RTL's DPG Media Acquisition: Regulatory Decision Imminent

Table of Contents

Competition Concerns at the Heart of the Regulatory Review

The primary focus of the regulatory review centers around potential competition issues arising from the merger of two media giants. Both RTL and DPG Media hold substantial market shares across various media platforms, raising concerns about reduced competition and potential market dominance.

Market Dominance in the Netherlands and Belgium

DPG Media and RTL currently hold significant market share in the Netherlands and Belgium across print, online, and broadcast media. Their combined reach would be substantial, leading to concerns about anti-competitive practices.

- Netherlands: DPG Media dominates the print market with titles like De Telegraaf and AD, while RTL possesses strong broadcast television channels. The merger could lead to a near monopoly in certain sectors. The Netherlands Authority for Consumers and Markets (ACM) is the key regulatory body overseeing the review.

- Belgium: A similar situation exists in Belgium, where both companies hold substantial market shares in various media segments. The Belgian Competition Authority is carefully scrutinizing the potential impact on media plurality and fair competition.

- Overlapping Services: Both companies offer news websites, online streaming services, and broadcast television channels, resulting in significant overlaps that could lead to reduced competition and innovation.

- Potential Remedies: To address these concerns, RTL might be required to offer remedies such as divesting certain assets or agreeing to structural changes to ensure a competitive media landscape. This could involve selling off specific publications, websites, or television channels.

Impact on Advertising Revenue and Market Prices

The merger could significantly impact advertising revenue and market prices. A combined RTL and DPG Media entity would control a massive portion of the advertising market, potentially leading to:

- Increased Advertising Rates: Reduced competition could allow the merged entity to increase advertising rates, harming smaller businesses and limiting advertising opportunities for new entrants.

- Higher Prices for Consumers: The resulting lack of competitive pressure might translate to higher prices for consumers who subscribe to media services or purchase products through advertising-supported platforms.

- Negative Impact on Smaller Media Companies: The dominant market position of the merged entity could put significant pressure on smaller media companies, potentially leading to closures and a decrease in media diversity.

The Role of Public Opinion and Media Scrutiny

Public opinion and media scrutiny play a crucial role in shaping the regulatory decision. Concerns voiced by various stakeholders significantly influence the regulatory authorities' assessment.

Public Debate and Concerns

The proposed merger has sparked considerable public debate, with concerns raised by:

- Competitors: Smaller media companies fear being squeezed out of the market by a dominant player.

- Consumer Groups: Consumer advocacy groups are worried about potential price hikes and reduced media diversity.

- Journalists: Concerns have been raised about potential impacts on journalistic independence and freedom of the press.

Media Coverage and its Influence

Extensive media coverage has shaped public opinion and influenced the regulatory process. News outlets have played a vital role in highlighting the potential risks and benefits of the acquisition.

- Positive Coverage: Some outlets have focused on the potential synergies and efficiency gains from the merger, suggesting potential benefits for viewers and readers.

- Critical Coverage: Other outlets have expressed concerns about the potential negative impact on competition, diversity, and journalistic independence. This diverse coverage reflects the complexity of the issue and highlights the importance of transparency.

Potential Outcomes and Their Implications

The regulatory decision could result in several outcomes, each with significant implications.

Approval with Conditions

Regulatory authorities might approve the merger subject to specific conditions designed to mitigate competition concerns. These conditions could include:

- Asset Divestments: RTL might be required to sell off certain publications, websites, or television channels to reduce market concentration.

- Behavioral Remedies: The merged entity might be subject to behavioral commitments, such as restrictions on pricing or advertising practices.

- Structural Changes: RTL might need to restructure its operations to ensure a more competitive media environment.

Rejection of the Acquisition

Rejecting the acquisition would have significant consequences for both RTL and DPG Media:

- Financial Implications: Both companies would incur substantial financial losses due to the termination of the deal.

- Strategic Setbacks: The failed acquisition could damage the reputations of both companies and hinder their future strategic growth plans.

Delayed Decision and Uncertainty

A prolonged decision-making process would create considerable uncertainty for:

- Both Companies: Uncertainty regarding the future could impact their investment decisions and operational planning.

- Employees: Employees in both companies would face uncertainty about their jobs and the future direction of their employers.

- Media Market: The delay would create instability in the media market, potentially impacting investor confidence and delaying investment decisions.

