Stock Market News: Immediate Impact Of Proposed Tariffs And UK Trade Agreement

Table of Contents

Immediate Impact of Proposed Tariffs on Stock Prices

Proposed tariffs significantly impact stock prices by increasing import costs for businesses. This leads to reduced profit margins, potentially resulting in lower stock valuations and increased stock price volatility. Specific sectors, like manufacturing and agriculture, are particularly vulnerable to these tariff impacts. The ripple effect extends beyond direct importers, influencing the entire supply chain. A trade war, sparked by retaliatory tariffs, further exacerbates market uncertainty.

- Increased input costs for businesses: Higher import costs translate directly to increased production expenses, squeezing profit margins.

- Reduced consumer purchasing power due to higher prices: Tariffs ultimately lead to higher prices for consumers, reducing their spending power and impacting demand.

- Potential for retaliatory tariffs from other countries, escalating trade tensions: A tit-for-tat tariff war creates widespread economic uncertainty and market instability.

- Sector-specific analysis: focus on industries heavily reliant on imported goods: Industries heavily reliant on imported raw materials or components are particularly vulnerable to tariff increases.

- Market uncertainty and increased volatility: The uncertainty surrounding future tariff policies contributes to increased market volatility, making investment decisions more challenging.

Analyzing the UK Trade Agreement's Short-Term Effects on the Market

The UK trade agreement, while offering long-term potential, has immediate implications for the stock market. Initial reactions depend on investor confidence and the specifics of the deal's impact on various sectors. Uncertainty surrounding future trade relations can also lead to volatility. The market reaction to the agreement has been mixed, reflecting the complexities of the deal.

- Initial market response to the agreement's announcement: The initial response often reflects investor sentiment and the perceived benefits or drawbacks of the agreement.

- Sectors most likely to benefit from increased trade with the UK: Certain sectors, like those involved in exporting goods or services to the UK, may experience a positive boost.

- Potential for increased export opportunities for certain companies: The agreement could create new export opportunities for companies able to access the UK market more efficiently.

- Lingering uncertainties related to regulatory changes and future trade negotiations: Uncertainty surrounding future trade regulations and potential disputes could lead to market hesitation.

- Impact on investor confidence and overall market sentiment: The agreement's overall impact on investor confidence plays a significant role in shaping the short-term market reaction.

Identifying Sectors Most Affected by Both Events

Certain sectors are disproportionately affected by both proposed tariffs and the UK trade agreement. Identifying these vulnerable industries is crucial for investors to assess risks and opportunities. Diversifying portfolios to mitigate these risks is also essential. Understanding which affected sectors are most vulnerable is key to successful risk assessment.

- Manufacturing: Heavily impacted by tariffs and potential disruptions to global supply chains.

- Agriculture: Highly sensitive to both tariffs and changes in trade agreements.

- Financial services: Affected by broader economic uncertainty stemming from trade tensions.

- Technology: Potential benefits from increased trade but also exposed to tariff risks on components and finished goods.

- Energy: Vulnerability depends heavily on the reliance on imports or exports of energy resources.

Developing a Robust Investment Strategy in Light of Current Market Conditions

Navigating the current market requires a well-defined investment strategy that accounts for the impacts of proposed tariffs and the UK trade agreement. This includes risk management, portfolio diversification, and a thorough market analysis. A long-term perspective is crucial to weather short-term market fluctuations.

- Thorough research and due diligence on individual stocks: Carefully assess the potential impact of tariffs and the trade agreement on specific companies.

- Diversification across different asset classes and sectors: Reduce risk by diversifying investments across various asset classes and industries.

- Regular portfolio rebalancing to manage risk effectively: Regularly adjust your portfolio to maintain your desired asset allocation.

- Long-term investment horizon to weather short-term market fluctuations: A long-term perspective is essential to ride out short-term market volatility.

- Considering hedging strategies to mitigate potential losses: Explore strategies to protect your portfolio against potential losses from market downturns.

Conclusion

The immediate impact of proposed tariffs and the finalized UK trade agreement on the stock market is complex and multifaceted. While some sectors might experience short-term setbacks, others could uncover new opportunities. By carefully analyzing these developments, understanding their impact on various sectors, and implementing a robust investment strategy that incorporates risk management and diversification, investors can navigate this dynamic environment and potentially benefit from long-term growth. Stay informed on the latest stock market news concerning proposed tariffs and the UK trade agreement to make well-informed investment decisions. Understanding the implications of global trade on your portfolio is crucial for successful long-term investing.

