Sabadell's Approach To Unicaja Investors: A Potential Merger On The Horizon

Table of Contents

Keywords: Sabadell, Unicaja, merger, banking merger, Spanish banking, bank acquisition, investor relations, financial news, Banco Sabadell, Unicaja Banco

The Spanish banking sector is abuzz with speculation surrounding a potential merger between Banco Sabadell and Unicaja Banco. This article delves into Sabadell's approach to Unicaja investors, examining the strategic motivations, potential challenges, and implications of this significant development in the Spanish financial landscape. We'll analyze the potential benefits and drawbacks for both banks and their respective shareholders, providing a comprehensive overview of this evolving situation.

Sabadell's Interest in Unicaja: A Strategic Analysis

Banco Sabadell, a major player in the Spanish banking market, has been rumored to be exploring a merger with Unicaja Banco. Several factors suggest Sabadell's strong interest in this potential acquisition. The bank is currently seeking to bolster its market position and achieve greater economies of scale. A merger with Unicaja would significantly strengthen its competitive advantage.

Sabadell's current financial standing, while healthy, could benefit from the synergies a merger would offer. The potential motivations for this move are multifaceted:

- Strengthening Market Position: A combined entity would significantly increase market share in Spain, giving it greater clout and influence.

- Synergies and Cost Reductions: Merging operations would streamline processes, reducing redundancies in branch networks and administrative functions, resulting in substantial cost savings.

- Expanded Product and Service Offerings: Combining the product portfolios of both banks would result in a wider range of offerings to attract a larger customer base.

- Enhanced Competitiveness: A larger, more robust bank is better positioned to compete against larger national and international rivals in the increasingly competitive Spanish banking sector.

Unicaja Investors' Perspective: Concerns and Expectations

A Sabadell-Unicaja merger would naturally have significant ramifications for Unicaja investors. The valuation offered by Sabadell, the potential for share dilution, and the long-term growth prospects post-merger are all key considerations.

Concerns among Unicaja shareholders might include:

- Share Price Implications: The immediate impact on share price upon announcement of a merger would depend on the offered valuation and market reaction.

- Dilution of Ownership: Existing Unicaja shareholders might see their ownership stake diluted as a result of the merger.

- Long-Term Growth Prospects: Investors will want assurance that the merged entity will offer superior long-term growth opportunities compared to remaining independent.

- Regulatory Approvals and Timelines: The speed and success of regulatory approvals will heavily influence the attractiveness of the merger for investors.

Regulatory Hurdles and Antitrust Considerations

Any merger between two major Spanish banks like Sabadell and Unicaja will inevitably face significant regulatory hurdles. The Spanish banking regulator, along with the European Commission, will scrutinize the deal for potential antitrust issues and its impact on competition within the market.

Key regulatory considerations include:

- European Commission Approval: Securing approval from the European Commission is crucial, as it assesses the deal’s impact on competition across the EU.

- Spanish Banking Regulations: Compliance with Spanish banking regulations is essential throughout the merger process.

- Competition Concerns and Market Dominance: Regulators will closely examine the combined market share to determine whether the merger creates an excessive concentration of power in the Spanish banking sector.

- Potential Remedies to Address Antitrust Issues: To overcome potential antitrust concerns, Sabadell might need to agree to divest certain assets or branches to maintain a competitive market landscape.

Market Reaction and Future Outlook for Sabadell and Unicaja

The market's reaction to the merger speculation will be pivotal. Stock price movements for both Sabadell and Unicaja will be closely watched by investors and analysts. Analyst reports and market sentiment will play a significant role in shaping the final outcome.

Factors influencing the future outlook include:

- Stock Price Analysis: Monitoring the stock price movements of both banks will provide insights into investor confidence.

- Expert Opinions and Analyst Predictions: Expert analysis and predictions from financial analysts will help gauge the market's expectations.

- Impact on the Spanish Banking Sector: The merger's success or failure will have wider implications for the structure and competitiveness of the Spanish banking sector.

- Long-Term Strategic Implications: The long-term success of the merged entity will depend on effective integration and the implementation of a clear strategic vision.

Conclusion

The potential merger between Banco Sabadell and Unicaja Banco presents a significant development in the Spanish banking landscape. While offering potential synergies and increased market share for Sabadell, the deal faces considerable regulatory hurdles and investor concerns. The success of the merger will depend on navigating these challenges, securing necessary approvals, and delivering on promises of long-term growth and value creation for all stakeholders. The coming months will be crucial in determining the final outcome. Stay informed about the latest developments in the potential Sabadell-Unicaja merger. Follow our updates for in-depth analysis and insights into the future of Spanish banking. Learn more about the implications of this potential Sabadell-Unicaja merger by subscribing to our newsletter.