Conclusion

The RTL and DPG Media acquisition is a landmark deal with significant implications for the European media landscape. The regulatory decision, expected soon, will determine the future of competition in the Netherlands and Belgium's media market. Competition concerns, public opinion, and potential remedies are key factors shaping this critical juncture. The outcome will have far-reaching consequences for media plurality, advertising markets, and consumer choices.

Call to Action: Stay informed about the latest developments regarding the RTL and DPG Media merger. Continue to follow our coverage for updates on the regulatory decision and its impact on the future of media consolidation. Learn more about the implications of this significant DPG Media acquisition and RTL’s strategy.

Featured Posts

-

Valencia Stun Real Madrid Mamardashvili The Match Winner

May 29, 2025

Valencia Stun Real Madrid Mamardashvili The Match Winner

May 29, 2025 -

Bell Shakespeare A Revitalised Henry V With Cracking Pace

May 29, 2025

Bell Shakespeare A Revitalised Henry V With Cracking Pace

May 29, 2025 -

Info Cuaca Jawa Timur Hujan Dan Petir 29 Maret 2024

May 29, 2025

Info Cuaca Jawa Timur Hujan Dan Petir 29 Maret 2024

May 29, 2025 -

Zaragoza Diploma Europeo Por Su Compromiso Con La Cultura

May 29, 2025

Zaragoza Diploma Europeo Por Su Compromiso Con La Cultura

May 29, 2025 -

Moto Gp Americas Gp Marquez On Pole Maintaining Perfect Record

May 29, 2025

Moto Gp Americas Gp Marquez On Pole Maintaining Perfect Record

May 29, 2025

Latest Posts

-

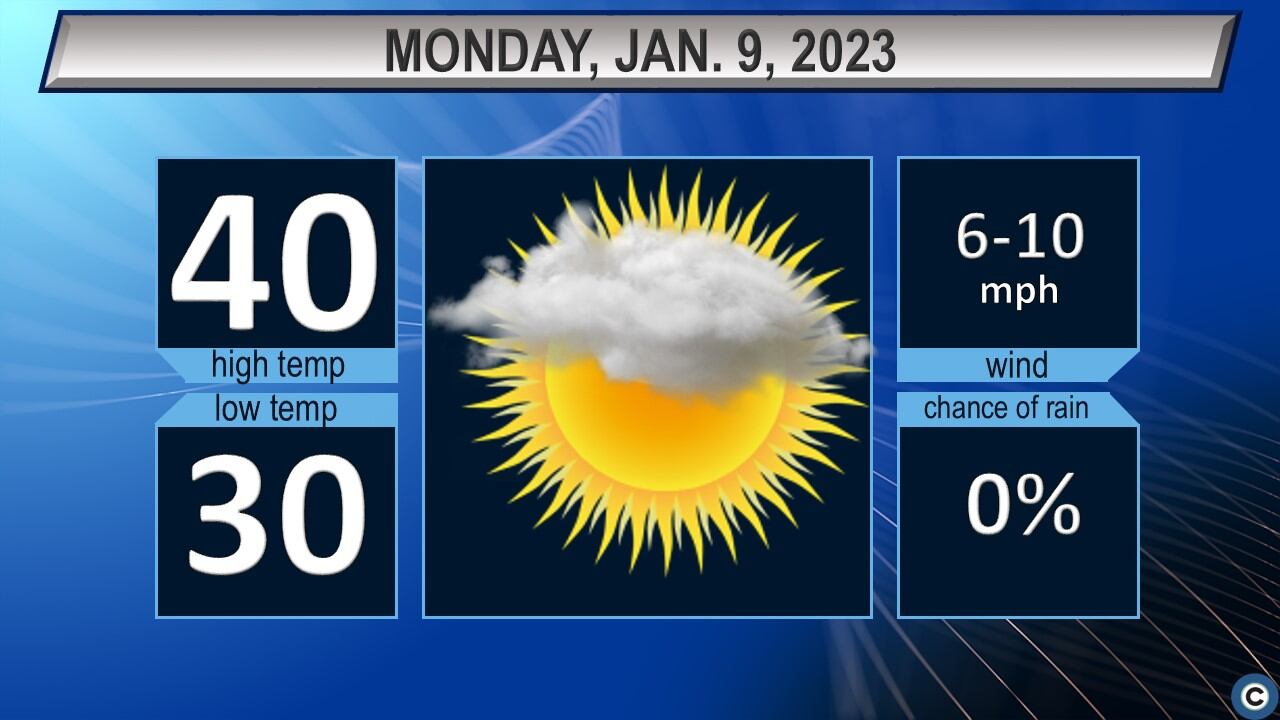

Northeast Ohio To See Rain Thursday Weather Update