Featured Posts

-

Valentina Shevchenko Vs Manon Fiorot Ufc 315 Fight Breakdown

May 11, 2025

Valentina Shevchenko Vs Manon Fiorot Ufc 315 Fight Breakdown

May 11, 2025 -

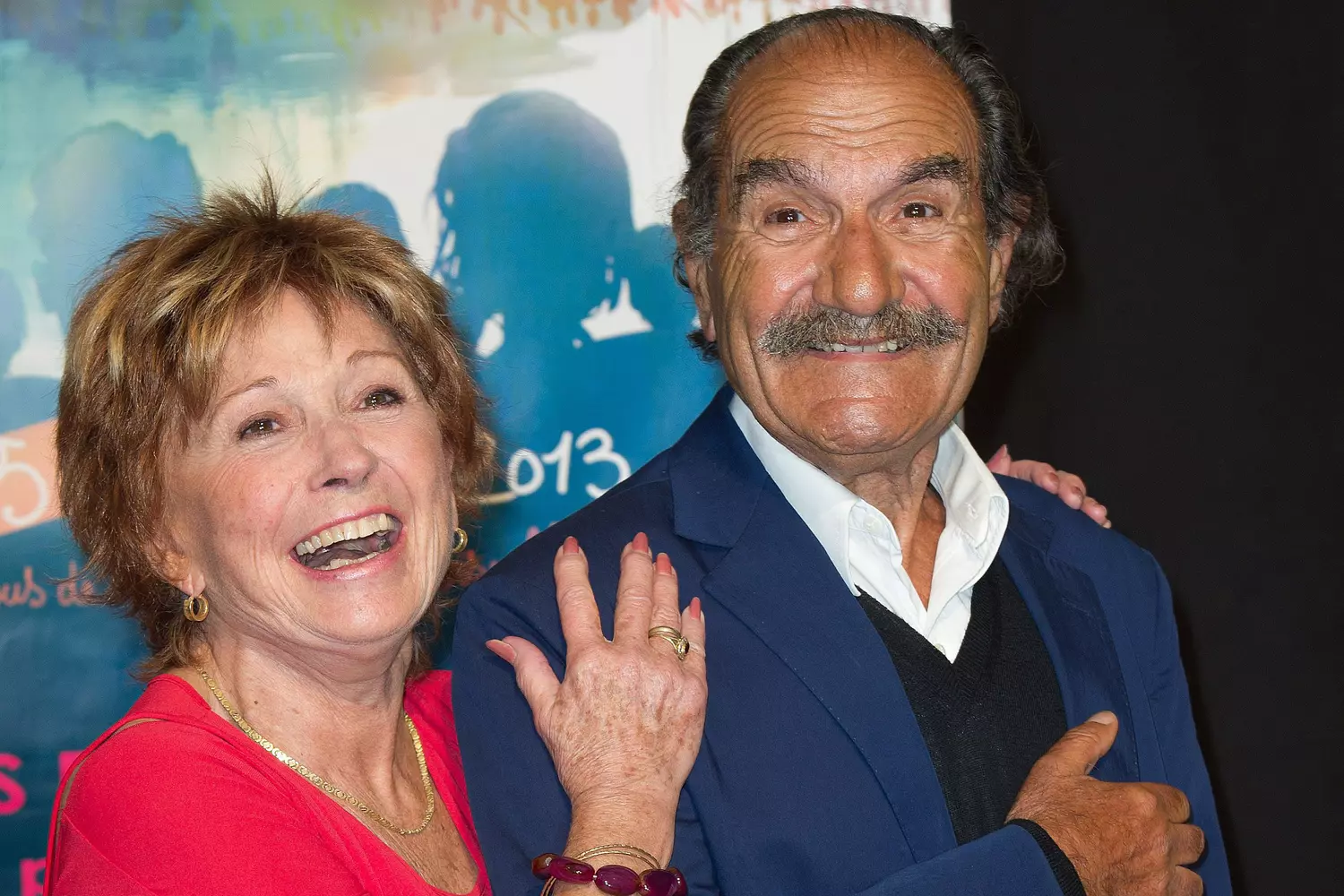

Scenes De Menages Gerard Hernandez Parle De Son Jeu Avec Chantal Ladesou

May 11, 2025

Scenes De Menages Gerard Hernandez Parle De Son Jeu Avec Chantal Ladesou

May 11, 2025 -

Optimiser Son Budget Des Conseils Pratiques Pour Faire Des Economies

May 11, 2025

Optimiser Son Budget Des Conseils Pratiques Pour Faire Des Economies

May 11, 2025 -

Kardashi An Vo Kreatsi A Ko A Gi Istaknuva Ne Zinite Oblini

May 11, 2025

Kardashi An Vo Kreatsi A Ko A Gi Istaknuva Ne Zinite Oblini

May 11, 2025 -

Jay Kelly I Nea Komodia Toy Noa Mpompak Me Toys Kloynei Kai Santler

May 11, 2025

Jay Kelly I Nea Komodia Toy Noa Mpompak Me Toys Kloynei Kai Santler

May 11, 2025