Significant Endowment Tax Increase Proposed For Ivy League Universities: Harvard And Yale In Focus

Table of Contents

The Proposed Legislation and its Details

The proposed legislation aims to levy a significant tax on university endowments exceeding a certain threshold. While the exact details are still being debated, initial proposals suggest a progressive tax rate, potentially starting at a lower percentage for smaller endowments and escalating sharply for those exceeding, say, $10 billion. Proponents argue this is a necessary step to address wealth inequality and ensure that these institutions, possessing vast financial resources, contribute more significantly to the public good. They advocate for redirecting these funds towards public education, increasing financial aid accessibility, or funding crucial social programs. However, the legislation may include exemptions for specific types of endowment assets or charitable funds.

Keywords: Endowment tax rate, proposed tax legislation, tax bill, higher education funding reform.

- Specific percentage increase proposed: Current proposals range from a few percentage points to a much higher rate for endowments above a certain threshold.

- Details about the calculation of the tax: The calculation method will likely be complex, considering factors such as investment returns and asset diversification.

- Specific examples of how the tax would affect Harvard and Yale: Given the size of their endowments, even a moderate percentage increase could result in billions of dollars in additional tax liability.

- Mention any potential impact on other institutions: While Harvard and Yale are the primary targets due to the size of their endowments, other wealthy universities could also face significant financial burdens.

Potential Impact on Harvard and Yale's Finances and Operations

The proposed endowment tax would have a profound impact on Harvard and Yale's financial stability and operational capacity. Considering the magnitude of their endowments, even a relatively small tax rate could translate into billions of dollars in lost revenue annually. This revenue loss would likely necessitate significant budgetary adjustments.

Keywords: Harvard endowment, Yale endowment, financial aid, research funding, university budget, capital projects.

- Estimated revenue loss for Harvard and Yale: Depending on the final tax rate, the revenue loss could be in the billions of dollars annually for each institution.

- Potential cuts to specific programs or departments: Reduced funding might necessitate cuts in research initiatives, academic programs, or support services.

- Impact on student tuition fees: To compensate for lost revenue, universities might be forced to increase tuition fees, potentially making higher education less accessible.

- Potential changes in university admissions policies: The financial strain could lead to changes in admissions policies, potentially impacting access for students from low-income backgrounds.

Arguments For and Against the Proposed Tax Increase

The proposed endowment tax has sparked a vigorous debate, with compelling arguments on both sides. Supporters emphasize the need for greater social equity and a fairer distribution of wealth. They highlight the vast disparities between the resources available to elite universities and the underfunded public education system. Opponents, however, argue that taxing endowments will stifle philanthropic giving and negatively impact research, financial aid, and overall university operations. They also raise concerns about unintended consequences, such as reduced investment in innovation and economic growth.

Keywords: Tax policy debate, wealth inequality, public benefit, philanthropic impact, university accountability.

- Arguments for increased funding for public education: Proponents argue that taxing endowments could help address the chronic underfunding of public education.

- Arguments against harming philanthropic giving: Critics fear the tax will discourage future donations to universities, potentially hindering long-term growth and innovation.

- Potential effects on the overall economy: The tax could have ripple effects on the economy, impacting employment and investment in research and development.

- Ethical considerations around taxing endowments: The debate also involves complex ethical questions surrounding the appropriate use of private wealth and the responsibilities of wealthy institutions.

The Future of Philanthropy and Higher Education Funding in Light of the Proposed Tax Increase

The proposed endowment tax has far-reaching implications for the future of philanthropy and higher education funding. A significant tax on endowments could significantly alter giving patterns, potentially leading to a decrease in donations to universities. Universities may need to explore alternative funding models, such as increased reliance on government funding or innovative fundraising strategies.

Keywords: Higher education funding models, philanthropic giving, university fundraising, future of philanthropy.

- Predictions for future giving patterns: The tax could cause a shift in philanthropic giving, with donors potentially directing funds to other charitable causes.

- Potential impact on private vs. public universities: The tax could exacerbate the already existing disparity between private and public universities, further disadvantaging public institutions.

- Potential for increased government funding: The tax could create pressure on the government to increase its funding for higher education.

- Discussion of alternative sources of revenue for universities: Universities may need to diversify their revenue streams, exploring new avenues such as online education, corporate partnerships, or intellectual property licensing.

Conclusion: The Future of Ivy League Endowments and the Debate over Endowment Tax Increases

The debate surrounding the proposed endowment tax increase is complex and far-reaching. While proponents argue for greater social equity and fairer distribution of wealth, opponents warn of potentially devastating consequences for higher education and philanthropy. The potential impact on Harvard, Yale, and other Ivy League universities is undeniable, potentially leading to significant budgetary cuts, tuition increases, and reduced access to higher education for many students. The future of higher education funding and the landscape of philanthropy hinge on the outcome of this ongoing debate. Stay informed about this critical issue, contact your representatives to voice your opinion on this legislation, and participate in the ongoing discussion about endowment tax increases and the future of higher education. Keywords: Ivy League endowment tax, higher education funding, university taxation, endowment tax reform.

