Steel Production Cuts In China: The Effect On Iron Ore And Global Trade

Table of Contents

Reduced Chinese Steel Production: The Catalyst for Change

China's steel output, historically a global behemoth, has experienced significant contractions. This isn't a random fluctuation; it's a confluence of factors driven by government policy and market forces.

-

Environmental Regulations: Stringent new environmental regulations aimed at curbing pollution from steel mills have forced production cutbacks. These regulations focus on reducing carbon emissions and improving air quality, impacting steel mill capacity and operational efficiency. The Chinese government's commitment to environmental sustainability is a key driver of these changes.

-

Government Initiatives to Curb Overcapacity: For years, China battled with overcapacity in its steel sector. To address this, the government implemented production quotas and encouraged mergers and acquisitions to consolidate the industry and improve efficiency. This streamlining process, while intended to bolster the long-term health of the industry, has resulted in immediate production reductions.

-

Slowing Economic Growth: China's economic growth, while still substantial, has slowed in recent years. This has reduced domestic demand for steel, further contributing to the production cuts. Reduced infrastructure projects and a slowdown in construction have decreased the need for steel, impacting overall demand.

The reduction in Chinese steel output is substantial. Reports indicate a decrease of [Insert specific percentage or tonnage data from a reliable source, e.g., "X% or Y million tonnes" ] in [Insert timeframe, e.g., "the last quarter"]. This has significantly impacted major Chinese steel producers like [List some major Chinese steel producers], forcing them to adapt their strategies through cost-cutting measures, diversification, and increased focus on higher value-added products.

