SSE's £3 Billion Spending Cut: Reasons, Impact, And Future Outlook

Table of Contents

Reasons Behind SSE's £3 Billion Spending Reduction

Several interconnected factors contributed to SSE's decision to slash its spending by £3 billion. Understanding these reasons is crucial to grasping the full implications of this decision.

Increased Regulatory Scrutiny and Uncertainty

The UK energy sector faces increasing regulatory scrutiny and uncertainty. Changes in government policies and regulations significantly impact investment decisions.

- Examples of specific regulations: New environmental regulations, stricter permitting processes for renewable energy projects, and changes in feed-in tariffs.

- Increased difficulty in obtaining permits: Lengthy and complex permitting processes for new energy infrastructure projects create delays and increase costs.

- Uncertainty surrounding future energy policies: Frequent changes in government policy create uncertainty, making it difficult for companies like SSE to plan long-term investments with confidence. This uncertainty significantly impacts investment decisions, potentially leading to delays or cancellations.

Economic Headwinds and Inflation

Soaring inflation and rising interest rates have created significant economic headwinds for SSE and the wider energy sector.

- Increased costs of materials and labor: The cost of materials, such as steel and copper, used in energy infrastructure projects has skyrocketed, impacting project budgets. Similarly, labor costs have also increased, adding further pressure.

- Challenges in securing financing: Higher interest rates make it more expensive to secure financing for large-scale energy projects, increasing the overall cost and potentially reducing profitability.

- Impact on project profitability: The combined effect of increased costs and higher interest rates has reduced the profitability of many energy projects, making them less attractive investment options. This financial reality likely influenced SSE's decision to cut spending.

Shifting Investment Priorities Towards Renewables

SSE's spending cut also reflects a strategic shift in investment priorities towards renewable energy sources. While a move towards sustainability, the transition necessitates significant upfront investments.

- Increased investment in wind, solar, and other renewable energy projects: SSE is directing its resources towards expanding its renewable energy portfolio, focusing on offshore wind, solar power, and other sustainable energy sources.

- Divestment from fossil fuel assets: SSE is likely divesting from some of its traditional fossil fuel assets, reallocating capital towards more sustainable ventures. This strategic shift requires significant investments in new technologies and infrastructure.

- Focus on long-term sustainability: This strategic realignment demonstrates SSE's commitment to a low-carbon future, but it also presents challenges in terms of managing the transition and ensuring financial stability during this transformative period.

Focus on Shareholder Returns

The decision to reduce spending also reflects a focus on maximizing shareholder returns.

- Pressure from investors for higher dividends: Investors often pressure companies to prioritize short-term returns over long-term investments. This pressure could have influenced SSE's decision to reduce spending and increase shareholder dividends.

- Need to maintain a strong credit rating: Maintaining a strong credit rating is crucial for securing future financing. By reducing spending, SSE may aim to strengthen its financial position and improve its credit rating.

- Balancing long-term investments with short-term returns: The decision highlights the challenge of balancing long-term strategic investments in renewable energy with the need to satisfy investor demands for immediate returns. This balancing act is a major consideration for energy companies navigating the energy transition.

Impact of the £3 Billion Spending Cut on SSE and the Wider Energy Sector

The £3 billion spending cut will have significant consequences for SSE, the UK energy sector, and the nation's broader economic and environmental goals.

Job Losses and Project Delays

The spending cuts could lead to job losses and delays in crucial energy projects.

- Specific examples of projects impacted: Specific project delays or cancellations will likely be announced by SSE in the coming months, impacting employment and potentially delaying the deployment of new energy infrastructure.

- Potential job losses in different departments: Job losses could affect various departments, including engineering, construction, and project management, particularly in areas related to fossil fuel assets.

- Implications for the wider UK economy: The implications for the wider UK economy are significant, potentially impacting local communities and the national employment rate.

Implications for the UK's Net-Zero Targets

The reduced spending could potentially hinder the UK's progress towards achieving its net-zero emissions targets.

- Analysis of the effect on renewable energy deployment: Decreased investment in renewable energy projects might slow down the deployment of crucial clean energy infrastructure.

- Potential delays in decarbonization efforts: Delays in building new renewable energy facilities could delay decarbonization efforts and potentially put the UK behind its climate targets.

- Discussion on alternative strategies: The UK government will need to consider alternative strategies to ensure that the country stays on track to meet its net-zero ambitions.

Effect on Energy Prices and Security of Supply

The spending cuts could have implications for energy prices and the security of energy supply in the UK.

- Potential increase in energy prices due to reduced investment: Reduced investment in new energy infrastructure could potentially lead to increased energy prices, affecting consumers and businesses alike.

- Discussion on the vulnerability of the energy system: The reduced investment might make the UK energy system more vulnerable to supply disruptions.

- Exploring potential mitigation strategies: The government and energy companies need to explore potential mitigation strategies to ensure energy security and manage the transition to a cleaner energy system effectively.

Future Outlook for SSE: Adapting to a Changing Energy Market

SSE faces a crucial period of adaptation and strategic realignment. The company must navigate a complex energy landscape characterized by uncertainty, economic challenges, and the imperative for rapid decarbonization.

Strategic Realignment and Restructuring

SSE will likely undergo significant strategic realignment and restructuring to adapt to the changing energy market.

- New investment priorities: The company will prioritize investments in renewable energy projects, potentially reducing investments in traditional fossil fuels.

