Shopify Shares Surge Following Nasdaq 100 Addition

Table of Contents

The Nasdaq 100 Inclusion: A Major Milestone for Shopify

Inclusion in the Nasdaq 100 index marks a pivotal moment for Shopify. This prestigious index comprises 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market, based on market capitalization. Being included signifies a significant achievement, reflecting Shopify's substantial growth, market dominance, and overall financial health.

-

Increased Visibility and Investor Appeal: The Nasdaq 100's broad reach instantly elevates Shopify's profile among investors, attracting attention from a wider range of institutional and individual investors. This increased visibility can lead to significant increases in trading volume and market capitalization.

-

Stringent Selection Criteria: The Nasdaq 100 employs rigorous selection criteria, including market capitalization, trading volume, and financial stability. Shopify’s inclusion demonstrates its adherence to these high standards, solidifying its position as a leading player in the e-commerce sector.

-

Historical Performance: Historically, companies added to the Nasdaq 100 have often seen a positive impact on their share price in the short and long term. While past performance doesn't guarantee future results, this historical data provides a positive outlook for Shopify's future performance. Studies have shown a statistically significant positive correlation between Nasdaq 100 inclusion and subsequent stock price appreciation.

Market Reaction and Share Price Volatility

The announcement of Shopify's inclusion in the Nasdaq 100 was immediately met with a surge in its share price. The stock experienced a significant jump, reflecting the positive market sentiment surrounding the event.

