's interpretation of these metrics is crucial. They don't rely on a single metric but rather consider them in conjunction with macroeconomic factors, providing a holistic view of the market's valuation. For instance, a high P/E ratio might be justified if future earnings growth is expected to be robust.

BofA's Consideration of Macroeconomic Factors

BofA's valuation assessment is intricately linked to macroeconomic factors, including:

- Interest Rates: Rising interest rates typically impact valuations by increasing the cost of borrowing, potentially slowing economic growth and dampening corporate profits. BofA carefully analyzes the trajectory of interest rates and their influence on future earnings expectations.

- Inflation: High inflation erodes purchasing power and can increase input costs for businesses, impacting profitability. BofA accounts for inflation's impact on earnings growth when evaluating market valuations.

- GDP Growth: Strong GDP growth often translates into higher corporate earnings, supporting higher valuations. Conversely, slow or negative GDP growth can put downward pressure on market valuations. BofA incorporates GDP growth forecasts in their models to project future earnings.

- Geopolitical Risks: Global political instability and unforeseen events can significantly impact market sentiment and valuation. BofA carefully monitors geopolitical risks and their potential effect on market performance.

The interplay between these macroeconomic factors and valuation metrics is complex. BofA's expertise lies in skillfully navigating these interdependencies to arrive at a balanced view of the market's health.

Addressing Specific Investor Concerns

Many investors harbor concerns about current stock market valuations. Some common anxieties include:

- High P/E Ratios in Certain Sectors: Some sectors show elevated P/E ratios, raising concerns about potential overvaluation.

- Potential for a Market Correction: The possibility of a sharp market downturn worries investors who fear substantial capital losses.

Counterarguments from BofA's Analysis

BofA's analysis addresses these concerns with several counterarguments:

- High P/E Ratios: BofA acknowledges high P/E ratios in some sectors but emphasizes the potential for sustained earnings growth in those sectors. They suggest that high valuations might be justified by strong future growth prospects. Their analysts highlight specific companies with robust growth trajectories to support this claim.

- Market Correction: BofA acknowledges the possibility of a market correction but contends that a significant downturn is unlikely given their assessment of macroeconomic factors and corporate earnings. They emphasize the importance of a long-term investment horizon.

BofA's Recommendations for Investors

BofA generally advises investors to maintain a diversified portfolio and to focus on long-term investment goals. They recommend a balanced approach, suggesting neither drastic buying nor selling. They might favor specific sectors they believe are poised for future growth, while recommending caution in other areas based on their valuation analysis. Specific recommendations often depend on individual investor risk tolerance and financial objectives.

Alternative Perspectives and Cautions

It's essential to acknowledge that other analysts hold differing views on market valuations. Some may be more pessimistic, citing potential risks such as persistent inflation or geopolitical instability. These differing perspectives highlight the importance of conducting thorough due diligence before making investment decisions. It's crucial to consult diverse sources of analysis and consider your own risk tolerance.

This article does not constitute financial advice. Always seek advice from a qualified financial advisor before making any investment decisions.

Conclusion

BofA's analysis offers reassurance to investors concerned about stock market valuations. While acknowledging elevated metrics in certain areas, their assessment considers a variety of factors, suggesting a cautiously optimistic outlook. They advise a long-term investment strategy, emphasizing diversification and a balanced portfolio. To gain a comprehensive understanding of BofA's market outlook, we encourage you to explore their detailed reports and analyses. Remember, understanding stock market valuation is crucial for making informed investment decisions. Stay informed and make strategic choices based on your own risk tolerance. Consult a financial advisor before making any investment decisions related to stock market valuation concerns.

