Ryanair: Tariff Wars Pose Biggest Threat To Growth, Announces Share Buyback

Table of Contents

Tariff Wars: A Major Headwind for Ryanair

The current climate of global trade disputes presents a considerable challenge to Ryanair's business model. Increased tariffs are impacting several key areas, pushing up operational costs and potentially affecting passenger numbers.

Increased Fuel Costs

One of the most significant impacts of tariff wars is the increased cost of aviation fuel. Tariffs on imported fuel directly translate to higher operational expenses for Ryanair.

- Specific examples: While precise figures fluctuate, industry reports suggest that tariffs have contributed to a [Insert percentage]% increase in fuel prices in [Insert timeframe]. This translates to a significant dent in Ryanair's profit margins.

- Fuel hedging strategies: Ryanair, like other airlines, employs fuel hedging strategies to mitigate some of the price volatility. However, the effectiveness of these strategies is limited when faced with substantial and unexpected tariff increases. The effectiveness of hedging is further hampered by the unpredictability of geopolitical events influencing global fuel prices.

- Impact on Profit Margins: The rise in fuel surcharges directly impacts profitability, potentially forcing the airline to adjust pricing strategies or seek further cost-cutting measures.

Impact on Aircraft Manufacturing and Maintenance

Tariffs also affect the cost of aircraft parts and maintenance services. These costs are significant for an airline of Ryanair's size.

- Affected parties: Tariffs on components sourced from specific countries, impacting manufacturers such as [mention specific manufacturers if known] and maintenance providers, directly increase Ryanair's expenses.

- Quantifiable impact: Estimates suggest that tariffs on aircraft parts and maintenance could contribute to a [Insert percentage]% increase in overall maintenance costs, creating a ripple effect on ticket prices.

- Knock-on effect on ticket prices: These added costs are likely to be partially passed on to consumers, resulting in higher fares and potentially impacting demand.

Effect on Passenger Numbers and Route Planning

The increase in ticket prices due to higher operational costs can directly impact passenger numbers and potentially force adjustments to Ryanair's route network.

- Reduced passenger numbers: Higher fares, a consequence of increased fuel and maintenance costs, could lead to a reduction in passenger traffic, particularly among price-sensitive travelers.

- Route adjustments: Ryanair might need to review its route network, potentially cancelling less profitable routes or adjusting frequencies to optimize efficiency in the face of reduced demand.

- Competitive pressures: The impact of tariffs is not felt in isolation. Competitors might also face similar challenges, altering the competitive landscape and potentially affecting market share.

Ryanair's Response: The Share Buyback Program

In response to these challenges, Ryanair has announced a substantial share buyback program, signaling a strategic response to the economic headwinds.

Details of the Buyback

Ryanair's share buyback program involves the repurchase of [Insert number] shares, at an estimated cost of [Insert amount], over a period of [Insert timeframe].

- Rationale: The company stated that the buyback reflects confidence in its long-term prospects and represents a return of value to shareholders. This is a significant financial commitment, demonstrating the company’s resolve to weather the current challenges.

- Financial details: [Insert details from official Ryanair statements if available, such as expected impact on earnings per share].

Strategic Implications of the Buyback

The share buyback sends a clear message to investors: Ryanair believes it can navigate the challenges of tariff wars and maintain its profitability.

- Signal of confidence: The buyback can be interpreted as a vote of confidence in Ryanair's future earnings and its ability to manage increased operational costs effectively.

- Increasing shareholder value: By reducing the number of outstanding shares, the buyback aims to increase the earnings per share (EPS), potentially driving up the share price and increasing shareholder value.

Alternative Strategies for Mitigating Tariff Impact

Beyond the share buyback, Ryanair is likely exploring other strategies to mitigate the negative impact of tariffs.

- Renegotiating contracts: Negotiating more favorable terms with suppliers of aircraft parts and maintenance services could help reduce costs.

- Exploring alternative fuel sources: Investigating sustainable aviation fuels (SAFs) or other alternative fuel sources could help reduce reliance on imported fuel and mitigate the impact of tariffs.

- Operational efficiency improvements: Focusing on operational efficiencies throughout the business can help absorb some of the increased costs.

