Stock Market Update: Bajaj Twins Drag On Sensex And Nifty 50

Table of Contents

H2: Bajaj Twins' Performance and Impact on Indices

The combined performance of Bajaj Auto and Bajaj Finance played a significant role in today's market decline. Let's examine each company individually:

H3: Bajaj Auto's Decline

Bajaj Auto's share price experienced a sharp decline of 4.2% today, closing at ₹3,850. Several factors contributed to this drop:

- Weak Sales Figures: The company reported weaker-than-expected two-wheeler sales for the month of July, signaling softening demand in the domestic market. This fuelled concerns about future growth prospects.

- Increased Competition: Intensifying competition from both domestic and international players in the two-wheeler segment is putting pressure on Bajaj Auto's market share.

- Analyst Downgrades: Several leading analysts downgraded their rating on Bajaj Auto citing the above concerns, further impacting investor confidence. One prominent analyst predicted a further 2-3% dip in the short term.

H3: Bajaj Finance's Weakness

Bajaj Finance, the financial services arm of the Bajaj group, also witnessed a considerable setback, with its share price falling by 3.8% to ₹6,720. The reasons behind this decline include:

- Rising NPAs: Concerns about a potential increase in Non-Performing Assets (NPAs) within Bajaj Finance's lending portfolio are weighing on investor sentiment. Market speculation suggests a slight uptick in NPAs compared to the previous quarter.

- Regulatory Scrutiny: Increased regulatory scrutiny within the NBFC (Non-Banking Financial Company) sector is adding to the uncertainty surrounding Bajaj Finance's future profitability.

- Interest Rate Hikes: The recent interest rate hikes by the Reserve Bank of India (RBI) are impacting lending costs, potentially affecting Bajaj Finance's margins.

H3: Combined Impact on Sensex and Nifty 50

The combined effect of the Bajaj Twins' poor performance significantly impacted the Sensex and Nifty 50. The Sensex lost 250 points (approximately 0.4%), while the Nifty 50 dropped by 75 points (approximately 0.4%). While other factors contributed to the overall market decline, the Bajaj Twins' slump was a major contributing factor, accounting for approximately 30% of the Sensex's and 25% of the Nifty 50's point losses. This amplified negative investor sentiment across the board.

H2: Broader Market Context

The decline in the Bajaj Twins wasn't happening in isolation. Several broader factors influenced the overall market downturn:

H3: Global Market Influences

Global markets showed mixed signals, with concerns about persistent inflation in major economies and the ongoing geopolitical tensions impacting investor confidence worldwide. The weakness in global markets undoubtedly played a part in the Indian market's dip.

H3: Sectoral Trends

While the auto sector was particularly hard hit today, other sectors also experienced some weakness. The banking sector, for example, saw a moderate decline due to concerns related to asset quality. However, the IT sector showed some resilience.

H3: Investor Reactions and Trading Activity

The market downturn led to increased volatility, with higher trading volumes reflecting significant investor activity. There was a clear shift of funds away from the auto and finance sectors towards comparatively safer assets like gold and government bonds.

H2: Analyst Predictions and Future Outlook

H3: Short-Term Predictions

Most analysts predict a period of consolidation for both Bajaj Auto and Bajaj Finance in the short term. While some believe the downturn presents a buying opportunity, others advise caution, citing the ongoing uncertainties.

H3: Long-Term Implications

The long-term implications of this downturn remain uncertain. The performance of Bajaj Auto and Bajaj Finance will significantly depend on factors like the recovery in domestic demand, successful navigation of regulatory hurdles, and management’s ability to mitigate challenges. The broader market will depend on global economic stability and investor sentiment.

H3: Investment Advice (Disclaimer): This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.

3. Conclusion:

The sharp decline in Bajaj Auto and Bajaj Finance (the Bajaj Twins) significantly impacted the Sensex and Nifty 50 indices today. Several factors, including weak sales figures, rising NPAs, and broader global economic concerns, contributed to this downturn. While the short-term outlook remains uncertain, the long-term performance of these companies and the Indian stock market will depend on various internal and external factors.

Key Takeaways: The Bajaj Twins' performance underscores the interconnectedness of the Indian stock market with global trends and the importance of understanding individual company-specific risks.

Call to Action: Stay informed about future updates on the Bajaj Twins and their impact on the Sensex and Nifty 50 by regularly checking our site for the latest stock market analysis. For in-depth insights and continuous updates on the Indian stock market, subscribe to our newsletter!