Featured Posts

-

60 Minutes Producers Resignation Loss Of Independence Cited After Trump Lawsuit

Apr 24, 2025

60 Minutes Producers Resignation Loss Of Independence Cited After Trump Lawsuit

Apr 24, 2025 -

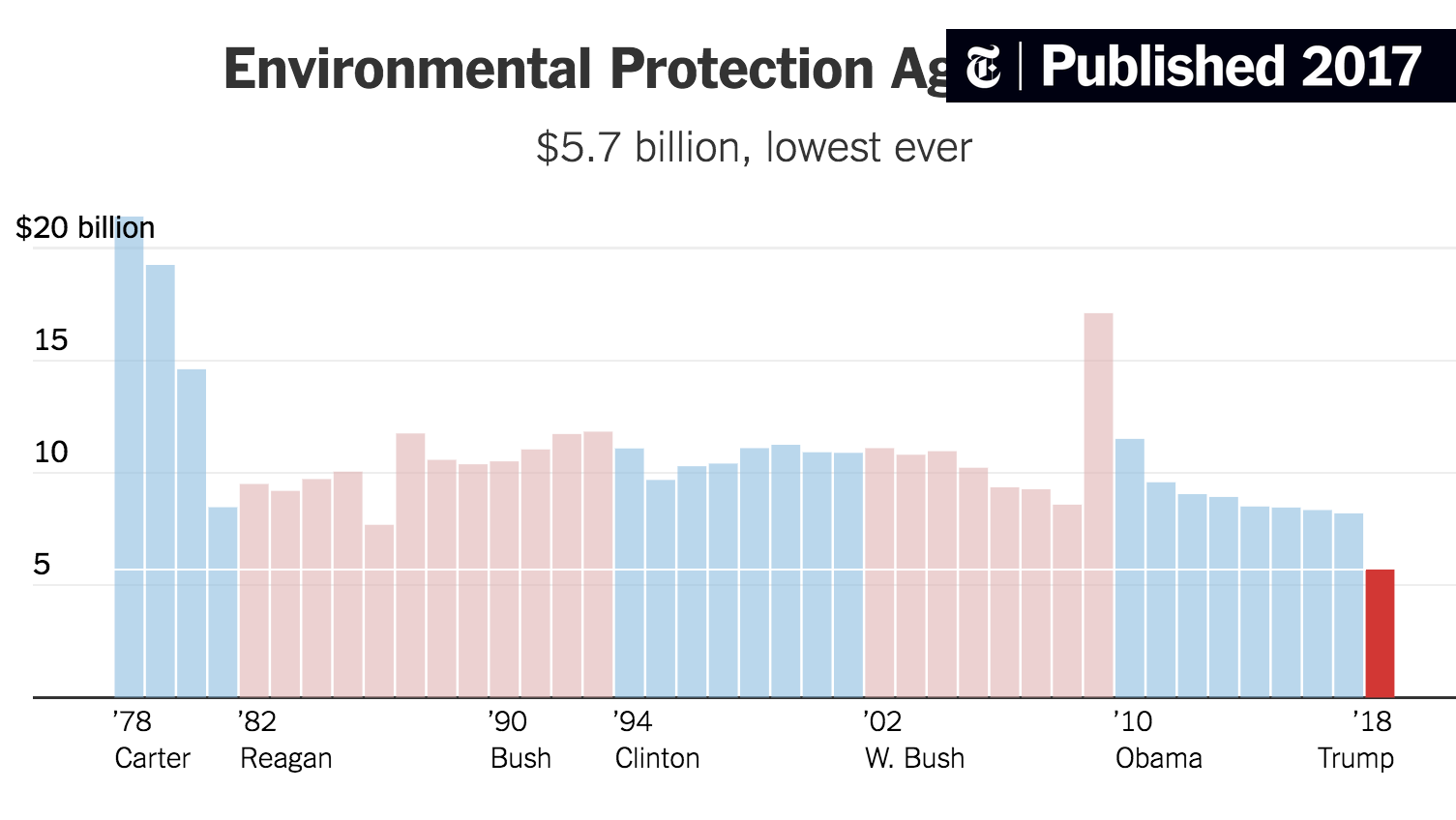

Rising Tornado Season Risks Amidst Trumps Budget Cuts

Apr 24, 2025

Rising Tornado Season Risks Amidst Trumps Budget Cuts

Apr 24, 2025 -

Death Of Sophie Nyweide Child Actor From Mammoth And Noah At 24

Apr 24, 2025

