Sanofi Acquires Dren Bio's Bispecific Myeloid Cell Engager

Table of Contents

Understanding Dren Bio's Bispecific Myeloid Cell Engager Technology

Dren Bio's technology centers around a bispecific myeloid cell engager – a type of targeted immunotherapy. Unlike traditional cancer treatments that may affect healthy cells, bispecific antibodies are designed to precisely target specific cancer cells, minimizing damage to healthy tissue. This targeted approach is a significant advantage.

- Bispecific Antibody Structure and Function: These engineered antibodies possess two distinct binding sites. One site binds to a specific antigen present on myeloid cancer cells, while the other site recruits immune cells, such as T cells or NK cells, to destroy the targeted cancer cells.

- Targeting Myeloid Cancer Cells: The exact target of Dren Bio's engager remains undisclosed in full detail for competitive reasons, but it likely focuses on antigens uniquely expressed on myeloid leukemia or myeloma cells. This precise targeting maximizes efficacy and minimizes off-target effects.

- Comparison with Other Immunotherapy Approaches: Compared to other immunotherapies like CAR T-cell therapy, bispecific myeloid cell engagers potentially offer advantages in terms of manufacturing complexity and ease of administration. While more research is needed for direct comparisons, initial data is promising.

- Preclinical and Clinical Data: While specific data from Dren Bio's trials may be limited due to the acquisition, the promise of the bispecific approach in preclinical studies paved the way for the Sanofi acquisition, highlighting its potential clinical effectiveness.

Sanofi's Strategic Rationale Behind the Acquisition

Sanofi's acquisition of Dren Bio's technology is a strategic move reflecting the company's commitment to strengthening its oncology pipeline and expanding its presence in the lucrative immunotherapy market.

- Strengthening Sanofi's Position in the Myeloid Cancer Market: This acquisition significantly bolsters Sanofi's existing oncology portfolio, providing a potential breakthrough treatment for a currently underserved area.

- Access to Innovative Technology and Expertise: Dren Bio's expertise in bispecific antibody engineering and myeloid cancer biology provides Sanofi with valuable intellectual property and a skilled team.

- Potential for Accelerated Drug Development and Market Entry: Sanofi's established infrastructure and resources can potentially expedite the clinical development and regulatory approval process for Dren Bio's bispecific myeloid cell engager, bringing this treatment to patients more quickly.

- Diversification of Sanofi's Oncology Pipeline: Adding this novel immunotherapy to its portfolio diversifies Sanofi's approach to cancer treatment, reducing dependence on any single modality.

Implications for Myeloid Cancer Patients and the Future of Treatment

The successful development and commercialization of Dren Bio's bispecific myeloid cell engager could dramatically alter the therapeutic landscape for myeloid cancers.

- Potential Improvement in Treatment Efficacy and Safety: The targeted nature of the therapy promises improved efficacy, potentially leading to higher remission rates and longer survival times, while minimizing adverse effects commonly associated with traditional chemotherapies.

- Expansion of Treatment Options for Patients with Limited Choices: For patients with relapsed or refractory myeloid cancers, where treatment options are limited, this new therapy offers a beacon of hope.

- Potential for Personalized Medicine Approaches: The technology could be adaptable to target specific genetic mutations or biomarkers found in certain subsets of myeloid cancers, paving the way for truly personalized treatment strategies.

- Impact on the Overall Prognosis of Myeloid Cancers: The potential for improved outcomes could dramatically enhance the overall prognosis for many individuals suffering from this often aggressive form of cancer.

Financial Aspects and Market Analysis of the Sanofi-Dren Bio Deal

While precise financial details remain confidential, the acquisition cost reflects Sanofi's strong belief in the commercial potential of Dren Bio's technology.

- Acquisition Cost and Payment Terms: The exact figures haven't been publicly released, indicating a potentially significant investment by Sanofi reflecting high market expectations.

- Market Size and Growth Potential for Myeloid Cancer Treatments: The myeloid cancer market is substantial and growing, presenting a significant financial opportunity for Sanofi.

- Sanofi's Projected Return on Investment: Given the unmet needs in myeloid cancer treatment, the projected return on investment for Sanofi is likely considerable, justifying the investment.

- Competitive Landscape and Market Share Analysis: Sanofi's acquisition positions them strongly in the competitive landscape, potentially capturing a significant market share once the drug receives regulatory approval.

Conclusion

Sanofi's acquisition of Dren Bio’s bispecific myeloid cell engager represents a landmark event in the fight against myeloid cancers. The potential for improved efficacy, safety, and expanded treatment options is significant. This strategic move strengthens Sanofi's oncology portfolio and highlights the growing importance of targeted immunotherapies in cancer treatment. The acquisition's financial implications underscore the high market expectations surrounding this innovative technology.

