Sasol (SOL) Investor Concerns After Two-Year Strategy Gap

Table of Contents

Underperformance and Missed Targets

Sasol's financial performance over the past two years has fallen short of expectations, raising significant concerns among investors. Missed targets across key performance indicators have led to a decline in the Sasol stock price and prompted negative reactions from analysts.

-

Financial Results: Sasol has reported lower-than-anticipated earnings and revenue, impacting profit margins significantly. Detailed financial reports show consistent deviations from projected targets, particularly in the chemicals and energy sectors.

-

Reasons for Underperformance: Several factors contribute to this underperformance. Operational challenges, including production bottlenecks and cost overruns in key projects, have hampered efficiency. Furthermore, fluctuating commodity prices and global market volatility have negatively impacted Sasol’s profitability.

-

Impact on Debt and Credit Rating: The persistent underperformance has increased Sasol's debt levels, putting pressure on the company's credit rating. This increased debt burden adds to investor concerns about the company's financial stability and its ability to meet its long-term obligations.

-

Investor Reactions: The disappointing financial results have led to a decline in Sasol's stock price, reflecting investor pessimism about the company's future. Several analysts have downgraded their ratings for Sasol stock, further exacerbating the negative sentiment.

Strategic Execution and the Two-Year Gap

A significant concern revolves around Sasol's two-year gap in strategic execution. This period of stalled progress has raised questions about the company's strategic planning and operational efficiency.

-

Strategic Goals and Shortcomings: Sasol’s initial strategic goals focused on improving operational efficiency, expanding into new markets, and enhancing its sustainability profile. However, the company fell significantly short of these targets.

-

Reasons for the Delay: The delay in strategic execution can be attributed to internal organizational issues, including a lack of coordination between different business units. External factors, such as unexpected market downturns and regulatory changes, also played a role.

-

Strategic Reviews and Revisions: In response to the criticism, Sasol has undertaken strategic reviews and announced revised strategies. These revisions often focus on streamlining operations, reducing costs, and prioritizing key projects.

-

Feasibility of Revised Strategy: The feasibility and credibility of Sasol's revised strategy remain to be seen. Successful implementation will require significant improvements in operational efficiency, cost control, and strategic decision-making.

ESG Concerns and Sustainability Initiatives

Sasol faces growing pressure regarding its environmental, social, and governance (ESG) performance. Investor concerns about the company's carbon emissions and sustainability initiatives are impacting investor sentiment.

-

ESG Impact on Investor Sentiment: Concerns about Sasol's carbon footprint and its contribution to climate change are increasingly influencing investor decisions. Many investors are now prioritizing ESG factors when making investment choices.

-

Sustainability Initiatives and Effectiveness: Sasol has implemented various sustainability initiatives, but their effectiveness remains questionable. Investors are scrutinizing the company's progress in reducing carbon emissions and improving its overall ESG performance.

-

Alignment with Investor Expectations: Sasol's ESG performance is lagging behind investor expectations. Addressing these concerns is crucial to regaining investor trust and attracting responsible investments.

-

Impact on Future Performance: Failure to adequately address ESG concerns could negatively impact Sasol's financial performance in the long run, as investors increasingly favor companies with strong ESG profiles.

Geopolitical Risks and Market Volatility

Sasol operates in a volatile global environment, exposing the company to significant geopolitical risks and market fluctuations. This volatility impacts the company's operations and financial performance.

-

Impact of Geopolitical Instability: Geopolitical instability, particularly in South Africa and global energy markets, can significantly affect Sasol's operations and profitability. Fluctuations in energy prices and political uncertainty pose considerable risks.

-

Exposure to Specific Geopolitical Risks: Sasol is heavily exposed to energy price volatility and political instability in South Africa, which can create significant challenges for its operations.

-

Risk Management Strategies: Sasol employs risk management strategies to mitigate these risks, but their effectiveness is constantly challenged by the unpredictable nature of geopolitical events.

-

Impact on Future Investment Decisions: The inherent risks associated with Sasol’s operations will undoubtedly continue to influence future investment decisions.

Conclusion

Investor concerns about Sasol (SOL) stem from a combination of underperformance, a two-year gap in strategic execution, growing ESG scrutiny, and exposure to geopolitical risks. The uncertainty surrounding the company’s future prospects is significant. Understanding the challenges and uncertainties surrounding Sasol (SOL) is crucial for investors to make informed decisions about their portfolio. Further research and careful consideration of the factors discussed are essential before investing in Sasol (SOL). Closely following Sasol's financial reporting and news releases is vital to staying abreast of the company’s progress and its ability to address these critical issues.

