Stock Market Today: Dow Futures Fluctuate, China's Economic Support Amid Trade Tensions

Table of Contents

Dow Futures Fluctuations: A Closer Look

Analyzing Dow Futures Movement

The Dow Jones Industrial Average futures are currently experiencing a period of heightened volatility. Several factors contribute to these fluctuations:

-

Economic Indicators: Rising inflation continues to pressure the Federal Reserve to maintain or increase interest rates. This impacts corporate borrowing costs and profitability, directly affecting the Dow Jones futures and overall market performance. High inflation erodes purchasing power and can lead to consumer spending slowdown.

-

Geopolitical Events: Global geopolitical instability, including ongoing conflicts and international relations, creates uncertainty that ripples through financial markets, impacting Dow Jones futures and other market indices.

-

Earnings Reports: Quarterly earnings reports from major corporations significantly influence investor sentiment and market movements. Disappointing earnings can lead to sell-offs, while strong results can boost market confidence and push Dow Jones futures higher.

-

Unexpected Economic News: Sudden and unexpected releases of economic data (e.g., unexpectedly high unemployment numbers or significant changes in consumer confidence) can trigger sharp and rapid changes in Dow Jones futures and broader market indices.

Investor Sentiment and Market Psychology

Investor sentiment, a crucial driver of market fluctuations, is currently mixed. Fear and greed, the fundamental emotions governing market psychology, are playing out in full force. Negative news coverage, particularly regarding inflation and geopolitical tensions, can heighten investor fear, leading to risk aversion and sell-offs. Conversely, positive news about economic growth or corporate performance can fuel investor greed and propel the market upward. The role of social media and 24/7 news cycles in shaping and amplifying investor perceptions cannot be overstated. Understanding the prevailing market sentiment— whether it leans towards a bull market or a bear market — is vital for navigating the current volatility.

China's Economic Support and Trade Tensions

China's Economic Stimulus Measures

In response to slowing economic growth, the Chinese government has recently unveiled several economic stimulus measures. These include:

-

Targeted Infrastructure Spending: Increased investment in infrastructure projects aims to boost domestic demand and create jobs.

-

Monetary Policy Adjustments: Easing monetary policy through interest rate cuts and increased liquidity aims to encourage borrowing and investment.

-

Tax Breaks and Subsidies: Providing tax relief and subsidies to businesses aims to stimulate private sector activity.

The ultimate success of these measures remains to be seen. While they aim to stimulate the China economy and prevent a sharper slowdown, the effectiveness will depend on several factors, including global economic conditions and the ongoing trade tensions with the US.

Impact of US-China Trade Relations

The ongoing trade tensions between the US and China continue to cast a long shadow over global stock markets. The history of tariffs and trade disputes has created uncertainty and disrupted global supply chains. While there have been periods of de-escalation, the potential for further trade restrictions remains a significant source of risk for investors. Any new developments, be it further tariffs or potential trade agreements, can have a substantial immediate impact on market sentiment and Dow Jones futures. The unpredictable nature of US-China trade relations is a major factor contributing to current market volatility.

Conclusion: Navigating the Uncertain Stock Market

In summary, the stock market today reflects a complex interplay between Dow futures fluctuations, China's economic policies, and persistent US-China trade tensions. Understanding these interconnected factors is crucial for investors. Staying informed about key economic indicators, monitoring investor sentiment, and following developments in US-China trade relations are essential for navigating this period of uncertainty. Consider diversifying your investment portfolio to mitigate risks associated with specific sectors or geopolitical events. Regularly check reputable financial news sources to stay updated on the stock market today and make informed decisions. The need for continuous monitoring of the stock market today, particularly the Dow futures and the China economy, cannot be overstated.

Featured Posts

-

A Strategic Military Base The Epicenter Of Us China Influence

Apr 26, 2025

A Strategic Military Base The Epicenter Of Us China Influence

Apr 26, 2025 -

Line Wait For Nintendo Switch 2 At Game Stop Was It Worth It

Apr 26, 2025

Line Wait For Nintendo Switch 2 At Game Stop Was It Worth It

Apr 26, 2025 -

After A Decade Construction Resumes On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025

After A Decade Construction Resumes On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025 -

