Should You Invest In XRP After Its 400% Increase? A Comprehensive Guide.

Table of Contents

Understanding XRP's Recent Price Surge

XRP's dramatic price increase isn't a random event; several factors have converged to fuel this impressive rally.

Factors Contributing to the 400% Increase:

-

Increased adoption by payment processors: Ripple, the company behind XRP, has been steadily increasing its partnerships with financial institutions globally. These partnerships utilize XRP's blockchain technology for faster and cheaper cross-border payments, driving demand. This increased usage translates directly into higher value.

-

Positive legal developments in the ongoing SEC lawsuit: The ongoing SEC lawsuit against Ripple has created significant uncertainty. However, recent positive developments in the case, such as favorable court rulings or expert testimony, have injected optimism into the market, boosting XRP's price. Keep an eye on the "Ripple vs SEC" developments for further price impacts.

-

Growing interest in blockchain and cryptocurrency technology: The broader cryptocurrency market has seen renewed interest, with many investors seeking exposure to alternative assets. This general market sentiment positively impacts XRP, alongside other cryptocurrencies. This growing interest in "blockchain technology" and the wider "cryptocurrency market" supports price increases across the board.

-

Speculative trading and market sentiment: As with any cryptocurrency, speculative trading and market sentiment play a significant role. Positive news, rumors, and even social media trends can cause rapid price fluctuations. "XRP price prediction" analyses often fuel this speculative element.

Analyzing Market Volatility and Risk:

Investing in XRP, or any cryptocurrency, inherently involves significant risk.

-

Cryptocurrency risk: The cryptocurrency market is famously volatile. Sharp price swings are common, and significant losses are possible. This "market volatility" is a key risk factor to consider.

-

Regulatory uncertainty: The regulatory landscape for cryptocurrencies remains unclear in many jurisdictions. Further regulatory actions, particularly concerning XRP and Ripple, could significantly impact its price. Understanding the "investment risk" associated with "regulatory uncertainty" is crucial.

-

Diversification strategy: It's essential to diversify your investment portfolio. Don't put all your eggs in one basket, especially in a highly volatile asset like XRP. A well-diversified portfolio can mitigate potential losses.

Evaluating XRP's Long-Term Potential

While the recent price surge is exciting, it's crucial to assess XRP's long-term prospects.

XRP's Technological Advantages and Use Cases:

XRP's technology offers several potential advantages:

-

Cross-border payments: XRP is designed to facilitate fast and efficient cross-border payments, offering a solution to the often slow and expensive traditional banking systems.

-

Transaction speed: Compared to some other cryptocurrencies, XRP transactions are significantly faster, which is a key advantage for financial institutions. The high "transaction speed" and "low transaction fees" are key selling points.

-

Potential for wider adoption in financial institutions: Ripple's partnerships with banks and payment providers suggest a potential for wider adoption in the financial sector, which could drive long-term growth. This is a significant point for those interested in "financial technology" and "payment solutions".

Ripple's Ongoing Legal Battle with the SEC:

The SEC lawsuit against Ripple is a significant factor influencing XRP's future.

-

SEC lawsuit Ripple: The outcome of this case will have a major impact on XRP's price and regulatory status.

-

Ripple vs SEC: A positive resolution could lead to increased adoption and price appreciation, while a negative outcome could severely depress the price. Understanding the "legal uncertainty" and potential implications is paramount.

-

Regulatory compliance: Regardless of the outcome, the case highlights the importance of regulatory compliance in the cryptocurrency space.

Strategies for Investing in XRP (if applicable):

If you're considering investing in XRP, carefully consider these strategies.

Determining Your Risk Tolerance:

-

Risk tolerance: Before investing, honestly assess your risk tolerance. Are you comfortable with the potential for significant losses?

-

Investment strategy: Develop an investment strategy aligned with your risk profile and financial goals. This includes determining how much you can afford to lose. Effective "portfolio management" is crucial.

-

Investment goals: Clearly define your investment goals. Are you investing for short-term gains or long-term growth?

Diversification and Responsible Investing:

-

Portfolio diversification: Never invest more than you can afford to lose, and always diversify your portfolio. Don't put all your eggs in one basket.

-

Responsible investing: Conduct thorough research before investing in any cryptocurrency, and only invest what you can afford to lose. This involves due diligence and understanding the associated "investment advice."

Conclusion: Should You Invest in XRP?

While XRP's 400% increase is impressive, investing in XRP remains a high-risk, high-reward proposition. The factors discussed – positive developments in the SEC lawsuit, increasing adoption, technological advantages, and inherent market volatility – all contribute to the decision of whether to invest in XRP. Carefully consider your personal risk tolerance, the ongoing legal battle, and the inherent volatility of the cryptocurrency market before deciding whether to invest in XRP. Remember to always conduct your own thorough research and seek professional financial advice if needed. Make an informed decision about whether to invest in XRP based on your own risk assessment and investment strategy.

