Ryanair's Buyback Plan Amidst Concerns Over Rising Tariffs

Table of Contents

Ryanair's Share Buyback Program: Details and Rationale

Ryanair's buyback plan represents a significant commitment to returning value to shareholders. While specific details might vary depending on the precise announcement, let's assume, for the sake of this example, a program of €500 million. This sizable share repurchase program is planned for completion within the next 12 months. Ryanair's rationale, as publicly stated, typically centers on the belief that its stock is currently undervalued, reflecting strong financial performance despite external challenges. The company likely views this as an opportune time to invest in itself by repurchasing shares.

- Size of the buyback program: €500 million (example figure)

- Timeline for completion: 12 months (example figure)

- Ryanair's official statement regarding the rationale: (Insert actual quote from Ryanair's official announcement here)

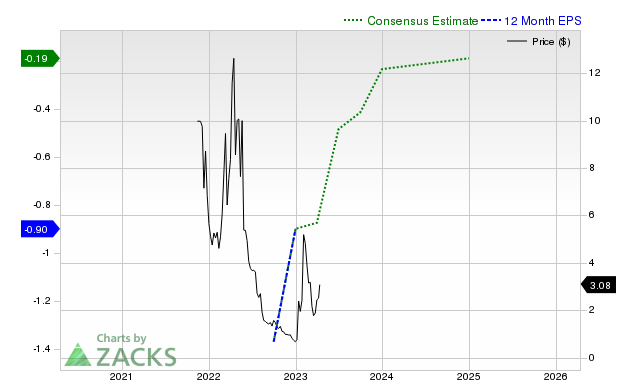

- Impact on outstanding shares: A reduction in the number of outstanding shares, potentially increasing earnings per share (EPS).

Rising Tariffs and Their Impact on the Aviation Industry

The aviation industry is facing a perfect storm of rising costs. Fuel prices, a major expense for airlines, have experienced significant increases, impacting profitability across the board. Airport charges and various regulatory fees are also contributing to escalating operating costs. Inflationary pressures further exacerbate the financial strain on airlines. These rising tariffs are forcing airlines to make tough decisions, potentially including fare increases and a reduction in the frequency of flights on certain routes.

- Specific examples of rising tariff categories: Fuel costs have increased by X% (Insert actual percentage data), airport charges by Y% (Insert actual percentage data).

- Impact on other major airlines: Many major European airlines are grappling with similar cost pressures, leading to various strategies to mitigate the impact on profitability.

- Government policies influencing tariff increases: Government regulations and environmental policies can influence fuel costs and airport charges, indirectly contributing to the increase in tariffs.

Ryanair's Strategy in Response to Rising Costs

Ryanair's share buyback program is only one component of its broader strategy to counter rising costs. The buyback signals confidence in the company's long-term prospects. Alongside the buyback, Ryanair likely employs other cost-cutting measures and revenue-generating initiatives.

- Details of any cost-cutting measures: This may include initiatives focused on fuel efficiency, such as optimizing flight routes and investing in more fuel-efficient aircraft. Negotiating better deals with fuel suppliers is another key strategy.

- New revenue streams explored by Ryanair: Ryanair is always exploring ancillary revenue opportunities, such as increased baggage fees, on-board sales, and priority boarding.

- Analysis of Ryanair's pricing strategy in response to increased costs: Ryanair might strategically increase fares on certain routes while maintaining competitive pricing on others, depending on market demand and competition.

