Stock Market Movers: Rockwell Automation Leads The Charge

Table of Contents

Rockwell Automation's Strong Q3 Earnings Report

Rockwell Automation's impressive Q3 2023 earnings report played a crucial role in its recent stock market performance. The report showcased robust financial health, exceeding analyst expectations and significantly impacting investor sentiment.

- Key Highlights: The report highlighted significant revenue growth, exceeding projections, driven by strong demand across various industrial sectors. Earnings per share (EPS) also surpassed estimates, demonstrating the company's profitability. Profit margins remained healthy, indicating efficient operations and strong pricing power.

- Contributing Factors: The positive financial results were fueled by several factors. Increased demand for industrial automation solutions, particularly within the automotive, food and beverage, and life sciences sectors, significantly boosted sales. The company's focus on providing cutting-edge automation solutions and digital transformation tools further contributed to its success.

- Investor Confidence: The fact that the Q3 earnings report exceeded analyst expectations instilled significant confidence in investors. This positive sentiment translated directly into increased demand for Rockwell Automation stock, pushing its price upward. The strong performance also validated the company's strategic direction and its ability to navigate challenging macroeconomic conditions.

- High-Performing Segments: Specific segments within Rockwell Automation, such as its industrial control and information solutions, experienced particularly robust growth, contributing heavily to the overall positive earnings report. This further solidified the company's position as a leader in the industrial automation market.

Increased Demand for Industrial Automation and Digital Transformation

The surge in Rockwell Automation's stock price is inextricably linked to the burgeoning global demand for industrial automation and digital transformation solutions. This trend is being driven by a confluence of factors impacting businesses worldwide.

- Driving Forces: Labor shortages across various industries are forcing companies to seek automation solutions to increase efficiency and productivity. Furthermore, the need for enhanced supply chain optimization and the rise of Industry 4.0 – the smart manufacturing revolution – are fueling demand for advanced automation technologies.

- Rockwell Automation's Leadership: Rockwell Automation is a key player in this rapidly expanding market. Its extensive portfolio of automation solutions, encompassing robotics, process control systems, and industrial software, positions it to capitalize on this significant growth opportunity. The company's technological advancements and strong market share solidify its leadership position.

- Digital Transformation Impact: Rockwell Automation's commitment to digital transformation initiatives, encompassing cloud-based solutions and data analytics, is further strengthening its competitive advantage and fueling its profitability. The company's offerings are helping industrial companies to improve efficiency, reduce downtime, and make better data-driven decisions.

- Successful Implementations: Numerous successful implementations of Rockwell Automation's solutions across various industries demonstrate its technological prowess and ability to deliver tangible value to its customers. These success stories contribute to positive word-of-mouth marketing and further solidify the company's reputation within the industry.

Strategic Acquisitions and Partnerships Fueling Growth

Rockwell Automation's strategic acquisitions and partnerships have played a significant role in its recent success and contribute to its appeal as a strong stock market mover. These initiatives have broadened the company's reach, capabilities, and technological offerings.

- Expanding Capabilities: Recent acquisitions have expanded Rockwell Automation's product portfolio, adding new technologies and capabilities that complement its existing offerings. These acquisitions have extended the company's reach into new market segments and enhanced its technological leadership.

- Strategic Synergies: Partnerships with key players in the industrial automation ecosystem have fostered innovation and created synergies that enhance the competitiveness and market reach of both partners. These collaborations have led to the development of innovative solutions that meet the evolving needs of industrial customers.

- Market Expansion: These strategic moves have allowed Rockwell Automation to penetrate new geographic markets and serve a wider range of customers. This expansion into new territories significantly contributes to revenue growth and strengthens the company's global footprint.

- Technological Innovation: Acquisitions and partnerships have brought in valuable expertise and cutting-edge technologies, enhancing Rockwell Automation's innovative capabilities and its ability to deliver advanced automation solutions to the market.

Positive Analyst Ratings and Future Outlook

The positive outlook for Rockwell Automation is further reinforced by favorable analyst ratings and projections for future growth. These predictions suggest continued upward momentum for the stock.

- Analyst Consensus: Many leading financial analysts have assigned buy ratings or strong buy recommendations to Rockwell Automation stock, reflecting a high degree of confidence in the company's future performance. These ratings have significantly influenced investor sentiment and contributed to the stock's upward trajectory.

- Growth Projections: Analysts project strong future growth for Rockwell Automation, based on the company's robust financial performance, the increasing demand for industrial automation, and its strategic initiatives. These positive projections have further fueled investor enthusiasm.

- Supporting Factors: Several factors support the positive outlook for Rockwell Automation, including the continued digital transformation of industrial processes, the growing adoption of smart manufacturing technologies, and the company's ability to innovate and adapt to evolving market trends.

- Potential Challenges: While the outlook is positive, potential challenges such as global economic uncertainty and supply chain disruptions could impact Rockwell Automation's performance. However, the company's strong financial position and strategic initiatives mitigate these risks.

Conclusion

Rockwell Automation's recent surge as a stock market mover is a direct consequence of its strong Q3 earnings, the burgeoning demand for industrial automation and digital transformation, strategic acquisitions, and positive analyst ratings. The company's forward-thinking approach and focus on innovation position it well for continued growth within the dynamic industrial automation sector. Understanding the key factors driving Rockwell Automation's success is vital for investors seeking exposure to this thriving market.

Call to Action: Stay informed on the latest developments in the stock market and consider adding Rockwell Automation to your portfolio of growth stocks. Understanding the key factors driving Rockwell Automation and other significant stock market movers is crucial for informed investment decisions. Learn more about investing in leading industrial automation companies like Rockwell Automation to capitalize on the growing demand for advanced automation solutions.

Featured Posts

-

Tony Bennett A Retrospective On His People And Music

May 17, 2025

Tony Bennett A Retrospective On His People And Music

May 17, 2025 -

7 Bit Casino Best Online Casino Canada For Canadian Players

May 17, 2025

7 Bit Casino Best Online Casino Canada For Canadian Players

May 17, 2025 -

Tam Krwz Ke Jwte Pr Pawn Rkhne Waly Khatwn Mdah Awr Adakar Ka Rdeml

May 17, 2025

Tam Krwz Ke Jwte Pr Pawn Rkhne Waly Khatwn Mdah Awr Adakar Ka Rdeml

May 17, 2025 -

A Look At The Chances Of A Severance Season 3

May 17, 2025

A Look At The Chances Of A Severance Season 3

May 17, 2025 -

Can Modular Homes Solve Canadas Housing Crisis Speed Cost And Viability

May 17, 2025

Can Modular Homes Solve Canadas Housing Crisis Speed Cost And Viability

May 17, 2025

Latest Posts

-

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025 -

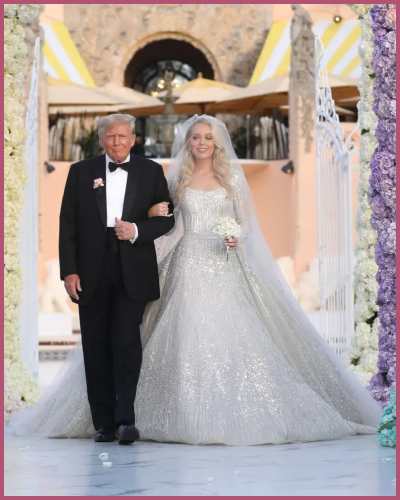

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025 -

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025 -

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025 -

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025