SSE Cuts Spending: £3 Billion Reduction Amidst Economic Slowdown

Table of Contents

Reasons Behind SSE's £3 Billion Spending Cut

SSE's decision to slash its spending by £3 billion is a multifaceted response to the current economic climate. Several key drivers are at play:

-

Economic Slowdown and Decreased Consumer Demand: The UK economy is experiencing a period of sluggish growth, leading to reduced energy consumption and impacting SSE's revenue projections. Lower demand directly translates into less need for investment in new infrastructure and expansion projects. This decreased consumer spending, coupled with increased energy prices, forces companies to reassess their financial strategies.

-

Increased Inflationary Pressures and Rising Input Costs: Soaring inflation is significantly increasing the cost of materials, labor, and other essential resources needed for SSE's operations. These escalating costs make many projects less financially viable, forcing a reassessment of planned investments. This issue directly affects the cost of building and maintaining energy infrastructure, including renewable energy projects.

-

Pressure from Investors and Shareholders to Improve Profitability: Facing increasing pressure to deliver strong returns to investors, SSE is likely prioritizing projects with a high return on investment (ROI) and streamlining operations to boost profitability. This often means prioritizing short-term gains over long-term investments, potentially hindering the company's future growth.

-

Potential Impact of Government Regulations and Energy Policies: The ever-evolving regulatory landscape and government policies concerning the energy sector play a crucial role. Uncertainty surrounding future regulations can lead to cautious investment strategies, particularly for long-term projects requiring significant upfront capital expenditure. Changes in government subsidies or support for renewable energy can also drastically influence investment decisions.

-

Focus Shift Towards Renewable Energy Investments and Grid Modernization: While cutting overall spending, SSE is likely shifting its investment priorities towards renewable energy sources and grid modernization projects. These areas are seen as crucial for long-term sustainability and compliance with government targets for carbon reduction, potentially explaining a reallocation of funds rather than a pure reduction.

Impact of the Spending Cuts on SSE's Operations

The £3 billion reduction in spending will inevitably impact various aspects of SSE's operations:

-

Potential Delays or Cancellations of Planned Infrastructure Projects: Projects involving the construction of new power plants, grid upgrades, and other large-scale infrastructure initiatives are likely to face delays or even cancellations, potentially hindering the UK's energy transition goals. This may result in slower growth in the renewable energy sector for SSE.

-

Impact on Job Security and Employment within the Company: Cost-cutting measures often involve workforce reductions, raising concerns about job security for employees involved in affected projects. This impact extends beyond direct job losses to broader economic implications within communities.

-

Reduced Research and Development Spending in Renewable Energy Technologies: Cuts to R&D may stifle innovation and delay the development of crucial renewable energy technologies. This can impede SSE’s ability to maintain its competitiveness in the evolving energy market.

-

Effects on Customer Service and Network Maintenance: Reduced investment in maintenance and upgrades could potentially impact the reliability of SSE's network and negatively affect customer service, leading to increased outages and potentially customer dissatisfaction.

-

Short-Term versus Long-Term Implications: While the immediate impact might be a boost to short-term profitability, the long-term consequences of reduced investment could limit future growth and competitiveness. This necessitates a careful balancing act between short-term financial stability and long-term strategic goals.

SSE's Future Strategy and Investment Priorities

In response to the economic downturn, SSE is likely to adopt a more focused and cost-efficient investment strategy:

-

Increased Focus on Cost-Efficiency and Operational Improvements: The company will likely prioritize internal cost reductions and operational efficiency improvements to offset the impact of reduced spending. This could involve streamlining processes, optimizing resource allocation, and negotiating better deals with suppliers.

-

Prioritization of Projects with the Highest Return on Investment: Future investments will be meticulously evaluated based on their ROI, favoring projects that are expected to generate substantial profits quickly. Less profitable projects might be delayed or abandoned entirely.

-

Continued Commitment to Renewable Energy Development and the Energy Transition: Despite the spending cuts, SSE is unlikely to abandon its commitment to renewable energy. However, the pace of investment might slow down, and the focus might shift towards projects with faster returns.

-

Potential for Strategic Partnerships and Collaborations: To share risks and leverage expertise, SSE might seek strategic partnerships and collaborations with other energy companies or investors. This could allow for larger projects while minimizing financial risk.

