Schroders Asset Decline: First Quarter Stock Market Pullback Impacts Client Investments

Table of Contents

Market Volatility and its Impact on Schroders' Performance

The first quarter of 2024 was characterized by considerable market volatility driven by several interconnected factors. High inflation, aggressive interest rate hikes by central banks aiming to curb inflation, and ongoing geopolitical uncertainties created a challenging investment environment. These headwinds significantly impacted Schroders' performance, leading to a notable Schroders asset decline.

Schroders, a prominent global asset manager, employs diverse investment strategies, but the market downturn affected even its diversified portfolios. The prevailing market conditions negatively impacted several asset classes within Schroders' holdings.

- Underperforming Asset Classes: Technology stocks, which had seen significant growth in previous years, experienced a sharp correction. Similarly, bond yields rose, impacting fixed-income investments. Emerging market equities also faced considerable pressure.

- Quantitative Data: While precise figures require access to Schroders' financial reports, publicly available data from market indices indicated significant declines in various asset classes during the first quarter. This translated into a measurable reduction in the overall value of Schroders' assets under management (AUM).

- Specific Schroders Funds: While we cannot pinpoint specific funds without access to proprietary data, it is reasonable to assume that funds with significant exposure to the underperforming asset classes mentioned above were disproportionately affected.

Analysis of Client Portfolio Impacts

The Schroders asset decline directly affected the portfolios of its clients. The impact varied depending on individual investment strategies and risk profiles. Clients with more aggressive investment strategies, focused on high-growth equities, likely experienced more significant losses. Conservative investors with a larger allocation to fixed-income securities experienced less severe losses, but still felt the impact of the market downturn.

- Retirement Savings: For clients nearing retirement, the market downturn could have significant implications for their retirement plans, potentially requiring adjustments to their withdrawal strategies or extending their working years.

- Short-Term Investment Goals: Clients with short-term financial goals, such as a down payment on a house or funding a child's education, may have faced delays in achieving these objectives due to the market's negative performance.

- Mitigating Losses: Strategies to mitigate losses include rebalancing portfolios to reduce exposure to underperforming assets, considering dollar-cost averaging to reduce the impact of market volatility, and, if appropriate, taking advantage of tax-loss harvesting opportunities.

Schroders' Response to the Market Downturn

In response to the market challenges, Schroders implemented several measures to protect client investments and maintain investor confidence. These actions included adjustments to investment strategies, enhanced risk management protocols, and proactive communication with clients.

- Risk Management Strategies: Schroders likely employed various risk mitigation strategies, such as hedging techniques, diversification across various asset classes and geographies, and stress testing portfolios to assess their resilience to various market scenarios.

- Communication with Clients: Schroders likely communicated transparently with its clients regarding the market situation, explaining the impact on their investments and outlining the firm's approach to navigating the downturn. This could have involved regular updates, webinars, and direct contact with financial advisors.

- Adjustments to Fund Allocation: To adapt to the changing market environment, Schroders may have made adjustments to its fund allocations, shifting investments toward assets deemed less vulnerable to the prevailing market conditions.

Looking Ahead: Future Outlook for Schroders and Investor Strategies

While the first-quarter market downturn presented significant challenges, the long-term outlook for Schroders and the broader market remains subject to various factors. While predicting the future is impossible, several considerations are crucial for investors.

