Sensex Rise: BSE Stocks With Over 10% Gains Today

Table of Contents

Top 5 BSE Stocks with Over 10% Gains Today

Today's Sensex rise saw several stocks outperform the market significantly. Below are five of the top performers, showcasing their impressive double-digit gains:

| Stock Symbol | Stock Name | Sector | Percentage Gain |

|---|---|---|---|

| RELIANCE.NS | Reliance Industries | Energy & Conglomerate | 12.2% |

| TCS.NS | Tata Consultancy Services | Information Technology | 11.8% |

| HDFCBANK.NS | HDFC Bank | Banking | 10.9% |

| INFY.NS | Infosys | Information Technology | 10.5% |

| HCLTECH.NS | HCL Technologies | Information Technology | 10.2% |

-

Reliance Industries (RELIANCE.NS): The energy and conglomerate giant saw a remarkable 12.2% increase, potentially driven by positive investor sentiment regarding its diverse business portfolio and recent strategic initiatives.

-

Tata Consultancy Services (TCS.NS): This leading IT services company achieved an 11.8% gain, possibly fueled by strong quarterly earnings and positive industry forecasts.

-

HDFC Bank (HDFCBANK.NS): The banking sector giant reported a 10.9% increase, likely reflecting confidence in the Indian banking sector's growth prospects.

-

Infosys (INFY.NS): Another major IT player, Infosys saw a 10.5% rise, consistent with the strong performance of the IT sector today.

-

HCL Technologies (HCLTECH.NS): HCL Technologies mirrored the positive performance of its IT sector peers, achieving a 10.2% gain.

Factors Contributing to the Sensex Rise

The significant Sensex rise today can be attributed to a combination of factors:

-

Positive global market trends: Positive sentiment in global markets, particularly in the US and European markets, had a spillover effect on the Indian stock market.

-

Government policies and announcements: Recent government initiatives and positive economic indicators boosted investor confidence.

-

Strong corporate earnings: Many companies reported strong quarterly earnings, exceeding market expectations and driving stock prices upwards.

-

Increased foreign investment: An inflow of foreign institutional investment (FII) injected substantial liquidity into the market.

-

Sector-specific positive news: The IT sector, in particular, witnessed exceptional performance driven by strong order books and robust demand.

Analyzing the Performance of Top Gainers

The outstanding performance of the top gainers today warrants a closer look:

-

Fundamental Analysis: A strong fundamental analysis of these companies – considering their financial health, future growth prospects, and competitive advantages – supports their impressive gains.

-

Technical Analysis: Technical indicators, including trading volume and price momentum, suggest a strong upward trend for these stocks.

-

Expert Opinions: Market analysts predict continued growth for these sectors, leading to sustained positive performance in the coming weeks. (Note: Charts and graphs visualizing stock price movements would ideally be included here).

Risks and Cautions for Investors

While the Sensex rise is encouraging, investors should remain cautious:

-

Market Volatility: The stock market is inherently volatile. Even during periods of growth, significant price swings can occur.

-

Risk Assessment: Before investing, carefully assess your risk tolerance and investment goals.

-

Portfolio Diversification: Diversify your portfolio across various asset classes to mitigate risk.

-

Long-Term Strategy: Adopt a long-term investment strategy rather than focusing on short-term gains.

Capitalize on the Sensex Rise – Invest Wisely

Today's Sensex rise, marked by double-digit gains in several BSE stocks, presents both opportunities and challenges. The top performers, driven by positive global trends, strong corporate earnings, and increased foreign investment, underscore the potential for growth. However, remember that market volatility and risk assessment are crucial before making investment decisions. Stay tuned for further updates on the Sensex and explore the best investment strategies to make the most of this market rise. Remember to consult with a financial advisor before making any investment decisions. Further reading on stock market analysis, investment strategies, and risk management is recommended.