The Impact on Iron Ore Prices and Demand

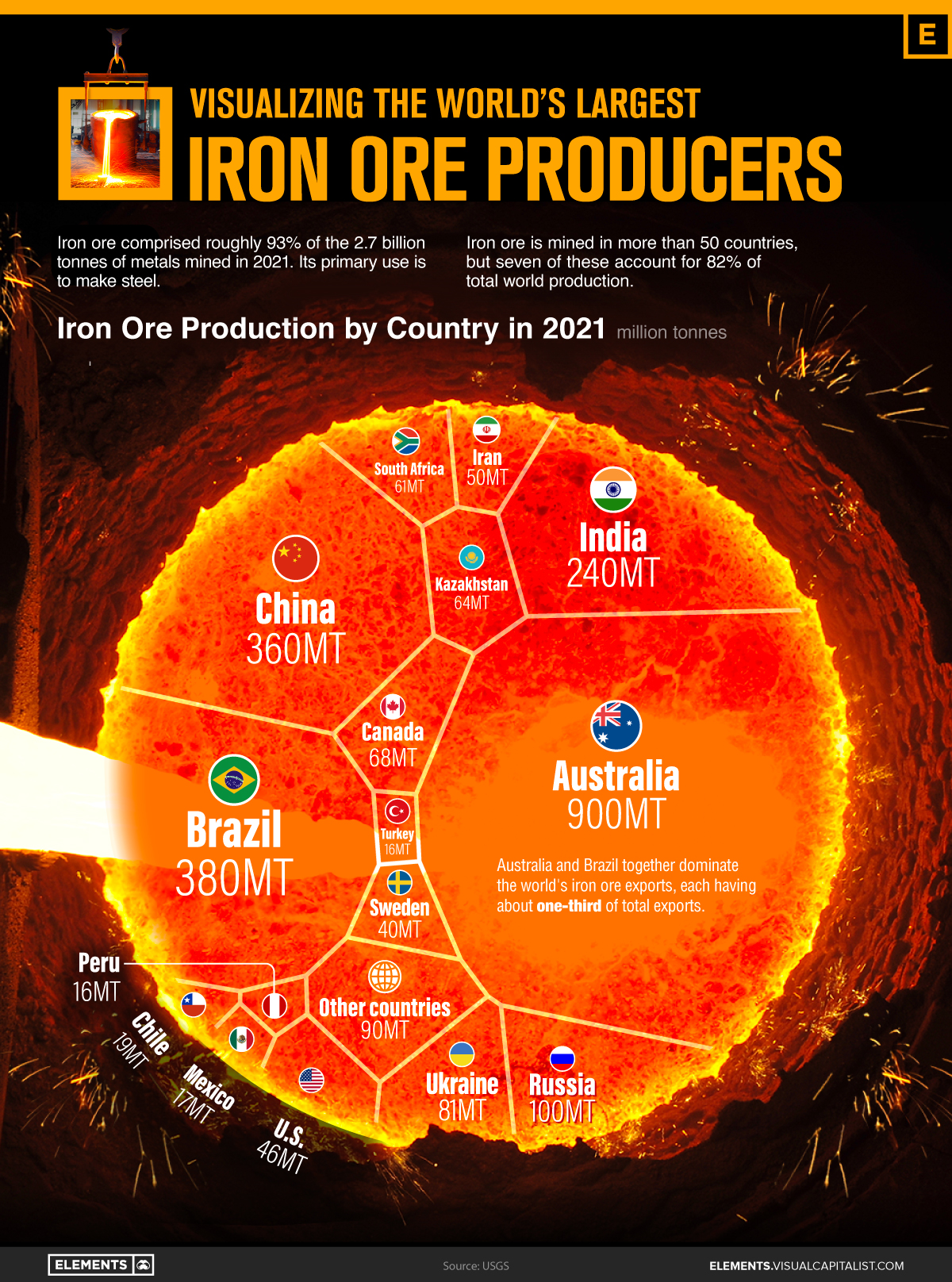

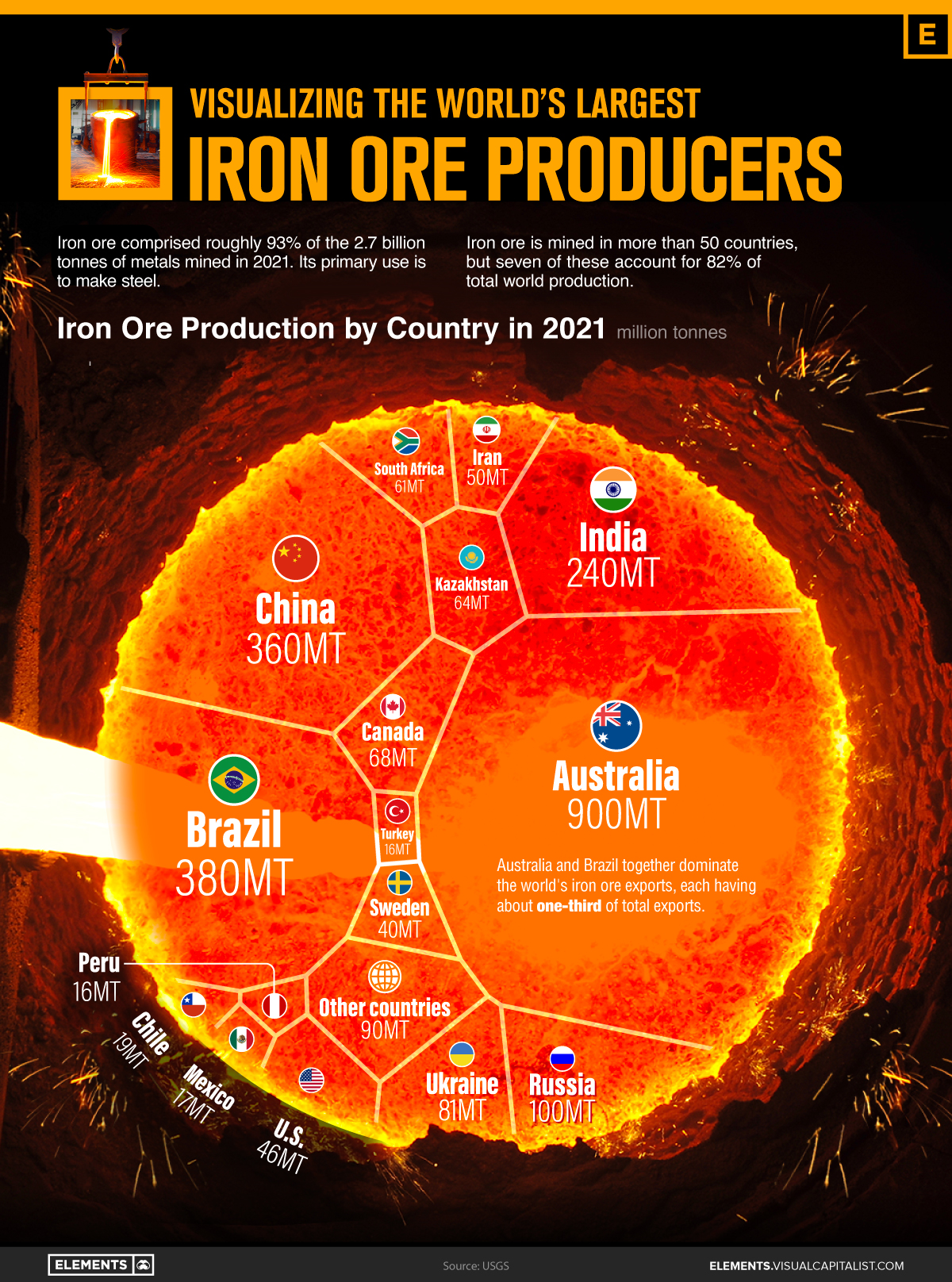

The direct correlation between reduced Chinese steel production and decreased iron ore demand is undeniable. China is the world's largest consumer of iron ore, and its production cuts have led to a significant drop in demand.

-

Iron Ore Price Fluctuations: The decreased demand has caused significant fluctuations in iron ore prices. Prices have [Describe the price movements – increased, decreased, or remained volatile] reflecting the supply and demand dynamics. [Cite sources to support price data].

-

Impact on Major Iron Ore Producers: Major iron ore producers like BHP, Rio Tinto, and Vale have felt the impact, experiencing reduced sales and profitability. They've had to adjust their production levels and explore new markets to mitigate losses.

-

Iron Ore Market Analysis and Forecast: Analysts predict [Insert predictions about future iron ore prices and market trends based on reliable sources]. The volatility is expected to persist until a more stable equilibrium between supply and demand is reached. The seaborne iron ore market, in particular, is experiencing significant upheaval.

Global Trade Implications: A Shifting Landscape

The reduction in Chinese steel production has created a ripple effect across global steel trade.

-

Global Steel Trade Flows: Countries that previously relied on Chinese steel imports are now seeking alternative sources. This is leading to a reshuffling of global steel trade flows.

-

Impact on Steel Exporters and Importers: Steel-exporting countries like [List examples] are experiencing both opportunities and challenges. Opportunities exist to fill the demand gap left by China, while challenges arise from increased competition and potential price wars. Meanwhile, steel-importing countries face uncertainty regarding supply chain reliability and pricing.

-

Increased Competition: The global steel market is experiencing increased competition as producers vie for market share. This competition could lead to further price adjustments and strategic alliances.

-

Supply Chain Disruptions: The changes in steel production and trade flows are causing some supply chain disruptions, particularly for industries reliant on steel as a key raw material. Logistics companies are adjusting their strategies to manage this evolving landscape.

Opportunities and Challenges for International Players

The changing dynamics in the global steel market present both opportunities and challenges for international players.

-

Opportunities for Other Steel Producers: Steel producers outside of China have a chance to expand their market share by filling the void left by reduced Chinese production. This requires strategic investments in capacity and efficient logistics.

-

Challenges for International Steel Companies: International steel companies face significant challenges, including navigating the complexities of international trade agreements, managing price volatility, and dealing with increased competition. Strategic planning and adaptability are key to success.