May 31, 2025

Northeast Ohio To See Rain Thursday Weather Update

May 31, 2025 -

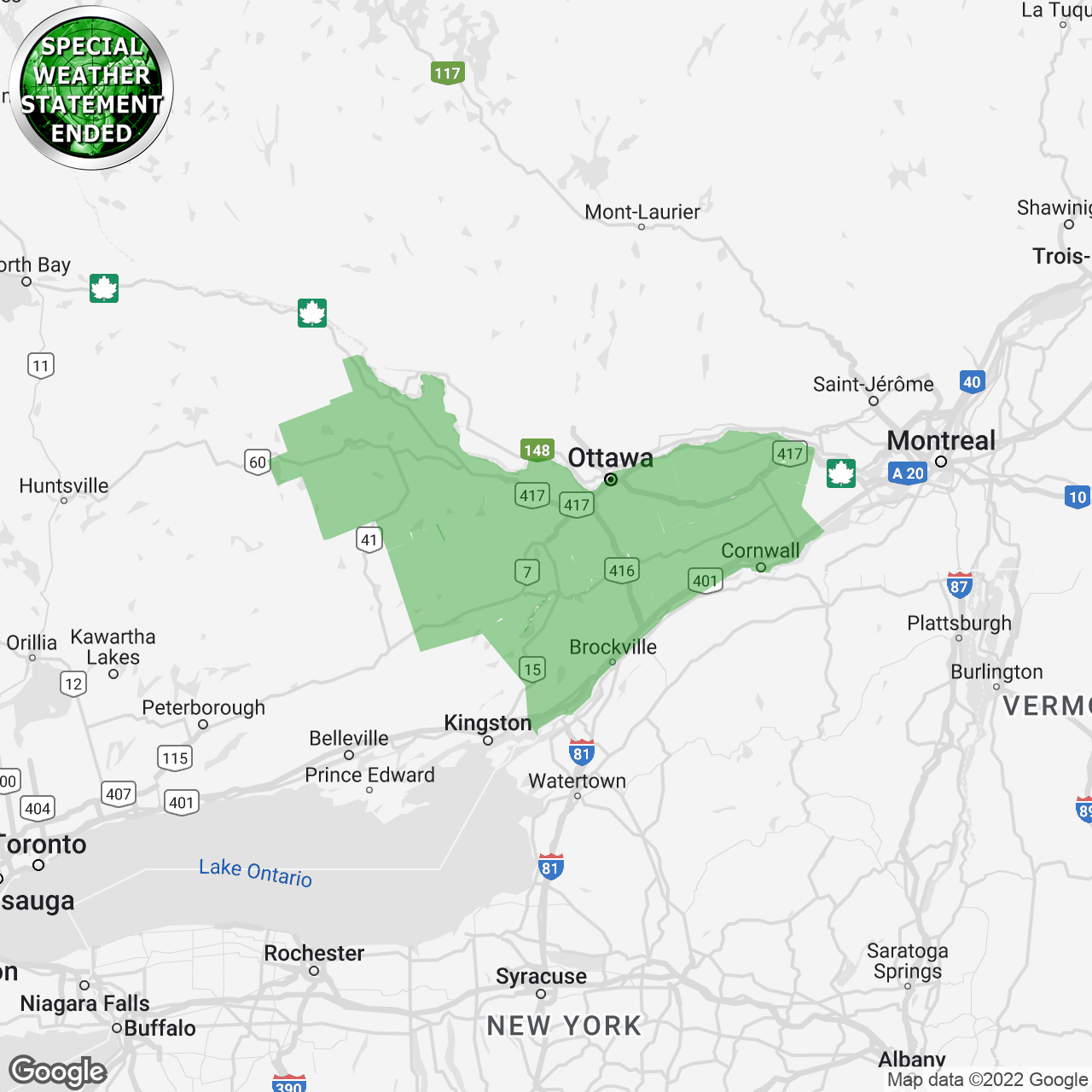

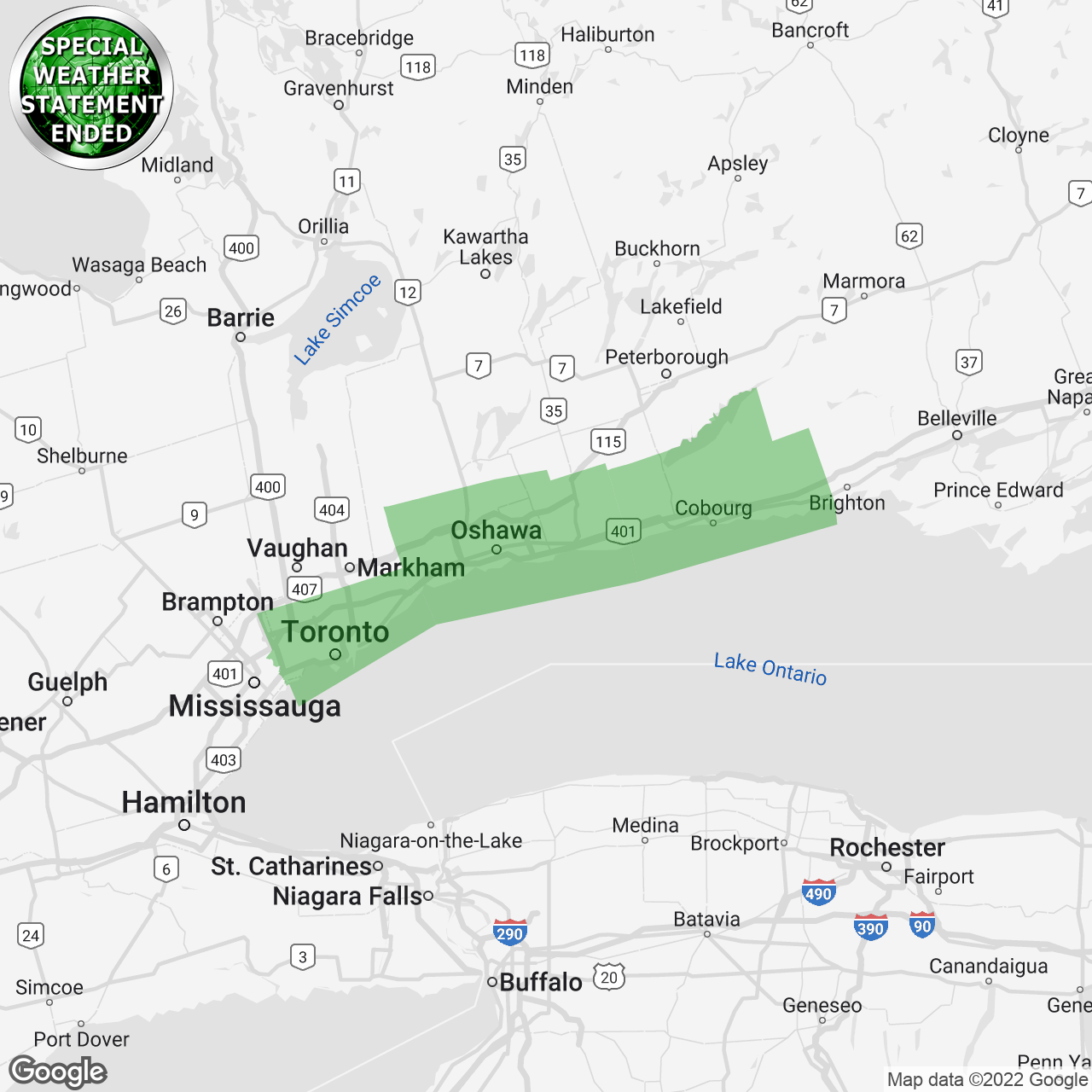

Special Weather Statement Increased Fire Risk In Cleveland And Akron

May 31, 2025

Special Weather Statement Increased Fire Risk In Cleveland And Akron

May 31, 2025 -

Increased Fire Risk Prompts Special Weather Statement In Cleveland Akron

May 31, 2025

Increased Fire Risk Prompts Special Weather Statement In Cleveland Akron

May 31, 2025 -

Northeast Ohio Weather Forecast Thursday Rain Returns

May 31, 2025

Northeast Ohio Weather Forecast Thursday Rain Returns

May 31, 2025 -

Cleveland And Akron Special Weather Statement High Fire Danger

May 31, 2025

Cleveland And Akron Special Weather Statement High Fire Danger

May 31, 2025