Should You Buy Palantir Stock Before May 5th? Wall Street's Surprising Consensus

Table of Contents

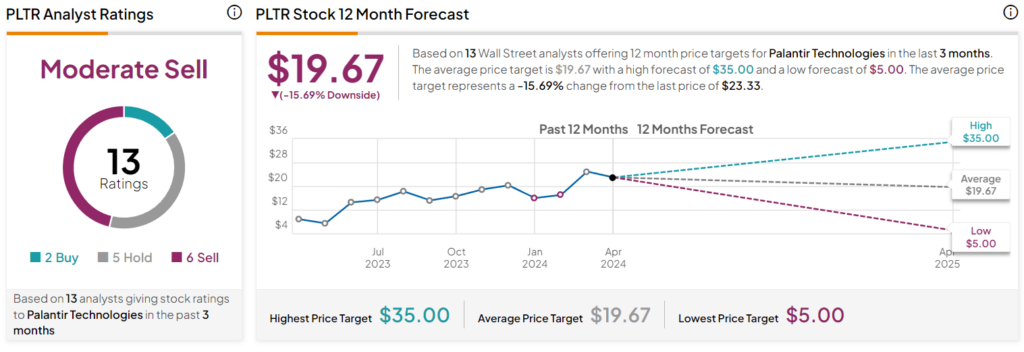

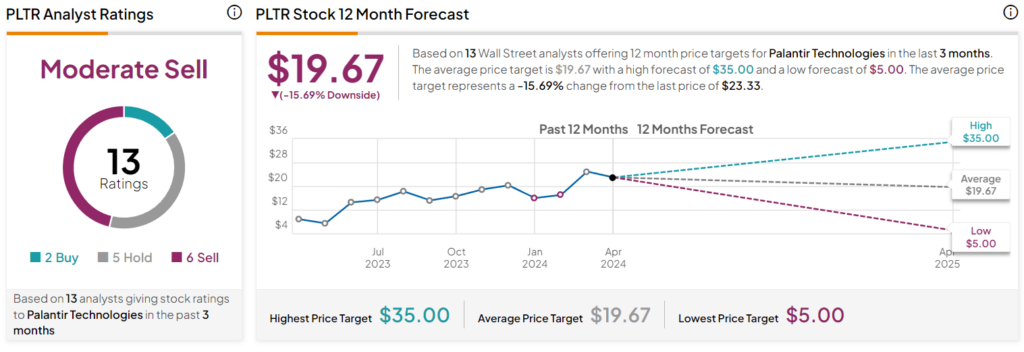

Wall Street's Current Sentiment Towards Palantir

The current sentiment towards Palantir stock is mixed, a blend of cautious optimism and lingering skepticism. While some analysts maintain a bullish outlook, citing the company's potential for long-term growth, others express concerns about profitability and valuation. Analyzing recent reports from key players like Morgan Stanley, Goldman Sachs, and others paints a complex picture.

- Analyst Ratings: While some analysts have issued "buy" ratings with ambitious price targets, others have maintained "hold" or even "sell" ratings, reflecting a divergence in opinions on Palantir's future performance.

- Price Targets: The range of price targets set by analysts highlights the uncertainty. Some predict significant upside potential, while others foresee a more modest increase or even a decline. Understanding the reasoning behind these varying targets is crucial for informed decision-making.

- Upgrades and Downgrades: Recent upgrades and downgrades provide valuable insights into shifting market sentiment. Monitoring these changes can help gauge the evolving consensus regarding Palantir stock.

Analyzing Palantir's Recent Performance and Financials

Palantir's recent financial performance has been a focal point of discussion among investors. While the company demonstrates consistent revenue growth fueled by its government and commercial contracts, profitability remains a key concern. High operating expenses and substantial investments in research and development continue to impact the bottom line.

- Quarterly Earnings Reports: A close examination of Palantir's recent quarterly earnings reports reveals a mixed bag. While revenue growth is positive, profitability lags behind expectations. Analyzing key metrics like gross margin and operating income is vital to understanding the company's financial health.

- Key Performance Indicators (KPIs): Monitoring KPIs such as customer acquisition cost, customer churn rate, and average revenue per user (ARPU) provides further insights into the company’s operational efficiency and growth trajectory.

- Upcoming Product Launches and Strategic Initiatives: Palantir's future hinges on its ability to innovate and expand its product offerings. Upcoming launches and strategic partnerships could significantly impact its financial performance and stock price.

Factors Influencing the May 5th Decision Point

Several factors could significantly impact Palantir's stock price around May 5th. The release of quarterly earnings reports, any major announcements regarding new contracts, or significant industry events could trigger substantial market reactions. It is vital to consider the broader macroeconomic landscape as well.

- Potential Catalysts: Potential catalysts for stock price movement include better-than-expected earnings, successful product launches, strategic partnerships, and positive regulatory developments.

- Potential Risks and Opportunities: Risks include slower-than-expected revenue growth, increased competition, and challenges in achieving profitability. Opportunities exist in expanding into new markets and developing innovative solutions.

- Overall Market Outlook: Interest rate hikes, inflation, and geopolitical instability can all impact investor sentiment and influence the performance of Palantir stock. Understanding the prevailing market conditions is essential.

Alternative Investment Strategies (Beyond a May 5th Decision)

A May 5th decision shouldn't be the sole focus. Palantir's long-term potential warrants consideration. Investors should also explore strategies to mitigate risk.

- Long-Term Investment Strategies: A long-term buy-and-hold strategy, coupled with dollar-cost averaging, might be appropriate for investors with a higher risk tolerance and a long-term outlook.

- Risk Management Techniques: Diversification, stop-loss orders, and hedging strategies can help manage the inherent risks associated with investing in Palantir stock.

- Other Investment Opportunities: Options trading, for instance, can offer opportunities to profit from price fluctuations, but it involves higher risk.

Conclusion: Should You Invest in Palantir Stock Before May 5th? The Verdict

The decision of whether to buy Palantir stock before May 5th is complex. While Wall Street shows mixed sentiment, the company's revenue growth is promising, but profitability remains a concern. Upcoming events could significantly influence the stock price, and the broader market conditions add another layer of complexity. Therefore, a nuanced approach is crucial. Consider your own risk tolerance and investment goals before making any decisions. Make an informed decision about Palantir stock by carefully weighing the potential risks and rewards. Analyze Palantir’s prospects before May 5th, and remember that further research into Palantir stock is crucial before investing.

Featured Posts

-

Scaling Tech Innovation Edmonton Unlimiteds Strategic Approach

May 09, 2025

Scaling Tech Innovation Edmonton Unlimiteds Strategic Approach

May 09, 2025 -

14 Edmonton Area School Projects Fast Tracked Ministers Announcement

May 09, 2025

14 Edmonton Area School Projects Fast Tracked Ministers Announcement

May 09, 2025 -

Snls Impression Of Harry Styles His Reaction And Why It Matters

May 09, 2025

Snls Impression Of Harry Styles His Reaction And Why It Matters

May 09, 2025 -

Madhyamik 2025 Result How To Check Merit List And Marks

May 09, 2025

Madhyamik 2025 Result How To Check Merit List And Marks

May 09, 2025 -

Kjoreforhold I Sor Norge Sjekk Vaermeldingen For Du Reiser Til Fjellet

May 09, 2025

Kjoreforhold I Sor Norge Sjekk Vaermeldingen For Du Reiser Til Fjellet

May 09, 2025