-

Long-Term Financial Outlook and Sustainability Goals: Despite the current financial constraints, maintaining a long-term financial outlook and commitment to sustainability goals will remain crucial for SSE's future success.

Comparison with Other Energy Companies

SSE's response to the economic slowdown is in line with strategies adopted by other major UK energy providers. Many companies are implementing similar cost-cutting measures, including workforce reductions and project delays. However, the extent of the cuts and the specific areas affected may vary depending on each company's individual circumstances and strategic priorities. This will likely lead to a reshaping of the competitive landscape within the UK energy market.

Analyst Reactions and Market Response to SSE's Announcement

The announcement of SSE cuts spending has drawn mixed reactions from financial analysts and investors. The immediate stock market response was generally negative, reflecting concerns about the impact on future growth. However, some analysts have expressed a more positive outlook, highlighting the cost-saving measures implemented. Overall, market sentiment regarding the energy sector remains cautious due to the prevailing economic uncertainty.

Analyzing the Significance of SSE Cuts Spending

SSE's £3 billion spending reduction underscores the challenges faced by the UK energy sector amidst economic uncertainty and inflationary pressures. The decision reflects a complex interplay of economic factors, investor pressures, and strategic considerations. While the short-term consequences might involve job losses and project delays, the long-term impact will depend on SSE's ability to navigate the changing landscape effectively, prioritizing crucial investments in renewable energy while maintaining operational efficiency. It’s crucial to monitor SSE's future actions and their implications for the UK energy market and the wider economy. Stay updated on the ongoing developments concerning SSE's spending reductions and the broader energy market by subscribing to our newsletter [link to newsletter] or following us on social media [links to social media]. The impact of SSE cuts is far-reaching and demands continued observation.

