Startups Stalling Before IPO: Exploring All Available Options

Table of Contents

Re-evaluating Your Business Model and Metrics

Before pursuing further funding or alternative exit strategies, a thorough reassessment of your business model and key performance indicators (KPIs) is crucial. This process involves identifying bottlenecks, addressing weaknesses, and refining your value proposition.

Identifying Bottlenecks and Addressing Weaknesses

- Analyze Key Performance Indicators (KPIs): Scrutinize your data. Are your customer acquisition costs (CAC) too high? Is your churn rate alarmingly elevated? Are all your revenue streams performing as expected? Identify the metrics that are lagging and understand why.

- Identify Areas Needing Improvement: Pinpoint the specific areas of your business that are hindering growth. This might involve inefficient processes, inadequate marketing strategies, or a lack of product-market fit.

- Conduct Thorough Market Research: Don't rely on assumptions. Conduct comprehensive market research to understand your competitive landscape, identify unmet needs, and validate your business model. This research should inform your strategic adjustments.

Data-driven decision-making is paramount here. Utilize analytics tools to gain a deep understanding of your business performance. A/B testing allows you to experiment with different approaches, iteratively improving your strategies based on concrete results. This rigorous analysis provides a solid foundation for making informed decisions about your next steps.

Refining Your Value Proposition and Target Market

- Refine Your Unique Selling Proposition (USP): Is your USP clearly defined and compelling? Does it resonate with your target audience? Re-evaluate your value proposition to ensure it stands out in a crowded market.

- Reassess Your Target Audience: Is your current target market truly the most profitable and scalable? Consider segmenting your market further or even pivoting to a more lucrative niche.

- Explore Niche Market Opportunities: Focusing on a niche market can often yield higher returns and reduce competition. Identifying underserved segments can lead to significant growth.

A strong brand identity and clear messaging are essential for attracting investors and customers. Investors are looking for a clear, compelling story about your company's potential. Refining your value proposition and target market is crucial for enhancing your narrative and ultimately, your valuation.

Securing Additional Funding and Strategic Partnerships

Securing sufficient funding is often critical for a startup aiming for an IPO or an alternative exit strategy. However, relying solely on traditional Venture Capital (VC) funding can be limiting. Exploring alternative funding options and strategic partnerships can significantly improve your chances of success.

Exploring Alternative Funding Options Beyond Venture Capital

- Angel Investors: Angel investors can provide valuable capital and mentorship.

- Crowdfunding Platforms (e.g., Kickstarter, Indiegogo): Crowdfunding can build brand awareness and generate early revenue.

- Debt Financing: Debt financing offers a less dilutive option compared to equity funding.

- Government Grants: Government grants can provide significant financial support for eligible startups.

- Strategic Partnerships for Revenue Sharing or Cross-Promotion: These partnerships can unlock new revenue streams and expand your market reach.

Each funding option has its own set of advantages and disadvantages. A well-crafted pitch deck highlighting your business's potential is essential for securing funding from any source. Understanding the nuances of each option will help you choose the best strategy for your specific needs.

Building Strategic Alliances for Growth and Market Expansion

- Collaborations with Complementary Businesses: Partnering with companies offering complementary products or services can broaden your appeal and reach.

- Technology Licensing Agreements: Licensing your technology to other companies can generate additional revenue streams.

- Joint Ventures to Reach New Markets and Customer Segments: Joint ventures allow you to leverage the expertise and resources of another company to expand into new territories or customer segments.

Strategic partnerships can significantly enhance your brand visibility, provide access to new technologies, and expand your distribution channels, making your startup much more attractive to potential investors and significantly improving IPO readiness.

Restructuring and Operational Efficiency

Before considering an IPO or an acquisition, many startups need to streamline their operations and improve their overall efficiency. This might involve cost reduction, process optimization, and strategic growth initiatives.

Streamlining Operations and Reducing Costs

- Identify Areas for Cost Reduction: Carefully analyze your expenses to identify areas where costs can be reduced without compromising quality.

- Optimize Workflows: Improve your internal processes to minimize waste and maximize efficiency.

- Implement Automation: Automation can improve efficiency, reduce overhead costs, and minimize errors.