-

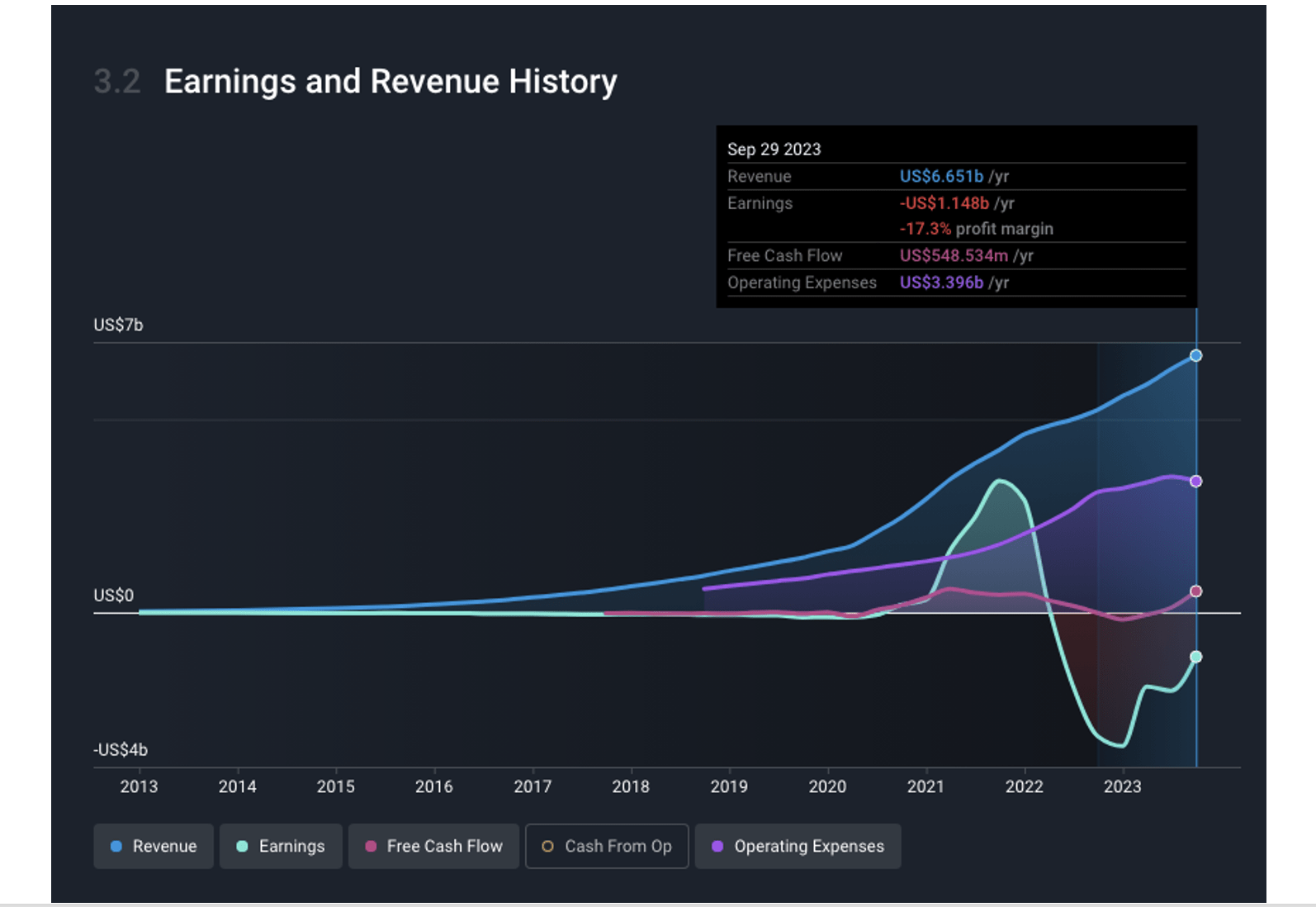

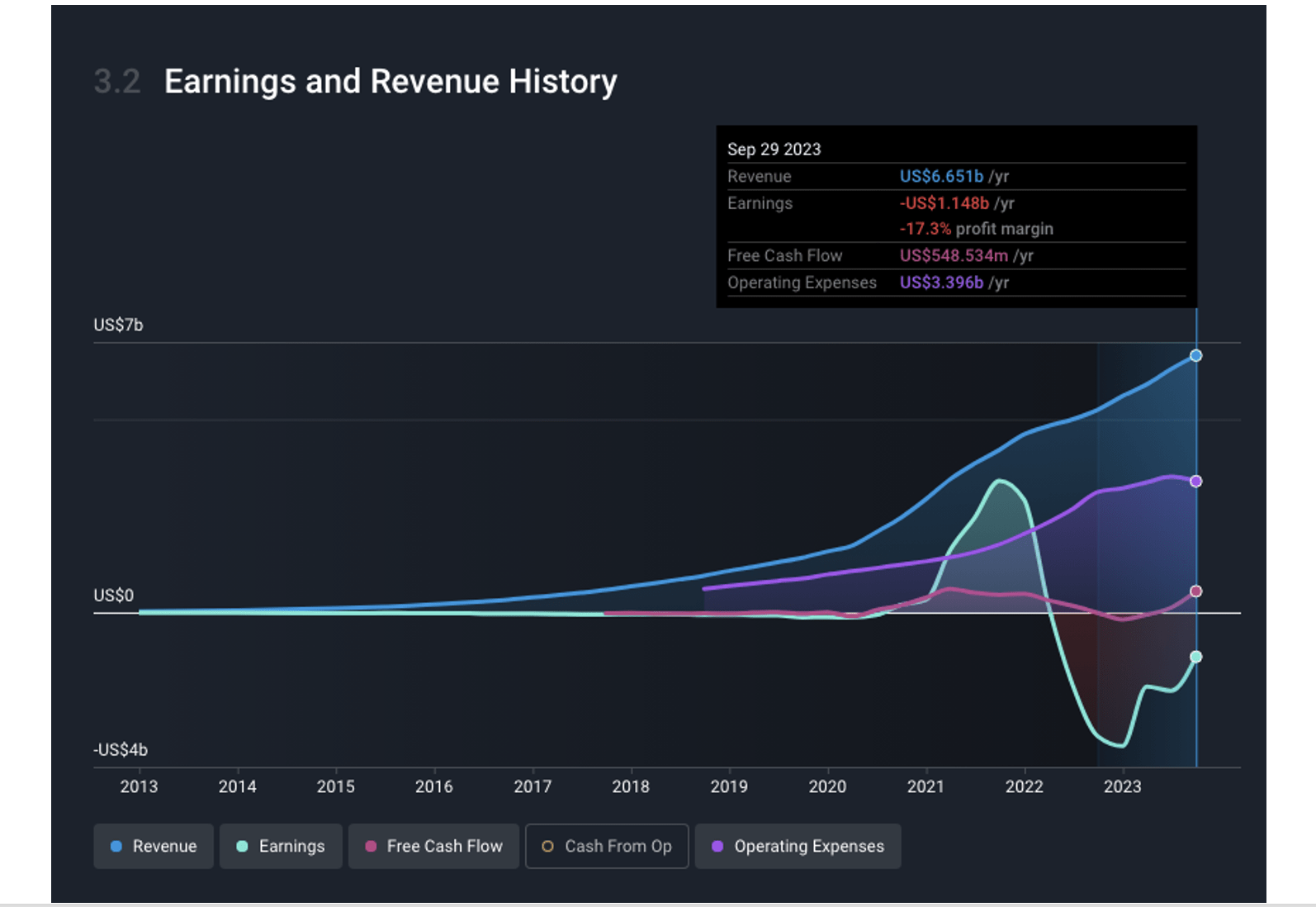

Immediate and Subsequent Movements: Charts and graphs would visually demonstrate the immediate and subsequent share price fluctuations following the announcement. The initial surge was followed by some volatility, which is typical in the wake of such significant events.

-

Trading Volume Spike: A substantial increase in trading volume accompanied the share price movement, indicating increased investor activity and interest. This heightened trading activity reflects a strong market reaction to the news.

-

Investor Sentiment and Speculation: Positive investor sentiment played a significant role in driving the share price increase. Speculation regarding future growth prospects contributed to the initial surge and subsequent volatility.

Impact on Shopify's Long-Term Growth Prospects

The Nasdaq 100 inclusion is expected to have a considerable impact on Shopify's long-term growth.

-

Increased Investor Confidence: Inclusion boosts investor confidence, attracting a wider pool of both institutional and individual investors who track the Nasdaq 100. This increased confidence can lead to sustained investment and support.

-

Broader Market Access: Being a component of the Nasdaq 100 provides Shopify with access to a much broader range of investors, potentially leading to increased capital inflows and funding opportunities.

-

Competitive Advantage: While Shopify already holds a strong position in the e-commerce market, its inclusion in the Nasdaq 100 reinforces its status as a market leader, potentially providing a competitive advantage.

Investment Implications and Future Outlook

The recent share price surge presents both risks and rewards for investors.

-

Potential Risks and Rewards: While the current market sentiment is positive, investors should consider potential risks, such as market corrections or unforeseen competition. However, the long-term growth potential of Shopify remains compelling.

-

