State Treasurers Express Concerns To Tesla Board About Musk's Direction

Table of Contents

Financial Instability and Risk Concerns

Recent volatility in Tesla's stock price has sent ripples through the portfolios of state pension funds and other public investments. This instability represents a significant risk to the treasurers' fiduciary duty to protect public funds. Several factors contribute to these concerns:

-

Erratic Stock Performance: Tesla's stock price has experienced dramatic swings, largely attributed to Elon Musk's unpredictable actions and pronouncements. This volatility creates significant investment risk for state treasurers.

-

The Twitter Acquisition: The controversial acquisition of Twitter by Musk, financed partly through the sale of Tesla shares, caused a substantial dip in Tesla's stock price, directly impacting the value of state investments.

-

Controversial Tweets: Musk's frequent and often controversial tweets, including those related to Tesla's operations and future plans, have added to the market uncertainty surrounding the company's performance and long-term stability.

The state treasurers' concerns are not merely speculative; they represent a tangible threat to the financial well-being of state pension funds and other public investments. The potential for significant financial losses necessitates a thorough examination of Tesla's leadership and operational practices. Keywords: Stock Volatility, Investment Risk, Pension Funds, Fiduciary Duty, Financial Losses, Tesla Stock Price.

ESG Concerns and Sustainability Questions

Beyond financial instability, state treasurers are also raising serious concerns about Tesla's commitment to Environmental, Social, and Governance (ESG) principles. ESG investing is becoming increasingly important for state treasurers, who are under pressure to demonstrate responsible stewardship of public funds. Concerns include:

-

Inconsistency with Public Commitments: While Tesla positions itself as a leader in sustainable transportation, some of Musk's actions and company practices have been perceived as contradicting these commitments.

-

Workplace Issues: Reports of workplace conditions at Tesla factories have raised concerns about the company's social responsibility.

-

Lack of Transparency: A lack of transparency in Tesla's reporting on its ESG performance further fuels these concerns among state treasurers.

The growing importance of ESG investing makes it crucial for Tesla to demonstrate a robust commitment to sustainability and social responsibility. Failure to do so not only jeopardizes state investments but also carries substantial reputational risk. Keywords: ESG Investing, Sustainability, Environmental Concerns, Social Responsibility, Governance, Reputational Risk, Tesla ESG Score.

Governance Issues and Board Accountability

State treasurers are questioning the effectiveness of Tesla's board of directors in overseeing Elon Musk's actions and mitigating the risks associated with his leadership style. Concerns include:

-

Lack of Oversight: Some argue that the board has not provided sufficient oversight of Musk's activities, leading to significant financial and reputational risks for the company.

-

Calls for Reform: There are growing calls for increased board independence and stronger corporate governance structures to better protect shareholder interests.

-

Long-Term Viability: The current governance structure raises concerns about Tesla's long-term viability and investor confidence. Weak corporate governance can significantly hinder a company's ability to attract and retain investment.

The concerns of state treasurers highlight the critical role of effective corporate governance in ensuring the responsible management of public companies. Keywords: Corporate Governance, Board of Directors, Oversight, Accountability, Tesla Governance, Shareholder Activism.

The Treasurers' Demands and Potential Next Steps

State treasurers are demanding increased transparency, improved governance, and a stronger commitment to ESG principles from Tesla's board. Their demands represent a significant escalation of pressure on the company:

-

Specific Requests: The requests may include detailed reports on Tesla's financial health, its ESG performance, and a clear plan to improve corporate governance.

-

Potential Consequences: Failure to meet these demands could result in divestment by state treasurers, leading to substantial financial losses for Tesla. Shareholder lawsuits are also a distinct possibility.

-

Broader Implications: This situation has broader implications for corporate governance and the role of institutional investors in holding companies accountable. The actions of state treasurers serve as a warning to other companies that questionable leadership and governance practices will face increased scrutiny. Keywords: Divestment, Shareholder Lawsuits, Institutional Investors, Corporate Accountability, Tesla Response.

Conclusion: The Future of Tesla and State Treasurer Involvement

The concerns raised by state treasurers underscore the significant financial and reputational risks associated with Elon Musk's leadership of Tesla. The potential for significant losses to state pension funds and other public investments necessitates a thorough review of Tesla's corporate governance and sustainability practices. The increased scrutiny facing Tesla reflects a growing trend towards greater transparency and accountability in corporate leadership. The actions of state treasurers highlight the growing need for greater transparency and accountability in corporate governance. Keep an eye on developments in the Tesla and Elon Musk situation as this story unfolds. The future of Tesla, and its relationship with institutional investors like state treasurers, hinges on the board's response to these legitimate and pressing concerns.