Conclusion

China's steel production cuts have created a significant ripple effect across the global iron ore and steel markets. The decrease in demand for iron ore has impacted prices and profitability for producers, while simultaneously shifting the dynamics of international trade. The resulting market volatility presents both opportunities and challenges for stakeholders worldwide.

Call to Action: Stay informed about the ongoing developments in China’s steel production cuts and their impact on the global iron ore and steel market. Regularly monitor market analysis and forecasts to navigate the complexities of this evolving landscape. Understanding these shifts is crucial for businesses involved in the global steel and iron ore trade to effectively manage risk and capitalize on new opportunities.

Featured Posts

-

Dakota Dzhonson Proval Goda Po Versii Zolotoy Maliny

May 09, 2025

Dakota Dzhonson Proval Goda Po Versii Zolotoy Maliny

May 09, 2025 -

Bao Mau Bao Hanh Tre Em Tien Giang Cong Dong Can Len Tieng Bao Ve Tre Nho

May 09, 2025

Bao Mau Bao Hanh Tre Em Tien Giang Cong Dong Can Len Tieng Bao Ve Tre Nho

May 09, 2025 -

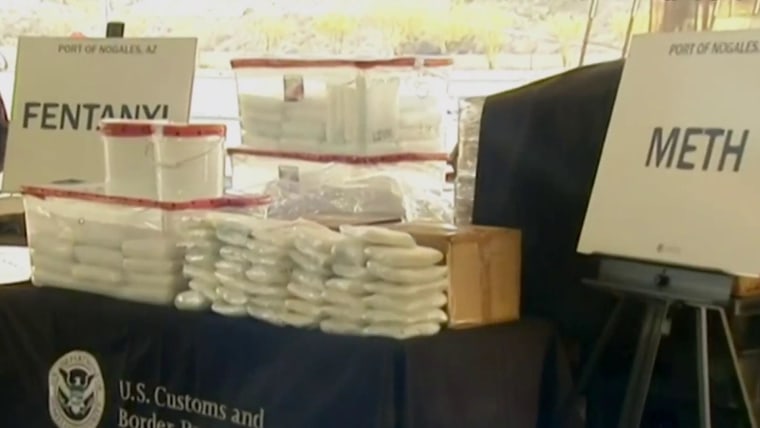

Largest Fentanyl Bust In Us History Pam Bondi Announces Major Seizure

May 09, 2025

Largest Fentanyl Bust In Us History Pam Bondi Announces Major Seizure

May 09, 2025 -

Khac Phuc Hau Qua Vu Bao Hanh Tre Em Tai Tien Giang

May 09, 2025

Khac Phuc Hau Qua Vu Bao Hanh Tre Em Tai Tien Giang

May 09, 2025 -

Dakota Johnsons Figure Hugging Dress A Materialists Premiere Highlight

May 09, 2025

Dakota Johnsons Figure Hugging Dress A Materialists Premiere Highlight

May 09, 2025

Latest Posts

-

Katya Joness Bbc Exit A Wynne Evans Betrayal

May 09, 2025

Katya Joness Bbc Exit A Wynne Evans Betrayal

May 09, 2025 -

Celebrity Antiques Road Trip Meet The Experts And Their Expertise

May 09, 2025

Celebrity Antiques Road Trip Meet The Experts And Their Expertise

May 09, 2025 -

Strictly Katya Jones Hints At Bbc Departure After Wynne Evans Betrayal

May 09, 2025

Strictly Katya Jones Hints At Bbc Departure After Wynne Evans Betrayal

May 09, 2025 -

Joanna Page And Wynne Evans Bbc Show Clash A Heated Moment

May 09, 2025

Joanna Page And Wynne Evans Bbc Show Clash A Heated Moment

May 09, 2025 -

How To Watch Celebrity Antiques Road Trip A Complete Guide

May 09, 2025

How To Watch Celebrity Antiques Road Trip A Complete Guide

May 09, 2025