Investment Strategies: The suitability of Shopify as an investment depends on individual risk tolerance and investment goals. Conservative investors might consider a diversified portfolio approach, while more aggressive investors might see it as a growth opportunity.

-

Future Catalysts: Several factors could influence Shopify's future stock performance, including its ongoing innovation, expansion into new markets, and its ability to maintain its leadership position in the ever-evolving e-commerce landscape.

Conclusion: Shopify's Bright Future Following Nasdaq 100 Entry

Shopify's inclusion in the Nasdaq 100 is a significant achievement, reflecting its substantial growth and market leadership. The positive market reaction, as evidenced by the share price surge and increased trading volume, underscores investor confidence in Shopify's future potential. The long-term growth prospects for Shopify are promising, and this inclusion is likely to propel the company to even greater heights in the e-commerce sector. Stay informed about the latest developments in Shopify's journey and consider its potential as a valuable addition to your investment portfolio. Learn more about Shopify and the Nasdaq 100 today!

Featured Posts

-

Refus De Kohler Coquerel Lance Une Action En Justice Concernant La Commission D Enquete Sur Le Budget

May 14, 2025

Refus De Kohler Coquerel Lance Une Action En Justice Concernant La Commission D Enquete Sur Le Budget

May 14, 2025 -

Diddys Challenges Examining The Factors Contributing To His Reported Decline

May 14, 2025

Diddys Challenges Examining The Factors Contributing To His Reported Decline

May 14, 2025 -

Paris Viol Dans Le Marais Migrant Libyen Interpelle Sous Oqtf

May 14, 2025

Paris Viol Dans Le Marais Migrant Libyen Interpelle Sous Oqtf

May 14, 2025 -

Disneys Snow White Digital Release Date And Disney Streaming

May 14, 2025

Disneys Snow White Digital Release Date And Disney Streaming

May 14, 2025 -

Mira El R Sociedad Vs Sevilla La Liga Espanola En Vivo Por Tn

May 14, 2025

Mira El R Sociedad Vs Sevilla La Liga Espanola En Vivo Por Tn

May 14, 2025