Significant Drop In BP Chief Executive's Compensation: 31% Decrease

Table of Contents

The Magnitude of the Pay Cut: Analyzing the 31% Reduction

The 31% reduction in BP Chief Executive's compensation represents a substantial decrease in total remuneration. Let's examine the figures: In the previous year, the CEO's total compensation package amounted to approximately $X million (insert actual figure if available). This included a base salary of $Y million, performance-based bonuses of $Z million, and stock options valued at $W million. The current year's compensation, following the 31% reduction, totals approximately $X-($X*.31) = $A million (insert calculated figure). This translates to a significant decrease across all compensation components.

- Base Salary: A reduction of approximately [Insert Percentage]%

- Bonuses: A decrease of approximately [Insert Percentage]% reflecting the company's financial performance.

- Stock Options: A reduction in value, reflecting the current market valuation of BP shares.

This substantial reduction in BP CEO salary stands in stark contrast to some other energy company CEOs, many of whom saw only minimal changes, or even increases, in their compensation during the same period. This comparison further emphasizes the magnitude of the change within BP's executive compensation structure. The changes to BP CEO salary and executive pay reduction serve as a case study in the dynamics of executive compensation in the volatile energy sector.

Reasons Behind the Significant Drop in BP Chief Executive's Compensation

Several factors contributed to the dramatic decrease in BP executive pay. The company's financial performance in the relevant period played a major role. BP experienced [Insert description of financial performance: e.g., lower-than-expected profits, increased operational costs, etc.]. This underperformance directly impacted the CEO's performance-based bonuses.

- Company Performance: Lower-than-projected profits directly impacted the bonus structure tied to financial targets.

- Shareholder Pressure: Activist investors may have exerted pressure on the board to reduce executive compensation, arguing that it was disproportionate to the company's performance. (Mention any specific investor actions if available).

- Strategic Shifts: BP's ongoing strategic shift towards renewable energy sources could also have influenced the board's decision. A focus on long-term sustainability might prioritize cost-cutting measures, including executive compensation.

- Board of Directors' Decision-Making: The Board of Directors likely weighed these various factors in their decision-making process. Their official statement likely emphasized the need for accountability and alignment with shareholder interests.

Impact and Implications of the Reduced BP CEO Compensation

The reduction in BP Chief Executive's compensation has far-reaching implications. The market reacted to the news with [Insert description of market reaction: e.g., a slight dip in the stock price, relatively little change, a positive response]. While the impact on investor sentiment remains to be fully assessed, the decrease could be viewed positively by some stakeholders as a sign of improved corporate governance.

- Impact on Investor Sentiment: [Analyze stock price changes and investor reactions]

- Effect on Employee Morale: The pay cut could potentially impact employee morale, especially if it's perceived as unfair or inconsistent with pay across other levels of the organization. However, it could also be viewed as a sign of shared sacrifice during a challenging period.

- Public Perception: The public reaction to the news has been mixed, with some praising the decision as a sign of corporate responsibility, and others criticizing it as insufficient given the company's performance and past controversies.

- Future Implications for Executive Compensation at BP: This substantial pay cut likely sets a new precedent for future executive compensation decisions at BP. It signifies a greater emphasis on aligning executive pay with company performance and shareholder expectations.

Conclusion: Understanding the Significance of the BP CEO Pay Cut

The 31% decrease in BP Chief Executive's compensation is a significant event, driven by a confluence of factors including underperformance, shareholder pressure, and strategic shifts within the company. This decision holds substantial implications for corporate governance, investor relations, and the broader discussion surrounding executive pay in the energy sector. The impact on employee morale and public perception also deserves further analysis. To stay informed about future changes in BP Chief Executive's compensation and the evolving dynamics of executive pay within the energy industry, follow our updates and analysis. Continue to learn more about the impact of this significant drop in BP Chief Executive's compensation on the energy sector and broader corporate governance.