Featured Posts

-

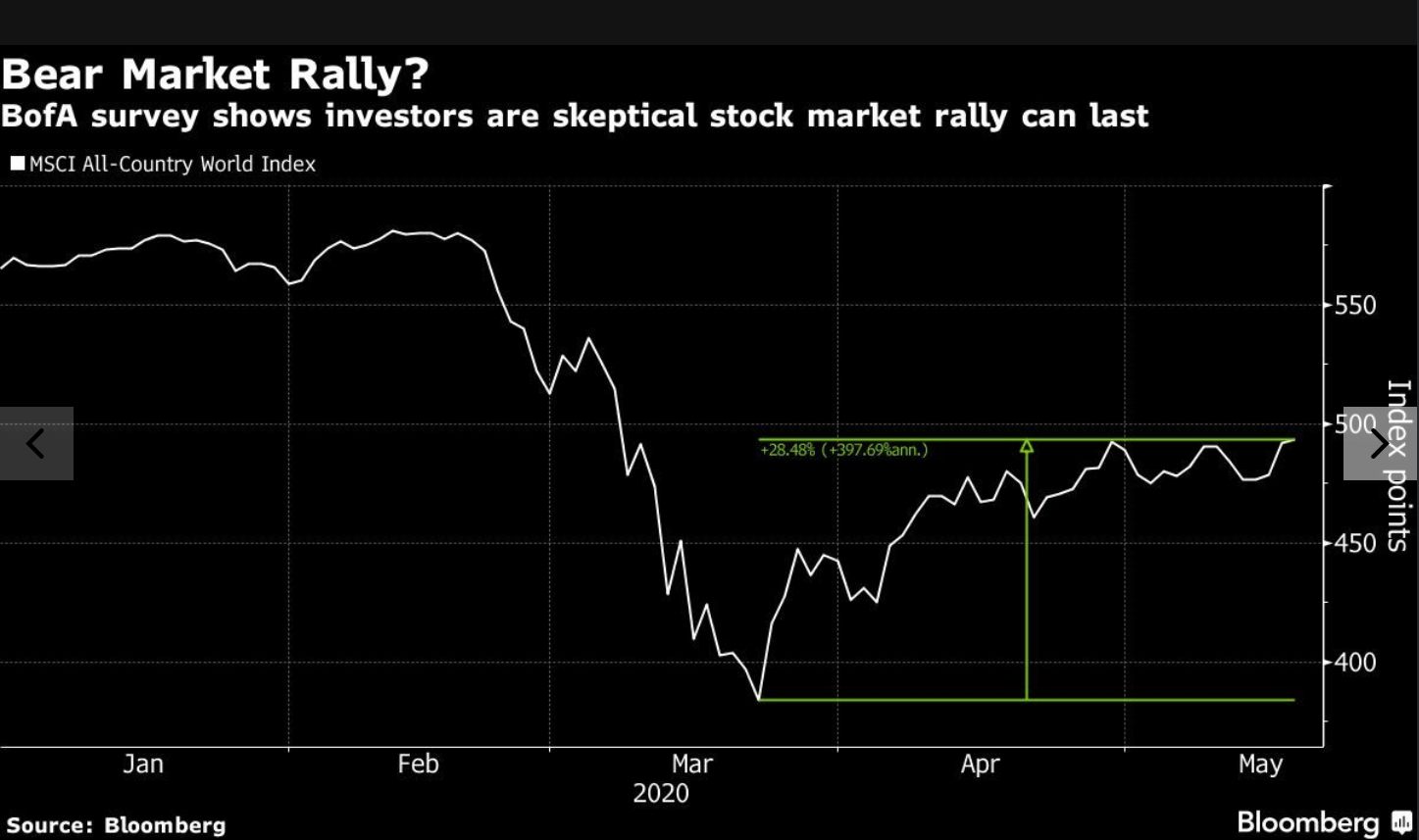

Stock Market Valuations Bof As Reassurance For Investors

May 13, 2025

Stock Market Valuations Bof As Reassurance For Investors

May 13, 2025 -

Golden Horse Awards Winner Lin Tsan Ting A Life In Cinematography Obituary

May 13, 2025

Golden Horse Awards Winner Lin Tsan Ting A Life In Cinematography Obituary

May 13, 2025 -

Mob Land Premiere Cassie Venturas Stunning Red Carpet Look While Pregnant

May 13, 2025

Mob Land Premiere Cassie Venturas Stunning Red Carpet Look While Pregnant

May 13, 2025 -

Eva Longoria Promotes New Disney Film In Chic Michael Kors Gown

May 13, 2025

Eva Longoria Promotes New Disney Film In Chic Michael Kors Gown

May 13, 2025 -

Semya Kadyshevykh Skandal Dolg I Zaschita Syna

May 13, 2025

Semya Kadyshevykh Skandal Dolg I Zaschita Syna

May 13, 2025

Latest Posts

-

2025 Mlb Season Assessing The Top Performers And Underperformers At The 30 Game Point

May 14, 2025

2025 Mlb Season Assessing The Top Performers And Underperformers At The 30 Game Point

May 14, 2025 -

The Traitors 2 Episode 1 Player Conflicts After The First Task And Bonus Footage

May 14, 2025

The Traitors 2 Episode 1 Player Conflicts After The First Task And Bonus Footage

May 14, 2025 -

Thirty Games In Evaluating Mlbs Biggest Winners And Losers In 2025

May 14, 2025

Thirty Games In Evaluating Mlbs Biggest Winners And Losers In 2025

May 14, 2025 -

Zdrajcy 2 Odcinek 1 Analiza Konfliktow Graczy Po Pierwszym Zadaniu

May 14, 2025

Zdrajcy 2 Odcinek 1 Analiza Konfliktow Graczy Po Pierwszym Zadaniu

May 14, 2025 -

Mlb Power Rankings Winners And Losers After 30 Games 2025 Season

May 14, 2025

Mlb Power Rankings Winners And Losers After 30 Games 2025 Season

May 14, 2025