Social Media Scrutiny: Goldman Sachs On Trump's Oil Price Preferences

Table of Contents

Goldman Sachs' Report: Key Findings and Interpretations

Goldman Sachs' report, released on [Insert Date of Report], suggested that former President Trump favored a specific range of oil prices, beneficial to certain aspects of the US economy. The report did not explicitly state Trump preferred certain prices, but rather analyzed his public statements and actions during his presidency to infer a potential preference range. This analysis sparked considerable debate about its methodology and interpretation. Different analysts and commentators offered varying interpretations of the findings, creating conflicting narratives and influencing market sentiment.

- Specific oil price levels mentioned in the report: The report suggested a preferred range between $[Lower Bound] and $[Upper Bound] per barrel, although the exact figures were open to interpretation.

- Goldman Sachs' reasoning behind their analysis: Goldman Sachs based its analysis on Trump's public pronouncements on energy independence, his criticism of high oil prices, and his administration's policies related to oil production.

- Potential economic implications of Trump’s preferred oil prices: The report speculated on potential effects on inflation, economic growth, and the overall energy sector if oil prices remained within or deviated from the suggested range. Lower prices might boost consumer spending but could also harm oil-producing states and companies. Conversely, higher prices could negatively affect consumer spending and inflation.

Social Media Reaction: Analysis of the Online Discourse

The Goldman Sachs report immediately became a focal point of intense online discussion across various platforms, generating considerable social media scrutiny. The reaction was highly polarized, reflecting existing political divisions.

- Examples of positive and negative social media commentary: Supporters of Trump praised the report as evidence of his economic acumen, while his critics accused Goldman Sachs of bias and of creating a misleading narrative.

- Key hashtags and keywords used in the online debate: #GoldmanSachs, #Trump, #OilPrices, #EnergyPolicy, #OilPricePreferences, and various partisan hashtags were heavily used.

- Prevalence of misinformation or misleading information: Significant misinformation and misleading interpretations of the report’s findings circulated widely, adding to the complexity of the online debate.

- Identification of prominent influencers and their stances: Prominent political commentators, economists, and energy experts weighed in on the debate, often reinforcing pre-existing partisan viewpoints. Their opinions heavily influenced the direction and tone of the online conversation.

The Influence of Political Polarization

The social media debate surrounding Goldman Sachs' analysis was significantly amplified by political polarization. The report's findings were interpreted through existing ideological lenses.

- Examples of partisan commentary: Supporters of Trump tended to highlight the positive aspects of the report, while his opponents focused on the negative implications.

- Links between specific political groups and their responses: Clear links emerged between the online responses and affiliation with specific political groups and ideologies, contributing to the echo chambers typical of polarized social media discourse.

Implications for the Energy Market and Geopolitics

The controversy surrounding the Goldman Sachs report has several significant implications for the energy market and geopolitics. The intense social media scrutiny affected investor confidence and introduced uncertainty into oil price forecasting.

- Potential impact on oil prices: The debate and varying interpretations of the report added volatility to the already unpredictable oil market, potentially impacting both short-term and long-term prices.

- Effects on energy investments: Uncertainty generated by the controversy could discourage investment in the energy sector, potentially hindering long-term energy security and infrastructure development.

- Geopolitical implications for US energy policy: The debate highlights the complex interplay between politics, economics, and energy policy, and underscores the potential for social media to significantly influence policy debates.

Conclusion

The Goldman Sachs report on Trump’s alleged oil price preferences sparked a firestorm of debate, highlighting the power of financial analysis and the intensity of social media scrutiny in shaping public perception. The polarized reaction, characterized by misinformation and partisan interpretations, underscored the fragility of investor confidence in the volatile energy market. The controversy emphasizes the need for careful analysis and critical engagement with information found online. The implications extend far beyond the immediate market fluctuations, potentially influencing future energy policy and international relations.

Call to Action: Continue the conversation! Share your thoughts on the Goldman Sachs analysis and the social media scrutiny surrounding Trump's supposed oil price preferences. Let's discuss the implications of this debate and its long-term effects on the global energy landscape. Join the conversation using #GoldmanSachs #Trump #OilPrices.

