Rising Retail Sales: Implications For Bank Of Canada Interest Rates

Table of Contents

Inflationary Pressures from Robust Retail Sales

Increased consumer spending is a key driver of inflation. When demand for goods and services outpaces supply, businesses respond by raising prices. This phenomenon, known as demand-pull inflation, is directly linked to strong retail sales figures.

- Increased demand leading to higher prices: A surge in retail sales indicates a significant increase in consumer demand across various sectors. This heightened demand puts upward pressure on prices as businesses struggle to meet the increased volume of orders.

- Impact on various sectors (e.g., food, energy, durable goods): The impact isn't uniform across all sectors. For instance, strong retail sales in the food and energy sectors can significantly contribute to inflation, affecting household budgets directly. Similarly, increased demand for durable goods, such as automobiles and appliances, can lead to price increases in these markets.

- Contribution to the overall Consumer Price Index (CPI): The CPI, a key measure of inflation, directly reflects the price changes in goods and services purchased by consumers. Strong retail sales figures directly translate into higher CPI readings, signaling inflationary pressures within the economy.

The interplay between rising retail sales, increased consumer spending, and inflation is undeniable. Understanding this dynamic is crucial for predicting the Bank of Canada's response. Strong retail sales, when coupled with other inflationary pressures, contribute to a higher CPI, potentially pushing the inflation rate above the Bank of Canada's target.

The Bank of Canada's Mandate and Response to Inflation

The Bank of Canada's primary mandate is to maintain price stability. This means keeping inflation within its target range, currently 2%. Rising retail sales, contributing to higher inflation, directly influence the Bank's policy decisions.