Featured Posts

-

Broadway Buzz Mia Farrows Visit To Sadie Sinks Photo 51

May 24, 2025

Broadway Buzz Mia Farrows Visit To Sadie Sinks Photo 51

May 24, 2025 -

Carry On Changes Southwest Airlines New Rules On Portable Chargers

May 24, 2025

Carry On Changes Southwest Airlines New Rules On Portable Chargers

May 24, 2025 -

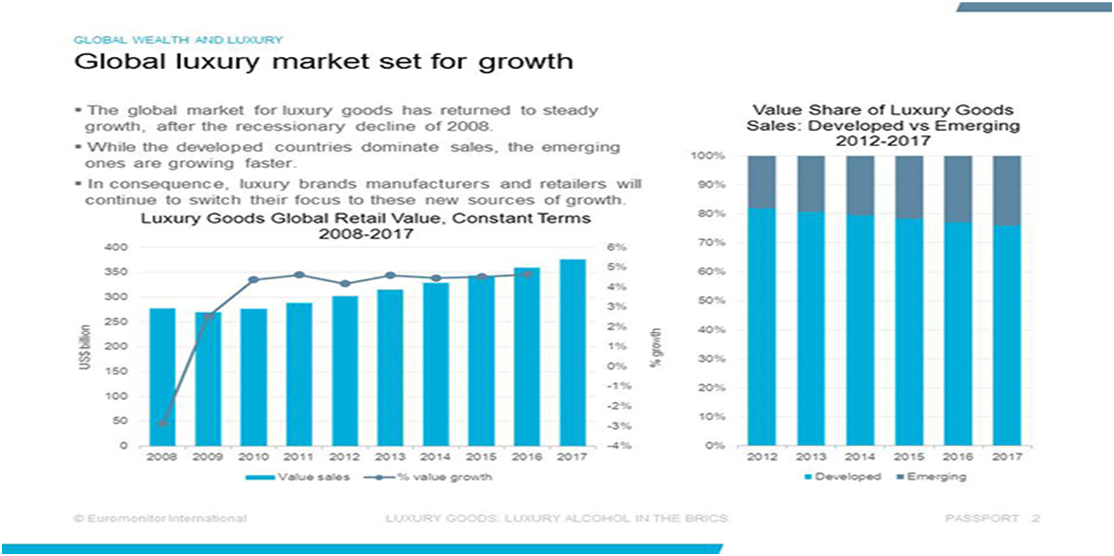

Paris Economy In The Red Analysis Of The Luxury Goods Sectors Impact

May 24, 2025

Paris Economy In The Red Analysis Of The Luxury Goods Sectors Impact

May 24, 2025 -

Unexpected News Dylan Dreyer Faces A Difficult Challenge

May 24, 2025

Unexpected News Dylan Dreyer Faces A Difficult Challenge

May 24, 2025 -

En Zeki Burclar Dahiligin Sirri Genlerde Mi

May 24, 2025

En Zeki Burclar Dahiligin Sirri Genlerde Mi

May 24, 2025

Latest Posts

-

The Last Rodeo Highlighting Neal Mc Donoughs Acting

