Should You Buy Palantir Stock? A Pre-May 5th Analysis.

Table of Contents

Palantir's Recent Performance and Financial Health

Revenue Growth and Profitability

Analyzing Palantir's recent quarterly earnings reports reveals a mixed bag. While revenue growth has been impressive, showing consistent year-over-year increases, profitability remains a key focus for the company. Let's examine some key figures:

- Q4 2022 Revenue: [Insert actual Q4 2022 revenue figure]. This represents a [percentage]% increase compared to Q4 2021. While showing growth, it's crucial to analyze this figure within the context of the overall market performance and compared to competitors.

- Government vs. Commercial Revenue: Palantir's revenue is split between government contracts and commercial sales. The proportion of each revenue stream is vital in assessing the company's diversification and risk profile. [Insert data on the percentage split, if available]. A heavier reliance on government contracts could pose risks discussed later.

- Path to Profitability: Palantir has been emphasizing its commitment to profitability. Tracking their progress in reducing operating expenses and improving margins is crucial. [Mention any recent announcements regarding profitability targets or strategies]. A comparison to similar companies in the data analytics space is essential for benchmarking their performance.

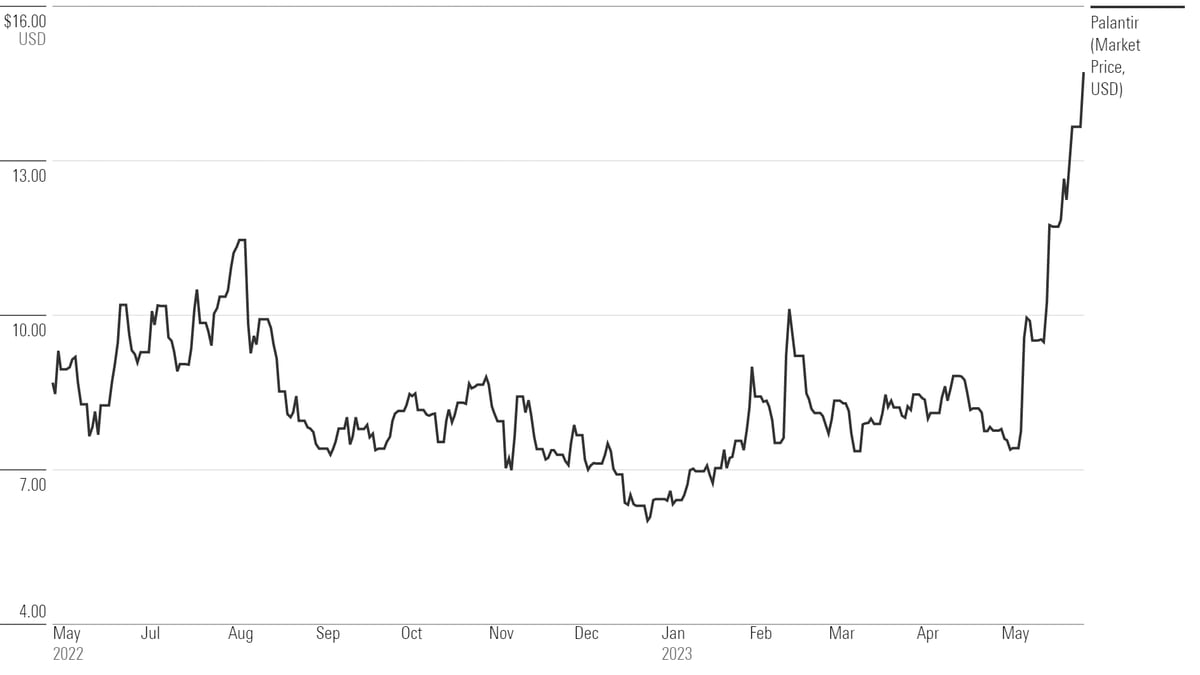

Stock Price Volatility and Market Sentiment

Palantir stock has historically exhibited significant volatility. Its price has fluctuated dramatically based on various factors, including earnings reports, news announcements, and overall market sentiment towards the tech sector.

- Recent News Impact: Any significant news events (e.g., new contract wins, product launches, regulatory changes) directly impact the stock price. [Discuss specific examples and their impact].

- Analyst Ratings and Price Targets: A range of analyst ratings and price targets reflects the diverse opinions surrounding Palantir's future performance. [Mention the average analyst rating and a range of price targets]. It's crucial to understand the reasoning behind these predictions.

- Investor Confidence: Investor sentiment towards Palantir stock can be gauged through trading volume, options activity, and social media sentiment. [If data is available, discuss the current investor sentiment].

