Should You Buy XRP After Its Recent 400% Rally?

Table of Contents

Understanding the Recent XRP Price Surge

The 400% increase in XRP's price wasn't a spontaneous event; several factors contributed to this remarkable rally. Positive developments in Ripple's ongoing legal battle with the SEC played a significant role, boosting investor confidence. Increased trading volume, fueled by speculation and broader positive market trends in the cryptocurrency space, also contributed to the price surge.

Ripple's Ongoing Legal Battle

The SEC lawsuit against Ripple Labs significantly impacted XRP's price and future prospects. The outcome of this legal battle remains uncertain, creating both risk and potential reward for investors.

- Current Status: The case is ongoing, with various court filings and arguments presented by both sides. Recent developments have been somewhat favorable to Ripple, contributing to the price surge.

- Potential Outcomes: A favorable ruling could significantly boost XRP's price, while an unfavorable outcome could lead to a substantial drop. The uncertainty surrounding the outcome is a major risk factor for potential investors.

- Effects on XRP's Value: The ongoing legal uncertainty has created significant volatility in XRP's price. Any news related to the case can trigger substantial price swings. This volatility needs careful consideration before investing. Keywords: Ripple lawsuit, SEC vs Ripple, XRP legal battle, XRP price volatility.

Market Sentiment and Speculation

Market sentiment and speculation played a crucial role in driving the XRP price increase. Positive news coverage, social media hype, and bullish predictions from some crypto analysts all contributed to the increased demand and price appreciation.

- Social Media Influence: Social media platforms like Twitter and Telegram became hubs for discussions and speculation about XRP, influencing trading decisions and market sentiment.

- News Articles and Expert Opinions: Positive news articles and optimistic forecasts from crypto analysts further fueled the rally, attracting new investors to the market.

- Broader Market Trends: A generally positive trend in the broader cryptocurrency market also contributed to the increase in XRP's price. Keywords: XRP market sentiment, XRP speculation, cryptocurrency market, social media influence on XRP.

Analyzing XRP's Fundamentals

While price movements are driven by market forces, understanding XRP's underlying technology and use cases is crucial for long-term investment decisions.

XRP's Use Cases and Technology

XRP is designed for fast, efficient, and low-cost cross-border payments. Its underlying technology, leveraging RippleNet, offers unique advantages compared to traditional banking systems.

- RippleNet: This network allows financial institutions to send payments globally using XRP, significantly reducing transaction times and costs.

- On-Demand Liquidity (ODL): ODL enables near-instantaneous cross-border payments by leveraging XRP to reduce reliance on pre-funded accounts. This functionality provides a significant advantage in international transactions.

- Speed and Efficiency: XRP transactions are significantly faster and more efficient than traditional banking systems, making it attractive for various financial applications. Keywords: XRP technology, RippleNet, cross-border payments, on-demand liquidity, XRP transaction speed.

Competition in the Crypto Market

XRP faces competition from other cryptocurrencies in the cross-border payment space, including Stellar Lumens (XLM). It's essential to consider XRP's strengths and weaknesses relative to these competitors when making investment decisions.

- XRP vs. Stellar Lumens (XLM): Both XRP and XLM are designed for cross-border payments; however, they differ in their underlying technology, market capitalization, and adoption rates.

- Strengths of XRP: Its established network, partnerships with financial institutions, and relatively high liquidity are significant strengths.

- Weaknesses of XRP: The ongoing legal battle and the dominance of other larger cryptocurrencies like Bitcoin and Ethereum represent potential challenges. Keywords: XRP competitors, Stellar Lumens, cryptocurrency comparison, XRP market capitalization.

Assessing the Risks of Investing in XRP

Investing in XRP, or any cryptocurrency, carries inherent risks that must be carefully considered.

Volatility and Price Fluctuations

XRP's price is extremely volatile. Past price swings demonstrate the potential for substantial gains and losses. Investing only what you can afford to lose is crucial.

- Examples of Past Price Swings: XRP has experienced periods of significant price increases and decreases, highlighting the unpredictable nature of the cryptocurrency market.

- Potential for Future Losses: The potential for significant price drops remains high due to the ongoing legal uncertainty and the volatile nature of the cryptocurrency market. Keywords: XRP volatility, cryptocurrency risk, investment risk, XRP price prediction.

