Stock Market Prediction: Outperforming Palantir In 3 Years - 2 Top Picks

Table of Contents

Palantir Technologies has undeniably captured significant attention in the stock market, known for its cutting-edge data analytics and strong government contracts. But can you identify investments poised to outperform its projected growth over the next three years? This article dives into the current market landscape and presents two promising alternatives with the potential to exceed Palantir's returns within this timeframe. We'll examine their growth trajectories, competitive advantages, and associated risks to provide a thorough overview and aid in your stock market prediction efforts.

Understanding Palantir's Current Market Position and Future Projections

Analyzing Palantir's Strengths and Weaknesses

-

Strengths:

- Strong government contracts, providing a stable revenue stream.

- Cutting-edge data analytics platform with a strong reputation.

- Expanding into the commercial sector, diversifying its revenue sources.

-

Weaknesses:

- Significant dependence on government contracts, creating vulnerability to budget changes.

- Potential for increased competition from established tech giants like Google and Amazon.

- High valuation, leaving room for potential market corrections.

Palantir's business model centers around providing sophisticated data analytics software to government agencies and commercial clients. While its current market capitalization is substantial, and analyst predictions suggest moderate growth, the reliance on government contracts presents a key risk. Any significant shifts in government spending could impact Palantir's revenue and stock price, highlighting the need for a diversified investment strategy.

Defining "Outperforming Palantir"

For the purposes of this analysis, "outperforming Palantir" means achieving a higher return on investment (ROI) than what is currently projected for Palantir over the next three years. We'll use reputable analyst predictions as a benchmark, aiming to identify investments with the potential to surpass these projections by a significant margin. This requires a careful assessment of various factors, including market trends, company performance, and risk tolerance.

Top Pick #1: CrowdStrike Holdings, Inc. (CRWD) - A Deep Dive

Investment Thesis for CrowdStrike

- Key Strengths:

- Leading provider of cloud-based endpoint protection.

- Strong market share in the rapidly expanding cybersecurity market.

- Recurring revenue model with high customer retention.

- Expanding product offerings and strategic acquisitions.

CrowdStrike's robust platform delivers comprehensive cybersecurity protection, a critical need in today's digital landscape. Its subscription-based model ensures predictable revenue streams, and its strong customer retention demonstrates market acceptance. This, coupled with consistent product innovation and strategic acquisitions, positions CrowdStrike for significant long-term growth. Financial analysis shows impressive revenue growth and increasing profitability, making it a compelling alternative for investors looking for growth beyond Palantir.

Risk Assessment for CrowdStrike

- Potential Risks:

- Intense competition in the cybersecurity sector.

- Vulnerability to evolving cyber threats and emerging technologies.

- Dependence on successful product innovation and market expansion.

While CrowdStrike enjoys a strong market position, competition from established players remains a risk. The ever-evolving nature of cybersecurity threats necessitates continuous innovation to maintain its leading edge. However, CrowdStrike’s proactive approach to innovation and strategic acquisitions helps to mitigate these risks.

Top Pick #2: Datadog, Inc. (DDOG) – A Detailed Look

Investment Thesis for Datadog

- Key Strengths:

- Leading provider of cloud-based monitoring and analytics services.

- Comprehensive platform covering various aspects of IT operations.

- Strong customer base spanning various industries.

- High growth potential driven by the increasing adoption of cloud computing.

Datadog offers a powerful platform for monitoring and managing complex IT infrastructure, a necessity for businesses operating in the cloud. Its comprehensive suite of tools caters to various needs, from application performance monitoring to security monitoring. The ongoing shift towards cloud-based infrastructure presents a significant tailwind for Datadog's growth, making it a strong contender for outperforming Palantir.

Risk Assessment for Datadog

- Potential Risks:

- Competition from established players in the monitoring and analytics space.

- Dependence on the continued growth of cloud computing adoption.

- Potential for integration challenges with existing systems.

The competitive landscape for monitoring and analytics tools is indeed crowded. However, Datadog’s comprehensive platform and ease of integration differentiate it from the competition. While the growth of cloud computing is generally expected to continue, a potential slowdown could impact Datadog’s trajectory. Therefore, careful monitoring of the market is essential for informed investment decisions.

Conclusion

This analysis compared Palantir's projected growth with two strong alternatives, CrowdStrike and Datadog. While Palantir offers a compelling investment opportunity, both CrowdStrike and Datadog showcase strong potential to deliver superior ROI over the next three years, based on their market position, growth trajectory, and financial performance. Remember to conduct thorough due diligence and consider your own risk tolerance before making any investment decisions. Diversification across various sectors is key to a robust long-term investment strategy.

Ready to explore investment opportunities that could outperform Palantir? Start your research on CrowdStrike and Datadog today! (Please note: This is not financial advice. Consult with a qualified financial advisor before making any investment decisions.)

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Conduct thorough research and consult with a financial advisor before making any investment decisions.)

