Should Investors Buy Palantir Stock Before May 5th? A Wall Street Perspective

Table of Contents

Palantir's Recent Financial Performance and Market Position

Palantir's recent financial performance has been a mixed bag. While the company has demonstrated consistent revenue growth, profitability remains a key focus. Examining recent quarterly earnings reports reveals valuable insights into the company's financial health. Analyzing revenue growth compared to previous quarters and years is crucial for understanding the trajectory of Palantir's business. Profitability margins and trends, especially concerning operating income and net income, indicate the company's efficiency and ability to translate revenue into profit.

- Revenue growth: [Insert recent quarterly revenue growth percentage and compare it to previous periods. Mention any significant year-over-year changes].

- Profitability margins: [Include data on gross margin, operating margin, and net margin. Analyze trends and highlight any significant shifts].

- Market share: Palantir holds a significant market share in the government data analytics sector. However, competition is fierce, particularly from players like Snowflake and Databricks in the commercial sector. [Include data or estimates on market share if available].

- Competitor Analysis: Palantir faces stiff competition from established players and emerging startups in the big data and AI analytics space. Understanding the strengths and weaknesses of these competitors (e.g., Snowflake's cloud-based data warehouse, Databricks' unified analytics platform) is crucial for assessing Palantir's long-term prospects.

Analyzing Palantir's Future Growth Potential

Palantir's future growth hinges on several key factors. The company's long-term strategy centers around expanding its AI-powered data analytics solutions across both government and commercial sectors. The growing demand for sophisticated data analytics, fueled by the rise of artificial intelligence and machine learning, presents a significant opportunity for Palantir.

- Market expansion: Palantir is actively pursuing new markets, both geographically and sector-wise. Success in penetrating these new markets will be crucial for sustained growth. [Provide examples of new market initiatives if known].

- Technological innovation: Palantir's continued investment in research and development, particularly in AI and machine learning, is essential for maintaining its competitive edge. [Discuss any recent advancements or product launches].

- AI and machine learning: The integration of AI and machine learning capabilities into Palantir's platform is a key differentiator. This will be essential in driving future growth and attracting new clients. [Highlight Palantir's AI initiatives].

- Analyst projections: [Mention any relevant analyst projections for Palantir's future revenue and earnings growth, citing sources].

Evaluating the Risks Associated with Investing in Palantir Stock

Investing in Palantir stock carries inherent risks. Understanding these risks is crucial before making an investment decision.

- Competitive landscape: The big data and analytics market is highly competitive, with established players and emerging startups vying for market share. Palantir's ability to maintain its competitive advantage will be critical.

- Government contract dependence: A significant portion of Palantir's revenue comes from government contracts. Changes in government spending or procurement policies could significantly impact the company's financial performance.

- Regulatory hurdles: Operating in the data analytics space exposes Palantir to regulatory scrutiny related to data privacy, security, and compliance. Changes in regulations could negatively impact the company's operations.

- Economic sensitivity: Palantir's business is sensitive to economic downturns. During economic recessions, both government and commercial spending on data analytics may decrease, impacting revenue growth.

- Stock price volatility: Palantir's stock price has historically been volatile, reflecting the inherent risks associated with the company's business model and market position.

The May 5th Catalyst and its Potential Impact on Palantir Stock

The May 5th earnings report will be a key catalyst for Palantir stock. The market will closely scrutinize the company's financial performance, guidance for the upcoming quarter, and any strategic updates.

- Potential market reaction: A strong earnings report exceeding expectations could lead to a positive market reaction, pushing the Palantir stock price higher. Conversely, a disappointing report could cause a sell-off.

- Pre- and post-earnings analysis: Investors should analyze the stock's performance in the days leading up to the report to assess market sentiment. Post-earnings analysis will help determine the market's reaction to the actual results.

- Analyst ratings and price targets: Follow analyst ratings and price targets to gauge overall market sentiment towards Palantir. [Mention any prominent analyst opinions].

- Trading volume expectations: Expect increased trading volume around the earnings release date as investors react to the news.

Conclusion

Whether to buy Palantir stock before May 5th is a complex decision. While Palantir exhibits substantial growth potential in the rapidly expanding AI and data analytics market, considerable risks remain. The May 5th earnings report will play a significant role in shaping investor sentiment. Thoroughly assess the information presented here and conduct your own comprehensive due diligence before making any investment decisions related to Palantir stock. Remember to consult with a qualified financial advisor for personalized investment advice tailored to your risk tolerance and financial goals. Remember to always diversify your portfolio.