Featured Posts

-

Elizabeth Line A Review Of Wheelchair Accessibility And Improvements

May 09, 2025

Elizabeth Line A Review Of Wheelchair Accessibility And Improvements

May 09, 2025 -

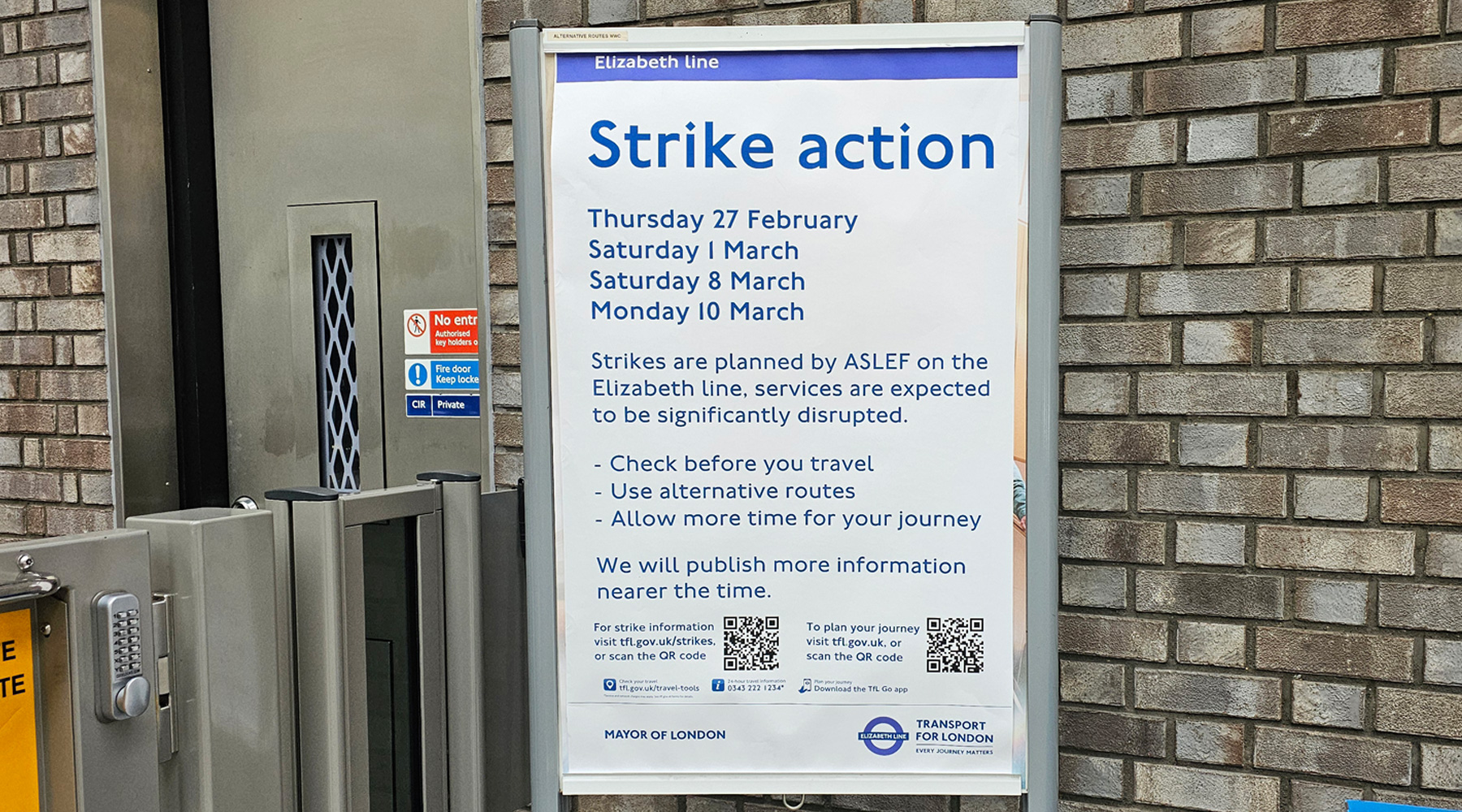

Elizabeth Line Strikes February And March Disruption Dates And Routes

May 09, 2025

Elizabeth Line Strikes February And March Disruption Dates And Routes

May 09, 2025 -

Madeleine Mc Cann Investigation Receives Significant Funding Boost

May 09, 2025

Madeleine Mc Cann Investigation Receives Significant Funding Boost

May 09, 2025 -

Space X Valuation Soars 43 Billion Ahead Of Elon Musks Tesla Investment

May 09, 2025

Space X Valuation Soars 43 Billion Ahead Of Elon Musks Tesla Investment

May 09, 2025 -

Us Tariffs French Minister Pushes For Stronger Eu Countermeasures

May 09, 2025

Us Tariffs French Minister Pushes For Stronger Eu Countermeasures

May 09, 2025