SocGen's New Executive Vice President: Alexis Kohler's Appointment And Its Implications

Table of Contents

Alexis Kohler's Background and Expertise

Previous Roles and Achievements

Before joining SocGen, Alexis Kohler held several key positions showcasing his deep understanding of French finance and public service. His career trajectory reveals a consistent focus on economic expertise and navigating complex financial markets. His experience includes significant roles within the French government, providing him with invaluable insights into regulatory frameworks and macroeconomic policy.

- Cabinet Director to the French Minister of the Economy and Finance: Oversaw crucial economic policy initiatives, demonstrating strong leadership and strategic planning abilities.

- Secretary-General of the French Ministry of the Economy and Finance: Managed the operational aspects of a large and complex government ministry, highlighting his organizational and administrative capabilities.

- Adviser to the French President: Provided high-level economic counsel, demonstrating his ability to operate effectively within the highest echelons of power.

Kohler's contributions have been widely recognized, earning him accolades within the French financial sector for his insightful analysis and effective policy implementation. His deep understanding of French economic policy will undoubtedly be a significant asset to SocGen.

Relevant Skills for SocGen

Kohler's skillset directly addresses several key challenges and opportunities facing SocGen. His expertise in risk management and regulatory compliance is particularly timely, given the ever-evolving regulatory landscape in the banking sector. His strategic planning capabilities will be crucial for guiding SocGen's future growth and navigating the complexities of the global financial markets. His background in international finance is also highly relevant in the context of SocGen's global operations.

- Expertise in risk management: Mitigating risks and ensuring regulatory compliance are paramount in the current financial climate.

- Strategic planning and execution: Guiding SocGen's strategic direction and ensuring efficient execution of initiatives.

- Deep understanding of regulatory frameworks: Navigating the complexities of international banking regulations and ensuring compliance.

- International finance experience: Leveraging knowledge of global markets to optimize SocGen’s international operations.

His contributions are expected to significantly benefit SocGen's ability to navigate increasingly complex regulatory environments and capitalize on emerging opportunities in global financial markets.

Implications for Société Générale's Strategy

Potential Impact on Business Units

Kohler's appointment is likely to have significant ramifications across SocGen's various business units. His expertise could lead to strategic shifts in investment banking strategies, focusing on specific sectors or geographical regions where he sees opportunities for growth. His understanding of regulatory pressures could also shape the bank’s approach to corporate finance, prioritizing deals that comply with stringent regulations. Within retail banking, his focus could be on streamlining operations and enhancing customer experiences through digital transformation.

- Investment Banking: Potential refocusing on sustainable finance or specific high-growth sectors.

- Corporate Finance: Emphasis on regulatory compliance and efficient deal execution.

- Retail Banking: Digital transformation initiatives to enhance customer experience and operational efficiency.

Long-Term Strategic Vision for SocGen

Under Kohler's leadership, SocGen could see a renewed emphasis on sustainability initiatives, aligning its operations with global environmental and social goals. His experience might lead to a more cautious approach to risk-taking, prioritizing stability and long-term growth over short-term gains. This could result in a repositioning of SocGen within the market, shifting away from riskier investments towards a more sustainable and responsible model.

- Enhanced focus on sustainable finance: Attracting environmentally conscious investors and clients.

- Cautious risk management approach: Prioritizing stability and long-term growth.

- Increased emphasis on digital transformation: Improving operational efficiency and customer experience.

- Strengthened regulatory compliance: Minimizing risk and ensuring stability.

Broader Market Context and Analysis

Industry Trends and Competitive Landscape

SocGen operates within a dynamic and competitive financial landscape. Global financial markets are subject to significant fluctuations influenced by geopolitical events, technological disruption, and regulatory changes. The impact of Brexit on European financial institutions, and the rise of fintech companies, are just two major challenges facing banks like SocGen. Kohler's experience in navigating complex economic environments will be crucial in helping the bank adapt and remain competitive.

- Increased competition from fintech firms: Requires strategic innovation and adaptation.

- Geopolitical uncertainty: Requires robust risk management and contingency planning.

- Evolving regulatory landscape: Demands close monitoring and proactive compliance.

Investor Sentiment and Market Reaction

The initial market reaction to Kohler's appointment has been largely positive, with SocGen's share price experiencing a modest increase. Analysts have generally expressed optimism about Kohler's experience and its potential benefits to the bank's long-term prospects. Investor confidence appears to be relatively high, indicating a positive outlook for SocGen under its new leadership. However, the long-term impact will depend on Kohler's actions and their effect on the bank's performance.

- Positive initial market reaction: Reflects investor confidence in Kohler's expertise.

- Increased scrutiny on SocGen's performance: Market will closely monitor the impact of Kohler’s actions.

- Long-term outlook will be determined by results: Performance will dictate investor sentiment.

Conclusion

The appointment of Alexis Kohler as Executive Vice President at SocGen signifies a potentially significant shift in the bank's strategic direction. His extensive experience and expertise in French finance and public service bring valuable assets to SocGen, potentially influencing its long-term strategy and market position. The impact on individual business units and the overall market response will be crucial areas to observe in the coming months. Further analysis of Alexis Kohler's actions and their effect on SocGen's performance will be essential to fully understand the long-term implications of this key appointment. Stay informed about the evolving story surrounding the Alexis Kohler SocGen appointment and its ripple effects on the financial landscape.

