Rolls-Royce: 2025 Financial Outlook And Tariff Impact Assessment

Table of Contents

Rolls-Royce's Current Financial Performance and Market Position

Rolls-Royce's current financial performance is a critical factor in predicting its 2025 outlook. Analyzing the Rolls-Royce sales figures and profit margins provides a baseline for future projections. Recent reports highlight consistent, albeit moderate, growth, driven primarily by strong demand in key markets like Asia and the Middle East. However, increased production costs and ongoing supply chain issues present challenges. The luxury car market trends are also a significant factor.

- Sales data for key models and regions: While specific sales figures are proprietary, publicly available data shows a preference for certain models in specific geographic regions. For example, the Cullinan SUV has driven significant sales growth in emerging markets.

- Comparison with competitors: Rolls-Royce competes with other ultra-luxury brands like Bentley and Ferrari. Comparing market share and sales performance against these competitors helps determine Rolls-Royce's competitive positioning and potential growth opportunities.

- Analysis of brand equity and customer loyalty: Rolls-Royce possesses unparalleled brand equity, translating into high customer loyalty and strong pricing power. This brand strength is a critical asset in navigating economic uncertainties.

Projected Sales and Revenue for 2025

The Rolls-Royce sales forecast for 2025 hinges on several factors. Market forecasts for the luxury car segment predict continued, though potentially slower, growth. Macroeconomic factors like global economic growth and inflation will significantly influence consumer spending on luxury goods. Rolls-Royce's strategic initiatives, such as new model launches and expansions into new markets, are intended to mitigate these challenges and drive revenue growth.

