Sensex LIVE: Market Soars, Nifty Reclaims 23,800 - Sector-wise Gains

Table of Contents

Sensex and Nifty Performance: A Detailed Look

The Indian market indices experienced a robust rally today. The Sensex opened at 63,200, reaching an intraday high of 63,550 before closing at 63,400, a significant gain of 250 points (0.4%). The Nifty 50 mirrored this positive trend, opening at 23,750, hitting a high of 23,850, and finally closing at 23,800 – a remarkable achievement after breaching key resistance levels. Trading volume was significantly higher than the previous day, indicating increased investor participation. This strong performance demonstrates the resilience of the Indian stock market and its potential for further growth.

- Sensex Opening: 63,200

- Sensex High: 63,550

- Sensex Closing: 63,400

- Sensex Percentage Change: +0.4%

- Nifty 50 Opening: 23,750

- Nifty 50 High: 23,850

- Nifty 50 Closing: 23,800

- Nifty 50 Percentage Change: +0.2%

- Trading Volume: Significantly higher than the previous day.

Sector-wise Gains: Identifying Top Performers

Several sectors contributed significantly to today's market rally. Let's examine the top performers:

Banking and Finance Sector's Robust Performance

The banking and finance sector emerged as a key driver of the market's upward trajectory. Leading public sector banks (PSU banks) and private sector banks witnessed substantial gains. Positive economic indicators, including robust credit growth and improving asset quality, boosted investor confidence. Moreover, recent policy changes related to lending and financial regulations further contributed to the sector's strength. Specific examples include HDFC Bank, ICICI Bank, and SBI, all showing significant percentage increases.

- Top Performers: HDFC Bank, ICICI Bank, SBI, and several NBFCs.

- Reasons for Growth: Positive economic indicators, robust credit growth, and favorable policy changes.

- Keywords: banking stocks, financial services, NBFCs, PSU banks, private sector banks.

IT Sector's Steady Growth

The IT sector displayed consistent growth, driven by sustained global demand for software services and significant project wins. Major IT companies reported strong performances, reflecting the sector's resilience and potential for future expansion. The increasing adoption of technology across various sectors further bolstered the sector's positive outlook.

- Top Performers: TCS, Infosys, HCL Technologies, and Wipro saw considerable gains.

- Reasons for Growth: Global demand for IT services and large project wins.

- Keywords: IT stocks, software stocks, tech stocks, information technology.

Other Notable Gainers

Beyond banking and IT, the auto and FMCG sectors also showcased impressive performance, contributing to the overall market rally. Positive consumer sentiment and increased demand fueled growth in these sectors. The energy sector also saw gains, driven by positive global oil prices.

- Sectors: Auto, FMCG, and Energy.

- Reasons for Growth: Positive consumer sentiment, increased demand, and favorable global commodity prices.

Factors Influencing Market Movement

Several factors contributed to today's positive market sentiment. Positive global market trends played a significant role, with major international indices also registering gains. Furthermore, recent economic news, including positive inflation data and strong industrial output figures, boosted investor confidence. The absence of significant geopolitical risks also contributed to a stable market environment. The recent RBI policy announcements also had a positive impact on market sentiment.

- Global Market Trends: Positive performance of major international indices.

- Economic News: Positive inflation data and strong industrial output.

- Geopolitical Factors: Absence of significant global uncertainties.

- RBI Policy: Positive market reaction to the central bank's announcements.

- Keywords: global markets, economic indicators, market sentiment, RBI policy, geopolitical risks.

Sensex LIVE: Takeaways and Future Outlook

Today's Sensex LIVE update showcased a robust market rally, with the Sensex and Nifty recording substantial gains. The banking, IT, auto, and FMCG sectors were key drivers of this positive performance. Factors such as positive global trends, strong economic indicators, and stable geopolitical conditions contributed to the increased investor confidence. While the outlook remains positive, investors should remain aware of potential risks and volatility in the market.

To stay updated on the latest Sensex LIVE updates, Nifty 50 outlook, and in-depth stock market analysis, visit our website regularly or subscribe to our daily market report for comprehensive insights. Stay informed with our daily Sensex updates and make informed investment decisions.

