Should You Invest In Uber Technologies (UBER)? A Detailed Look

Table of Contents

UBER's Business Model and Financial Performance

Understanding Uber's Revenue Streams

Uber's success stems from its diversified business model. It operates primarily through several key segments, each contributing to its overall revenue generation:

- Ride-hailing: This remains Uber's core business, connecting passengers with drivers through its app. Revenue is generated through commissions on each ride. Key revenue drivers in this segment include peak-hour demand, surge pricing, and expansion into new markets.

- Uber Eats: This food delivery service has become a significant revenue contributor, connecting users with restaurants and other food vendors. Revenue is generated through commissions on each order, delivery fees, and subscription services. Key revenue drivers here include increasing restaurant partnerships, marketing campaigns targeting users and restaurants, and expansion into new geographic areas.

- Freight: Uber Freight connects shippers with trucking companies, offering a digital platform for managing freight transportation. Revenue is generated through commissions on each shipment. Key revenue drivers include strategic partnerships with large logistics companies and the increasing demand for efficient freight solutions.

These diverse revenue streams provide Uber with some resilience against economic downturns impacting one sector.

Analyzing Uber's Financial Health

Assessing Uber's financial health requires examining key metrics from its financial statements. While revenue growth has been impressive, profitability has remained a challenge. Analyzing recent quarterly earnings reports reveals fluctuations in profit margins. Key metrics to monitor include:

- Revenue Growth Rate: Examining year-over-year revenue growth provides insights into the company's expansion and market penetration.

- Profit Margins: Analyzing operating and net profit margins helps assess the company's efficiency and profitability.

- Debt-to-Equity Ratio: This metric indicates the company's financial leverage and its ability to manage debt.

| Metric | Q1 2023 (Illustrative) | Q2 2023 (Illustrative) | Trend |

|---|---|---|---|

| Revenue (USD Billions) | 8.8 | 9.2 | Increasing |

| Net Income (USD Millions) | -200 | -150 | Improving |

| Debt-to-Equity Ratio | 1.5 | 1.4 | Decreasing |

(Note: These are illustrative figures. Always refer to official Uber financial reports for the most up-to-date information.)

Competitive Landscape and Market Share

Uber faces stiff competition in the ride-hailing and food delivery markets. Key competitors include Lyft in the US, Didi in China, and various regional players. Analyzing Uber's market share across different geographic regions is crucial. Understanding Uber's competitive advantages, such as its brand recognition, technological capabilities, and extensive network, is also vital. However, challenges include intense competition, regulatory hurdles, and the high cost of maintaining a large driver network. A visualization of market share (a chart would be included here in a published article) would illustrate Uber's position against its rivals.

Growth Potential and Future Outlook for Uber (UBER)

Expansion into New Markets and Services

Uber's future growth hinges on its ability to expand into new markets and offer innovative services. Expansion into emerging economies with growing middle classes presents significant opportunities. Furthermore, diversifying into new service areas, such as autonomous vehicles and last-mile delivery solutions, could unlock substantial growth potential.

- International expansion: Targeting underserved markets in Asia, Africa, and Latin America.

- New service offerings: Developing and deploying autonomous vehicle technology, expanding logistics services beyond freight.

Technological Advancements and Innovation

Uber's investment in technology, particularly artificial intelligence (AI) and machine learning, is critical for maintaining its competitive edge. AI-powered route optimization, dynamic pricing, and fraud detection can enhance efficiency and profitability. The development and implementation of self-driving cars could revolutionize the ride-hailing industry, significantly impacting operating costs and potentially creating a new revenue stream.

- AI-driven optimization: Improving route efficiency, reducing operational costs.

- Autonomous vehicle technology: Reducing labor costs and potentially offering new service models.

Regulatory Landscape and Potential Challenges

The regulatory landscape significantly influences Uber's operations. Government regulations regarding licensing, driver classification, and data privacy vary considerably across different regions. Navigating these regulations efficiently and complying with changing policies is crucial for sustained growth. Potential challenges include legal battles, licensing issues, and evolving safety standards.