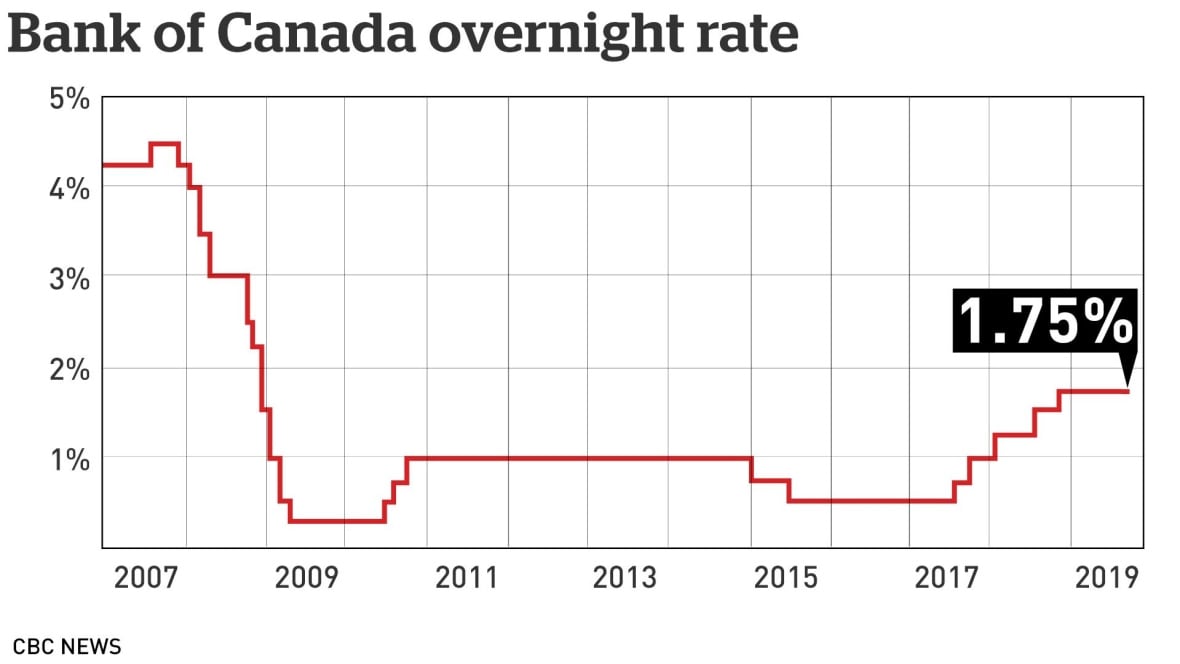

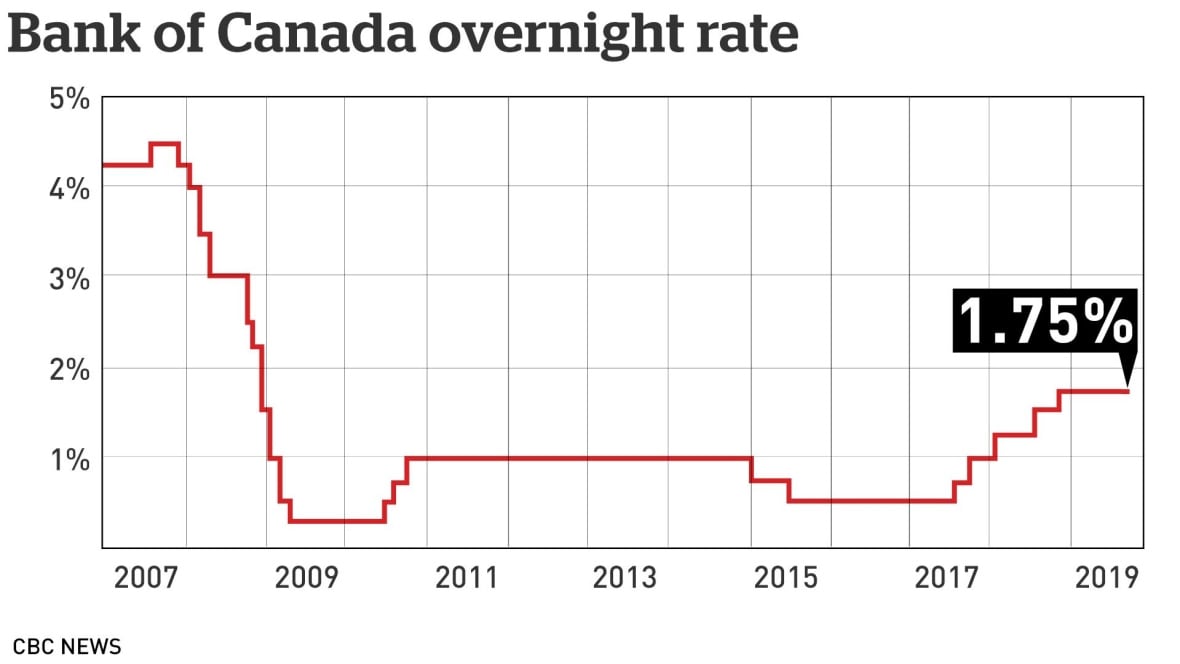

- Overview of the Bank's monetary policy tools (interest rate adjustments): The Bank's primary tool for managing inflation is adjusting its key interest rate—the overnight rate. By increasing this rate, the Bank makes borrowing more expensive, cooling down consumer spending and investment.

- Explanation of how interest rate hikes curb inflation: Higher interest rates reduce consumer spending by making loans and mortgages more expensive. Businesses also reduce investment due to increased borrowing costs. This reduced demand helps to alleviate inflationary pressures.

- Potential side effects of interest rate increases (e.g., economic slowdown): While interest rate hikes are effective in curbing inflation, they also have potential side effects. Increased borrowing costs can lead to a slowdown in economic growth, potentially impacting employment and investment. The Bank of Canada must carefully balance the need to control inflation with the potential risks to economic growth.

The Bank of Canada carefully monitors economic indicators like inflation, retail sales, and employment to guide its monetary policy decisions, aiming for a soft landing—reducing inflation without triggering a recession.

Analyzing Recent Retail Sales Data and Economic Indicators

Statistics Canada's recent reports reveal a robust growth in retail sales. This, coupled with other key economic indicators, paints a complex picture. Analyzing this data is crucial for understanding potential future interest rate movements.

- Specific data points and their interpretation: The 1.3% increase in July 2024, for example, needs to be analyzed in conjunction with previous months' data to establish trends. Seasonal adjustments and underlying drivers of the sales growth are also important factors to consider.

- Comparison to previous periods and trends: Comparing the recent retail sales data with previous years' figures helps establish long-term trends. Are sales consistently exceeding expectations, or is this a temporary spike?

- Mention any significant deviations from expectations: Significant deviations from economist forecasts or previous trends signal a need for a deeper investigation into the underlying causes. This may indicate a stronger-than-expected economic recovery or underlying inflationary pressures.