Featured Posts

-

Waarom Geeft Nrc Nu Gratis Toegang Tot The New York Times

May 01, 2025

Waarom Geeft Nrc Nu Gratis Toegang Tot The New York Times

May 01, 2025 -

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025 -

France Triumphs Over Italy Duponts Masterclass Performance

May 01, 2025

France Triumphs Over Italy Duponts Masterclass Performance

May 01, 2025 -

Medias Interpretatie Van Zware Auto Een Geen Stijl Analyse

May 01, 2025

Medias Interpretatie Van Zware Auto Een Geen Stijl Analyse

May 01, 2025 -

Priscilla Pointer Dalla Star Dies At 100 A Legacy Remembered

May 01, 2025

Priscilla Pointer Dalla Star Dies At 100 A Legacy Remembered

May 01, 2025

Latest Posts

-

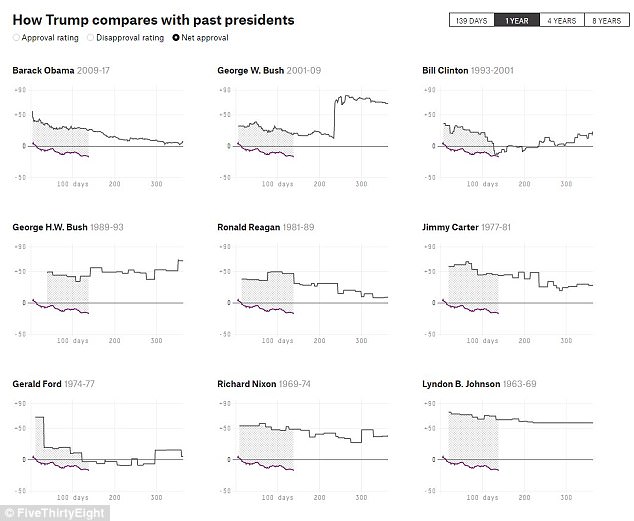

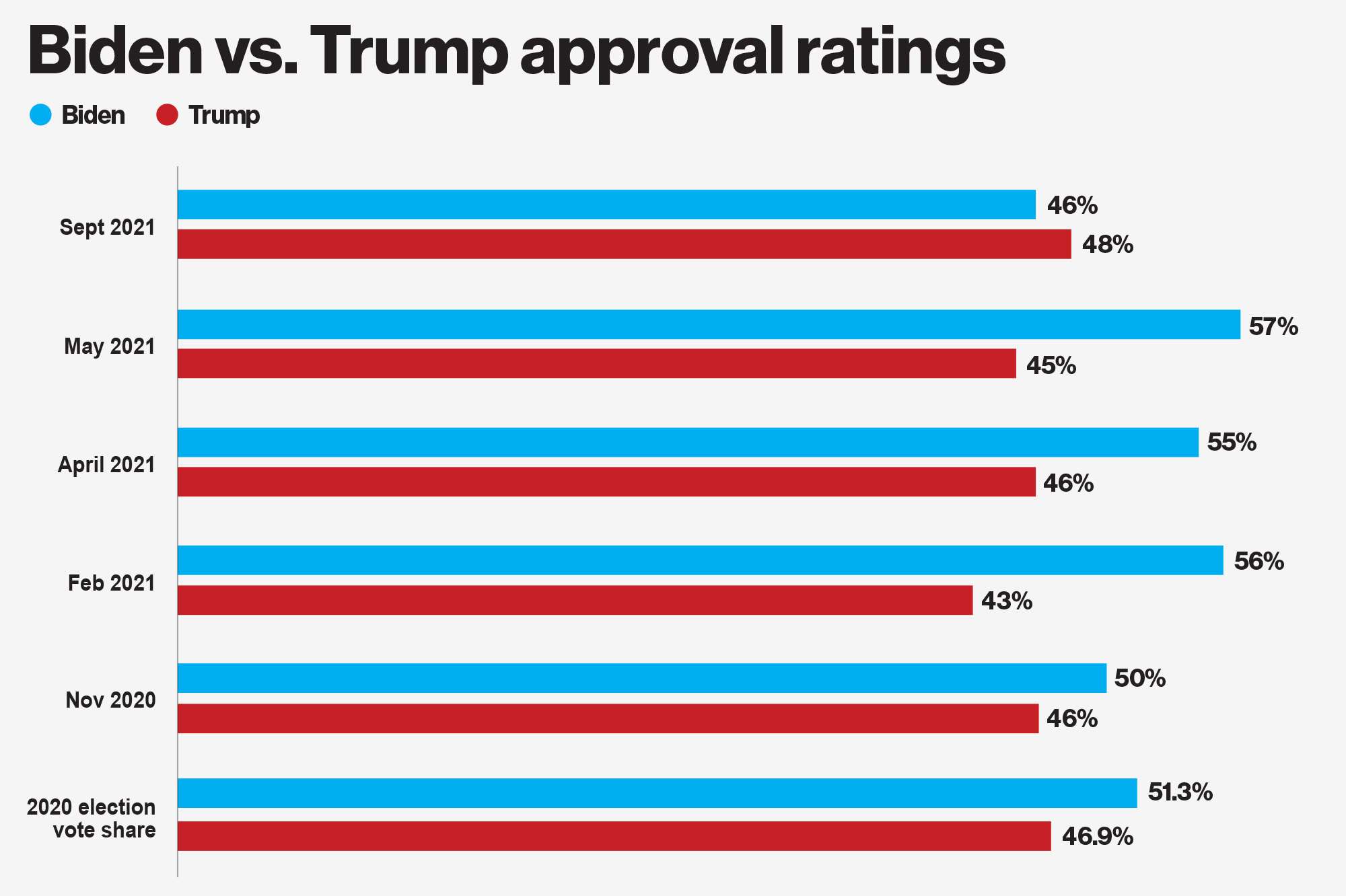

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025 -

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025 -

39 Approval Trumps First 100 Days And The Impact Of Travel Restrictions

May 01, 2025

39 Approval Trumps First 100 Days And The Impact Of Travel Restrictions

May 01, 2025 -

Black Sea Beaches Closed Russias Response To Major Oil Spill

May 01, 2025

Black Sea Beaches Closed Russias Response To Major Oil Spill

May 01, 2025 -

Trump Approval Rating Drops To 39 Analysis Of The First 100 Days

May 01, 2025

Trump Approval Rating Drops To 39 Analysis Of The First 100 Days

May 01, 2025