Investor Sentiment and Stock Market Reaction

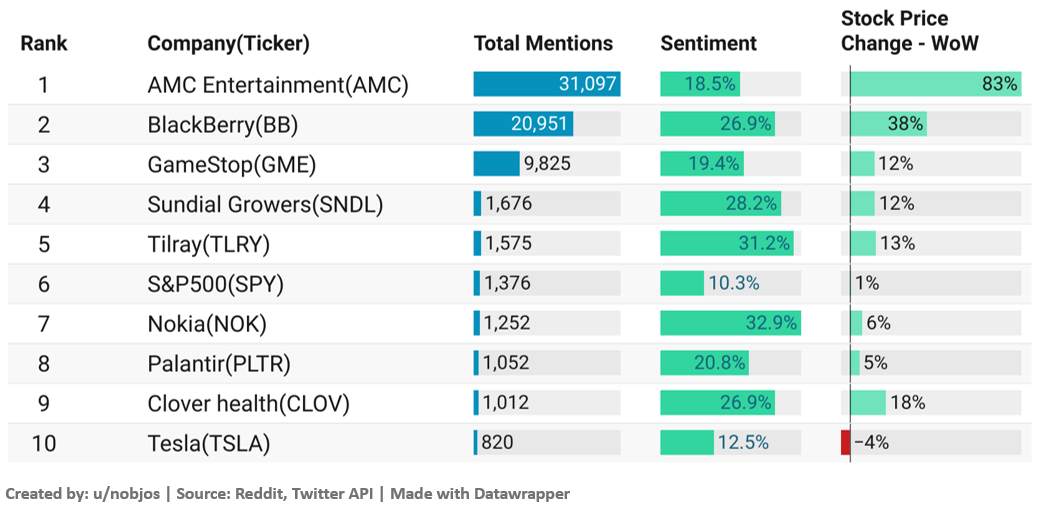

The market's response to Ryanair's buyback announcement is crucial in assessing its overall success. A positive stock price movement immediately following the announcement would indicate investor confidence in the company's strategy and future prospects. Conversely, a negative or muted response could suggest skepticism. Analysis of analyst ratings and forecasts provides further insight into investor sentiment. Comparing Ryanair's stock performance to its competitors can also highlight the effectiveness of its strategic response to rising tariffs.

- Stock price movement following the announcement: (Insert actual data on stock price changes)

- Analyst ratings and forecasts: (Summarize key analyst opinions and predictions)

- Comparison to competitor stock performance: (Compare Ryanair's performance to other major airlines)

Potential Risks and Challenges

While Ryanair's buyback plan demonstrates confidence, potential risks and challenges remain. The current economic climate presents significant uncertainty.

- Economic recession risks: A potential economic downturn could negatively impact travel demand, reducing Ryanair's revenue and profitability.

- Further increases in fuel prices: Unpredictable fluctuations in fuel prices remain a significant risk to Ryanair's operational costs.

- Potential impact on future expansion plans: The buyback program might divert funds that could otherwise be used for fleet expansion or the development of new routes.

Conclusion: Assessing Ryanair's Buyback Plan Amidst Rising Tariffs

Ryanair's share buyback plan, while seemingly bold in the face of rising tariffs, represents a multifaceted approach to navigating the challenges within the aviation industry. The success of this strategy hinges on various factors, including the overall economic climate, the continued control of operational costs, and the maintenance of strong passenger demand. While the buyback signals confidence, careful monitoring of its impact on Ryanair’s financial health and stock price is crucial. To stay informed about the evolving situation surrounding Ryanair's Buyback Plan Amidst Concerns Over Rising Tariffs, subscribe to financial news outlets, follow Ryanair's financial reports, and continue monitoring Ryanair stock performance in relation to the buyback program. Understanding this complex interplay is vital for investors and passengers alike.

Featured Posts

-

Is Ferraris Focus On Hamilton A Threat To Leclerc

May 20, 2025

Is Ferraris Focus On Hamilton A Threat To Leclerc

May 20, 2025 -

The Value Proposition Of Middle Management Benefits For Companies And Their Workforces

May 20, 2025

The Value Proposition Of Middle Management Benefits For Companies And Their Workforces