Conclusion

The escalating impact of tariff wars presents a significant challenge to Ryanair's growth. While the share buyback demonstrates a level of confidence in the company's long-term outlook, the airline’s capacity to effectively offset the substantial cost increases remains a key factor in its future success. Understanding the ongoing effects of these trade disputes on Ryanair and the broader airline industry is vital for investors, travelers, and industry analysts. To stay informed about Ryanair’s strategies and the evolving impacts of global trade, further research into the company's future plans is recommended. Keep monitoring news and developments concerning Ryanair to fully comprehend the lasting effects of these tariff wars.

Featured Posts

-

Fenerbahce De Yeni Bir Doenem Dusan Tadic In Tarihi Transferi

May 20, 2025

Fenerbahce De Yeni Bir Doenem Dusan Tadic In Tarihi Transferi

May 20, 2025 -

Qbts Stock Predicting The Earnings Report Impact

May 20, 2025

Qbts Stock Predicting The Earnings Report Impact

May 20, 2025 -

Incendio Em Escola Da Tijuca Repercussao E Desespero Entre A Comunidade

May 20, 2025

Incendio Em Escola Da Tijuca Repercussao E Desespero Entre A Comunidade

May 20, 2025 -

Rio De Janeiro Incendio Em Escola Na Tijuca Causa Tristeza E Reflexao

May 20, 2025

Rio De Janeiro Incendio Em Escola Na Tijuca Causa Tristeza E Reflexao

May 20, 2025 -

Eurovision 2025 Meet The Top 5 Favorite Acts

May 20, 2025

Eurovision 2025 Meet The Top 5 Favorite Acts

May 20, 2025

Latest Posts

-

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 20, 2025

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 20, 2025 -

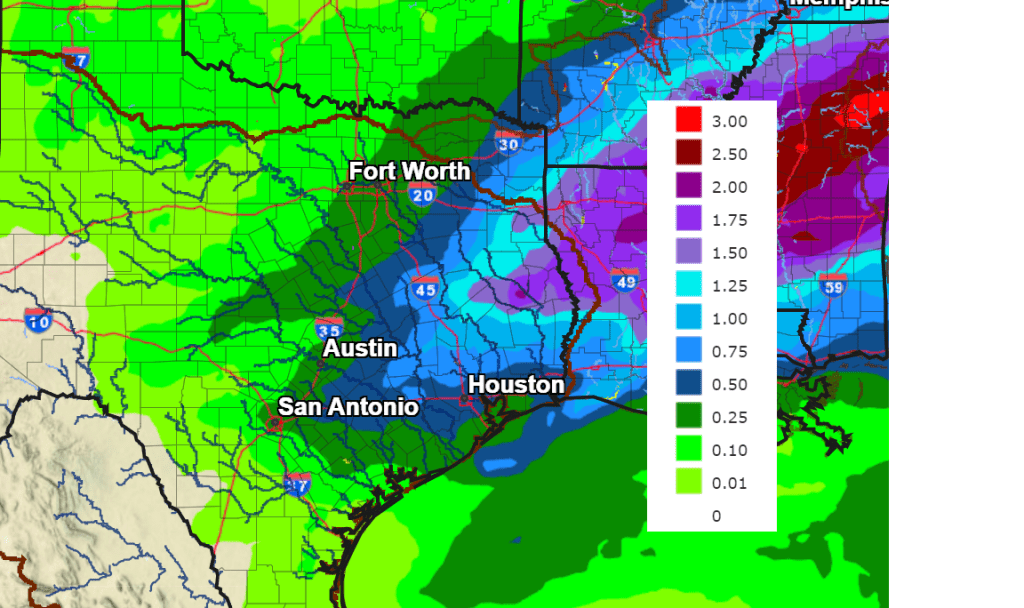

Mild Temperatures And Little Rain Chance Perfect For Outdoor Activities

May 20, 2025

Mild Temperatures And Little Rain Chance Perfect For Outdoor Activities

May 20, 2025 -

Washington County Breeder Faces Action After 49 Dogs Removed

May 20, 2025

Washington County Breeder Faces Action After 49 Dogs Removed

May 20, 2025 -

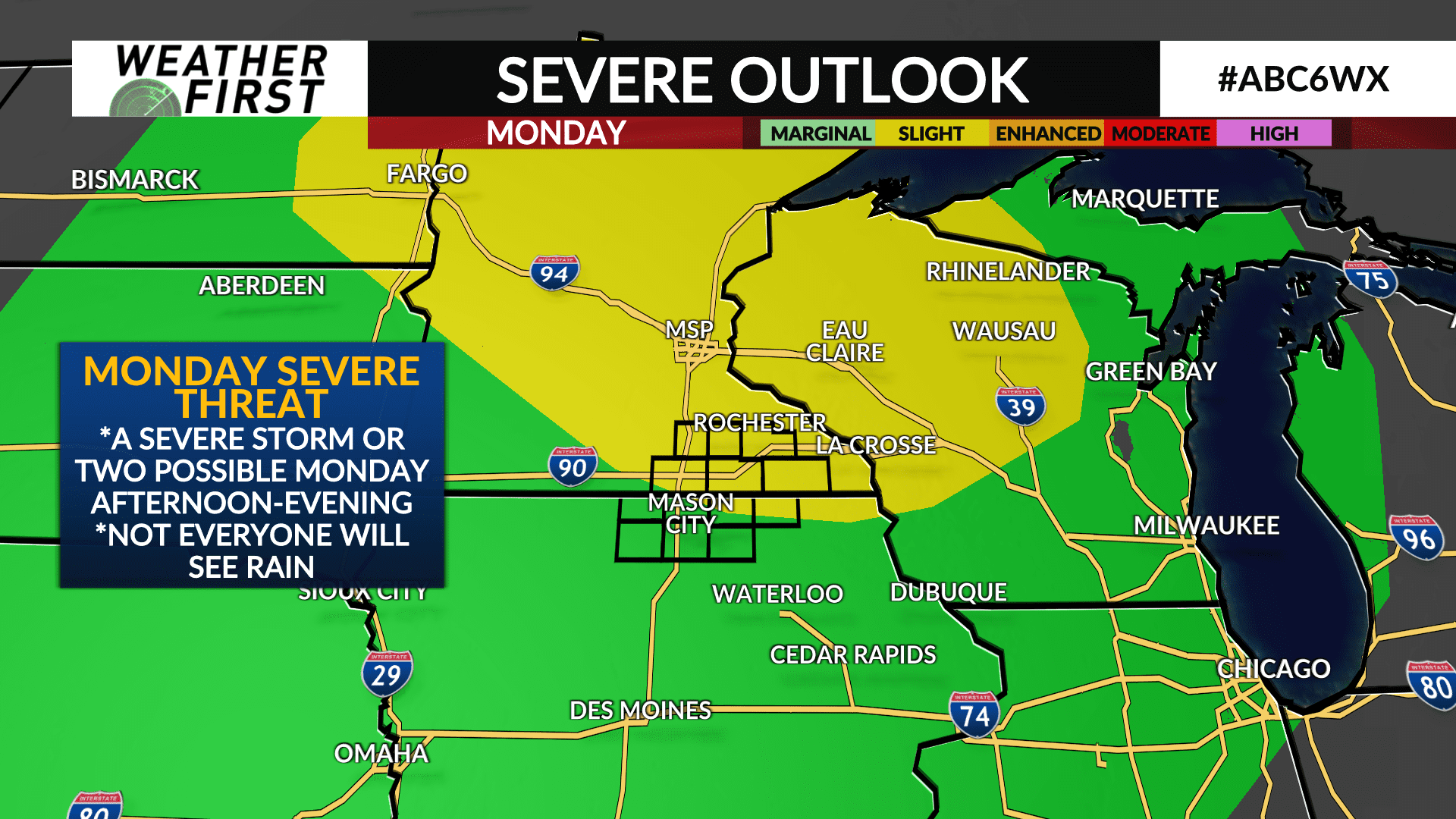

Increased Storm Chance Overnight Severe Weather Possible Monday

May 20, 2025

Increased Storm Chance Overnight Severe Weather Possible Monday

May 20, 2025 -

Expect Mild Temperatures And Little Rain Chance This Week

May 20, 2025

Expect Mild Temperatures And Little Rain Chance This Week

May 20, 2025