Should You Invest In Palantir Stock Before May 5th?

Table of Contents

Palantir's Recent Performance and Future Outlook

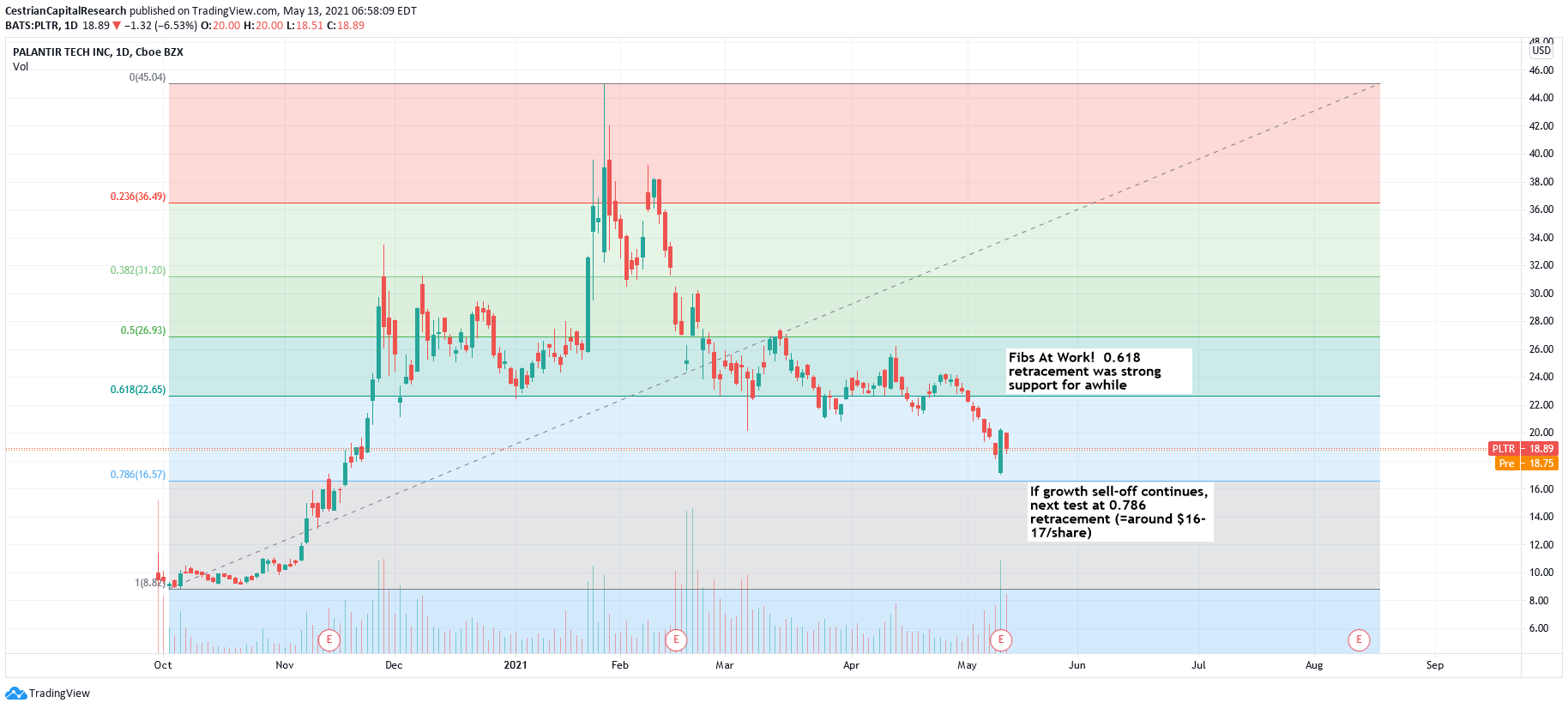

Analyzing Palantir's recent stock price movements reveals a history of volatility. Understanding these trends is crucial for predicting future performance. To assess the Palantir stock price trajectory, we need to consider several factors.

-

Recent Earnings Reports and Financial Performance: Palantir's recent earnings reports should be carefully examined. Look for trends in revenue growth, profitability, and overall financial health. Significant deviations from expectations can drastically impact the PLTR stock forecast.

-

Significant News and Announcements: Any major news, partnerships, or announcements impacting Palantir's operations—such as new contracts, product launches, or regulatory changes—will directly affect investor sentiment and the Palantir stock price.

-

Growth Strategy and Market Position: Palantir's growth strategy, including its expansion into new markets and its competitive landscape within the big data and analytics sector, needs thorough assessment. Analyzing its market position against competitors helps determine its long-term viability and growth prospects.

