Should You Buy XRP (Ripple) Now While It's Under $3?

Table of Contents

Current Market Conditions and XRP's Price

The cryptocurrency market is notoriously volatile. Understanding the current market climate and XRP's position within it is crucial before considering an XRP investment. Factors influencing XRP's price include overall market sentiment (fear and greed index), regulatory changes globally, and technological advancements within the broader crypto space and specifically within Ripple's ecosystem.

- Recent Price Movements: XRP's price has shown significant fluctuations in recent months, influenced by news related to the Ripple lawsuit and broader market trends. Analyzing these movements, comparing them to historical highs and lows, provides valuable context.

- Market Capitalization and Ranking: XRP's market capitalization and its ranking among other cryptocurrencies reflect its current standing in the crypto landscape. Tracking this metric allows investors to gauge its relative strength and potential for growth compared to its competitors.

- Current XRP Price: While the current price of XRP sits below $3, it's vital to remember that cryptocurrency prices can shift rapidly. Monitoring real-time data and staying informed about market trends is essential for any investor.

The Ongoing Ripple vs. SEC Lawsuit and Its Impact

The legal battle between Ripple and the Securities and Exchange Commission (SEC) casts a long shadow over XRP's future. The SEC alleges that XRP is an unregistered security, a claim Ripple vehemently denies. The outcome of this lawsuit will significantly impact XRP's price and investor sentiment.

- Key Arguments: Understanding the core arguments presented by both sides—the SEC's case for XRP being a security and Ripple's defense—is essential for assessing the potential outcomes.

- Potential Outcomes: A favorable ruling for Ripple could lead to a significant price surge, while an unfavorable ruling could result in substantial losses for XRP investors. Considering both scenarios is crucial for risk assessment.

- Impact on Investor Confidence: The uncertainty surrounding the lawsuit naturally affects investor confidence and trading volume. Analyzing trading patterns and investor sentiment during periods of legal developments can provide insights into potential market reactions.

Ripple's Technology and Future Prospects

Ripple's technology and its potential for growth are key factors to consider. RippleNet, Ripple's payment solution, facilitates faster and cheaper cross-border transactions, targeting a multi-trillion dollar market. The potential for wider adoption of XRP within this system is significant.

- RippleNet Adoption: The increasing number of financial institutions adopting RippleNet demonstrates the growing acceptance of Ripple's technology within the traditional financial sector. Analyzing the partnerships and their impact on transaction volume highlights the growth potential.

- XRP Utility: XRP's utility within the RippleNet ecosystem is crucial. Understanding its role in facilitating transactions and its potential for broader applications helps in assessing its long-term value proposition.

- Global Payment System: The potential for XRP to become a significant player in the global payment system is a key driver of its potential. Examining the market share of existing payment systems and Ripple's ability to disrupt them is vital for long-term projections.

Potential Risks and Rewards of Investing in XRP

Investing in XRP, like any cryptocurrency, carries inherent risks. High volatility is a defining characteristic of the cryptocurrency market, meaning significant price swings can occur in short periods.

- Diversification: Diversifying your investment portfolio is crucial to mitigate risks. Don't put all your eggs in one basket, especially in a volatile asset class like cryptocurrencies.

- Regulatory Uncertainty: Regulatory uncertainty remains a significant risk factor. Changes in regulatory frameworks can have a major impact on the price and legality of cryptocurrencies.

- Thorough Research: Before investing in XRP, conduct thorough research. Understand the technology, the market dynamics, and the risks involved.

Comparing XRP to Other Cryptocurrencies

Comparing XRP to other leading cryptocurrencies like Bitcoin and Ethereum provides context for its potential. Consider factors like market capitalization, price volatility, technological differences, and use cases.

- Advantages and Disadvantages: Identify XRP's advantages and disadvantages compared to its competitors. This comparative analysis helps determine its unique selling points and potential weaknesses.

- Investor Choice: Understanding what factors drive investors' choices between different cryptocurrencies can provide insights into the market dynamics and XRP's competitive landscape.

- Unique Investment Opportunity: Assess whether XRP offers a unique investment opportunity based on its technology, use cases, and potential for future growth.

Conclusion

The decision of whether or not to buy XRP while it's under $3 is a personal one, dependent on your risk tolerance and investment goals. The ongoing Ripple lawsuit, market conditions, and Ripple's long-term vision are all crucial factors to consider. While the potential for significant returns exists, the inherent risks, including the volatility of the cryptocurrency market and the uncertainty surrounding the lawsuit, cannot be ignored. Do your own research before making any decisions about buying XRP. Remember, only invest what you can afford to lose.