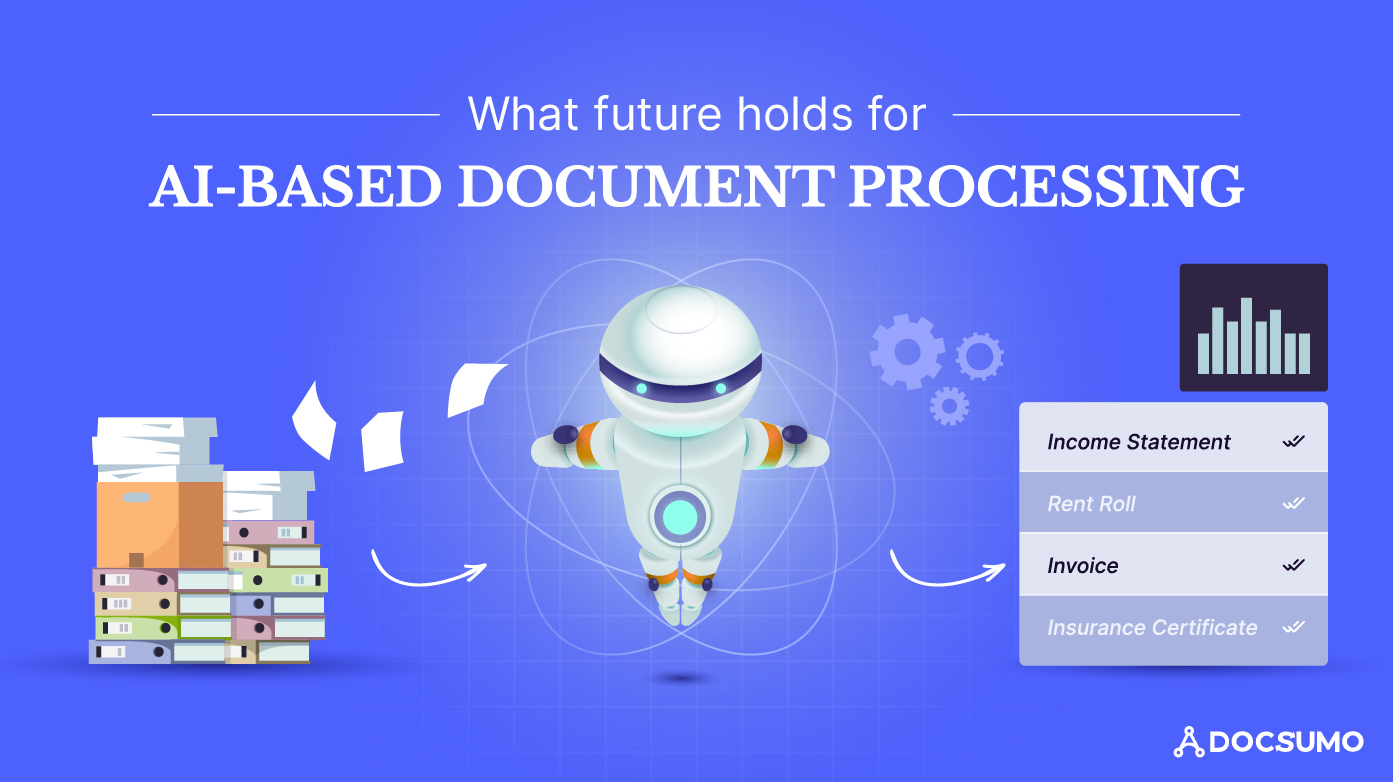

Ai Driven Podcast Creation Analyzing Repetitive Scatological Documents

Apr 26, 2025

Ai Driven Podcast Creation Analyzing Repetitive Scatological Documents

Apr 26, 2025 -

Chinas Impact On Bmw And Porsche Sales Market Headwinds And Strategic Responses

Apr 26, 2025

Chinas Impact On Bmw And Porsche Sales Market Headwinds And Strategic Responses

Apr 26, 2025

Latest Posts

-

Vaccine Skeptics Leadership Of Federal Immunization Autism Research Sparks Debate

Apr 27, 2025

Vaccine Skeptics Leadership Of Federal Immunization Autism Research Sparks Debate

Apr 27, 2025 -

Government Appoints Vaccine Skeptic To Lead Autism Vaccine Study

Apr 27, 2025

Government Appoints Vaccine Skeptic To Lead Autism Vaccine Study

Apr 27, 2025 -

Controversial Appointment Vaccine Skeptic To Head Immunization Autism Research

Apr 27, 2025

Controversial Appointment Vaccine Skeptic To Head Immunization Autism Research

Apr 27, 2025 -

Federal Study On Autism And Vaccines Headed By Vaccine Skeptic

Apr 27, 2025

Federal Study On Autism And Vaccines Headed By Vaccine Skeptic

Apr 27, 2025 -

Vaccine Skeptic Appointed To Lead Federal Autism Immunization Study

Apr 27, 2025

Vaccine Skeptic Appointed To Lead Federal Autism Immunization Study

Apr 27, 2025