- Renegotiate Contracts with Suppliers: Negotiate better terms with your suppliers to reduce your procurement costs.

Lean methodologies and other process improvement techniques can help optimize operational efficiency. By focusing on efficiency, you can improve profitability and enhance your company's overall attractiveness to potential buyers or investors.

Implementing Cost-Effective Growth Strategies (Growth Hacking)

- Focus on Organic Growth: Leverage content marketing, SEO, social media marketing, email marketing, and referral programs to drive organic growth.

- Leverage Viral Marketing Tactics: Identify strategies to encourage organic sharing and virality to reach a wider audience.

Growth hacking involves using creative and cost-effective strategies to rapidly increase user acquisition and engagement. These tactics can significantly boost valuations quickly and cheaply, making your startup more appealing for an IPO or acquisition.

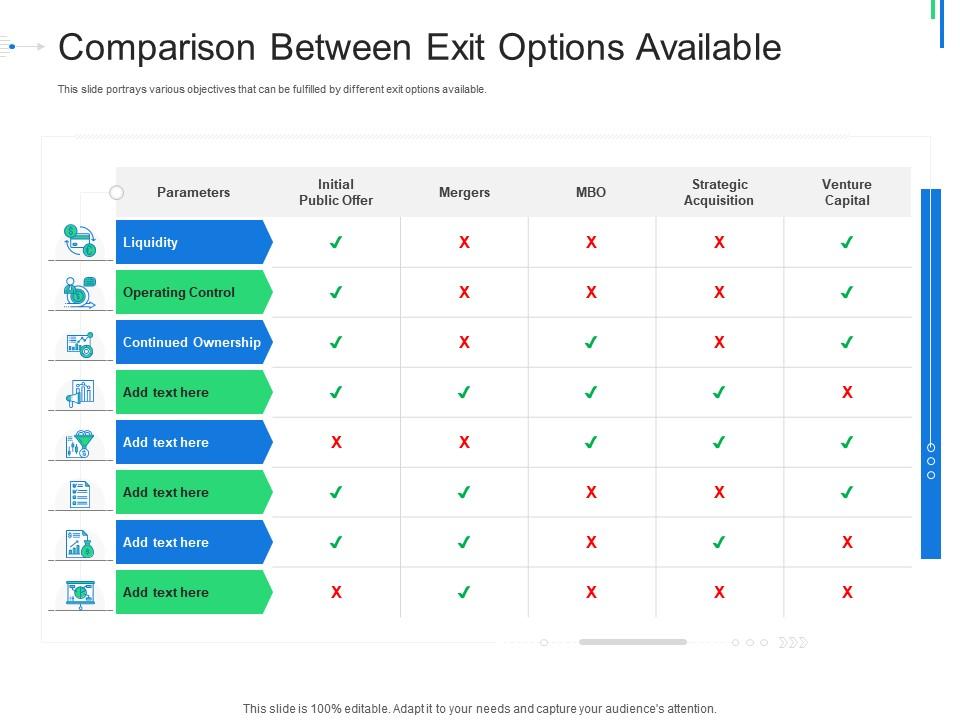

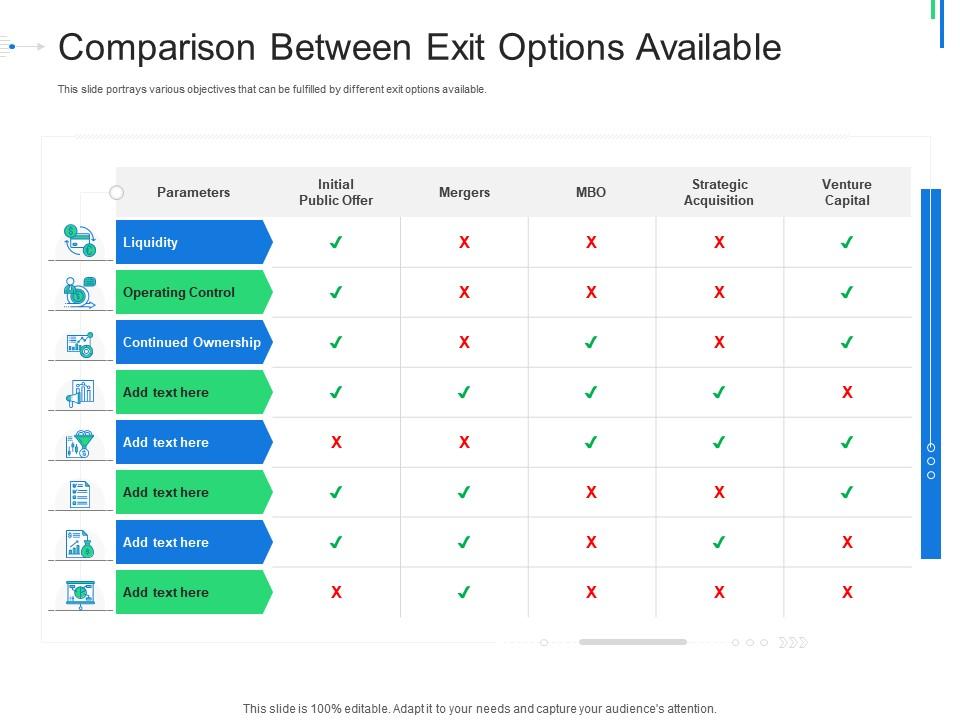

Exploring Alternative Exit Strategies

If an IPO isn't currently feasible, exploring alternative exit strategies, such as mergers and acquisitions (M&A) or a strategic sale, can be beneficial.

Mergers and Acquisitions (M&A)

- Identify Potential Acquirers: Research companies that could benefit from acquiring your startup.

- Prepare a Compelling M&A Pitch: Craft a compelling presentation showcasing the value proposition of your company.

- Navigate the Complexities of the Acquisition Process: Engage experienced legal and financial advisors to guide you through the process.

Being acquired can offer several advantages, including immediate liquidity and access to resources that could otherwise take years to obtain. Understanding the benefits and drawbacks of being acquired compared to going public will allow you to make informed decisions.

Strategic Sale to a Larger Company