Featured Posts

-

Parker Mc Collum And George Strait A Musical Legacy In The Making

May 14, 2025

Parker Mc Collum And George Strait A Musical Legacy In The Making

May 14, 2025 -

Tommy Fury Visszatert Budapestre Es Uezent Jake Paulnak

May 14, 2025

Tommy Fury Visszatert Budapestre Es Uezent Jake Paulnak

May 14, 2025 -

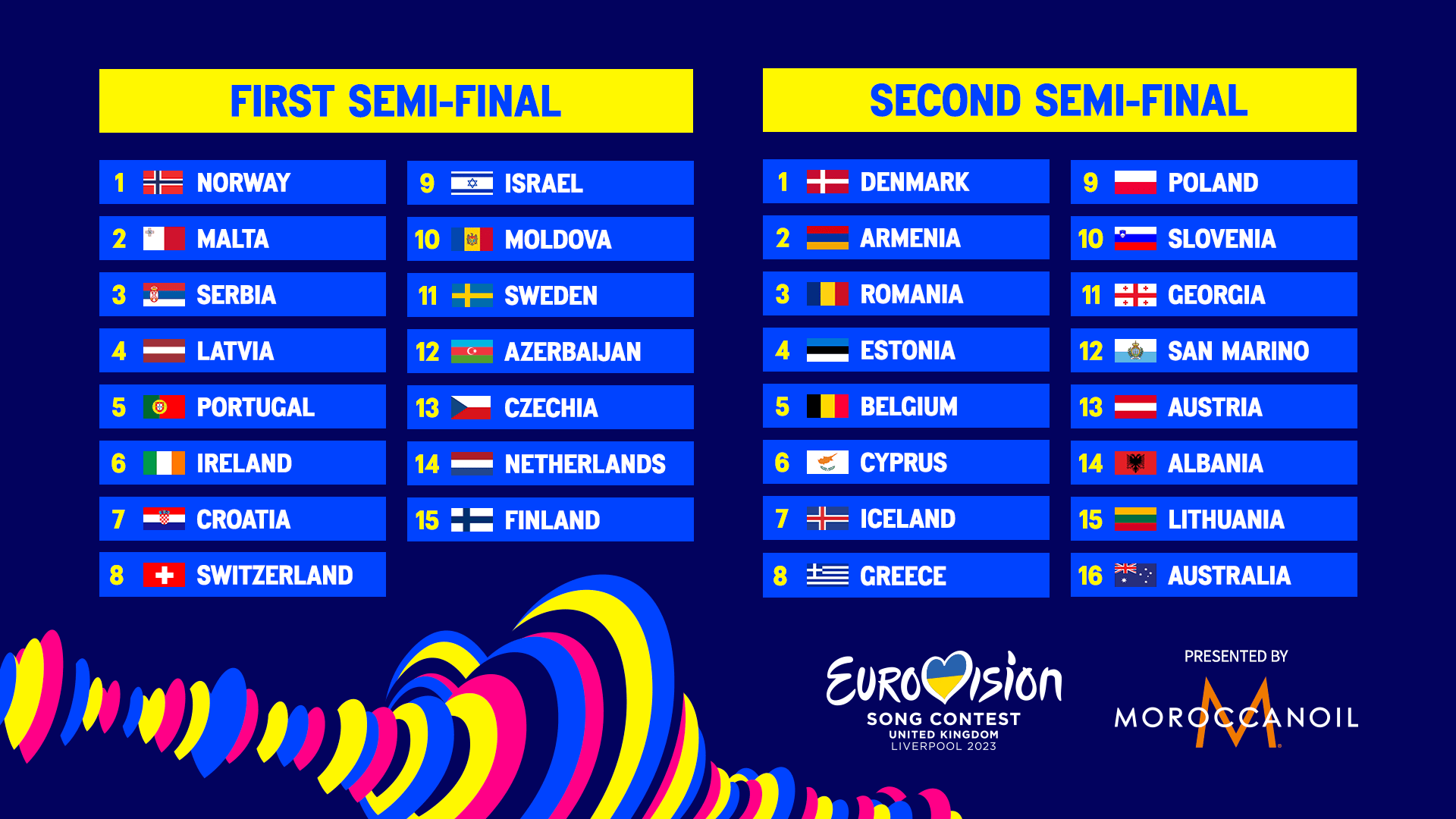

Eurovision Song Contest 2025 Complete Schedule Of Semi Finals And Final

May 14, 2025

Eurovision Song Contest 2025 Complete Schedule Of Semi Finals And Final

May 14, 2025 -

Snow White Box Office Another Disappointing Weekend According To Nolte

May 14, 2025

Snow White Box Office Another Disappointing Weekend According To Nolte

May 14, 2025 -

Recalled Dressings And Birth Control Pills Ontario And Canada Urgent Update

May 14, 2025

Recalled Dressings And Birth Control Pills Ontario And Canada Urgent Update

May 14, 2025