Featured Posts

-

The Most Popular Baby Names Of 2024 Tradition And Trend

May 16, 2025

The Most Popular Baby Names Of 2024 Tradition And Trend

May 16, 2025 -

Tam Krwz Ke Jwte Pr Mdah Ka Pawn Kya Hwa

May 16, 2025

Tam Krwz Ke Jwte Pr Mdah Ka Pawn Kya Hwa

May 16, 2025 -

The King Of Davoss Demise Causes And Consequences

May 16, 2025

The King Of Davoss Demise Causes And Consequences

May 16, 2025 -

Portugal Vence A Belgica 1 0 Resumen Del Encuentro Y Goles

May 16, 2025

Portugal Vence A Belgica 1 0 Resumen Del Encuentro Y Goles

May 16, 2025 -

Paddy Pimblett Ufc 314 Fight And Future Championship Aspirations

May 16, 2025

Paddy Pimblett Ufc 314 Fight And Future Championship Aspirations

May 16, 2025

Latest Posts

-

Le Marche Famelique Des Gardiens Solutions Et Perspectives

May 16, 2025

Le Marche Famelique Des Gardiens Solutions Et Perspectives

May 16, 2025 -

Un Marche Famelique Pour Les Gardiens Une Analyse Du Secteur

May 16, 2025

Un Marche Famelique Pour Les Gardiens Une Analyse Du Secteur

May 16, 2025 -

Understanding The 2025 Nhl Draft Lottery Key Information For Utah Hockey Fans

May 16, 2025

Understanding The 2025 Nhl Draft Lottery Key Information For Utah Hockey Fans

May 16, 2025 -

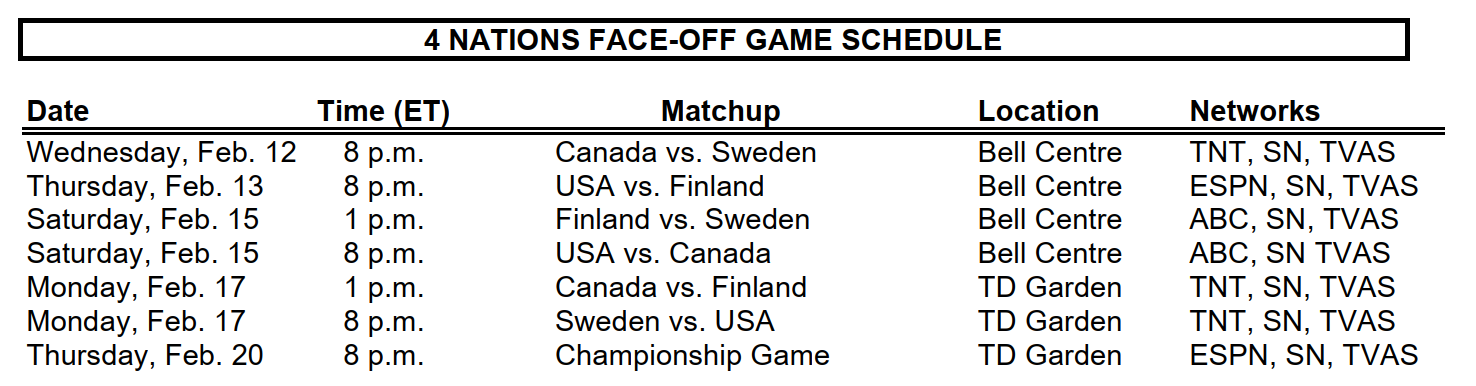

Nhl 4 Nations Face Off Peis Half Million Dollar Bill Scrutinized

May 16, 2025

Nhl 4 Nations Face Off Peis Half Million Dollar Bill Scrutinized

May 16, 2025 -

Analyse De La Decision De La Lnh De Decentraliser Son Repechage

May 16, 2025

Analyse De La Decision De La Lnh De Decentraliser Son Repechage

May 16, 2025