Palantir's Future Growth Potential

Government Contracts and Expansion

Palantir's significant government contracts form a core part of its revenue stream. Securing and expanding these contracts is crucial for its continued growth.

- Key Government Agencies: Palantir works with various government agencies globally. Identifying key partnerships and their potential for renewal or expansion is essential. [Mention specific examples of agencies and the scope of their collaborations].

- International Expansion: Palantir's strategy to secure contracts internationally significantly broadens its market reach and reduces reliance on a single government's budget. [Discuss their progress in international markets].

- Competitive Landscape: The government contracting space is competitive. Analyzing Palantir's competitive advantages, like its advanced data analytics capabilities and strong security protocols, is vital in predicting future success.

Commercial Market Penetration

Palantir's expansion into the commercial market is vital for long-term growth and diversification.

- Commercial Partnerships: Highlighting successful partnerships and case studies in various commercial sectors (healthcare, finance, etc.) showcases Palantir's ability to adapt its technology to diverse industries. [Give concrete examples].

- Sales and Marketing Strategies: Analyzing Palantir's sales and marketing efforts to attract and retain commercial clients reveals their ability to penetrate these markets effectively. [Discuss any noteworthy initiatives].

- Commercial Market Competition: The commercial market is highly competitive. Understanding Palantir's competitive advantages and differentiating factors is vital. [Mention key competitors and their strengths and weaknesses].

Technological Innovation and Product Development

Continuous investment in R&D is crucial for Palantir's long-term competitiveness.

- New Products and Technologies: [Mention any new products or technologies in development or recently launched]. The potential impact of these innovations on revenue growth should be analyzed.

- Intellectual Property: A strong intellectual property portfolio protects Palantir's competitive advantage and provides a barrier to entry for new competitors.

- Disruptive Innovation: The potential for Palantir to develop disruptive technologies in the data analytics field is key to its long-term success.

Risks and Challenges Facing Palantir

Competition and Market Saturation

The data analytics and software market is fiercely competitive.

- Major Competitors: [List major competitors like Microsoft, AWS, Google, etc. and analyze their strengths and weaknesses compared to Palantir].

- Market Saturation: The potential for market saturation and the impact on Palantir's market share need careful consideration.

- New Entrants: The emergence of new players with innovative technologies poses a constant threat.

Dependence on Government Contracts

Palantir's heavy reliance on government contracts presents inherent risks.

- Government Spending: Changes in government spending policies directly impact Palantir's revenue.

- Geopolitical Risks: International political instability can disrupt government contracts and operations.

- Diversification Strategy: Palantir's efforts to diversify into the commercial market are crucial to mitigate this risk.

Valuation and Stock Price

Palantir's valuation relative to its peers and historical performance is a crucial factor for investors.

- Valuation Metrics: Analyzing key valuation metrics (P/E ratio, Price-to-Sales ratio, etc.) and comparing them to competitors provides insight into whether the stock is overvalued or undervalued.

- Future Stock Price: Factors impacting the future stock price include earnings growth, market sentiment, and overall economic conditions.

- Overvaluation Risk: Determining whether the current stock price reflects the company's future potential is crucial to avoid overvaluation risks.

Conclusion

This pre-May 5th analysis of Palantir stock reveals a company with significant growth potential, driven by its strong presence in the government sector and increasing penetration into the commercial market. However, investors should be aware of the risks associated with its dependence on government contracts and the competitive landscape. Ultimately, the decision of whether to buy Palantir stock depends on your individual risk tolerance and investment goals. Carefully weigh the potential rewards against the inherent risks before making any investment decisions regarding Palantir stock. Conduct your own thorough due diligence before investing in Palantir stock or any other stock. Remember that this is not financial advice, and investing in Palantir stock involves risk.

Featured Posts

-

Trump Appoints Jeanine Pirro As Top D C Prosecutor

May 10, 2025

Trump Appoints Jeanine Pirro As Top D C Prosecutor

May 10, 2025 -

Sharing Your Story How Trumps Executive Orders Affected Transgender Lives

May 10, 2025

Sharing Your Story How Trumps Executive Orders Affected Transgender Lives

May 10, 2025 -

Us Ipo Filing Omada Health And Its Andreessen Horowitz Investment

May 10, 2025

Us Ipo Filing Omada Health And Its Andreessen Horowitz Investment

May 10, 2025 -

International Transgender Day Of Visibility 3 Ways To Be A Better Ally

May 10, 2025

International Transgender Day Of Visibility 3 Ways To Be A Better Ally

May 10, 2025 -

Ukrainskie Bezhentsy I S Sh A Ugroza Novogo Krizisa Dlya Germanii

May 10, 2025

Ukrainskie Bezhentsy I S Sh A Ugroza Novogo Krizisa Dlya Germanii

May 10, 2025