Scandal Fallout: PwC's Strategic Exit From Over A Dozen Countries

Table of Contents

The Triggering Events: Unveiling the Scandals that Led to PwC's Retreat

The strategic exits by PwC aren't isolated incidents; they're the culmination of several significant scandals and regulatory breaches that have severely damaged the firm's reputation and eroded public trust. These incidents highlight systemic issues within the auditing industry and raise concerns about the effectiveness of current regulatory frameworks.

-

Tax Avoidance Schemes: PwC has faced accusations of facilitating tax avoidance schemes for high-profile clients in multiple jurisdictions. These allegations, coupled with leaked internal documents, have fueled public outrage and intensified regulatory scrutiny. The consequences include hefty fines and reputational damage in countries like the UK and Switzerland.

-

Auditing Failures: In several instances, PwC has been criticized for failures in its auditing practices, leading to inaccurate financial reporting and investor losses. These failures have undermined investor confidence and raised questions about the firm's competence and adherence to professional standards. Specific cases involving the misreporting of financial data in various sectors have contributed to the crisis.

-

Client Confidentiality Breaches: Allegations of client confidentiality breaches have further tarnished PwC's image. The unauthorized disclosure of sensitive client information has led to legal battles and further eroded public trust. This breach of ethical conduct has been a critical factor in the loss of client confidence.

-

Conflicts of Interest: Instances of conflicts of interest, where PwC simultaneously provided consulting and auditing services to the same client, have also contributed to the crisis. This practice has been widely criticized for compromising the independence and objectivity of the firm's audit work, leading to regulatory penalties.

Geographic Impact: Which Countries are Affected by PwC's Strategic Exits?

PwC's strategic withdrawals are not limited to a single region; they span the globe, impacting various countries and their respective economies.

-

Europe: Several European countries, including those in the UK, have seen PwC reduce its presence or completely withdraw. This has created uncertainty for businesses relying on PwC's services and sparked a scramble for alternative auditing firms. The UK withdrawal, in particular, represents a major shift in the accounting landscape.

-

Asia-Pacific: The impact on the Asia-Pacific region is significant, particularly in countries where PwC held a dominant market share. Businesses in these regions are now navigating a new competitive landscape.

-

South America: Similarly, countries in South America are grappling with the implications of PwC's withdrawal. The need for alternative audit providers is driving market consolidation and potentially impacting the pricing of audit services.

-

Africa: The fallout from PwC's global restructuring extends to Africa. Local businesses face the task of transitioning to new audit firms while dealing with the broader economic implications. The impact is especially pronounced in economies that are heavily reliant on foreign investment and expertise.

The disruption caused by these withdrawals creates uncertainty for businesses and could lead to delays in financial reporting and increased audit costs.

Long-Term Implications: Assessing the Future of PwC and the Auditing Profession

The PwC scandal has far-reaching consequences, affecting not only the firm itself but the entire auditing profession.

-

PwC's Future: The long-term impact on PwC's global brand and market share remains uncertain. The firm faces a challenging task in rebuilding its reputation and regaining the trust of clients and investors. A comprehensive restructuring and internal reform are crucial for its survival.

-

Auditing Industry Reform: The scandal has intensified calls for greater regulatory oversight and reform within the auditing industry. This includes increased transparency, stricter ethical guidelines, and potentially stricter separation of auditing and consulting services.

-

Global Accounting Standards: The crisis is likely to trigger discussions regarding potential revisions to global accounting standards to enhance transparency and prevent similar future occurrences. International collaboration and stricter enforcement are anticipated.

-

Investor Confidence: The events surrounding PwC have shaken investor confidence and raised serious questions about the reliability of financial reporting. This could lead to increased scrutiny of corporate governance practices.

The Search for Solutions: Can PwC Recover its Reputation and Trust?

PwC faces a monumental task in restoring its reputation and regaining public trust. This requires a multi-pronged approach:

-

Reputation Management: A robust reputation management strategy is crucial, involving transparent communication and proactive measures to address public concerns. This may include independent reviews and audits to demonstrate a commitment to change.

-

Crisis Communication: Open and honest communication with stakeholders – clients, investors, and regulators – is vital. This requires acknowledging past mistakes and demonstrating a genuine commitment to change.

-

Ethical Reforms: Significant internal reforms are necessary to address the ethical lapses that led to the scandals. This involves establishing stronger ethical guidelines, enhancing training programs, and promoting a culture of integrity.

-

Transparency Initiatives: Increased transparency in the firm's operations and decision-making processes is essential to rebuild trust. This may involve enhanced reporting mechanisms and greater accountability.

Conclusion

PwC's strategic exit from over a dozen countries marks a significant turning point, highlighting the severe consequences of ethical lapses and regulatory breaches within the accounting profession. The fallout extends beyond PwC itself, impacting global markets, investor confidence, and the broader discussion surrounding corporate governance and ethical business practices. The PwC scandal underscores the critical need for robust regulatory oversight and a renewed commitment to ethical standards within the auditing industry. Staying informed about the evolving situation and the implications of PwC’s actions is crucial for businesses, investors, and regulators alike. Continue following the unfolding story of PwC’s strategic exits to understand the long-term implications of this significant event and the future of the accounting profession.