Featured Posts

-

Vybz Kartels Historic New York City Performance Date Venue And Ticket Info

May 21, 2025

Vybz Kartels Historic New York City Performance Date Venue And Ticket Info

May 21, 2025 -

Netflix Adds Sesame Street Full Story And Other Top Headlines

May 21, 2025

Netflix Adds Sesame Street Full Story And Other Top Headlines

May 21, 2025 -

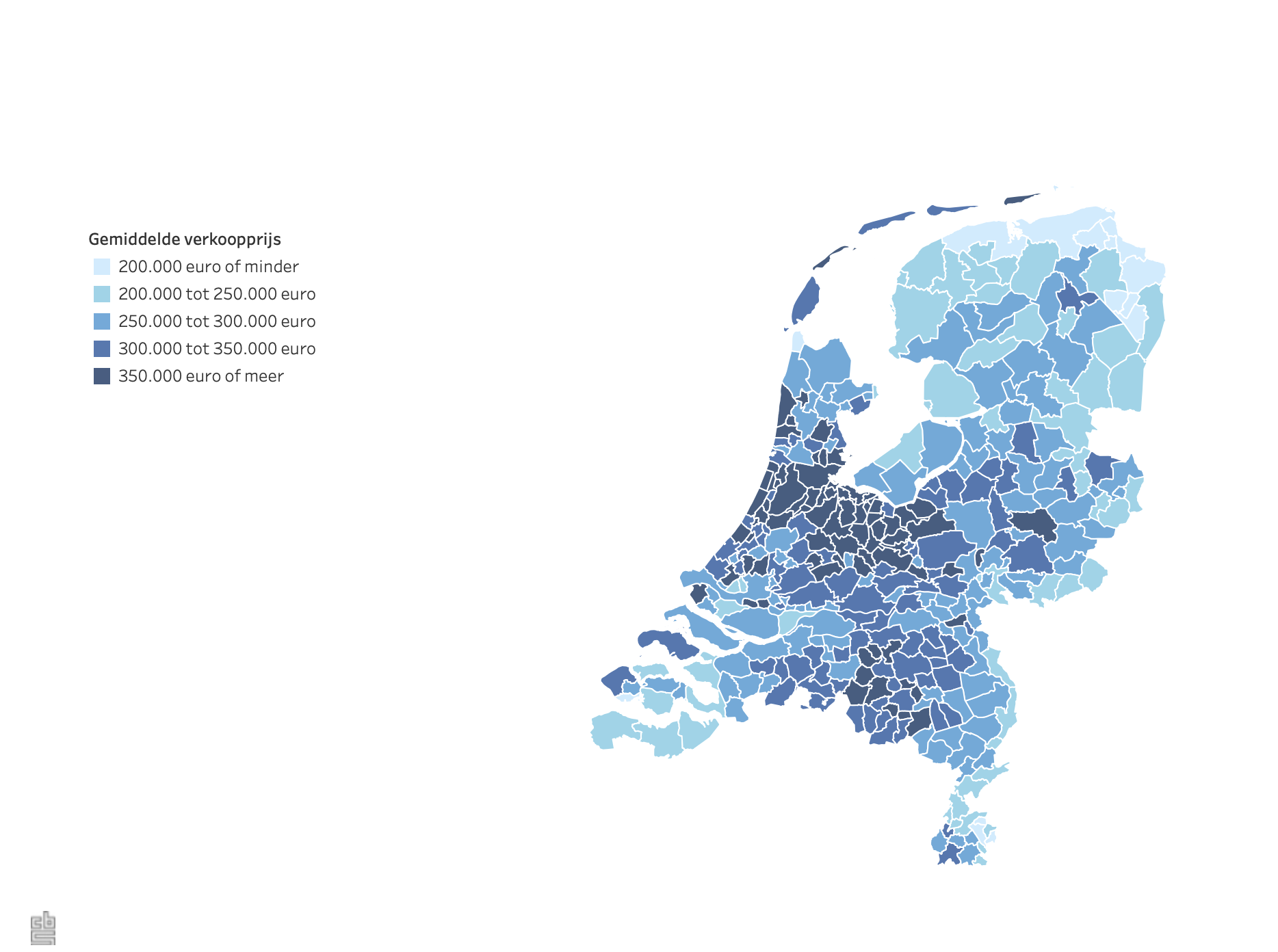

Huizenprijzen Stijgen Ondanks Economische Tegenwind Abn Amro Verwachting

May 21, 2025

Huizenprijzen Stijgen Ondanks Economische Tegenwind Abn Amro Verwachting

May 21, 2025 -

Le Hellfest Investit Le Noumatrouff Une Programmation Musicale Exceptionnelle A Mulhouse