Death Of Sophie Nyweide Child Actor From Mammoth And Noah At 24

Apr 24, 2025 -

Remembering Sophie Nyweide Child Star Of Mammoth And Noah Dies At 24

Apr 24, 2025

Remembering Sophie Nyweide Child Star Of Mammoth And Noah Dies At 24

Apr 24, 2025 -

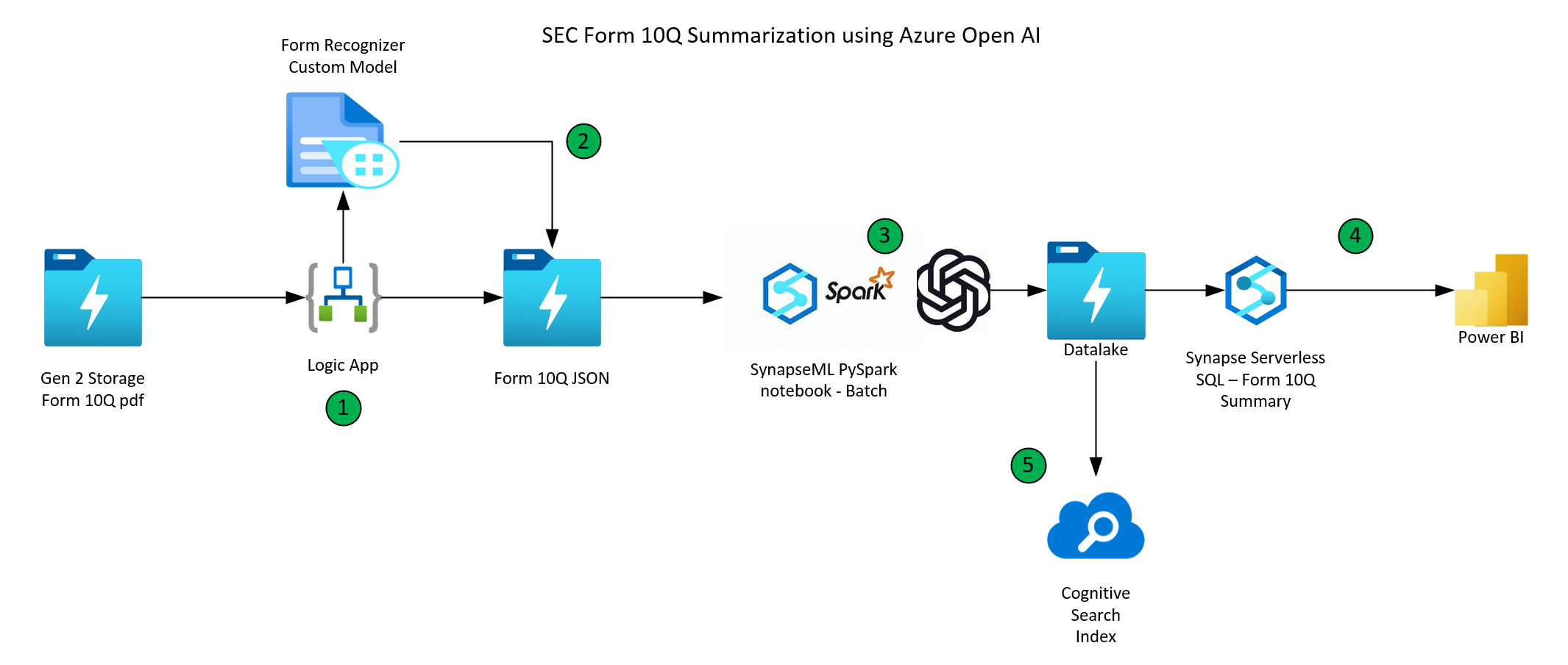

New Open Ai Tools Make Voice Assistant Development Easier 2024 Event Recap

Apr 24, 2025

New Open Ai Tools Make Voice Assistant Development Easier 2024 Event Recap

Apr 24, 2025