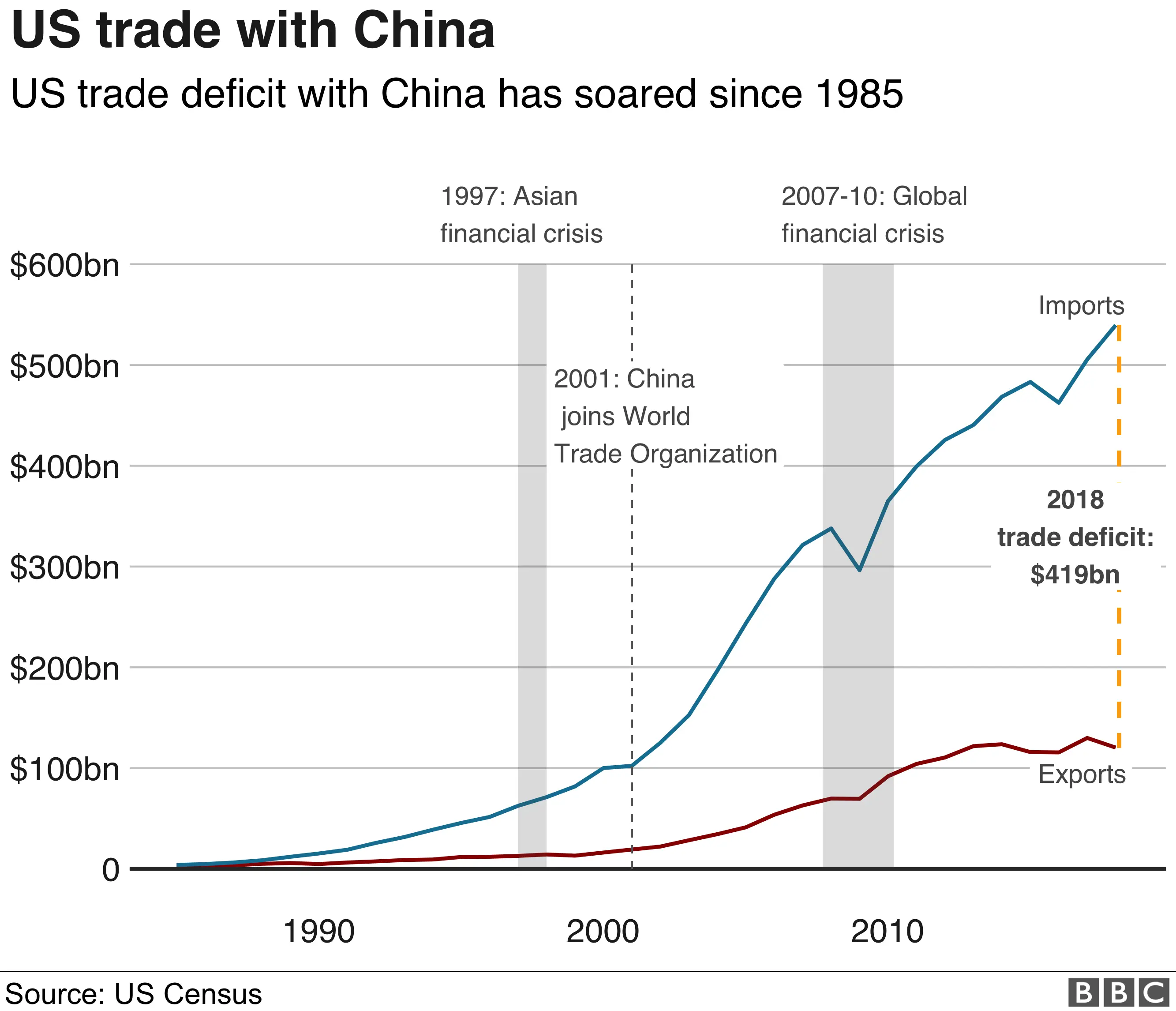

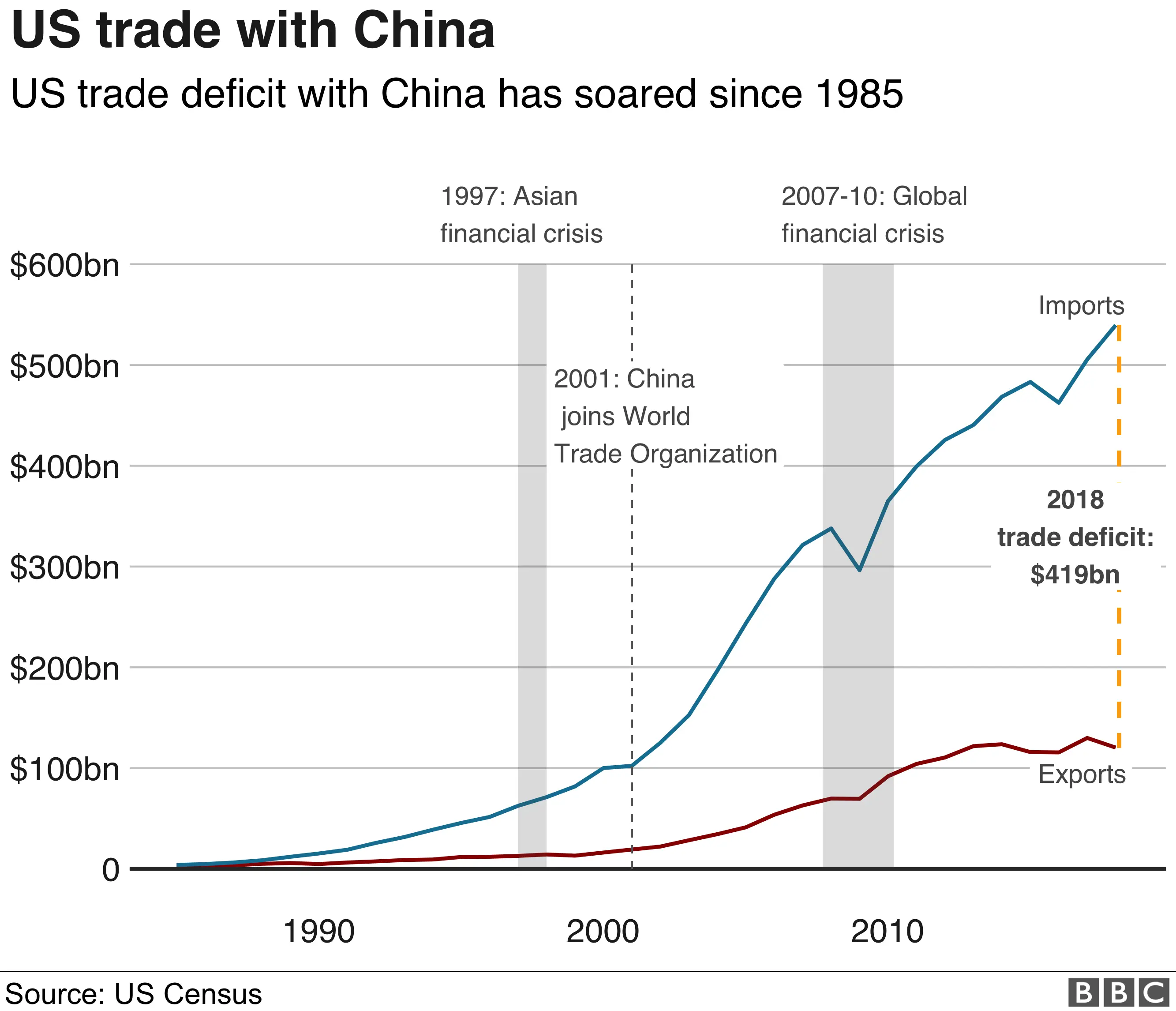

- Sales projections by region: Sales projections vary by region, with continued strong growth anticipated in Asia, particularly China, while North America and Europe may experience more moderate growth.

- Estimated growth rates for different product segments: The introduction of new models and variants will impact the growth rate of different product segments. Electric vehicle adoption within the luxury segment will also shape future sales.

- Impact of potential supply chain disruptions: The ongoing volatility in global supply chains poses a significant risk to Rolls-Royce's production capacity and thus its revenue projections. Diversification strategies are crucial to mitigate this risk.

