SSE Cuts £3 Billion Spending: Impact On Growth And Future Plans

Table of Contents

Impact of the Spending Cuts on SSE's Growth Strategy

The £3 billion spending reduction will undoubtedly have a significant impact on SSE's growth strategy, both in the short and long term. Reduced capital expenditure directly translates to potentially lower revenue and profit margins in the coming years. This is especially true considering SSE's significant investments in renewable energy sources in the past. The cuts could affect the company's competitive standing, potentially hindering its ability to keep pace with competitors who are aggressively investing in new technologies and expanding their market share.

- Reduced investment in renewable energy projects (wind, solar): The curtailment of investment in renewable energy projects, a key area of focus for SSE in recent years, could slow down the development of new wind farms and solar installations. This directly impacts the company's capacity for green energy generation and its ability to meet future energy demands sustainably.

- Potential delays in network infrastructure upgrades: Essential upgrades to the electricity network infrastructure may face delays due to the spending cuts. This could lead to efficiency losses and potentially impact the reliability of the energy supply.

- Impact on research and development initiatives: Reduced funding for research and development could hinder innovation and the development of new, cutting-edge technologies within the energy sector. This limits future growth potential and competitiveness.

- Effect on job creation and employment within SSE: A reduction in investment inevitably leads to a reevaluation of staffing levels. While not explicitly stated, potential job losses or hiring freezes could be a consequence of the spending cuts.

The potential for slower growth compared to competitors who continue to invest heavily in expansion and innovation is a significant concern. This reduced growth trajectory needs to be carefully monitored by investors and stakeholders alike. Official statements from SSE will be crucial in understanding the full extent of these impacts.

Analyzing SSE's Revised Investment Priorities

Following the £3 billion spending cut, SSE is likely to prioritize certain areas over others. The company’s revised investment strategy will be crucial for understanding its future direction and long-term success. This likely means a shift towards more profitable ventures and core business operations, potentially including:

- Increased focus on operational efficiency: Expect to see a greater emphasis on cost optimization across all SSE operations to maximize profits from existing assets.

- Prioritization of existing profitable energy assets: Existing energy assets that are already generating strong returns are likely to receive greater investment and attention.

- Strategic acquisitions or divestments: SSE may explore strategic acquisitions of smaller, profitable companies or divest itself of non-core assets to free up capital.

- Changes to the dividend policy: The spending cuts might affect SSE’s dividend policy, potentially leading to adjustments in dividend payouts to shareholders.

These changes present both opportunities and risks. While focusing on core assets and operational efficiency can improve profitability in the short term, it also presents the risk of missing out on long-term growth opportunities in emerging technologies and markets. Industry expert opinions will be essential in assessing these risks and opportunities.

Long-Term Implications and Future Plans for SSE

The long-term consequences of SSE's £3 billion spending cut remain to be seen, but several potential impacts stand out. The financial stability and resilience of the company are major considerations. The ability to meet its sustainability goals, crucial for attracting environmentally conscious investors, is another critical factor.

- Impact on carbon reduction targets: The reduction in investments in renewable energy could potentially jeopardize SSE's commitment to carbon reduction targets.

- Changes to the company's environmental, social, and governance (ESG) strategy: The spending cuts might lead to adjustments in the company’s ESG strategy, with potential impacts on its long-term sustainability initiatives.

- Potential for attracting or retaining investors: The spending cuts could affect investor confidence, potentially making it harder to attract new investors or retain existing ones.

- Long-term effects on customer service: Potential delays in infrastructure upgrades might indirectly affect the quality and reliability of customer service.

However, the restructuring also presents opportunities. Streamlining operations and focusing on core competencies can enhance efficiency and profitability. The evolving energy landscape, characterized by technological advancements and shifting energy demands, presents both challenges and possibilities for SSE to navigate.

Conclusion: Understanding the Long-Term Effects of SSE's £3 Billion Spending Cut

SSE's £3 billion spending cut represents a significant strategic shift with far-reaching implications for the company's growth, future plans, and financial outlook. The reduction in investment, while potentially improving short-term profitability, could hinder long-term growth and innovation, particularly in the crucial renewable energy sector. The revised investment priorities, focusing on operational efficiency and core assets, carry both risks and opportunities. The long-term consequences for SSE's financial stability, its ability to achieve sustainability goals, and its standing within the competitive energy landscape require close monitoring. It remains crucial for investors and stakeholders to understand the implications of these decisions. Stay updated on SSE's progress and the ongoing implications of this significant financial decision. Continue to follow our coverage for in-depth analysis of SSE's future plans and the wider energy sector.