May 21, 2025

Le Hellfest Investit Le Noumatrouff Une Programmation Musicale Exceptionnelle A Mulhouse

May 21, 2025 -

Abn Amro Opslag Alternatieven Voor Online Betalingen

May 21, 2025

Abn Amro Opslag Alternatieven Voor Online Betalingen

May 21, 2025

Latest Posts

-

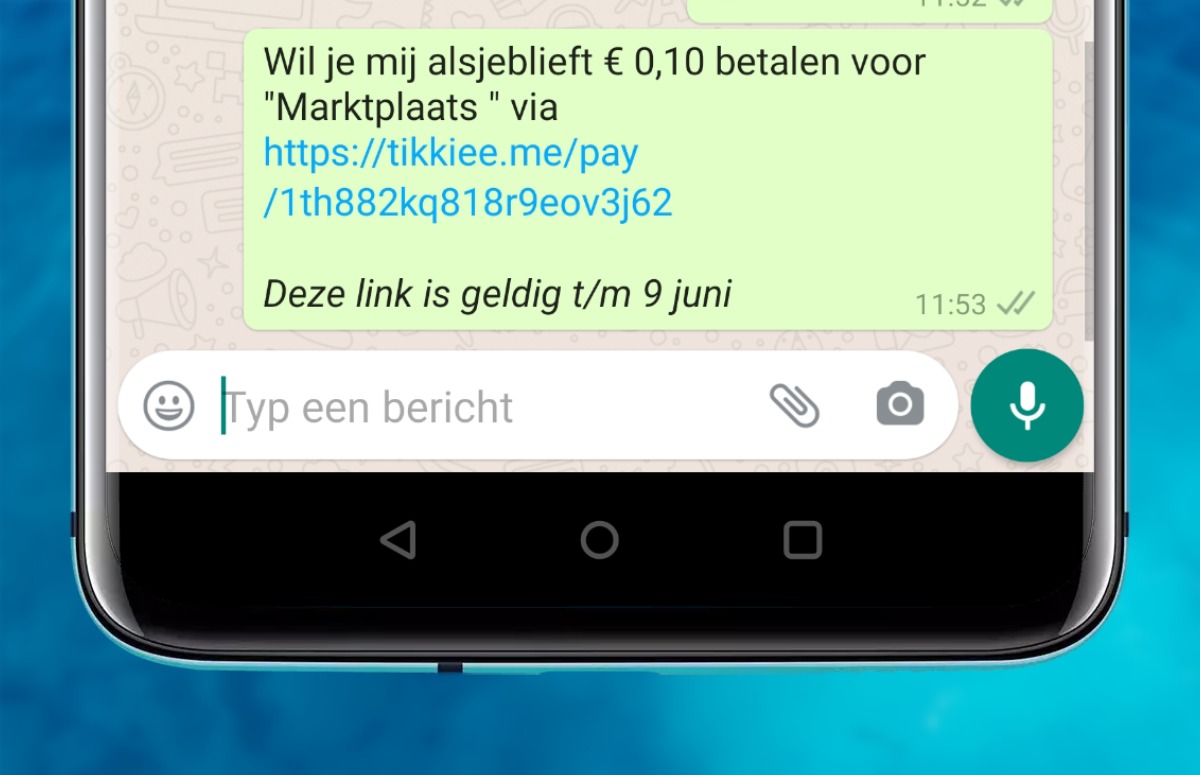

Betaalverkeer In Nederland Van Bankrekening Tot Tikkie

May 21, 2025

Betaalverkeer In Nederland Van Bankrekening Tot Tikkie

May 21, 2025 -

Tikkie Gebruiken Een Gids Voor Nederlandse Bankieren

May 21, 2025

Tikkie Gebruiken Een Gids Voor Nederlandse Bankieren

May 21, 2025 -

Unpacking The Debate Australian Trans Influencers Record Breaking Feat

May 21, 2025

Unpacking The Debate Australian Trans Influencers Record Breaking Feat

May 21, 2025 -

Australian Trans Influencers Record Fact Or Fiction A Detailed Look

May 21, 2025

Australian Trans Influencers Record Fact Or Fiction A Detailed Look

May 21, 2025 -

Record Setting Run William Goodge Conquers Australia On Foot

May 21, 2025

Record Setting Run William Goodge Conquers Australia On Foot

May 21, 2025