In addition to retail sales, the Bank of Canada considers other indicators such as the employment rate and consumer confidence to formulate its monetary policy. A strong labor market and high consumer confidence can support increased consumer spending, further contributing to inflationary pressures.

Predicting Future Interest Rate Movements Based on Retail Sales

Based on the analysis of recent retail sales data and other economic indicators, several scenarios are possible regarding future interest rate adjustments by the Bank of Canada.

- Possible scenarios: further interest rate hikes, holding rates steady, or potential rate cuts: Given the strong retail sales and potential inflationary pressures, a further interest rate hike remains a strong possibility. However, if other economic indicators suggest a cooling economy, the Bank might choose to hold rates steady or even consider a rate cut in the future.

- Justification for each scenario based on the evidence presented: The probability of each scenario will depend on the evolution of inflation, employment figures, and overall economic growth. If inflation persists despite previous rate hikes, further increases are likely. If inflation begins to ease, the Bank might pause or even reverse course.

- Mention the uncertainties and limitations of forecasting: Economic forecasting inherently involves uncertainty. Unexpected events, both domestic and global, can significantly impact the economic outlook and influence the Bank of Canada's decisions.

Predicting future interest rates requires careful consideration of numerous variables and their intricate relationships. The Bank of Canada's communication plays a vital role in guiding market expectations.

Conclusion: The Interplay of Rising Retail Sales and Bank of Canada Interest Rates – What's Next?

Rising retail sales exert significant upward pressure on inflation, directly impacting the Bank of Canada's monetary policy decisions. The Bank's response, in the form of interest rate adjustments, aims to maintain price stability while considering the potential effects on economic growth. Analyzing recent retail sales data alongside other economic indicators provides valuable insights into the likely direction of future interest rate movements. However, it is important to remember that economic forecasting remains uncertain, and unexpected events can influence the trajectory of the economy.

To stay informed about the impact of rising retail sales and Bank of Canada interest rates on your personal finances and investments, regularly monitor the latest economic data released by Statistics Canada [link to Statistics Canada website] and follow announcements from the Bank of Canada [link to Bank of Canada website]. Understanding this crucial connection will empower you to make informed financial decisions.

Featured Posts

-

Nanari Kynning A Fyrstu 100 Rafutgafu Porsche Macan

May 25, 2025

Nanari Kynning A Fyrstu 100 Rafutgafu Porsche Macan

May 25, 2025 -

Demna At Gucci A New Era In Fashion Design

May 25, 2025

Demna At Gucci A New Era In Fashion Design

May 25, 2025 -

Fatal Officer Involved Shooting In Myrtle Beach 1 Dead 11 Injured Sled Investigation

May 25, 2025

Fatal Officer Involved Shooting In Myrtle Beach 1 Dead 11 Injured Sled Investigation

May 25, 2025 -

Macrons Party Supports New Legislation Banning Hijabs For Under 15s

May 25, 2025

Macrons Party Supports New Legislation Banning Hijabs For Under 15s

May 25, 2025 -

The Future Of Healthcare Philips Future Health Index 2025 Report On Ai

May 25, 2025

The Future Of Healthcare Philips Future Health Index 2025 Report On Ai

May 25, 2025

Latest Posts

-

President Snows Casting A 3 Time Oscar Nominee Joins The Hunger Games Prequel

May 25, 2025

President Snows Casting A 3 Time Oscar Nominee Joins The Hunger Games Prequel

May 25, 2025 -

Dr Terrors House Of Horrors Tips For Surviving The Experience

May 25, 2025

Dr Terrors House Of Horrors Tips For Surviving The Experience

May 25, 2025 -

Unlocking The Mysteries Of Dr Terrors House Of Horrors

May 25, 2025

Unlocking The Mysteries Of Dr Terrors House Of Horrors

May 25, 2025 -

Top 5 Action Packed Episodes Of Lock Up Season 5 Your Viewing Guide

May 25, 2025

Top 5 Action Packed Episodes Of Lock Up Season 5 Your Viewing Guide

May 25, 2025 -

Dr Terrors House Of Horrors A Review Of The Ultimate Horror Attraction

May 25, 2025

Dr Terrors House Of Horrors A Review Of The Ultimate Horror Attraction

May 25, 2025