SSE's Revised Spending Plan: £3 Billion Cut Reflects Market Conditions

Table of Contents

Market Conditions Driving the Spending Cut

The decision to reduce spending by £3 billion is a direct response to a confluence of factors creating considerable uncertainty in the energy market. These challenging market conditions necessitate a reassessment of capital expenditure and a more cautious approach to future investments.

- Increased Inflation and Rising Interest Rates: Soaring inflation and subsequent interest rate hikes have increased the cost of borrowing, making large-scale investments considerably more expensive for SSE. This inflationary pressure impacts every stage of a project, from initial planning to final completion.

- Supply Chain Disruptions and Material Cost Increases: Global supply chain disruptions continue to plague various industries, including energy. The increased cost of raw materials, coupled with delays in procurement, significantly inflates project budgets.

- Uncertainty in the Energy Market due to Geopolitical Factors: The ongoing geopolitical instability, particularly in Eastern Europe, has introduced considerable volatility into the energy market. This uncertainty makes long-term investment planning significantly more complex and risky.

- Impact of Government Regulations and Policies: Changes in government regulations and policies regarding energy production and distribution add another layer of complexity to investment decisions. Navigating the evolving regulatory landscape adds costs and delays to projects. This regulatory uncertainty contributes to the overall risk assessment for large-scale energy projects.

Details of the £3 Billion Reduction

The £3 billion reduction in SSE's spending plan is not a uniform cut across all areas. Instead, the company has targeted specific areas for cost-saving measures, prioritizing projects deemed essential for maintaining business continuity and achieving long-term strategic goals.

- Renewable Energy Projects: While SSE remains committed to renewable energy, some projects have been scaled back or delayed. This includes potential delays in the development of new wind farms and other renewable energy infrastructure.

- Network Infrastructure: Investments in upgrading and expanding the electricity network have also been affected. This could lead to potential delays in improving grid capacity and resilience.

- Operational Costs: SSE has also implemented cost-saving measures within its operational expenditure, aiming to streamline processes and improve efficiency. This could include reductions in staffing levels or outsourcing certain functions.

While a precise breakdown of the £3 billion cut across different sectors hasn't been publicly released in detail, it's clear that the reduction reflects a strategic re-evaluation of capital expenditure priorities in response to the challenging market environment.

Impact on SSE's Future Projects and Strategy

The revised spending plan will inevitably impact SSE's long-term strategy and its ability to meet ambitious net-zero targets. The reduced investment in renewable energy projects could potentially slow down the energy transition and impact the company's capacity to meet its sustainability goals.

- Long-term Strategy: The revised plan necessitates a re-evaluation of SSE's long-term strategic goals, potentially leading to a reassessment of project timelines and priorities.

- Renewable Energy Investment: The reduced investment in renewable energy raises concerns about the pace of the energy transition and its impact on meeting ambitious carbon reduction targets.

- Net-Zero Targets: Achieving net-zero targets may be delayed, requiring SSE to find alternative strategies to compensate for the reduced investment in renewable energy infrastructure.

- Business Continuity: While cost-cutting measures are necessary, the impact on job security and business continuity remains a crucial consideration.

Analyst Reactions and Market Response to the Announcement

The announcement of SSE's revised spending plan has been met with a mixed response from analysts and investors. While some understand the necessity of the cost-cutting measures given the current market conditions, others express concerns about the potential long-term impact on SSE's growth and its commitment to renewable energy.

- Market Analysis: Initial market analysis suggests a cautious response, with SSE's stock price experiencing some fluctuations following the announcement. The long-term impact on investor sentiment remains to be seen.

- Investor Sentiment: Investor sentiment appears to be currently cautious, awaiting further clarification on SSE's revised strategy and its implications for future returns.

- Stock Market Performance: The stock market's immediate response is indicative of the uncertainty surrounding the revised spending plan and its impact on the company's overall performance.

- Industry Expert Opinion: Industry experts have offered varied opinions, ranging from understanding the necessity of the cuts to expressing concern over potential setbacks in the energy transition.

Conclusion: Understanding the Implications of SSE's Revised Spending Plan

SSE's decision to cut its spending plan by £3 billion reflects the significant challenges posed by current market conditions. The reduction, impacting renewable energy projects and network infrastructure, necessitates a reassessment of the company's long-term strategy and potentially its ability to meet its net-zero targets. The market's response has been cautious, indicating the uncertainty surrounding the long-term implications of this decision. Stay informed about further updates on SSE's revised spending plan and the evolving energy market conditions by following reputable financial news sources.

Featured Posts

-

Beenie Mans New York Takeover Is This The Future Of It A Stream

May 22, 2025

Beenie Mans New York Takeover Is This The Future Of It A Stream

May 22, 2025 -

Clisson Le Theatre Tivoli En Images Un Tresor Du Patrimoine Selectionne

May 22, 2025

Clisson Le Theatre Tivoli En Images Un Tresor Du Patrimoine Selectionne

May 22, 2025 -

Abn Amro Aex Stijging Na Positieve Kwartaalresultaten

May 22, 2025

Abn Amro Aex Stijging Na Positieve Kwartaalresultaten

May 22, 2025 -

Vstuplenie Ukrainy V Nato Poslednie Zayavleniya Evrokomissara

May 22, 2025

Vstuplenie Ukrainy V Nato Poslednie Zayavleniya Evrokomissara

May 22, 2025 -

Activite Des Cordistes Impact De La Construction De Tours A Nantes

May 22, 2025

Activite Des Cordistes Impact De La Construction De Tours A Nantes

May 22, 2025

Latest Posts

-

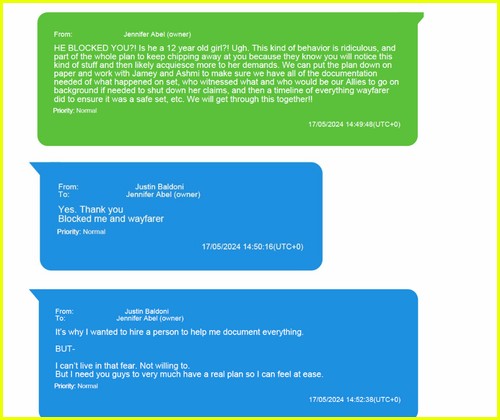

Taylor Swift Text Leak Allegation Did Blake Livelys Lawyer Make Threats

May 22, 2025

Taylor Swift Text Leak Allegation Did Blake Livelys Lawyer Make Threats

May 22, 2025 -

Blake Lively Lawyers Alleged Threat Taylor Swift Texts At The Center Of Controversy

May 22, 2025

Blake Lively Lawyers Alleged Threat Taylor Swift Texts At The Center Of Controversy

May 22, 2025 -

Blake Lively Alleged Controversies And Speculations Explored

May 22, 2025

Blake Lively Alleged Controversies And Speculations Explored

May 22, 2025 -

Zasterezhennya Yevrokomisara Yaki Riziki Chekayut Ukrayinu Na Shlyakhu Do Nato

May 22, 2025

Zasterezhennya Yevrokomisara Yaki Riziki Chekayut Ukrayinu Na Shlyakhu Do Nato

May 22, 2025 -

Vstup Ukrayini Do Nato Poglyad Yevrokomisara Na Potentsiyni Nebezpeki Dlya Ukrayini

May 22, 2025

Vstup Ukrayini Do Nato Poglyad Yevrokomisara Na Potentsiyni Nebezpeki Dlya Ukrayini

May 22, 2025