Stock Market Today: Dow, S&P 500 Live Updates For May 29

Table of Contents

Dow Jones Industrial Average (DJIA) Performance

Opening Bell and Early Trading

The Dow Jones Industrial Average opened at 33,900 on May 29th, showing a slight increase of 0.2% compared to the previous day's closing price. This positive start was fueled by positive earnings reports from several blue-chip companies and generally optimistic investor sentiment.

- Open: 33,900

- High (Early Trading): 34,050

- Low (Early Trading): 33,850

- Percentage Change (Early): +0.2%

These early gains indicated a potential positive trend for the Dow Jones Today, though the market remained cautious due to ongoing geopolitical uncertainties. Dow Jones Live tracking showed considerable activity in early trading.

Midday Movement and Key Catalysts

Midday trading saw a slight dip in the Dow Jones Intraday performance, with the index briefly falling below its opening price. This correction was primarily attributed to a sudden drop in oil prices following a concerning report on global energy demand. Several Dow Jones components experienced moderate declines, including those in the energy sector.

- Midday Low: 33,800

- Key Catalyst: Sharp decline in oil prices due to weakening global demand forecasts.

- Affected Companies: Chevron, ExxonMobil experienced noticeable share price drops.

Dow Jones News outlets reported on this midday shift, analyzing the impact of the oil price drop on the overall market.

Closing Bell and Day's Summary

The Dow Jones closed at 33,950 on May 29th, representing a modest daily gain of 0.4%. While the midday dip introduced some volatility, positive investor sentiment ultimately prevailed.

- Closing Price: 33,950

- Daily Percentage Change: +0.4%

- Volume Traded: High, reflecting increased investor activity.

- Comparison to Analyst Predictions: Slightly below average analyst predictions.

The Dow Jones Daily Summary showed resilience despite early challenges, reflecting a generally positive market outlook, though short of initial projections. The Dow Jones Market Sentiment concluded the day on a cautiously optimistic note.

S&P 500 Index Performance

Opening, Midday, and Closing Trends

The S&P 500 followed a similar trend to the Dow Jones, opening slightly higher and experiencing a midday correction before closing with moderate gains. The S&P 500 today displayed a similar level of volatility as the Dow, mirroring the broader market sentiment.

- Open: 4,200

- High: 4,220

- Low: 4,180

- Close: 4,210

- Percentage Change: +0.5%

S&P 500 Live updates reflected the day's fluctuations, closely tracking the interplay between positive and negative factors influencing the index's movement.

Sector-Specific Performance

Sector performance within the S&P 500 was mixed. The Technology sector performed well, driven by positive earnings reports from major tech companies, while the Energy sector underperformed due to the aforementioned oil price drop.

- Top Performing Sector: Technology (+1.2%)

- Underperforming Sector: Energy (-0.8%)

- Reasoning: Strong earnings in tech offset by reduced energy demand concerns.

Analyzing S&P 500 sectors provides valuable insights into the nuances of market performance.

Impact of Major Economic Indicators

The release of positive consumer confidence data on May 29th had a generally supportive impact on the S&P 500's performance, offsetting some of the negative effects of the energy sector's decline.

- Economic Indicator: Consumer Confidence Index

- Impact: Positive consumer confidence data bolstered overall market sentiment.

The influence of economic indicators on the S&P 500 is a crucial factor in understanding market dynamics.

Overall Market Sentiment and Outlook

Investor Confidence

Investor confidence remained relatively high despite the midday market correction. While concerns about inflation and geopolitical instability persisted, positive corporate earnings and robust consumer data helped to maintain a generally optimistic outlook.

- Prevailing Sentiment: Cautiously optimistic

- Notable Investor Comments: Many analysts pointed to the resilience of the market as a positive sign.

Analyzing investor confidence provides valuable insight into the potential future direction of the market.

Predictions and Future Expectations

The May 29th performance suggests a potentially positive short-term outlook for the market, although the situation remains fluid. Ongoing geopolitical events and economic data releases will continue to significantly influence investor decisions in the near term.

- Short-Term Outlook: Potentially positive, though subject to further news and economic data.