- Identify Potential Strategic Buyers: Target larger companies that align strategically with your business.

- Negotiate Favorable Terms: Secure the best possible terms and conditions during the sale negotiations.

- Ensure a Smooth Transition of Ownership: Plan for a smooth transition to ensure continued business success under new ownership.

A strategic sale can offer access to resources, market expertise, and wider distribution networks, allowing your business to reach its full potential under the umbrella of a larger organization.

Conclusion

Startups stalling before an IPO face complex challenges, but many viable paths forward exist. By carefully re-evaluating your business model, securing additional funding through diverse channels, restructuring operations for maximum efficiency, and exploring alternative exit strategies like M&A, you can overcome these hurdles. Don't let your startup stall – explore all available options and chart a path towards success, whether it's through a successful IPO or another lucrative exit strategy. Proactive planning and strategic decision-making are key. Start planning your next steps today to navigate the challenges and achieve your ultimate goals.

Featured Posts

-

Mirka I Rodzer Federer Dva Para Blizanaca Fotografije I Detalji

May 14, 2025

Mirka I Rodzer Federer Dva Para Blizanaca Fotografije I Detalji

May 14, 2025 -

Joaquin Caparros Y El Sevilla Fc 25 Anos De Un Vinculo Inolvidable

May 14, 2025

Joaquin Caparros Y El Sevilla Fc 25 Anos De Un Vinculo Inolvidable

May 14, 2025 -

Dean Huijsen A Look At The Potential Barcelona Transfer

May 14, 2025

Dean Huijsen A Look At The Potential Barcelona Transfer

May 14, 2025 -

Eurojackpotin Jaettivoitto 4 8 Miljoonaa Euroa Voitettu Suomessa

May 14, 2025

Eurojackpotin Jaettivoitto 4 8 Miljoonaa Euroa Voitettu Suomessa

May 14, 2025 -

Is Jobe Bellingham Headed To Borussia Dortmund A Transfer Analysis

May 14, 2025

Is Jobe Bellingham Headed To Borussia Dortmund A Transfer Analysis

May 14, 2025