Featured Posts

-

What Is Xrp And How Does It Work

May 01, 2025

What Is Xrp And How Does It Work

May 01, 2025 -

Six Nations Rugby France Claims Victory Englands Strong Showing Scotland And Ireland Struggle

May 01, 2025

Six Nations Rugby France Claims Victory Englands Strong Showing Scotland And Ireland Struggle

May 01, 2025 -

Ramaphosas Decision A Commission For Apartheid Era Atrocities

May 01, 2025

Ramaphosas Decision A Commission For Apartheid Era Atrocities

May 01, 2025 -

France Crushes Italy A Warning Shot For Ireland In Six Nations

May 01, 2025

France Crushes Italy A Warning Shot For Ireland In Six Nations

May 01, 2025 -

Christopher Stevens Reviews Michael Sheens Debt Charity Project

May 01, 2025

Christopher Stevens Reviews Michael Sheens Debt Charity Project

May 01, 2025

Latest Posts

-

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025 -

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025 -

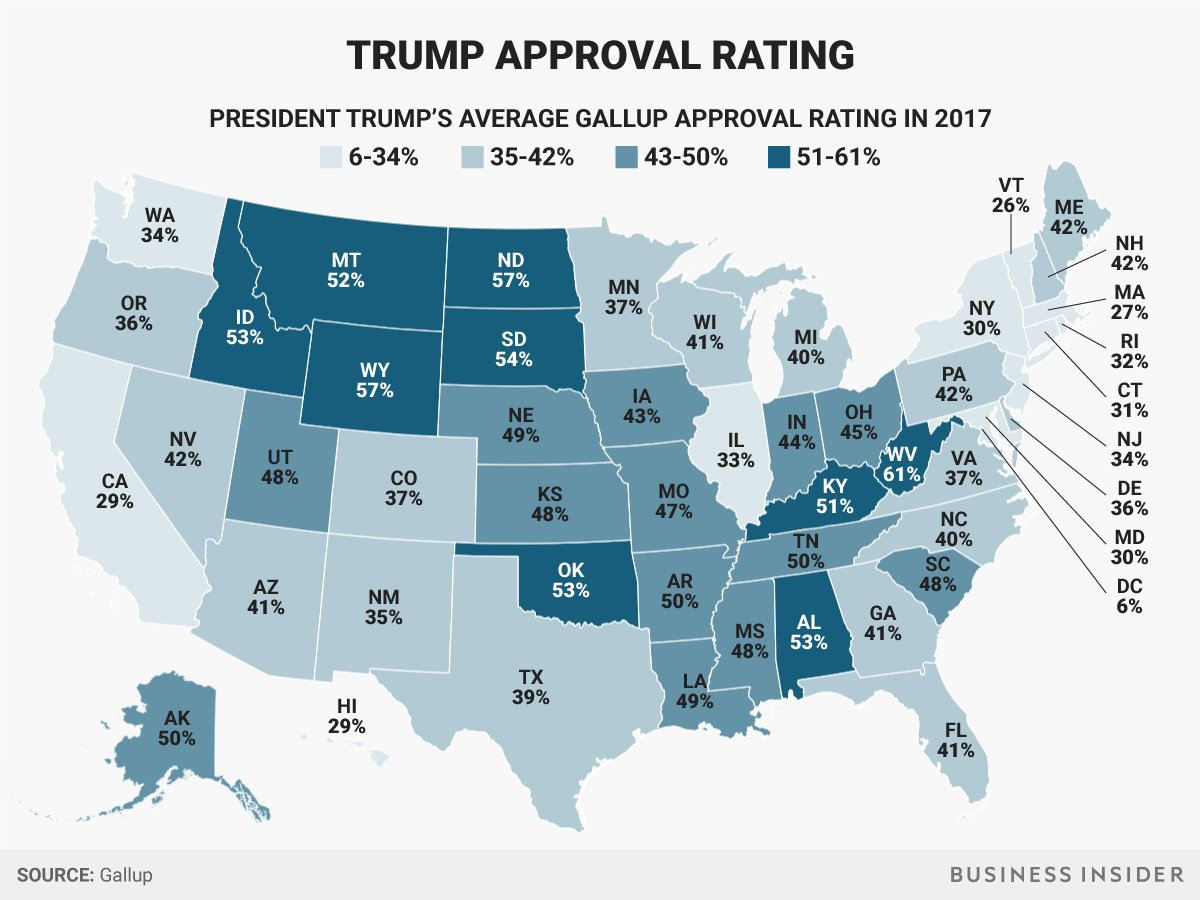

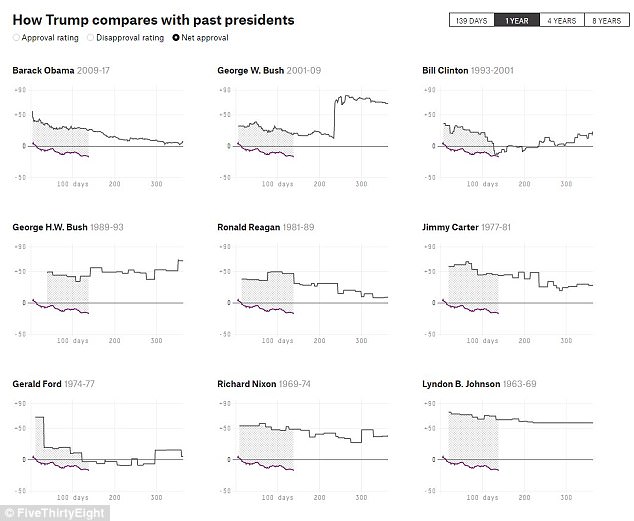

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025 -

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025 -

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025