-

Upcoming Product Launches and Partnerships: Any anticipated product launches or strategic partnerships could significantly impact Palantir's future revenue and, consequently, the PLTR stock price. The success or failure of these initiatives could influence investor confidence.

-

Overall Market Sentiment: The overall market sentiment towards Palantir—positive, negative, or neutral—is another crucial factor. This sentiment is often reflected in analyst ratings and media coverage, providing valuable insights into investor expectations. Understanding this sentiment will help in forecasting potential fluctuations in the Palantir stock price.

Analyzing Key Financial Metrics for Palantir Investment

Before investing in Palantir, a thorough examination of its key financial metrics is essential. This analysis helps determine the company's financial health and investment potential.

-

Revenue Growth Analysis: Consistent and sustainable revenue growth is a key indicator of a healthy company. Examine Palantir's historical revenue growth and assess its future projections.

-

Profitability (Margins, Earnings Per Share): Analyzing profitability, including gross margins, operating margins, and earnings per share (EPS), provides insights into Palantir's ability to generate profits and returns for its investors. Compare these figures with industry benchmarks.

-

Debt Levels and Financial Health: A high level of debt can indicate financial instability. Evaluate Palantir's debt-to-equity ratio and its overall financial health to assess its risk profile.

-

Cash Flow Generation: Strong cash flow is vital for a company's sustainability. Analyze Palantir's operating cash flow and free cash flow to understand its ability to fund operations and future growth.

-

Valuation Metrics (P/E Ratio, etc.): Compare Palantir's valuation metrics, such as its price-to-earnings (P/E) ratio, with those of its competitors and the broader market to determine if it's currently overvalued or undervalued. This helps decide if the current Palantir valuation justifies the investment.

Risks and Potential Rewards of Investing in Palantir Before May 5th

Investing in Palantir before May 5th presents both potential rewards and considerable risks. A balanced assessment is crucial.

Potential Risks:

-

Market Volatility: The stock market is inherently volatile, and Palantir stock is no exception. External factors, economic downturns, or negative news can significantly impact its price.

-

Competition: The big data and analytics market is highly competitive. Palantir faces competition from established players and emerging startups, impacting its market share and growth potential.

-

Dependence on Government Contracts: Palantir's revenue is partially dependent on government contracts. Changes in government spending or policy could negatively affect its financial performance.

-

Potential for Future Losses: Investing in stocks always carries the risk of potential losses. Palantir's stock price could decline, leading to financial losses for investors.

Potential Rewards:

-

Long-Term Growth Potential: Palantir operates in a rapidly growing market with substantial long-term growth potential. Successful execution of its strategy could lead to significant returns.

-

Significant Returns on Investment: If Palantir's growth trajectory meets or exceeds expectations, investors could see substantial returns on their investment.

-

First-Mover Advantage: Palantir holds a first-mover advantage in some market niches, providing a competitive edge and potential for market dominance.

Alternative Investment Strategies Considering the May 5th Deadline

If you're hesitant about investing in Palantir before May 5th, several alternative investment strategies can be considered.

-

Diversification: Diversifying your investment portfolio across different asset classes and sectors reduces overall risk. Consider investing in other tech stocks or different sectors altogether.

-

Investing in Other Tech Stocks: The technology sector offers various other investment opportunities. Research and compare different tech companies to find alternatives with similar growth potential and lower risk.

-

Waiting for Further Information: Before investing, wait for additional information, such as the May 5th announcement (if any), further financial reports, or analyst upgrades to gain a clearer picture of Palantir's future outlook.

-

Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of price fluctuations, reducing the impact of market volatility.

Conclusion

Deciding whether to invest in Palantir stock before May 5th requires careful consideration of its recent performance, financial health, future outlook, and the inherent risks. While Palantir possesses considerable growth potential, significant risks are also present. Alternative investment strategies, such as diversification and waiting for further information, offer less risky options. Ultimately, the decision rests on your risk tolerance and investment goals. Thoroughly research Palantir stock, conduct further due diligence, and consult with a financial advisor before investing. Remember to always invest responsibly.