Featured Posts

-

High Stock Market Valuations And Why Bof A Believes They Re Justified

Apr 23, 2025

High Stock Market Valuations And Why Bof A Believes They Re Justified

Apr 23, 2025 -

Die 50 2025 Wer Ist Raus Teilnehmer Termine Streaming Infos

Apr 23, 2025

Die 50 2025 Wer Ist Raus Teilnehmer Termine Streaming Infos

Apr 23, 2025 -

Trump Again Targets Jerome Powell Urges His Removal From Office

Apr 23, 2025

Trump Again Targets Jerome Powell Urges His Removal From Office

Apr 23, 2025 -

Teslas Board Defends Musks Leadership Amidst State Treasurer Concerns

Apr 23, 2025

Teslas Board Defends Musks Leadership Amidst State Treasurer Concerns

Apr 23, 2025 -

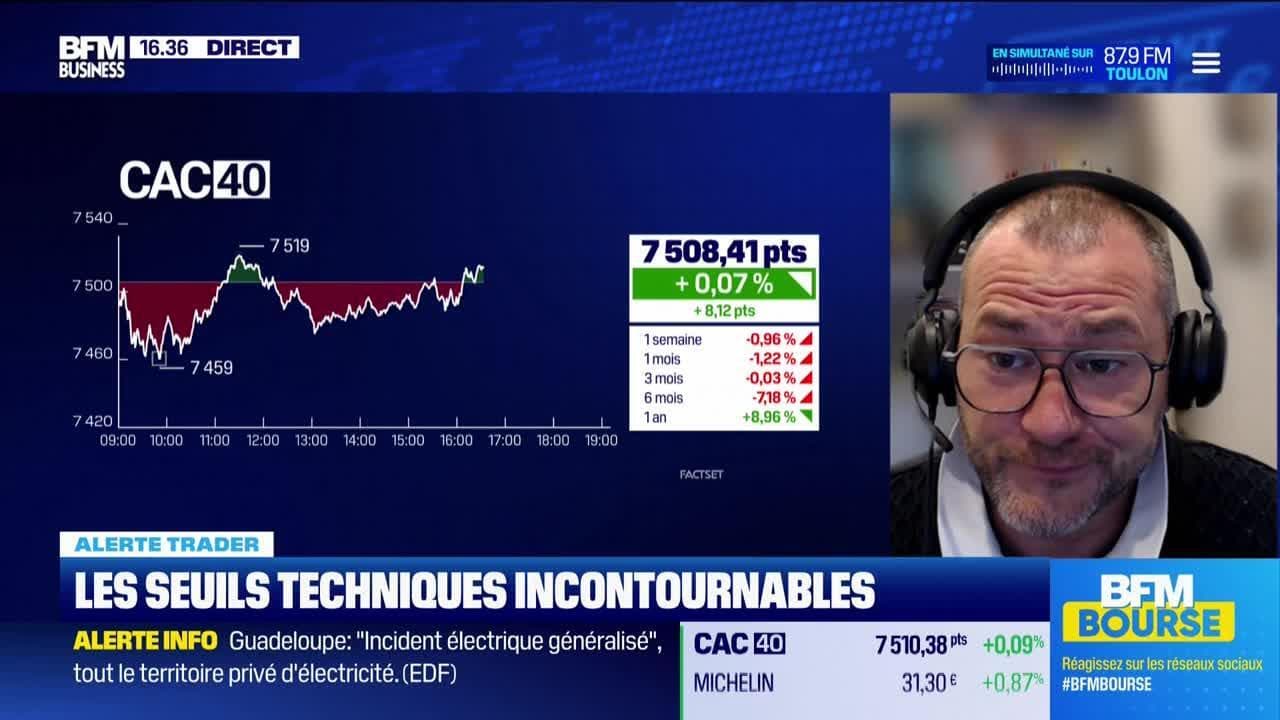

Trading Et Seuils Techniques Identifier Les Opportunites D Investissement

Apr 23, 2025

Trading Et Seuils Techniques Identifier Les Opportunites D Investissement

Apr 23, 2025