May 24, 2025

The Last Rodeo Highlighting Neal Mc Donoughs Acting

May 24, 2025 -

Sylvester Stallones Tulsa King Season 2 Blu Ray Release Date And Sneak Peek

May 24, 2025

Sylvester Stallones Tulsa King Season 2 Blu Ray Release Date And Sneak Peek

May 24, 2025 -

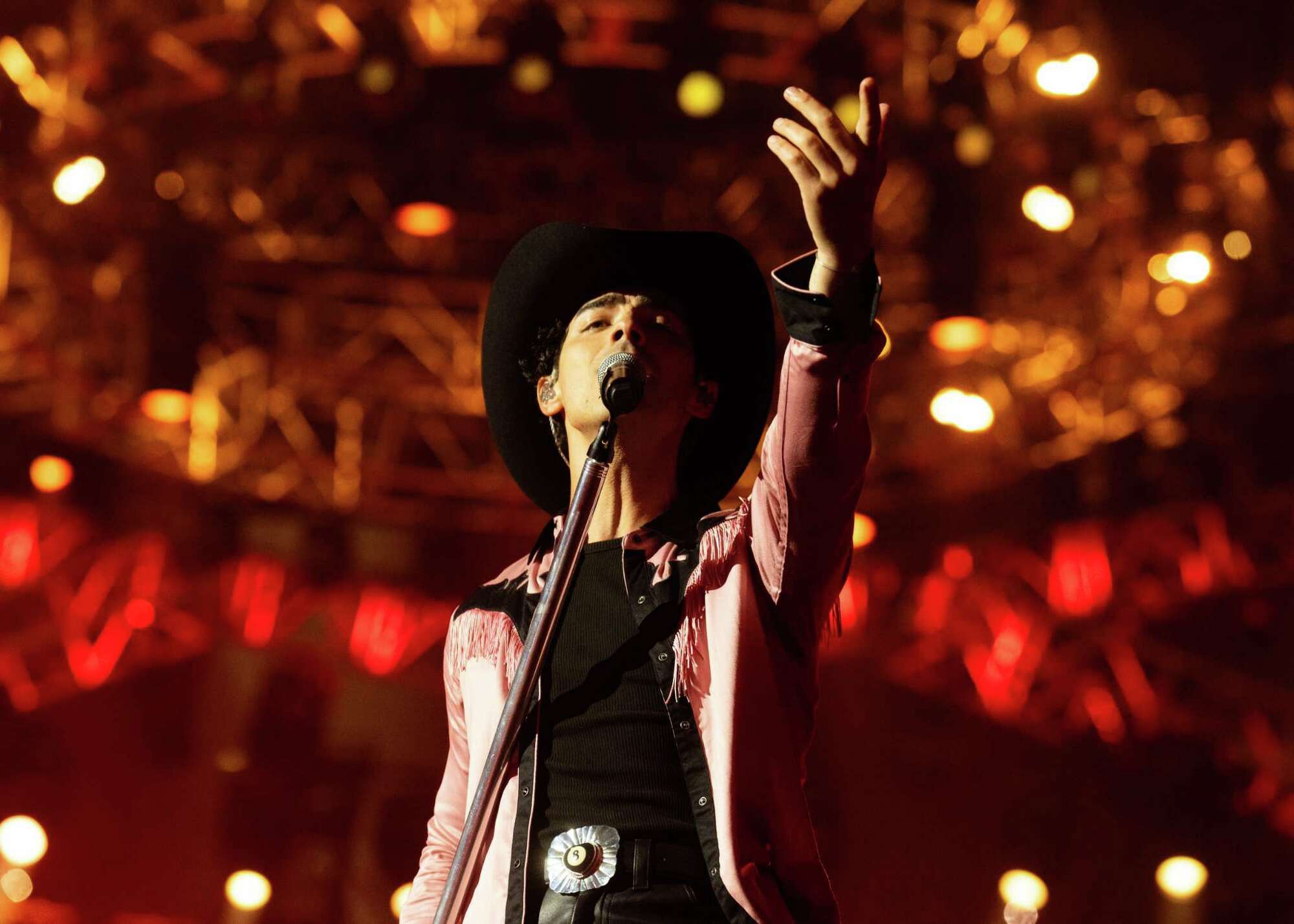

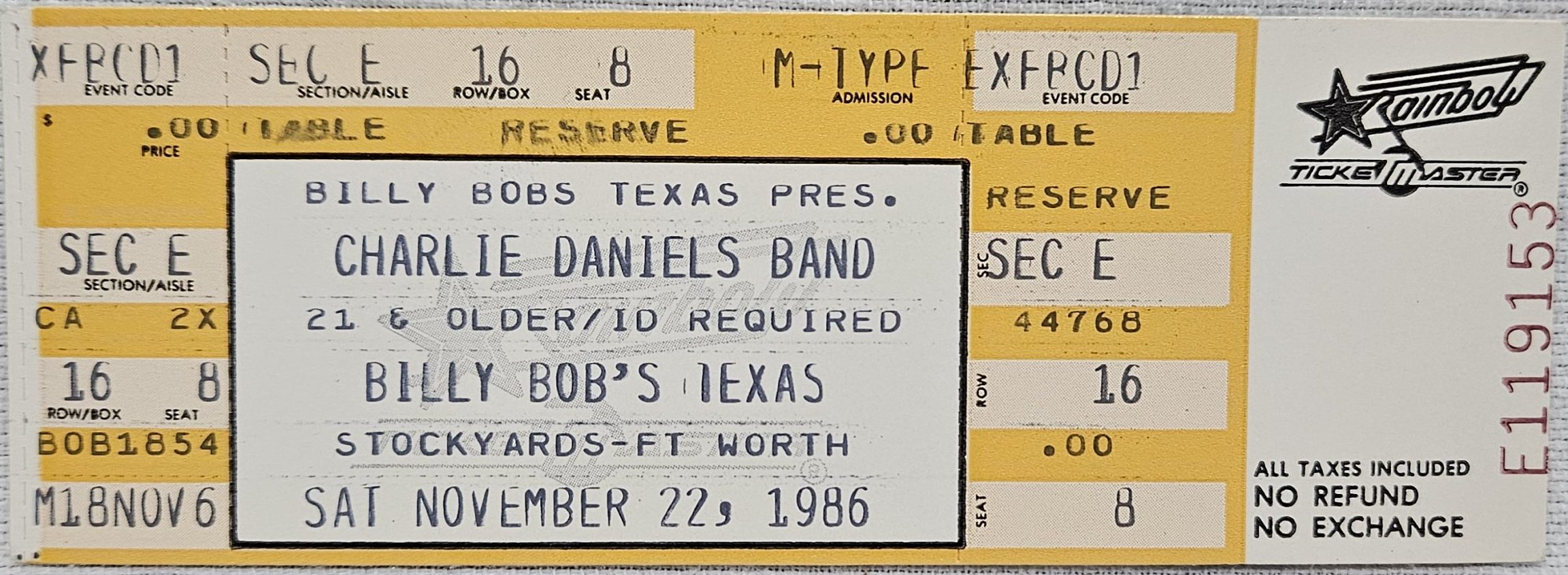

Surprise Joe Jonas Plays Unannounced Concert At Fort Worth Stockyards

May 24, 2025

Surprise Joe Jonas Plays Unannounced Concert At Fort Worth Stockyards

May 24, 2025 -

Sylvester Stallone Returns In Tulsa King Season 2 Blu Ray Sneak Peek

May 24, 2025

Sylvester Stallone Returns In Tulsa King Season 2 Blu Ray Sneak Peek

May 24, 2025 -

Fort Worth Stockyards Joe Jonas Delivers Surprise Show

May 24, 2025

Fort Worth Stockyards Joe Jonas Delivers Surprise Show

May 24, 2025