Featured Posts

-

Wynne Evans And The Go Compare Advert The Impact Of The Strictly Controversy

May 10, 2025

Wynne Evans And The Go Compare Advert The Impact Of The Strictly Controversy

May 10, 2025 -

El Bolso Hereu De Dakota Johnson Minimalismo Y Estilo

May 10, 2025

El Bolso Hereu De Dakota Johnson Minimalismo Y Estilo

May 10, 2025 -

Elizabeth Hurley Baring All Her Most Daring Cleavage Moments

May 10, 2025

Elizabeth Hurley Baring All Her Most Daring Cleavage Moments

May 10, 2025 -

Analysis Fox News Debate On Trump Tariffs And Economic Consequences

May 10, 2025

Analysis Fox News Debate On Trump Tariffs And Economic Consequences

May 10, 2025 -

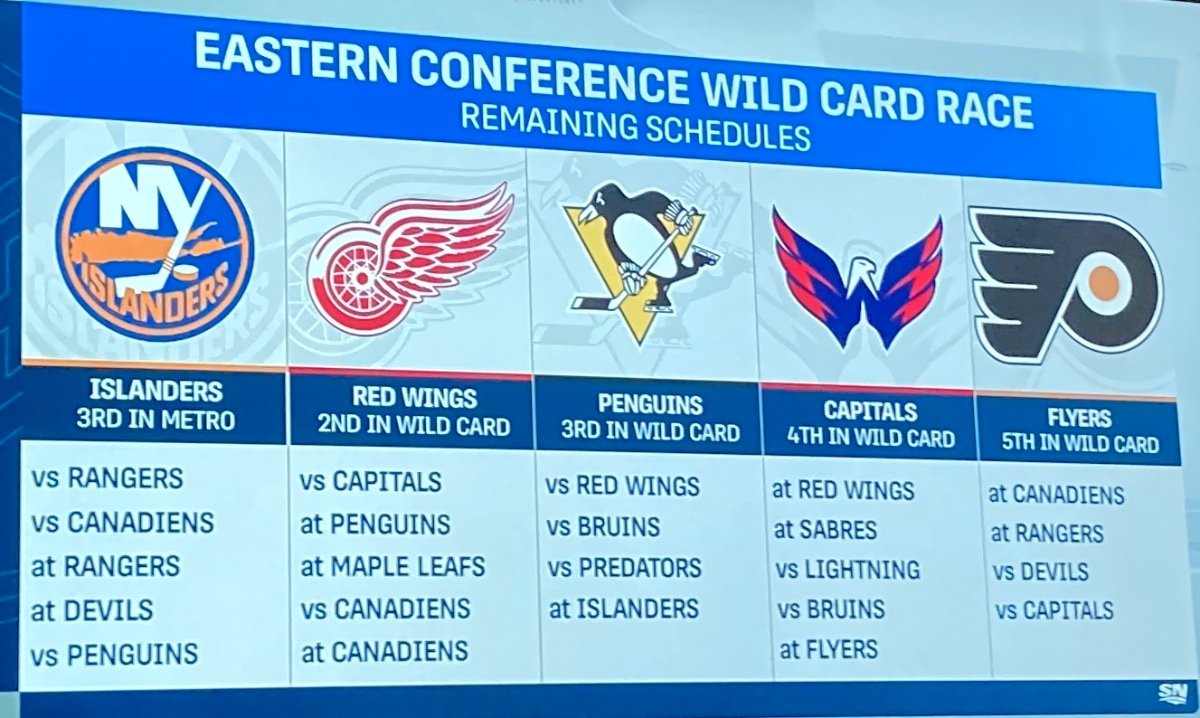

Post Game Analysis Red Wings Playoff Dreams Diminish After Vegas Defeat

May 10, 2025

Post Game Analysis Red Wings Playoff Dreams Diminish After Vegas Defeat

May 10, 2025

Latest Posts

-

Ukrainskie Bezhentsy I S Sh A Ugroza Novogo Krizisa Dlya Germanii

May 10, 2025

Ukrainskie Bezhentsy I S Sh A Ugroza Novogo Krizisa Dlya Germanii

May 10, 2025 -

Germaniya Analiz Vozmozhnogo Uvelicheniya Chisla Ukrainskikh Bezhentsev V Svyazi S Deystviyami S Sh A

May 10, 2025

Germaniya Analiz Vozmozhnogo Uvelicheniya Chisla Ukrainskikh Bezhentsev V Svyazi S Deystviyami S Sh A

May 10, 2025 -

Riski Novogo Naplyva Ukrainskikh Bezhentsev V Germaniyu Vliyanie S Sh A

May 10, 2025

Riski Novogo Naplyva Ukrainskikh Bezhentsev V Germaniyu Vliyanie S Sh A

May 10, 2025 -

Imf Review Of Pakistans 1 3 Billion Loan Package Current Situation And Analysis

May 10, 2025

Imf Review Of Pakistans 1 3 Billion Loan Package Current Situation And Analysis

May 10, 2025 -

Izolyatsiya Zelenskogo Pochemu Nikto Ne Priekhal 9 Maya

May 10, 2025

Izolyatsiya Zelenskogo Pochemu Nikto Ne Priekhal 9 Maya

May 10, 2025