Featured Posts

-

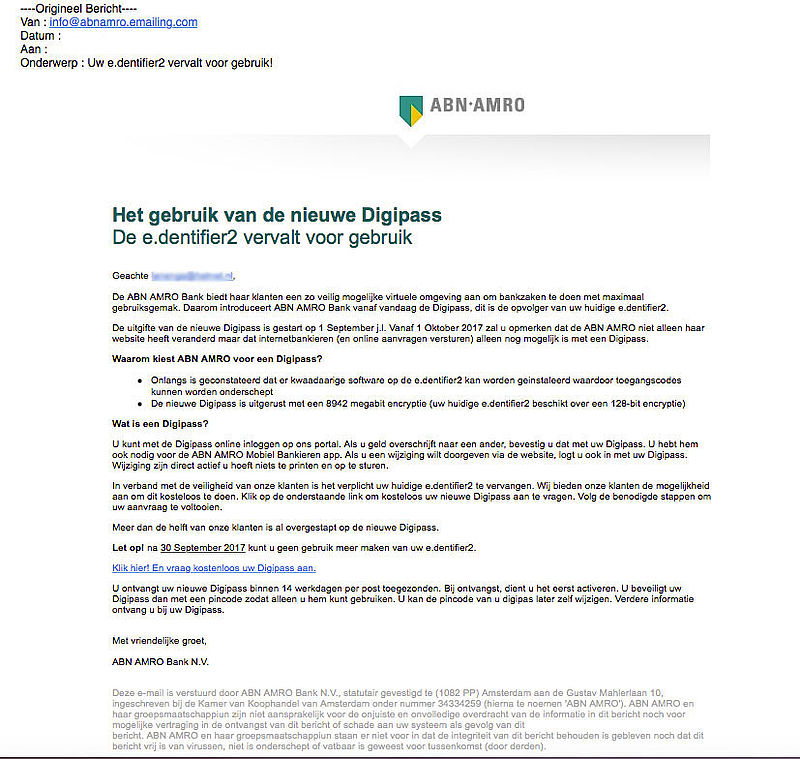

Abn Amro Groeiend Autobezit Drijft Occasionverkoop Omhoog

May 22, 2025

Abn Amro Groeiend Autobezit Drijft Occasionverkoop Omhoog

May 22, 2025 -

Elektrik Kesintileri Rutte Sanchez Goeruesmesi Ve Nato Nun Tepkisi

May 22, 2025

Elektrik Kesintileri Rutte Sanchez Goeruesmesi Ve Nato Nun Tepkisi

May 22, 2025 -

Alles Over Het Verkoopprogramma Voor Abn Amro Kamerbrief Certificaten

May 22, 2025

Alles Over Het Verkoopprogramma Voor Abn Amro Kamerbrief Certificaten

May 22, 2025 -

Dexter Resurrection Analyzing The Popularity Of The New Villain

May 22, 2025

Dexter Resurrection Analyzing The Popularity Of The New Villain

May 22, 2025 -

Vybz Kartel Speaks Prison Life Freedom Family And New Music

May 22, 2025

Vybz Kartel Speaks Prison Life Freedom Family And New Music

May 22, 2025

Latest Posts

-

Is Blake Lively And Taylor Swifts Friendship On The Rocks After Subpoena Reports

May 22, 2025

Is Blake Lively And Taylor Swifts Friendship On The Rocks After Subpoena Reports

May 22, 2025 -

Blake Lively And Taylor Swift Friendship Fracture Over Subpoena

May 22, 2025

Blake Lively And Taylor Swift Friendship Fracture Over Subpoena

May 22, 2025 -

Taylor Swift Blake Lively Feud Is A Legal Battle To Blame

May 22, 2025

Taylor Swift Blake Lively Feud Is A Legal Battle To Blame

May 22, 2025 -

Taylor Swifts Involvement In Blake Lively And Justin Baldonis Legal Dispute An Exclusive Look

May 22, 2025

Taylor Swifts Involvement In Blake Lively And Justin Baldonis Legal Dispute An Exclusive Look

May 22, 2025 -

Taylor Swift And Blake Lively Friendship Fracture Amid Legal Dispute

May 22, 2025

Taylor Swift And Blake Lively Friendship Fracture Amid Legal Dispute

May 22, 2025