- Long-Term Outlook: Market forecast remains uncertain due to numerous variables.

Market Predictions for the future are complex and dependent on evolving economic and political circumstances.

Conclusion

The Dow Jones and S&P 500 experienced a day of moderate gains on May 29th, despite a midday correction driven primarily by a decline in oil prices. Positive corporate earnings and consumer confidence data helped to offset these challenges, resulting in a generally positive market sentiment. Key factors influencing the market included company performance, energy prices, and economic data releases. Understanding these influences is essential for informed investment decisions.

Stay informed about the daily performance of the Dow and S&P 500 with our regular "Stock Market Today" updates! Click here for more in-depth market analysis. (Insert Link Here)

Featured Posts

-

Musikgeschichte Live Mozarts Clavierkonzert In Augsburg

May 30, 2025

Musikgeschichte Live Mozarts Clavierkonzert In Augsburg

May 30, 2025 -

A Retrospective On Anna Neagle Her Impact On British Film

May 30, 2025

A Retrospective On Anna Neagle Her Impact On British Film

May 30, 2025 -

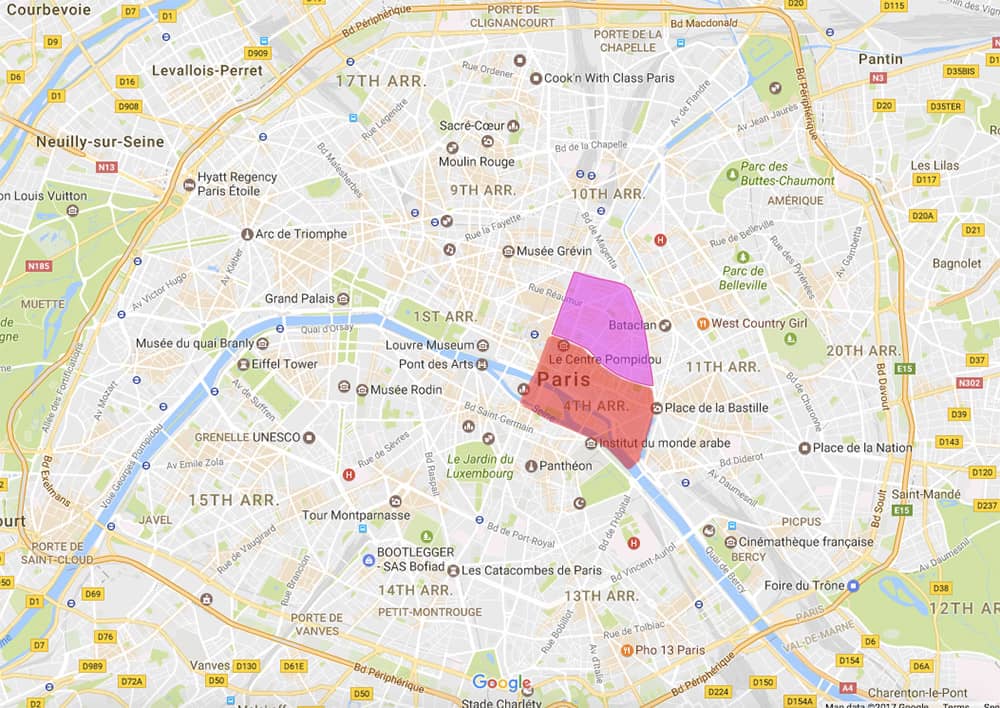

The Ultimate Guide To Paris Neighborhoods

May 30, 2025

The Ultimate Guide To Paris Neighborhoods

May 30, 2025 -

Motor Sport 197 Hp Mengapa Kawasaki Z H2 Tidak Tersedia Di Indonesia

May 30, 2025

Motor Sport 197 Hp Mengapa Kawasaki Z H2 Tidak Tersedia Di Indonesia

May 30, 2025 -

Investir Dans La Mobilite Durable Au Vietnam L Engagement De La France

May 30, 2025

Investir Dans La Mobilite Durable Au Vietnam L Engagement De La France

May 30, 2025