Self-Defense Shooting: Do You Need Insurance Coverage?

Table of Contents

The High Costs of Self-Defense Legal Battles

The aftermath of a self-defense shooting can be financially devastating, regardless of the outcome of any criminal proceedings. Navigating the legal system requires significant resources, and the costs can quickly spiral out of control.

Legal Fees and Representation

Securing skilled legal representation specializing in self-defense cases is paramount. Self-defense laws are complex and vary significantly by jurisdiction. An experienced attorney can effectively navigate these complexities and build a robust defense.

- Bullet Points:

- Hourly rates for self-defense lawyers can range from $300 to $800 or more, depending on location and experience.

- Retainer fees can easily reach tens of thousands of dollars upfront.

- Litigation can stretch for months or even years, significantly increasing legal costs.

- Expert witness fees (ballistics experts, forensic specialists) add substantial expense.

Civil Lawsuits

Even if you are acquitted in a criminal trial, you can still face a civil lawsuit. Civil liability focuses on financial compensation for damages, separate from criminal culpability. Victims or their families can sue for significant monetary awards.

- Bullet Points:

- Potential lawsuits include wrongful death, assault and battery, and emotional distress claims.

- Damages awarded in similar cases can range from tens of thousands to millions of dollars.

- The emotional toll of a lawsuit, even if ultimately successful, can be immense.

What Self-Defense Insurance Covers

Self-defense insurance is specifically designed to mitigate the financial risks associated with self-defense shootings. It provides crucial coverage to protect you from potentially crippling legal costs.

Legal Defense Costs

A comprehensive self-defense insurance policy will cover a wide range of legal expenses, providing peace of mind during a stressful time.

- Bullet Points:

- Legal representation fees, including hourly rates and retainer fees.

- Expert witness fees for crucial testimony.

- Court costs, filing fees, and other associated legal expenses.

- Bail bonds, should they become necessary.

- Costs associated with pre-trial investigation and evidence gathering.

- Coverage for appeals processes.

Potential Settlements and Judgments

Self-defense insurance can cover settlements or judgments awarded against you in a civil lawsuit, up to the policy limits.

- Bullet Points:

- It's crucial to select a policy with adequate coverage limits to account for potential damages.

- Understanding policy exclusions is vital to avoid gaps in coverage.

Other Potential Coverages

Some self-defense insurance policies offer additional benefits beyond just legal costs.

- Bullet Points:

- Crisis management support to help navigate the immediate aftermath of a shooting incident.

- Public relations assistance to manage media interactions and public perception.

- Counseling services to help cope with the psychological trauma of the event.

Types of Self-Defense Insurance Policies

Several types of insurance policies can offer self-defense coverage, each with varying levels of protection and cost.

Comparing Policies and Coverage

Choosing the right policy requires careful consideration and comparison shopping.

- Bullet Points:

- Homeowner's or renter's insurance policies may include limited self-defense liability coverage as a rider or add-on.

- Specialized self-defense insurance policies provide comprehensive coverage tailored to the needs of firearm owners.

- Compare policy limits, premiums, and exclusions carefully.

- Research multiple providers to find the best coverage at the most competitive price.

Factors to Consider When Choosing a Policy

Selecting a self-defense insurance policy requires careful attention to several key factors.

- Bullet Points:

- What are the policy limits?

- Are there any exclusions? What activities or situations are not covered?

- What is the reputation and financial stability of the insurance provider?

- Does the policy cover both criminal and civil actions?

- What additional services are included (crisis management, legal representation)?

Conclusion

The financial consequences of a self-defense shooting can be overwhelming. Legal fees, potential civil lawsuits, and other related expenses can quickly drain your resources. Self-defense insurance plays a crucial role in mitigating these risks, offering vital protection and peace of mind. By understanding the importance of adequate coverage and comparing different policy options, responsible firearm owners can protect themselves and their futures. Don't face self-defense legal battles alone; secure the right insurance coverage. Protect yourself and your future – explore self-defense insurance options today! [Link to relevant resource 1] [Link to relevant resource 2]

Featured Posts

-

Dog Walking In Didcot For Mental Health Awareness Week

May 13, 2025

Dog Walking In Didcot For Mental Health Awareness Week

May 13, 2025 -

50 Cent And Tory Lanez Attack Reporter For A Ap Rocky Question

May 13, 2025

50 Cent And Tory Lanez Attack Reporter For A Ap Rocky Question

May 13, 2025 -

Understanding Stock Market Valuations A Bof A Perspective

May 13, 2025

Understanding Stock Market Valuations A Bof A Perspective

May 13, 2025 -

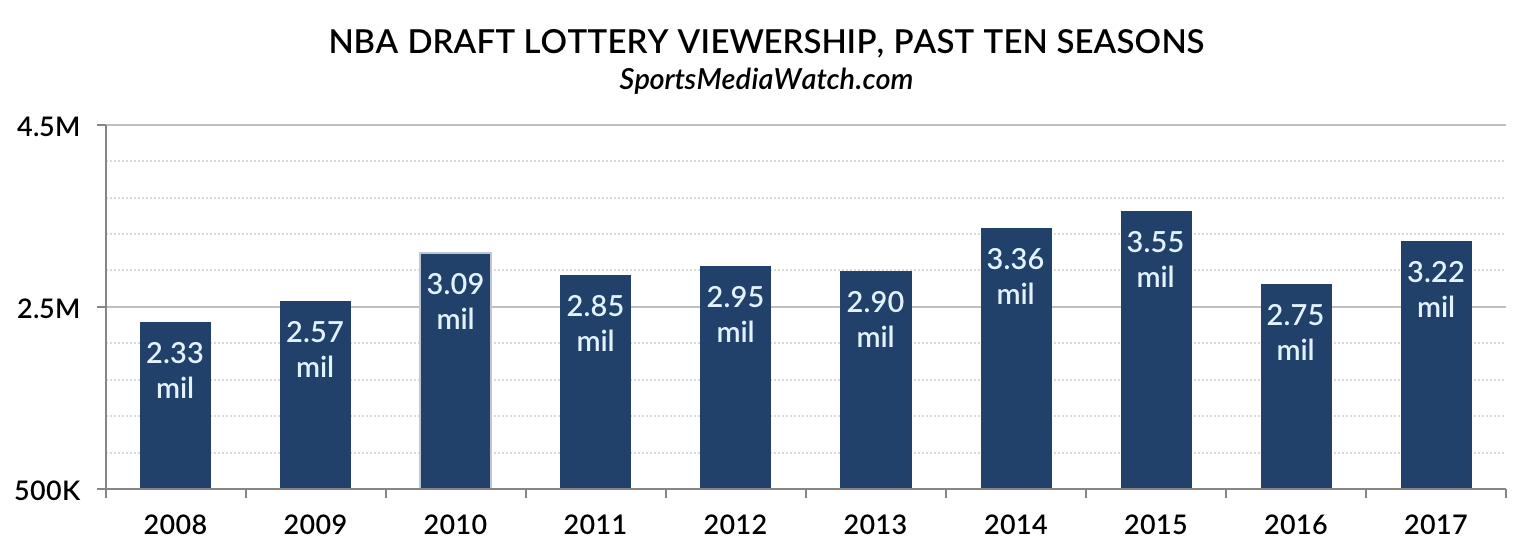

How Espn Changed Its Nba Draft Lottery Show

May 13, 2025

How Espn Changed Its Nba Draft Lottery Show

May 13, 2025 -

Den Of Thieves 2 Netflix Release Date Everything You Need To Know

May 13, 2025

Den Of Thieves 2 Netflix Release Date Everything You Need To Know

May 13, 2025