Rockwell Automation's Strong Earnings Drive Market Uptick

Table of Contents

Record Revenue Growth Fuels Positive Market Sentiment

Rockwell Automation's recent earnings report showcased significant revenue growth, exceeding expectations and fueling positive market sentiment. This increase marks a substantial improvement compared to previous quarters and years, signifying a robust demand for industrial automation solutions.

Several factors contributed to this impressive growth:

- Increased Demand for Industrial Automation Solutions: The global push towards automation across various industries, including manufacturing, food and beverage, and pharmaceuticals, is a major driver. Companies are increasingly investing in automation to improve efficiency, productivity, and reduce operational costs.

- Successful Product Launches and Innovative Technologies: Rockwell Automation's continuous investment in research and development has resulted in the launch of innovative products and technologies that meet evolving market needs. This includes advancements in industrial control systems, robotics, and digital transformation solutions.

- Strong Performance Across Key Geographical Regions: Rockwell Automation demonstrated consistent growth across key geographical markets, indicating strong global demand for their offerings. Specific regional breakdowns in their earnings report highlight the widespread adoption of their solutions.

- Strategic Acquisitions and Partnerships: Strategic acquisitions and partnerships have broadened Rockwell Automation's product portfolio and market reach, further contributing to the revenue surge. These strategic moves demonstrate a proactive approach to market expansion.

For example, the company reported a [insert percentage]% increase in revenue, reaching [insert revenue figure] in the last quarter, compared to [insert previous quarter's figure] and [insert previous year's figure]. As stated by [Name and Title of Rockwell Automation Executive], "[Insert relevant quote from earnings call highlighting revenue growth]".

Profitability and Margin Expansion Indicate Operational Efficiency

Beyond the impressive revenue growth, Rockwell Automation demonstrated significant improvements in profitability and margin expansion. This reflects enhanced operational efficiency and a strong focus on cost management. This positive trend points towards the company's long-term financial sustainability and increased shareholder value.

Key factors driving this improved profitability include:

- Cost Optimization Initiatives: Rockwell Automation has implemented effective cost optimization strategies across its operations, resulting in improved efficiency and reduced expenditure.

- Improved Operational Efficiency: Streamlined processes and optimized resource allocation have contributed to higher operational efficiency, translating into better profit margins.

- Effective Supply Chain Management: Strong supply chain management has mitigated risks and ensured timely delivery of products and services, contributing to overall operational efficiency.

The company reported a [insert percentage]% increase in profit margins, reaching [insert margin figure], showcasing the positive impact of their operational efficiency initiatives. This improvement directly contributes to increased shareholder value and investor confidence.

Positive Outlook for Future Growth in Industrial Automation

The positive trends witnessed in Rockwell Automation's recent earnings are further supported by the positive outlook for the broader industrial automation market. This robust growth is fuelled by:

- The continued adoption of Industry 4.0 technologies: The increasing adoption of technologies like the Industrial Internet of Things (IIoT) and smart manufacturing solutions is driving strong growth in the industrial automation sector.

- Growing demand for digital transformation solutions: Companies are increasingly seeking digital transformation solutions to improve efficiency, reduce operational costs, and gain a competitive edge.

- Expansion into new markets and technologies: Rockwell Automation's strategic initiatives include expanding into new markets and emerging technologies, securing future growth opportunities.

Rockwell Automation is well-positioned to capitalize on these trends, with plans for further expansion into [mention specific areas].

Market Reaction and Investor Confidence

The market reacted positively to Rockwell Automation's strong earnings announcement, with the company's stock price experiencing a significant [insert percentage]% increase. This demonstrates strong investor confidence in the company's future prospects and its ability to sustain this growth trajectory.

Analyst ratings and forecasts also reflect positive sentiment. [Mention specific analyst ratings or forecasts, citing sources]. For example, [Analyst Name from Firm Name] stated "[Insert relevant quote about positive outlook for Rockwell Automation]".

Rockwell Automation's Competitive Advantage in the Industrial Automation Landscape

Rockwell Automation enjoys a significant competitive advantage in the industrial automation landscape due to several key factors:

- Technological Leadership: Rockwell Automation's strong technological leadership and continuous innovation ensures its products remain at the forefront of the industry.

- Market Share: The company holds a substantial market share, demonstrating its dominance and brand recognition.

- Focus on Innovation and Digital Transformation: The company's strong focus on digital transformation solutions is key to maintaining its position in the rapidly evolving market.

- Strong Customer Relationships: Cultivating strong customer relationships built on trust and reliability ensures ongoing business and loyalty.

Compared to its key competitors, Rockwell Automation's [mention specific competitive advantages]. This competitive positioning strengthens its prospects for continued growth.

Conclusion: Rockwell Automation's Strong Earnings Signal Positive Momentum

Rockwell Automation's strong earnings report signals positive momentum for the company and the broader industrial automation sector. Record revenue growth, improved profitability, and a positive future outlook driven by increased demand and strategic initiatives have all contributed to this success. The market's positive reaction underscores investor confidence in Rockwell Automation's ability to maintain this trajectory. Understanding the implications of Rockwell Automation's strong earnings is crucial for investors and industry professionals alike. Stay informed about Rockwell Automation's continued growth and its impact on the industrial automation landscape by visiting their website or following their news releases.

Featured Posts

-

Valerio Therapeutics S A Postpones Publication Of 2024 Annual Financial Report

May 17, 2025

Valerio Therapeutics S A Postpones Publication Of 2024 Annual Financial Report

May 17, 2025 -

Trumps Public Humiliation A Lawrence O Donnell Show Moment

May 17, 2025

Trumps Public Humiliation A Lawrence O Donnell Show Moment

May 17, 2025 -

Conference Track Meet Complete Roundup Of Award Winners

May 17, 2025

Conference Track Meet Complete Roundup Of Award Winners

May 17, 2025 -

The Caitlin Clark Question Angel Reeses Blunt Response

May 17, 2025

The Caitlin Clark Question Angel Reeses Blunt Response

May 17, 2025 -

Jackbit Casino Your Guide To The Best Bitcoin Gambling In 2025

May 17, 2025

Jackbit Casino Your Guide To The Best Bitcoin Gambling In 2025

May 17, 2025

Latest Posts

-

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025 -

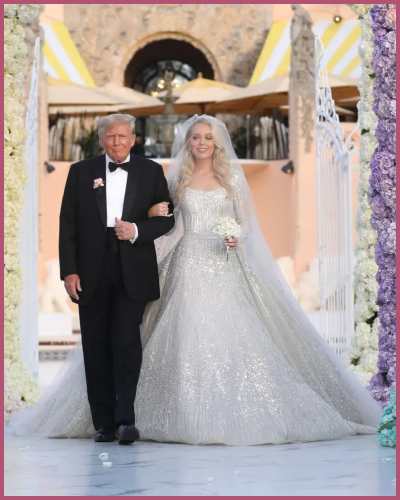

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025 -

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025 -

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025 -

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025