Featured Posts

-

Leon Draisaitls Stellar Season Earns Him Hart Trophy Nomination

May 09, 2025

Leon Draisaitls Stellar Season Earns Him Hart Trophy Nomination

May 09, 2025 -

Tesla And Us Policy Impact On Elon Musks Billions

May 09, 2025

Tesla And Us Policy Impact On Elon Musks Billions

May 09, 2025 -

Le Role De La Ville De Dijon Face Aux Difficultes De L Etablissement Epicure

May 09, 2025

Le Role De La Ville De Dijon Face Aux Difficultes De L Etablissement Epicure

May 09, 2025 -

The Ai Challenge Can Apple Maintain Its Competitive Edge

May 09, 2025

The Ai Challenge Can Apple Maintain Its Competitive Edge

May 09, 2025 -

Violences Conjugales A Dijon Le Proces Du Boxeur Bilel Latreche Fixe En Aout

May 09, 2025

Violences Conjugales A Dijon Le Proces Du Boxeur Bilel Latreche Fixe En Aout

May 09, 2025

Latest Posts

-

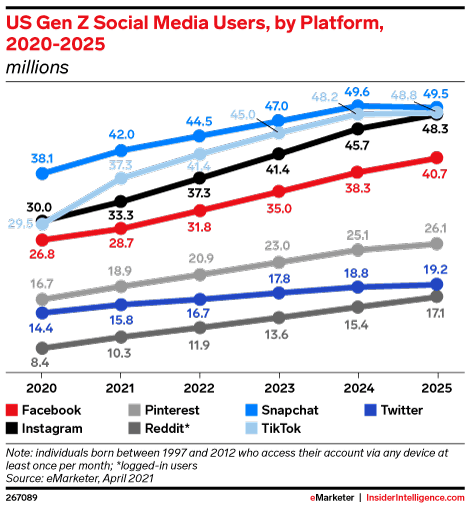

Androids Design Refresh Attracting A Younger Audience

May 10, 2025

Androids Design Refresh Attracting A Younger Audience

May 10, 2025 -

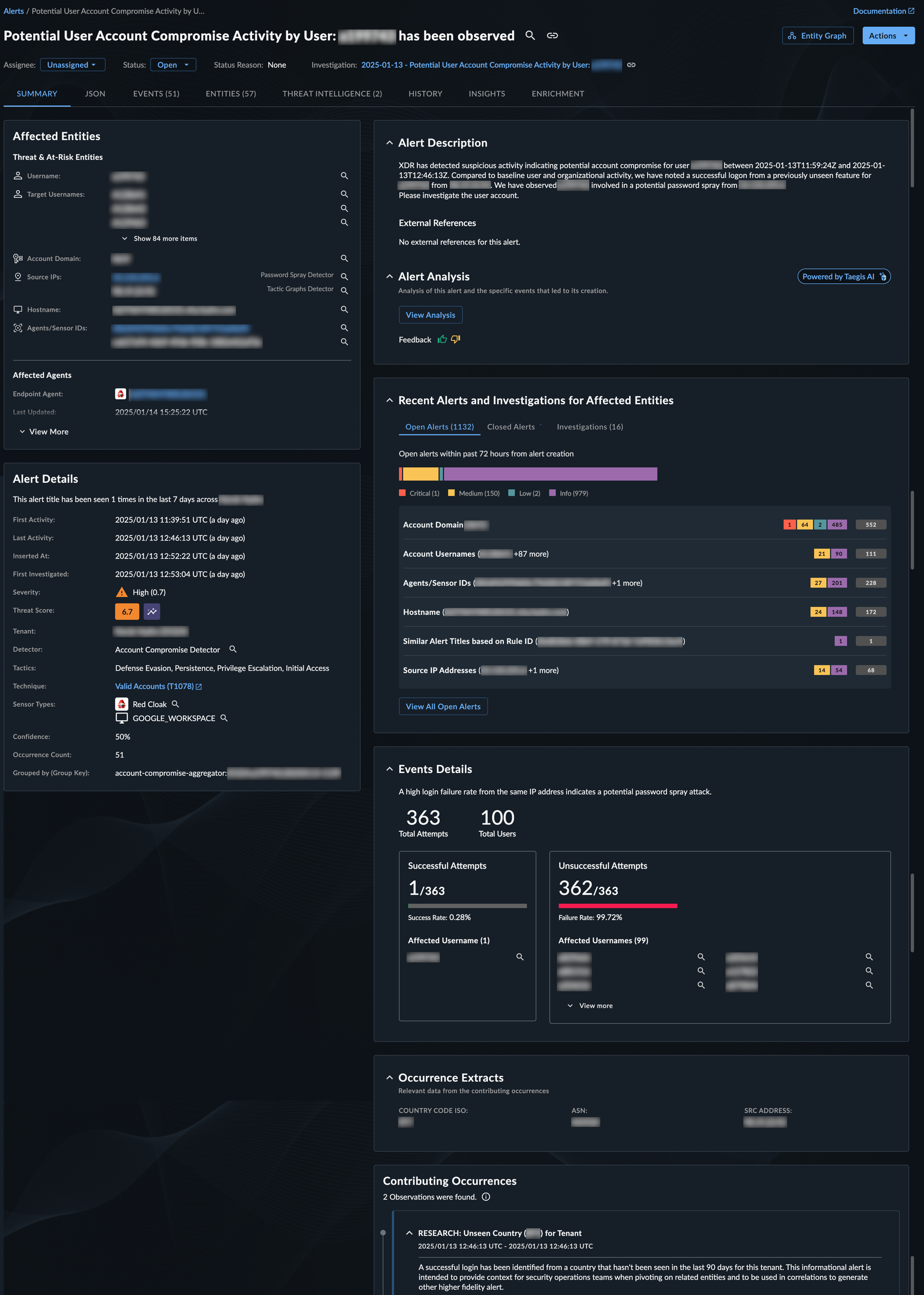

Office365 Security Failure Millions Lost In Executive Account Hack

May 10, 2025

Office365 Security Failure Millions Lost In Executive Account Hack

May 10, 2025 -

A New Look For Android Impact On Gen Z Users

May 10, 2025

A New Look For Android Impact On Gen Z Users

May 10, 2025 -

Millions In Losses Federal Case Details Office365 Executive Account Compromise

May 10, 2025

Millions In Losses Federal Case Details Office365 Executive Account Compromise

May 10, 2025 -

The Appeal Of Androids Redesign To Young Consumers

May 10, 2025

The Appeal Of Androids Redesign To Young Consumers

May 10, 2025