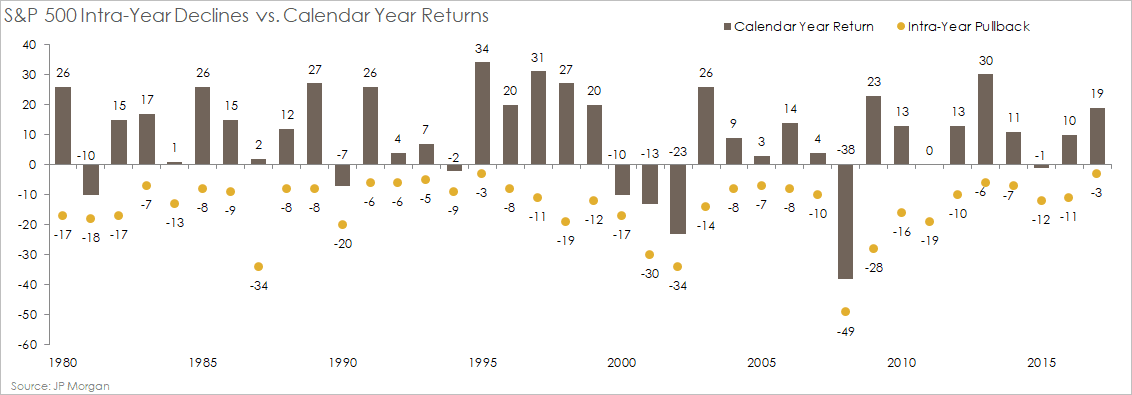

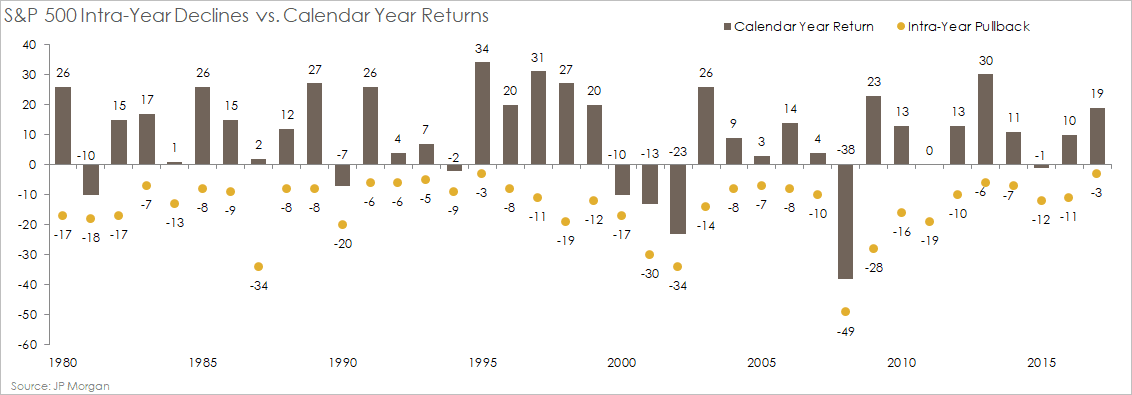

- Potential Long-Term Growth Prospects: Historically, stock markets have shown a tendency to recover from downturns, and long-term investors should maintain a perspective that accounts for these cyclical fluctuations. Specific growth prospects for Schroders will depend on its ability to adapt to changing market conditions and maintain its strong reputation for asset management.

- Strategies for Diversification and Risk Mitigation: A well-diversified portfolio, spread across different asset classes and geographies, is crucial to mitigating risk. This diversification minimizes the impact of any single asset class's underperformance.

- Importance of Long-Term Investment Planning: Long-term investment planning remains crucial, regardless of short-term market fluctuations. Investors with a long-term perspective are better equipped to withstand market volatility and benefit from long-term growth opportunities.

Understanding and Managing Schroders Asset Decline

The first-quarter 2024 market pullback resulted in a notable Schroders asset decline, impacting client portfolios to varying degrees. Understanding market volatility and its potential impact on investments is paramount. Effective risk management strategies, such as diversification and long-term planning, are vital for mitigating potential losses.

Don't let the recent Schroders asset decline deter you from long-term financial planning. Contact a financial advisor today to discuss your investment strategy and navigate market volatility effectively. For more information on investment management best practices, you can explore resources from [link to a relevant financial resource website].

Featured Posts

-

T 50

May 03, 2025

T 50

May 03, 2025 -

Nick Robinson And Emma Barnett Unveiling The Truth Behind Their Radio 4 Hosting Arrangements

May 03, 2025

Nick Robinson And Emma Barnett Unveiling The Truth Behind Their Radio 4 Hosting Arrangements

May 03, 2025 -

Analysis Has Labour Earned The Nasty Party Label

May 03, 2025

Analysis Has Labour Earned The Nasty Party Label

May 03, 2025 -

Daisy May Coopers Engagement Ring A Closer Look

May 03, 2025

Daisy May Coopers Engagement Ring A Closer Look

May 03, 2025 -

Robust Poll Data System Eliminating Election Irregularities Ensuring Accuracy

May 03, 2025

Robust Poll Data System Eliminating Election Irregularities Ensuring Accuracy

May 03, 2025