Assessment of Tariff Impacts on Rolls-Royce

Tariffs represent a significant risk to Rolls-Royce's 2025 financial outlook. Import/export duties and tariffs on raw materials directly impact production costs. These costs could significantly affect Rolls-Royce's profit margins and pricing strategies. The tariff impact on luxury cars, in general, necessitates strategic responses.

- Analysis of specific tariffs and their potential impact on raw materials: Specific tariffs on materials like aluminum, steel, and rare earths used in Rolls-Royce vehicles could inflate production costs substantially.

- Potential changes to pricing strategies to offset tariff impacts: To maintain profitability, Rolls-Royce may need to adjust its pricing strategies, potentially impacting sales volume.

- Assessment of the impact of tariffs on Rolls-Royce's competitive position: The imposition of tariffs could shift the competitive landscape, impacting Rolls-Royce's relative position against its competitors.

Potential Risks and Uncertainties

Beyond tariffs, several risks and uncertainties could impact the Rolls-Royce 2025 financial outlook. Geopolitical factors, regulatory changes, and technological disruptions all pose potential challenges. A thorough Rolls-Royce risk assessment is crucial.

- Risks related to Brexit and global trade relations: Ongoing uncertainty surrounding Brexit and global trade relations could disrupt supply chains and impact market access.

- Risks related to the electrification of luxury vehicles: The transition to electric vehicles requires substantial investment and adaptation, presenting both opportunities and challenges.

- Risks related to changing consumer preferences: Evolving consumer preferences and demands require Rolls-Royce to adapt its product offerings and marketing strategies to maintain its position in the market.

Investing in the Future: The Rolls-Royce 2025 Financial Outlook

In conclusion, the Rolls-Royce 2025 financial outlook presents a mixed picture of potential growth and considerable challenges. While the brand's inherent strength and strategic initiatives offer opportunities, the impact of tariffs, macroeconomic factors, and various risks must be carefully considered. The potential for supply chain disruptions and the evolving regulatory landscape necessitates a proactive approach to risk management. To stay abreast of the Rolls-Royce 2025 financial outlook and the continuing impact of tariffs on the luxury automotive industry, follow the company's official financial releases and subscribe to reputable financial news sources for the latest updates. Understanding the Rolls-Royce financial projections is vital for navigating this dynamic environment.

Featured Posts

-

M M A

May 03, 2025

M M A

May 03, 2025 -

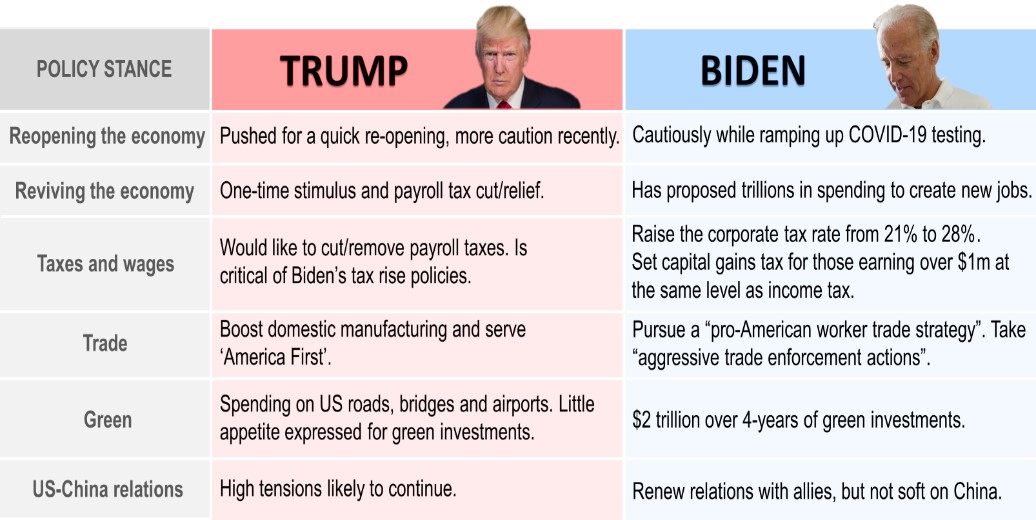

Slowing Economy Assessing President Bidens Economic Policies

May 03, 2025

Slowing Economy Assessing President Bidens Economic Policies

May 03, 2025 -

Indias Firm Stance Justice Remains Priority Despite De Escalation Plea

May 03, 2025

Indias Firm Stance Justice Remains Priority Despite De Escalation Plea

May 03, 2025 -

La Politique Exterieure De Macron Vers Une Intensification De La Pression Sur La Russie

May 03, 2025

La Politique Exterieure De Macron Vers Une Intensification De La Pression Sur La Russie

May 03, 2025 -

Alan Roden Author Profile And Works At The Spectator

May 03, 2025

Alan Roden Author Profile And Works At The Spectator

May 03, 2025