Featured Posts

-

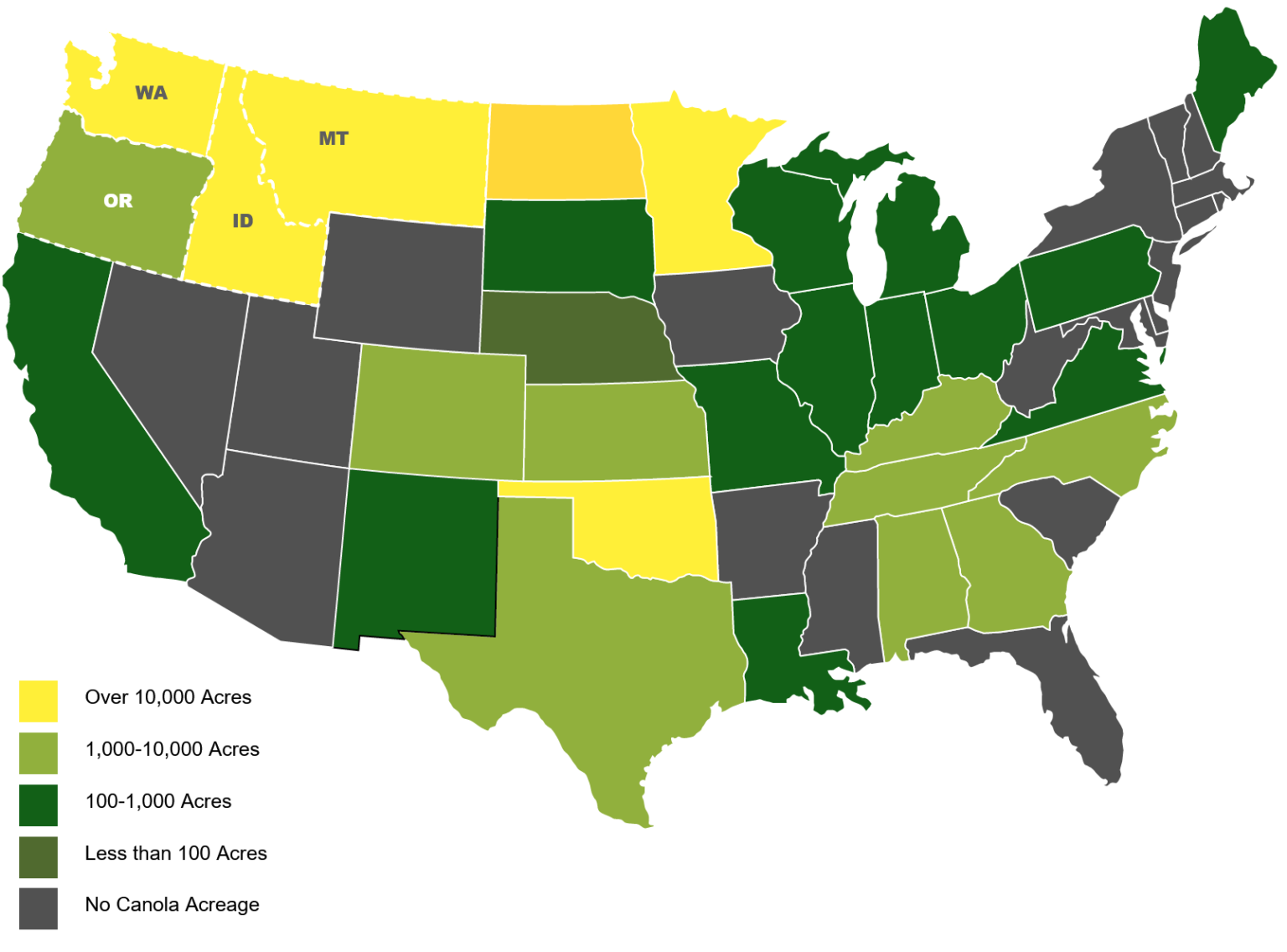

Chinas Canola Supply Chain Adapting To The Canada Fallout

May 09, 2025

Chinas Canola Supply Chain Adapting To The Canada Fallout

May 09, 2025 -

Oilers Vs Kings Prediction Game 1 Playoffs Best Bets And Picks

May 09, 2025

Oilers Vs Kings Prediction Game 1 Playoffs Best Bets And Picks

May 09, 2025 -

The Monkey 2025 Predicting A Potential Failure For A Stephen King Adaptation

May 09, 2025

The Monkey 2025 Predicting A Potential Failure For A Stephen King Adaptation

May 09, 2025 -

Police To Guard Mc Cann Family At Prayer Vigil After Stalker Threat

May 09, 2025

Police To Guard Mc Cann Family At Prayer Vigil After Stalker Threat

May 09, 2025 -

Elizabeth Line Accessibility Addressing Wheelchair Gaps For Passengers

May 09, 2025

Elizabeth Line Accessibility Addressing Wheelchair Gaps For Passengers

May 09, 2025

Latest Posts

-

Sharing Your Story The Impact Of Trumps Executive Orders On Transgender Lives

May 10, 2025

Sharing Your Story The Impact Of Trumps Executive Orders On Transgender Lives

May 10, 2025 -

How Trumps Executive Orders Affected The Transgender Community Personal Accounts

May 10, 2025

How Trumps Executive Orders Affected The Transgender Community Personal Accounts

May 10, 2025 -

Bangkok Post The Urgent Need For Transgender Rights Reform

May 10, 2025

Bangkok Post The Urgent Need For Transgender Rights Reform

May 10, 2025 -

Trump Executive Orders And Their Impact On Transgender Individuals Your Stories Matter

May 10, 2025

Trump Executive Orders And Their Impact On Transgender Individuals Your Stories Matter

May 10, 2025 -

Advocates Push For Transgender Equality Bangkok Post Reports

May 10, 2025

Advocates Push For Transgender Equality Bangkok Post Reports

May 10, 2025