- Driver classification: Ongoing legal battles regarding the classification of drivers as independent contractors or employees.

- Data privacy: Compliance with evolving data privacy regulations.

Investment Considerations and Risks

Assessing the Risk-Reward Ratio of Investing in UBER

Investing in Uber Technologies (UBER) involves both significant potential rewards and considerable risks.

Potential Rewards:

- Long-term growth potential in a rapidly expanding market.

- Diversification into multiple revenue streams.

- Technological innovation leading to cost efficiencies and new revenue opportunities.

Potential Risks:

- High market volatility due to its growth stage and competitive landscape.

- Regulatory uncertainty and potential legal challenges.

- Dependence on driver networks and potential labor-related issues.

- Competition from established players and new entrants.

Comparing Uber to Other Investments

Before investing in Uber, compare its investment profile with other tech stocks and companies in the transportation or delivery sector. Consider factors such as valuation, growth trajectory, and risk tolerance. Diversifying your investment portfolio is crucial to mitigate risk.

Conclusion: Should You Invest in Uber Technologies (UBER)?

Investing in Uber Technologies (UBER) presents a complex picture. While its diversified business model, technological advancements, and potential for international growth are compelling, significant risks remain, including intense competition, regulatory hurdles, and profitability challenges. This analysis provides a framework; however, thorough due diligence is essential before making any investment decisions. Research Uber's financial reports, analyze market trends, and assess your own risk tolerance before deciding whether investing in Uber Technologies (UBER) aligns with your financial goals. Remember that this is not financial advice, and further research is crucial before investing in UBER stock.

Featured Posts

-

Champions League Semi Final Arsenals Chances Against Psg

May 08, 2025

Champions League Semi Final Arsenals Chances Against Psg

May 08, 2025 -

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1

May 08, 2025

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1

May 08, 2025 -

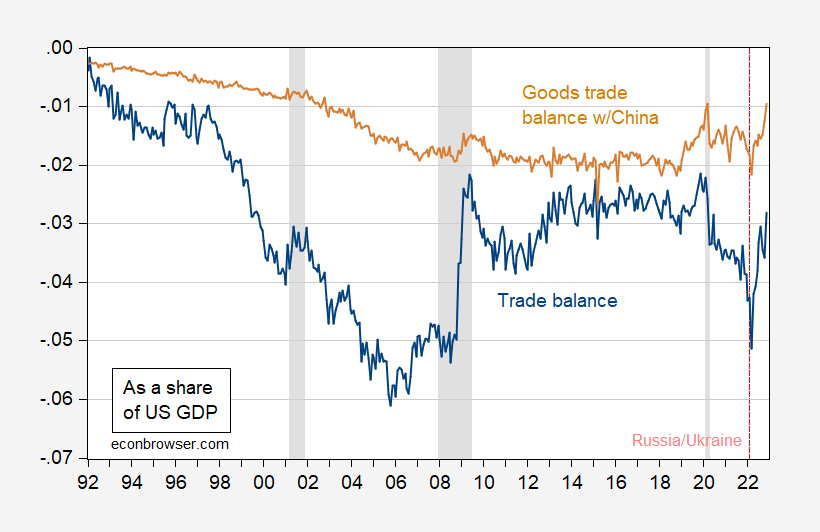

Canadas Trade Deficit Shrinks 506 Million In Latest Figures

May 08, 2025

Canadas Trade Deficit Shrinks 506 Million In Latest Figures

May 08, 2025 -

Uber Ceo Kalanick Admits Abandoning Project Decision Was A Mistake

May 08, 2025

Uber Ceo Kalanick Admits Abandoning Project Decision Was A Mistake

May 08, 2025 -

Psl 10 Tickets Available Today Get Yours Now

May 08, 2025

Psl 10 Tickets Available Today Get Yours Now

May 08, 2025