Featured Posts

-

Hostage Crisis In Gaza A Continuing Nightmare For Families

May 13, 2025

Hostage Crisis In Gaza A Continuing Nightmare For Families

May 13, 2025 -

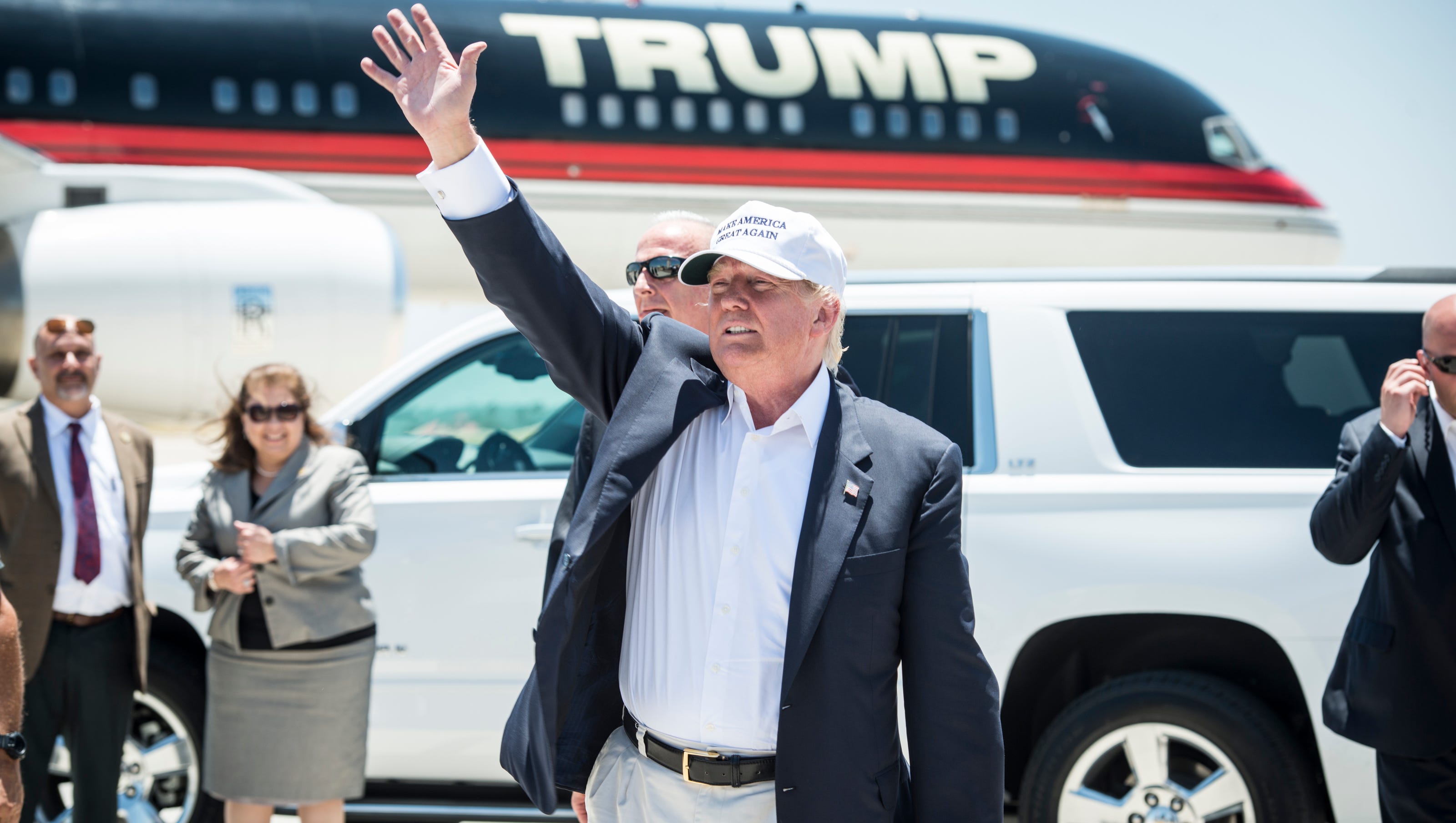

Trumps Plan To Track Undocumented Immigrants Via Irs Data Approved By Judge

May 13, 2025

Trumps Plan To Track Undocumented Immigrants Via Irs Data Approved By Judge

May 13, 2025 -

Diddys Ex Cassie Pregnant Again Third Child On The Way

May 13, 2025

Diddys Ex Cassie Pregnant Again Third Child On The Way

May 13, 2025 -

Scarlett Johansson Visszater A Marvelbe A Kult Filmrol Es A Joevorol

May 13, 2025

Scarlett Johansson Visszater A Marvelbe A Kult Filmrol Es A Joevorol

May 13, 2025 -

Dzherard Btlr Trogna Fenovete Si S Blgarska Snimka

May 13, 2025

Dzherard Btlr Trogna Fenovete Si S Blgarska Snimka

May 13, 2025