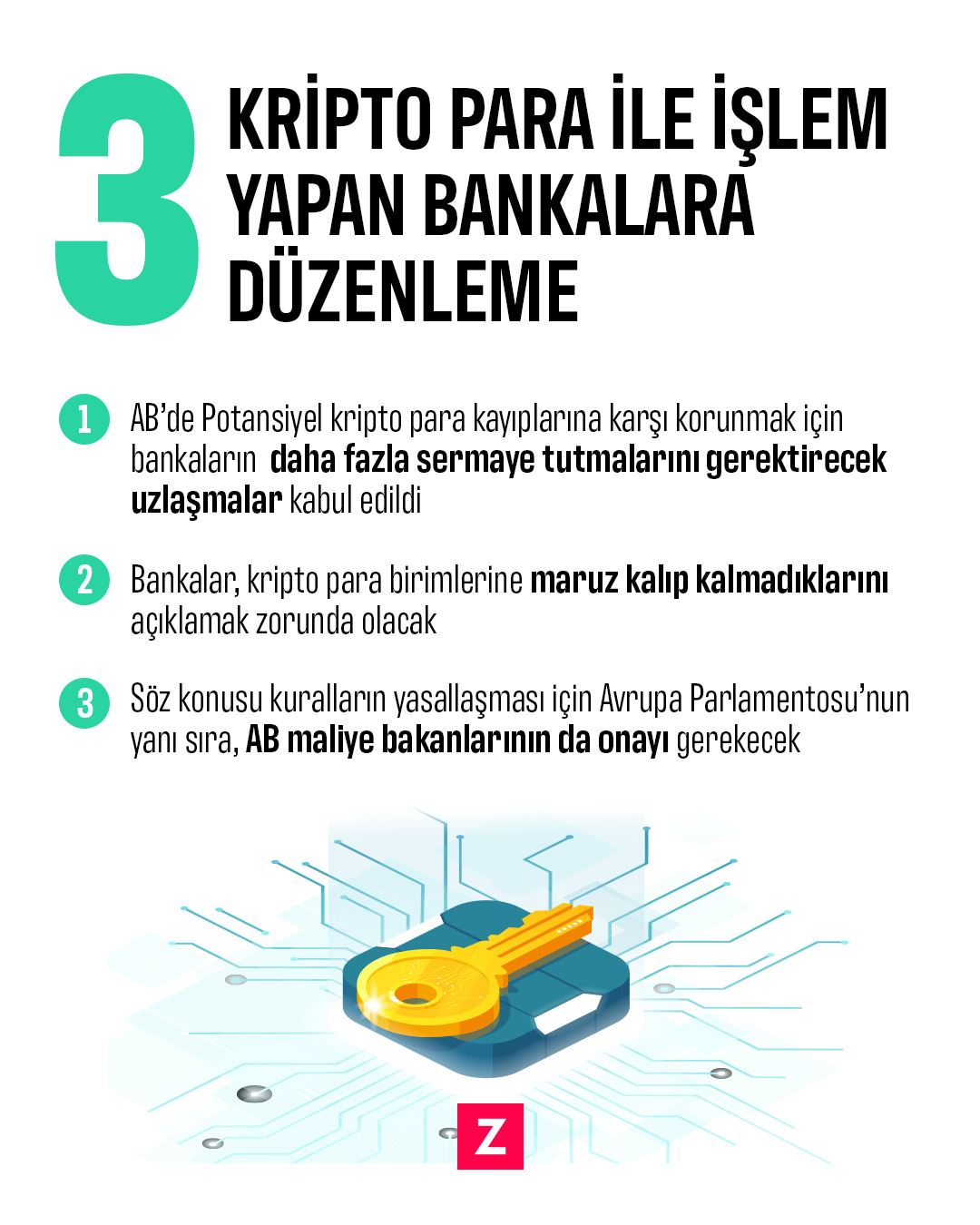

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains unclear. Future regulations could significantly impact XRP's price and usability.

- Ongoing Regulatory Landscape: Governments worldwide are still developing regulations for cryptocurrencies, creating uncertainty for investors.

- Potential Implications: Stricter regulations could limit XRP's adoption and negatively impact its price. Conversely, favorable regulations could lead to increased adoption and price appreciation. Keywords: XRP regulation, cryptocurrency regulation, regulatory uncertainty.

Conclusion

The decision of whether or not to buy XRP after its recent 400% rally involves carefully weighing potential rewards against significant risks. The ongoing Ripple lawsuit, market sentiment, and inherent cryptocurrency volatility all play crucial roles. While XRP’s technology and use cases offer potential advantages, the uncertainty surrounding the legal battle and regulatory environment cannot be ignored. Remember to conduct thorough research and understand the risks involved before investing in XRP. Ultimately, the decision of whether or not to buy XRP is a personal one. Weigh the potential rewards against the significant risks before investing in XRP.

Featured Posts

-

Ps Zh Aston Villa Istoriya Protistoyan U Yevrokubkakh

May 08, 2025

Ps Zh Aston Villa Istoriya Protistoyan U Yevrokubkakh

May 08, 2025 -

Brezilya Da Bitcoin Oedemeleri Yasal Mi Maaslar Icin Yeni Kurallar

May 08, 2025

Brezilya Da Bitcoin Oedemeleri Yasal Mi Maaslar Icin Yeni Kurallar

May 08, 2025 -

Nba Stars Kuzma And Tatum Instagram Post Sparks Online Discussion

May 08, 2025

Nba Stars Kuzma And Tatum Instagram Post Sparks Online Discussion

May 08, 2025 -

Kripto Para Piyasasinda Kripto Lider In Yuekselisi Neden Bu Kadar Popueler

May 08, 2025

Kripto Para Piyasasinda Kripto Lider In Yuekselisi Neden Bu Kadar Popueler

May 08, 2025 -

Andor Season 2 Redefining Star Wars A Rogue One Actors Perspective

May 08, 2025

Andor Season 2 Redefining Star Wars A Rogue One Actors Perspective

May 08, 2025