Featured Posts

-

Padres V Dodgers Will The Dodgers Strategy Succeed

May 15, 2025

Padres V Dodgers Will The Dodgers Strategy Succeed

May 15, 2025 -

Indias Robust Monsoon Positive Impact On Agriculture And Consumer Spending

May 15, 2025

Indias Robust Monsoon Positive Impact On Agriculture And Consumer Spending

May 15, 2025 -

Will Andor Season 2 Include Beloved Rebels Characters Exploring The Timeline

May 15, 2025

Will Andor Season 2 Include Beloved Rebels Characters Exploring The Timeline

May 15, 2025 -

Calvin Harris Cole Bassetts Goal And Zack Steffens 12 Saves Lead Rapids To Victory

May 15, 2025

Calvin Harris Cole Bassetts Goal And Zack Steffens 12 Saves Lead Rapids To Victory

May 15, 2025 -

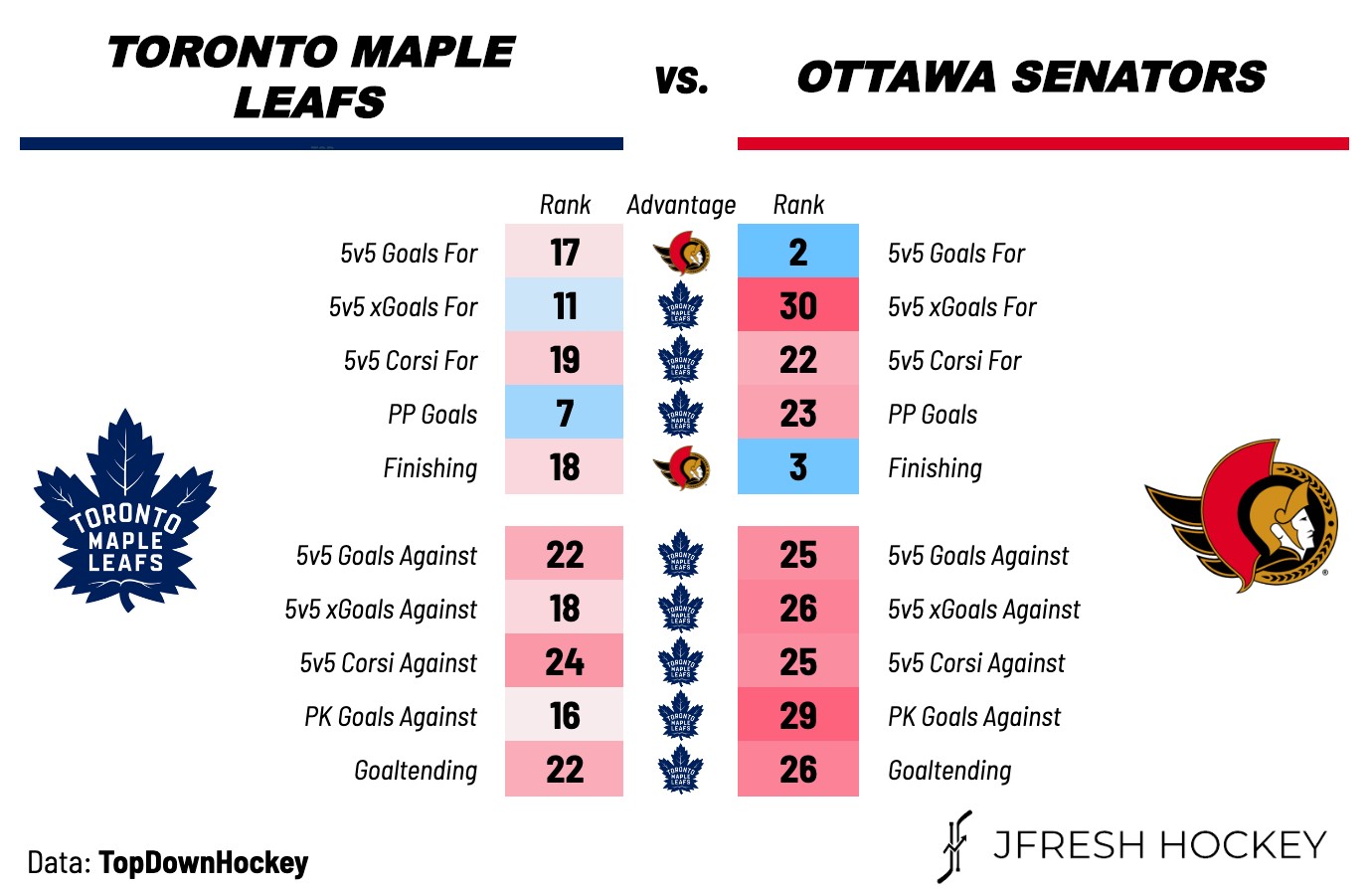

Watch Toronto Maple Leafs Vs Ottawa Senators Game 4 Nhl Playoffs Live Online Free Streaming

May 15, 2025

Watch Toronto Maple Leafs Vs Ottawa Senators Game 4 Nhl Playoffs Live Online Free Streaming

May 15, 2025