Schneider Electric's 2024 Outlook: Robust Revenue And Earnings Growth In Data Center Market

Table of Contents

Strong Demand Fuels Schneider Electric's Data Center Growth

The surge in demand for Schneider Electric Data Center solutions is fueled by several key factors.

Increased Global Data Consumption

The world's appetite for data is insatiable. This insatiable demand drives the need for more sophisticated and efficient data centers to handle the ever-growing volume of information. This, in turn, fuels the demand for Schneider Electric's comprehensive suite of solutions.

- Growth in cloud computing: The continued expansion of cloud services necessitates massive data center infrastructure.

- AI and machine learning: The rise of artificial intelligence and machine learning algorithms requires immense computing power, further driving data center expansion.

- Internet of Things (IoT): The proliferation of connected devices generates a vast amount of data that needs to be stored and processed.

- Big data analytics: Organizations increasingly rely on data analytics to gain insights, demanding robust data center capabilities.

- Increased need for edge computing infrastructure: Processing data closer to its source reduces latency and improves efficiency, creating demand for edge data centers and their associated infrastructure.

- Rising demand for energy-efficient data center designs: Sustainability concerns and rising energy costs are pushing the industry toward more energy-efficient data center designs, a key area where Schneider Electric excels.

Schneider Electric's Competitive Advantage

Schneider Electric isn't just participating in this growth; it's leading it. Their competitive advantage stems from several key aspects:

- Market leadership in various segments: Schneider Electric holds a strong market share across numerous data center infrastructure segments.

- Innovative product offerings: The company consistently introduces cutting-edge technologies, such as advanced cooling systems and intelligent power management solutions.

- Strong partnerships with key players: Collaboration with leading cloud providers, IT infrastructure companies, and system integrators strengthens their market reach and influence.

- Proven track record of delivering reliable solutions: Schneider Electric has a long history of providing reliable and dependable data center solutions to customers worldwide, building trust and loyalty.

Strategic Investments and Acquisitions

Schneider Electric's commitment to growth is evident in its strategic investments and acquisitions:

- Investments in software and digitalization: The company invests heavily in developing advanced software solutions for data center infrastructure management (DCIM), enhancing operational efficiency and optimizing resource utilization.

- Acquisitions enhancing portfolio breadth and expertise: Strategic acquisitions broaden their product portfolio and bring in specialized expertise, strengthening their overall market position.

- Focus on sustainability and green data center solutions: Schneider Electric recognizes the importance of sustainability and is actively developing and promoting energy-efficient and environmentally friendly data center solutions.

Financial Projections and Key Performance Indicators (KPIs)

Schneider Electric's positive outlook is reflected in its strong financial projections. While precise figures may vary depending on the official release, we can expect significant growth across key performance indicators.

Revenue Growth Projections

Schneider Electric anticipates substantial revenue growth in its data center business segment for 2024. This growth will be driven by the factors discussed above, including the increased demand for data storage, processing, and energy-efficient solutions. We anticipate a double-digit percentage increase in revenue, with significant contributions from software solutions, hardware upgrades, and ongoing maintenance services. Geographical growth will likely be strongest in regions with rapidly expanding digital economies.

Profitability and Margin Expansion

The company’s projected improved profitability and margin expansion are expected to result from enhanced operational efficiency, effective pricing strategies, and economies of scale. We expect to see a significant increase in EBITDA margin, demonstrating improved cost management and a stronger return on investment (ROI).

Investor Sentiment and Stock Performance

The positive outlook for Schneider Electric's data center business has generally been met with favorable investor sentiment. [Insert link to a reputable financial news source showing stock performance and analyst ratings]. Analyst predictions generally reflect a positive outlook for the company's stock performance based on the anticipated growth in the data center sector.

Challenges and Opportunities for Schneider Electric in the Data Center Market

While the outlook is positive, Schneider Electric faces certain challenges and opportunities.

Competition and Market Dynamics

Schneider Electric operates in a competitive market, with major players vying for market share. [Mention key competitors like Vertiv, ABB, etc.]. The emergence of new technologies and innovative business models presents both challenges and opportunities. The company must continue to innovate and adapt to maintain its leadership position.

Supply Chain Management and Global Economic Uncertainty

Global supply chain disruptions and economic uncertainty pose risks to Schneider Electric's data center business. The company is proactively addressing these challenges by diversifying its supply sources, implementing robust inventory management strategies, and developing resilient supply chains.

Sustainability and ESG Initiatives

Sustainability is increasingly critical in the data center industry. Schneider Electric’s commitment to Environmental, Social, and Governance (ESG) initiatives is a key differentiator. Their focus on energy-efficient data centers and carbon footprint reduction enhances their reputation and appeals to environmentally conscious customers. This commitment is a strategic advantage, attracting clients prioritizing sustainable practices.

Conclusion

Schneider Electric's 2024 outlook for the data center market is remarkably strong, fueled by robust demand, strategic investments, and a commitment to innovation. The projected revenue and earnings growth underscore the company's leading position in this rapidly evolving sector. While challenges exist, Schneider Electric's proactive strategies and dedication to sustainability position it for continued success. To learn more about Schneider Electric's data center solutions and its future plans, visit the official Schneider Electric website. Explore how Schneider Electric can help your data center thrive – visit their [link to Schneider Electric's data center solutions page] today.