Call to Action: Stay updated on the latest developments regarding Sanofi's bispecific myeloid cell engager and its potential to revolutionize myeloid cancer treatment. Further research and ongoing clinical trials will be crucial in fully understanding the impact of this innovative technology. Learn more about Sanofi's oncology pipeline and advancements in bispecific antibody therapies to stay informed about this exciting development in cancer research.

Featured Posts

-

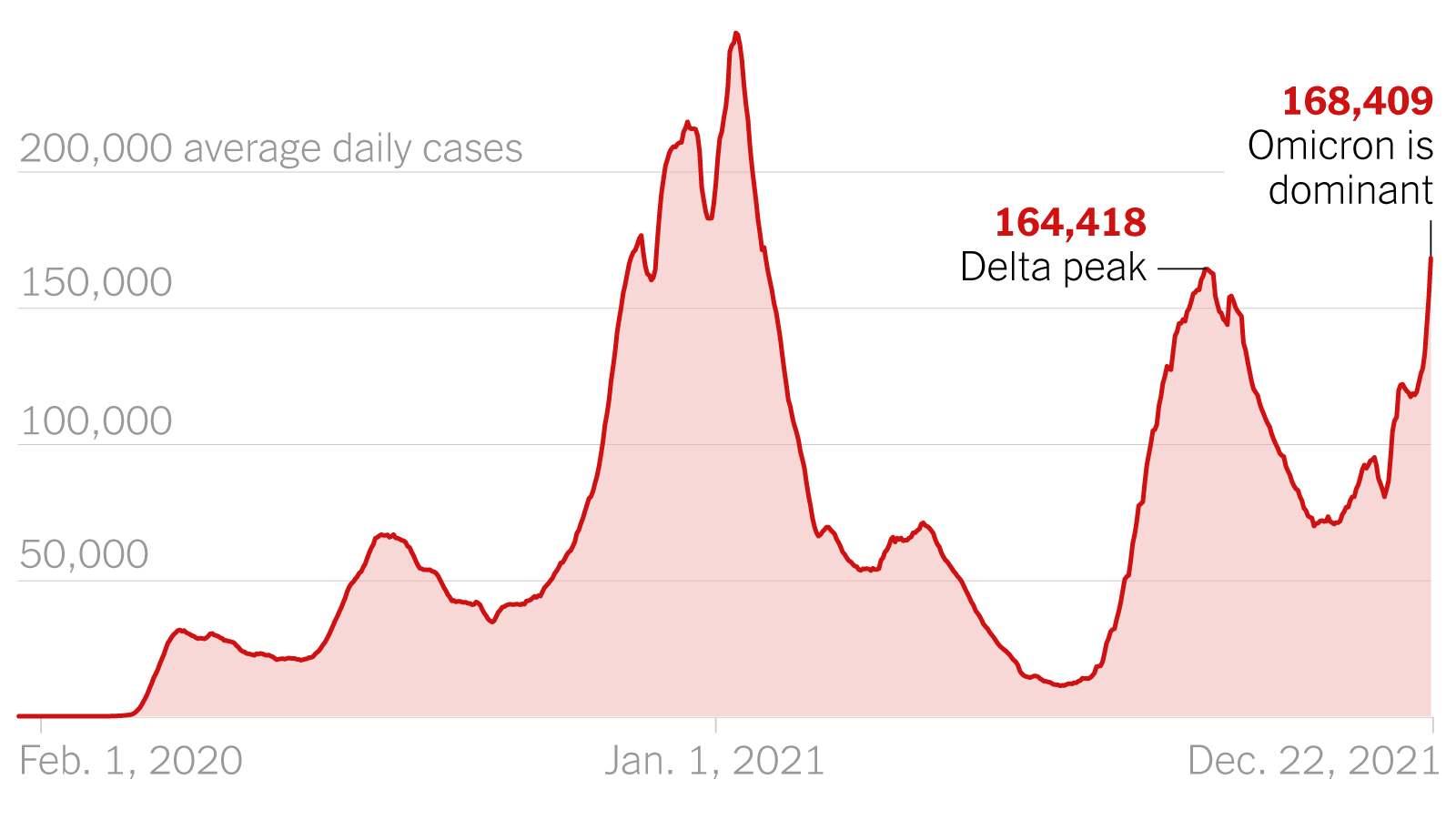

Tracking The Spread A New Covid 19 Variant And Its Effect On Infection Rates

May 31, 2025

Tracking The Spread A New Covid 19 Variant And Its Effect On Infection Rates