- Changes in leadership and management: Changes in leadership and management could be expected as the company adapts to new strategic priorities and market realities.

- Cost-cutting measures: SSE will likely implement further cost-cutting measures to improve its financial position and ensure long-term sustainability.

Opportunities for Growth in the Renewable Energy Sector

Despite the challenges, SSE has significant opportunities for growth in the rapidly expanding renewable energy sector.

- Potential for expansion in offshore wind: Offshore wind presents a substantial growth opportunity for SSE, given the UK's significant offshore wind resources.

- Opportunities in new renewable technologies: The company could explore opportunities in emerging renewable technologies, such as hydrogen and tidal energy.

- Exploration of international markets: SSE might explore expansion into international renewable energy markets to diversify its portfolio and reduce reliance on the UK market.

Long-Term Sustainability and ESG Considerations

SSE's commitment to long-term sustainability and Environmental, Social, and Governance (ESG) factors remains crucial.

- Strategies for reducing carbon emissions: SSE must implement robust strategies to further reduce its carbon emissions and contribute to the UK's net-zero targets.

- Community engagement initiatives: Active engagement with local communities is crucial to ensure the responsible development of renewable energy projects.

- Commitment to responsible business practices: SSE must maintain a strong commitment to responsible business practices across its operations, demonstrating transparency and accountability.

Conclusion: Understanding the Implications of SSE's £3 Billion Spending Cut

SSE's £3 billion spending cut reflects a confluence of factors, including increased regulatory uncertainty, economic headwinds, strategic shifts towards renewable energy, and a focus on shareholder returns. This decision will have significant implications for jobs, energy projects, and the UK's net-zero goals. While presenting challenges, it also opens up opportunities for SSE to strategically realign its business and capitalize on the growth potential within the renewable energy sector. The future success of SSE, and indeed the UK's energy transition, hinges on the company's ability to navigate these complexities while maintaining its commitment to long-term sustainability. To stay informed about SSE’s activities and the broader implications of this significant spending cut, subscribe to relevant news sources and follow updates on SSE investment news and UK energy market analysis focusing on renewable energy investment. Understanding SSE's investment strategies is crucial for comprehending the future of UK energy.

Featured Posts

-

The Goldbergs The Shows Impact On Pop Culture

May 22, 2025

The Goldbergs The Shows Impact On Pop Culture

May 22, 2025 -

The Allure Of Cassis Blackcurrant Flavors Uses And Recipes

May 22, 2025

The Allure Of Cassis Blackcurrant Flavors Uses And Recipes

May 22, 2025 -

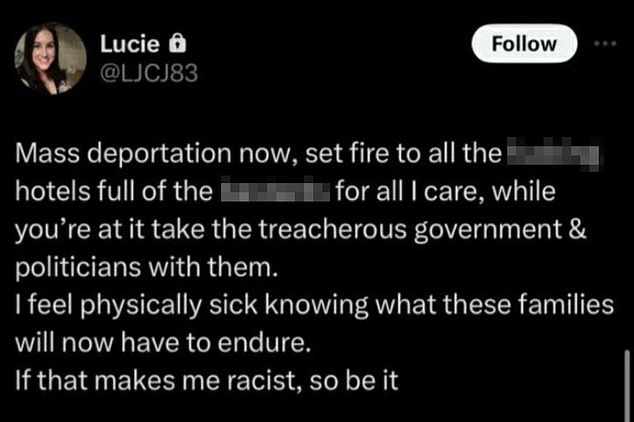

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 22, 2025

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 22, 2025 -

Agents Statement On Klopps Potential Real Madrid Move

May 22, 2025

Agents Statement On Klopps Potential Real Madrid Move

May 22, 2025 -

Slot Confirms Liverpools Fortune Enrique Analyzes Alissons Performance

May 22, 2025

Slot Confirms Liverpools Fortune Enrique Analyzes Alissons Performance

May 22, 2025

Latest Posts

-

Chi Varto Ukrayini Priyednuvatisya Do Nato Analiz Poperedzhennya Yevrokomisara

May 22, 2025

Chi Varto Ukrayini Priyednuvatisya Do Nato Analiz Poperedzhennya Yevrokomisara

May 22, 2025 -

Analiz Zayav Yevrokomisara Schodo Vstupu Ukrayini Do Nato Ta Pov Yazanikh Rizikiv

May 22, 2025

Analiz Zayav Yevrokomisara Schodo Vstupu Ukrayini Do Nato Ta Pov Yazanikh Rizikiv

May 22, 2025 -

Nato Ta Ukrayina Yevrokomisar Poperedzhaye Pro Klyuchovi Zagrozi Priyednannya

May 22, 2025

Nato Ta Ukrayina Yevrokomisar Poperedzhaye Pro Klyuchovi Zagrozi Priyednannya

May 22, 2025 -

Vstup Ukrayini Do Nato Otsinka Rizikiv Ta Viklikiv Za Danimi Unian

May 22, 2025

Vstup Ukrayini Do Nato Otsinka Rizikiv Ta Viklikiv Za Danimi Unian

May 22, 2025 -

Ukrayina Ta Nato Poperedzhennya Yevrokomisara Pro Potentsiyni Nebezpeki

May 22, 2025

Ukrayina Ta Nato Poperedzhennya Yevrokomisara Pro Potentsiyni Nebezpeki

May 22, 2025