Featured Posts

-

Uk Government To Tighten Student Visa Rules Asylum Implications

May 10, 2025

Uk Government To Tighten Student Visa Rules Asylum Implications

May 10, 2025 -

Meet Jeanine Pirro Education Net Worth And Career Highlights

May 10, 2025

Meet Jeanine Pirro Education Net Worth And Career Highlights

May 10, 2025 -

Bundesliga Matchday 27 Cologne Seizes First Place From Hamburg

May 10, 2025

Bundesliga Matchday 27 Cologne Seizes First Place From Hamburg

May 10, 2025 -

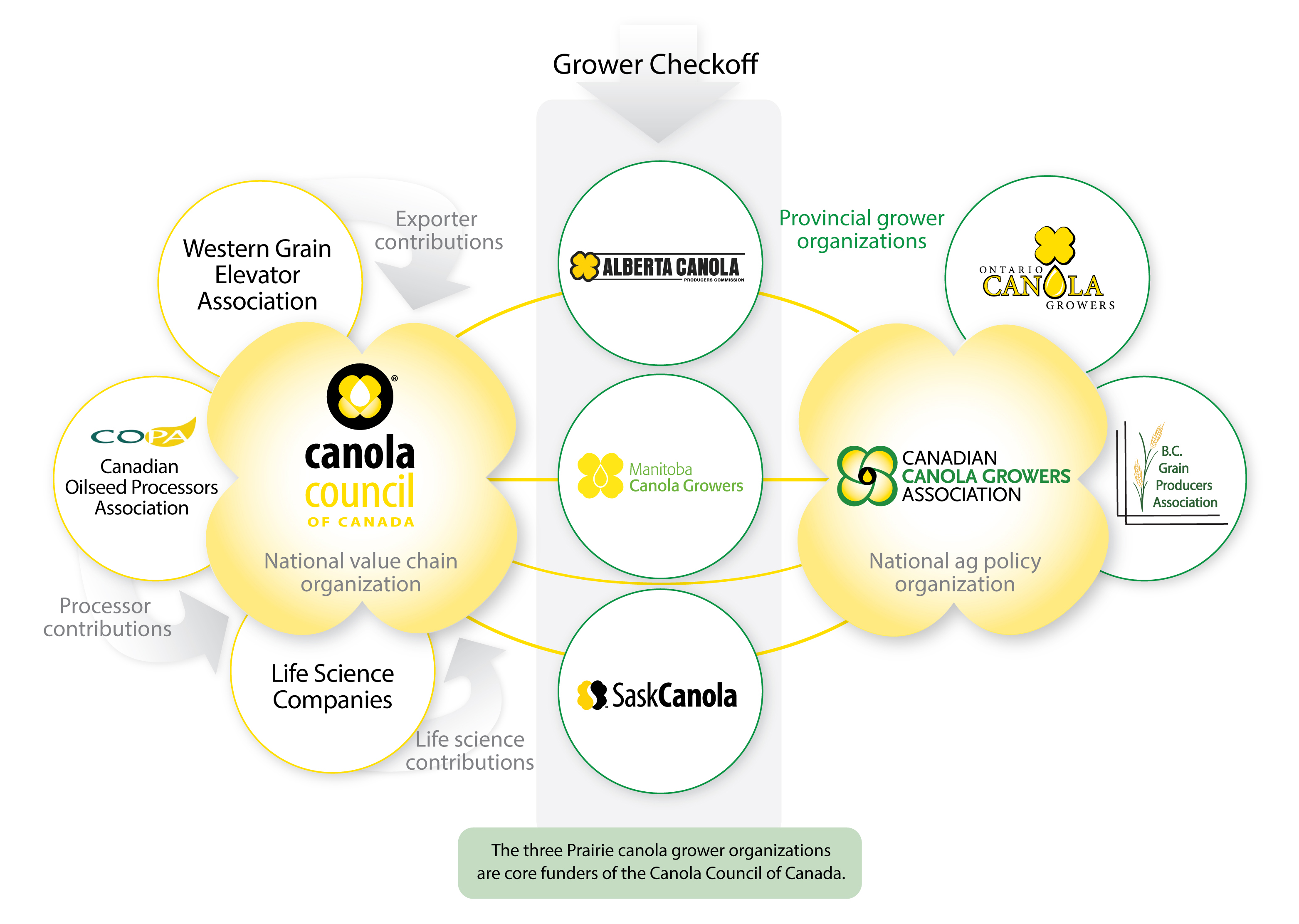

Chinas Canola Supply Chain Adapting To The Canada Break

May 10, 2025

Chinas Canola Supply Chain Adapting To The Canada Break

May 10, 2025 -

Invest Smart The Definitive Guide To The Countrys Emerging Business Hotspots

May 10, 2025

Invest Smart The Definitive Guide To The Countrys Emerging Business Hotspots

May 10, 2025