May 31, 2025 -

Foreign Student Ban Harvard Granted Extended Reprieve By Judge

May 31, 2025

Foreign Student Ban Harvard Granted Extended Reprieve By Judge

May 31, 2025 -

L Etoile De Mer Symbole D Une Lutte Pour Les Droits De La Nature

May 31, 2025

L Etoile De Mer Symbole D Une Lutte Pour Les Droits De La Nature

May 31, 2025 -

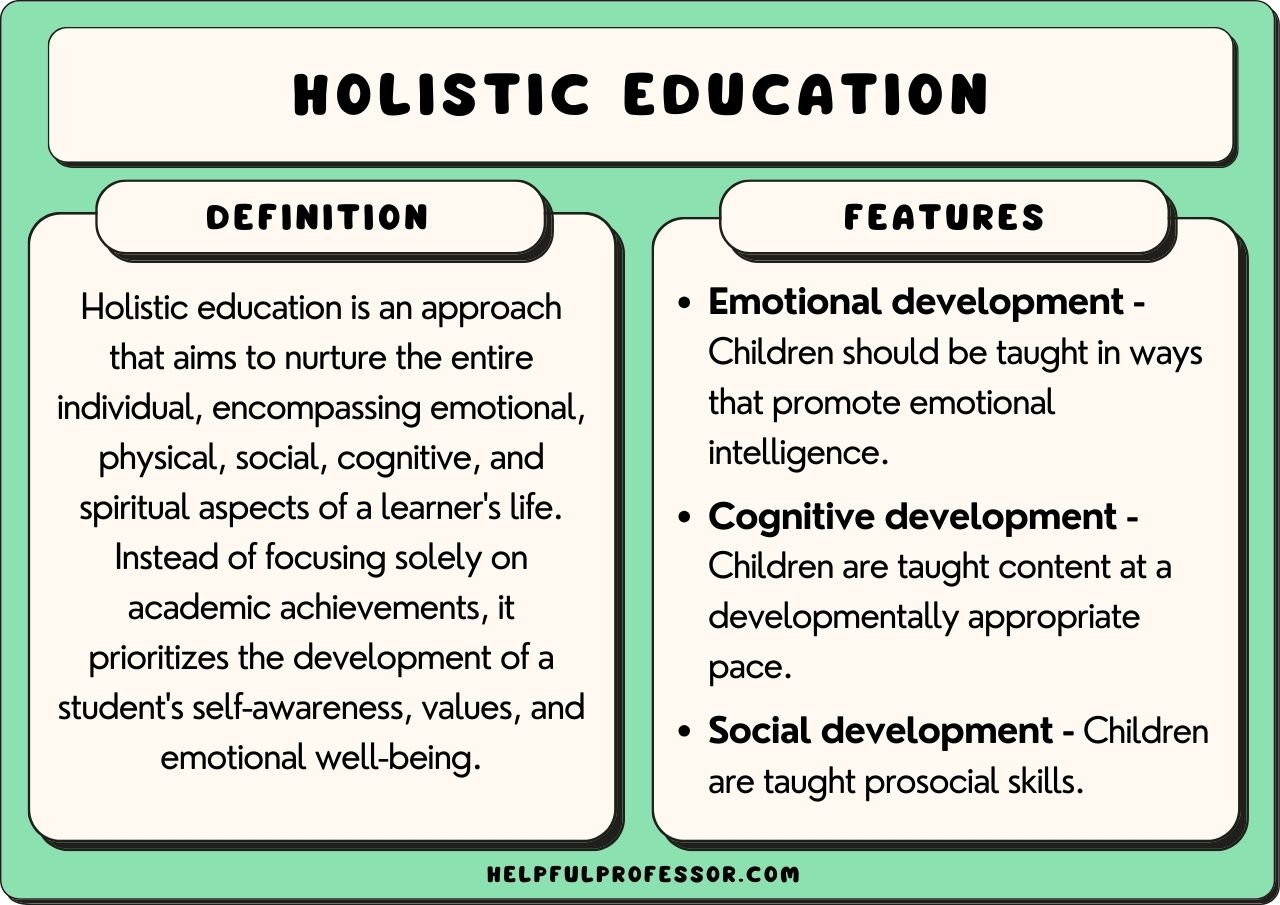

Building The Good Life A Holistic Approach To Personal Growth

May 31, 2025

Building The Good Life A Holistic Approach To Personal Growth

May 31, 2025 -

What Is The Good Life Exploring Personal Definitions And Aspirations

May 31, 2025

What Is The Good Life Exploring Personal Definitions And Aspirations

May 31, 2025