May 20, 2025 -

Breaking Israel Permits Food Deliveries To Gaza Following Extended Restrictions

May 20, 2025

Breaking Israel Permits Food Deliveries To Gaza Following Extended Restrictions

May 20, 2025 -

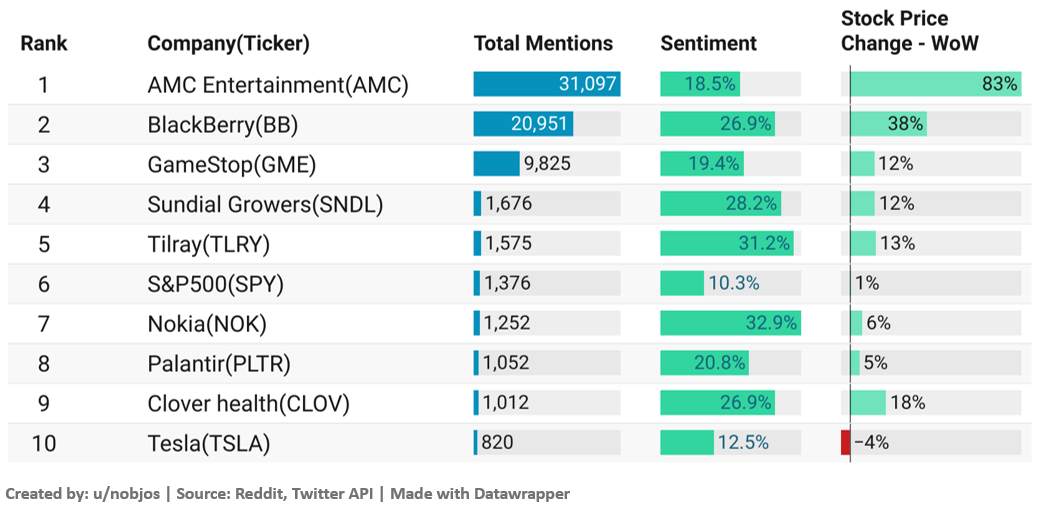

Reddits 12 Most Discussed Ai Stocks Investment Potential

May 20, 2025

Reddits 12 Most Discussed Ai Stocks Investment Potential

May 20, 2025 -

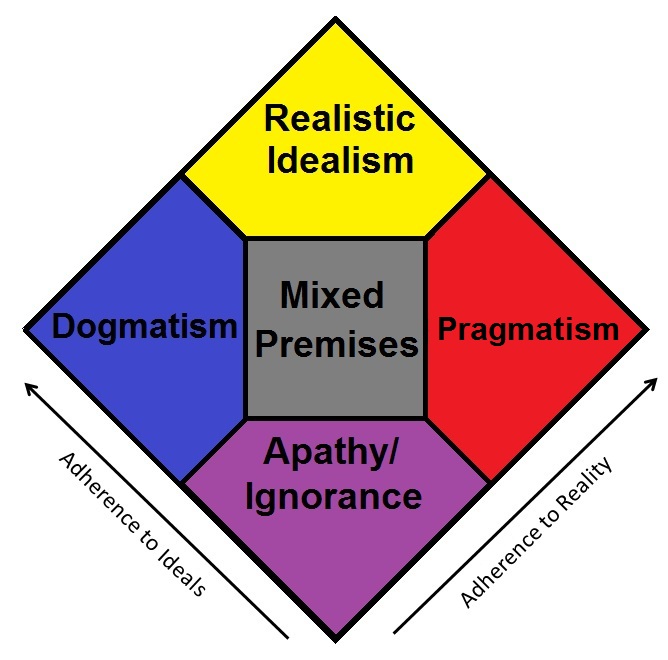

Pragmatism Vs Idealism In Nigeria Parallels With The Kite Runner

May 20, 2025

Pragmatism Vs Idealism In Nigeria Parallels With The Kite Runner

May 20, 2025

Latest Posts

-

Ai Stock Investing Reddits 12 Best Bets

May 20, 2025

Ai Stock Investing Reddits 12 Best Bets

May 20, 2025 -

Reddits 12 Most Discussed Ai Stocks Investment Potential

May 20, 2025

Reddits 12 Most Discussed Ai Stocks Investment Potential

May 20, 2025 -

Deadline Approaching Big Bear Ai Bbai Investors Contact Gross Law Firm

May 20, 2025

Deadline Approaching Big Bear Ai Bbai Investors Contact Gross Law Firm

May 20, 2025 -

12 Promising Ai Stocks A Reddit Community Analysis

May 20, 2025

12 Promising Ai Stocks A Reddit Community Analysis

May 20, 2025 -

Gross Law Firm Representing Investors In Big Bear Ai Bbai Stock

May 20, 2025

Gross Law Firm Representing Investors In Big Bear Ai Bbai Stock

May 20, 2025