Featured Posts

-

Coronation Street Shock Exit For Fan Favourite Imminent

Apr 30, 2025

Coronation Street Shock Exit For Fan Favourite Imminent

Apr 30, 2025 -

7 Key Announcements From Carnival Cruise Line In The Coming Month

Apr 30, 2025

7 Key Announcements From Carnival Cruise Line In The Coming Month

Apr 30, 2025 -

Iopcs Ofcom Complaint Concerns Raised Over Bbc Panoramas Chris Kaba Coverage

Apr 30, 2025

Iopcs Ofcom Complaint Concerns Raised Over Bbc Panoramas Chris Kaba Coverage

Apr 30, 2025 -

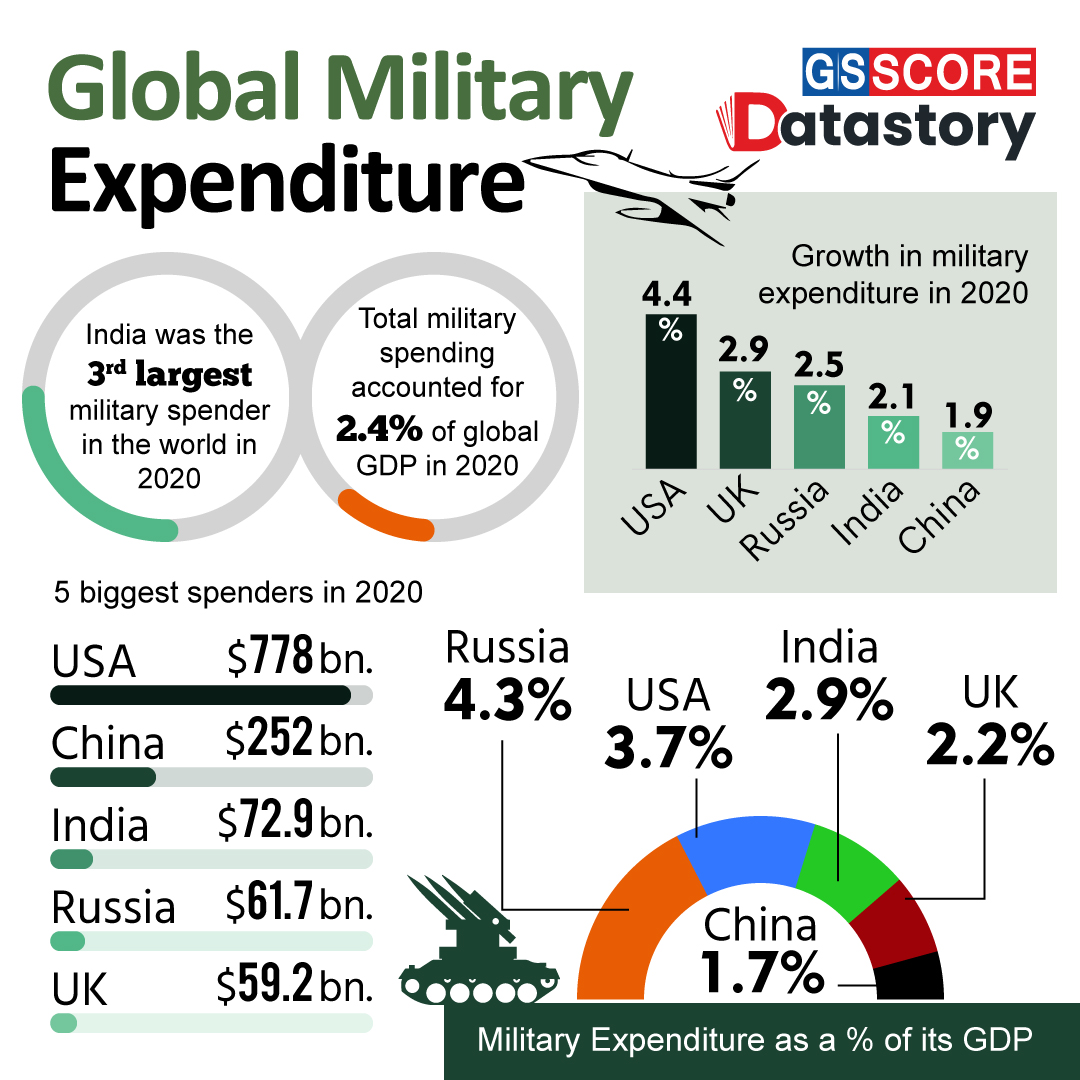

Surge In Global Military Expenditure The European Security Dilemma

Apr 30, 2025

Surge In Global Military Expenditure The European Security Dilemma

Apr 30, 2025 -

Beyonces New Levis Campaign Fans React To Her Revealing Shorts

Apr 30, 2025

Beyonces New Levis Campaign Fans React To Her Revealing Shorts

Apr 30, 2025