Featured Posts

-

Abn Amro Rapporteert Sterke Toename In Occasionverkoop

May 21, 2025

Abn Amro Rapporteert Sterke Toename In Occasionverkoop

May 21, 2025 -

Building A Food Business In Louth Lessons From A Young Entrepreneur

May 21, 2025

Building A Food Business In Louth Lessons From A Young Entrepreneur

May 21, 2025 -

Australian Outback Conquered New Speed Record Set On Foot

May 21, 2025

Australian Outback Conquered New Speed Record Set On Foot

May 21, 2025 -

Mulhouse Le Noumatrouff Presente Une Selection De Groupes Du Hellfest

May 21, 2025

Mulhouse Le Noumatrouff Presente Une Selection De Groupes Du Hellfest

May 21, 2025 -

Razvod Vanje Mijatovic Istina O Navodnom Razlogu

May 21, 2025

Razvod Vanje Mijatovic Istina O Navodnom Razlogu

May 21, 2025

Latest Posts

-

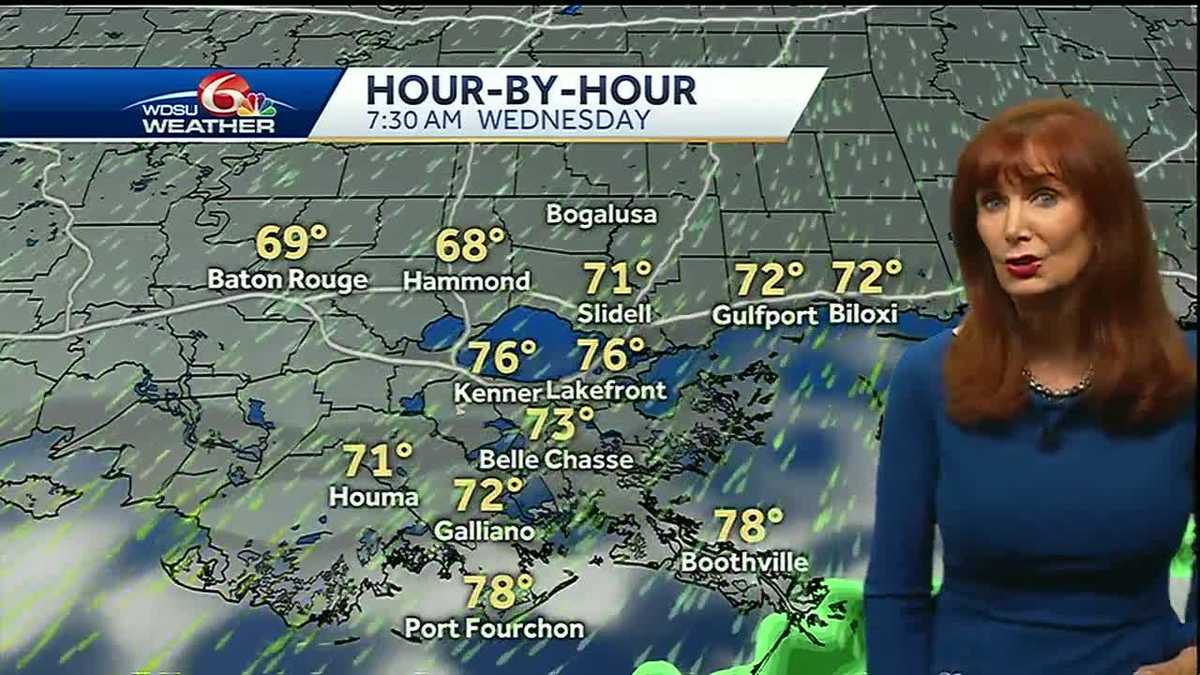

Planning For Drier Weather Tips And Advice

May 21, 2025

Planning For Drier Weather Tips And Advice

May 21, 2025 -

Drier Weather Ahead Your Guide To Dry Conditions

May 21, 2025

Drier Weather Ahead Your Guide To Dry Conditions

May 21, 2025 -

Is Drier Weather In Sight What To Expect This Season

May 21, 2025

Is Drier Weather In Sight What To Expect This Season

May 21, 2025 -

Big Bear Ai Is This Ai Stock Worth Buying

May 21, 2025

Big Bear Ai Is This Ai Stock Worth Buying

May 21, 2025 -

Analyzing Big Bear Ai Stock Should You Invest Today

May 21, 2025

Analyzing Big Bear Ai Stock Should You Invest Today

May 21, 2025