Featured Posts

-

Porsche Macan Electric A Deep Dive Into The New Drive Experience

Apr 29, 2025

Porsche Macan Electric A Deep Dive Into The New Drive Experience

Apr 29, 2025 -

Cardinal Becciu Seeks Retrial Based On New Evidence

Apr 29, 2025

Cardinal Becciu Seeks Retrial Based On New Evidence

Apr 29, 2025 -

British Paralympian Missing In Las Vegas Urgent Search After Week Long Silence

Apr 29, 2025

British Paralympian Missing In Las Vegas Urgent Search After Week Long Silence

Apr 29, 2025 -

The Lingering Impact Of Pandemic Fiscal Support On Inflation Ecb Analysis

Apr 29, 2025

The Lingering Impact Of Pandemic Fiscal Support On Inflation Ecb Analysis

Apr 29, 2025 -

Capital Summertime Ball 2025 Ticket Information And Purchase Process

Apr 29, 2025

Capital Summertime Ball 2025 Ticket Information And Purchase Process

Apr 29, 2025

Latest Posts

-

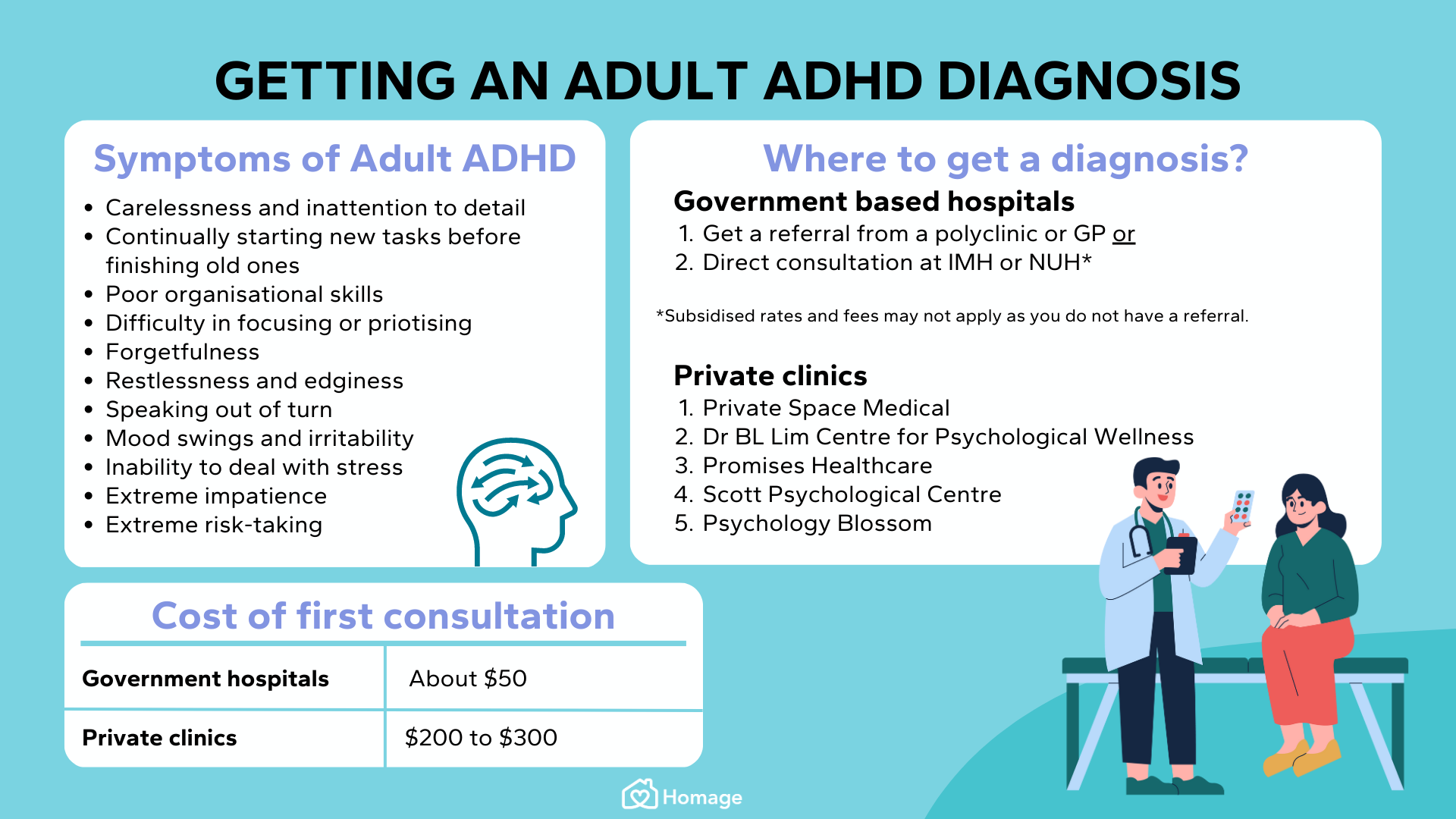

Suspect Adult Adhd A Guide To Diagnosis And Treatment

Apr 29, 2025

Suspect Adult Adhd A Guide To Diagnosis And Treatment

Apr 29, 2025 -

Adult Adhd Next Steps After A Suspected Diagnosis

Apr 29, 2025

Adult Adhd Next Steps After A Suspected Diagnosis

Apr 29, 2025 -

Suspecting Adult Adhd A Practical Guide To Next Steps

Apr 29, 2025

Suspecting Adult Adhd A Practical Guide To Next Steps

Apr 29, 2025 -

Adult Adhd Understanding Your Diagnosis And Moving Forward

Apr 29, 2025

Adult Adhd Understanding Your Diagnosis And Moving Forward

Apr 29, 2025 -

Improve Focus Naturally Effective Natural Approaches To Adhd

Apr 29, 2025

Improve Focus Naturally Effective Natural Approaches To Adhd

Apr 29, 2025