Ripple's XRP Price Surge: Analysis Of The Trump Effect

Table of Contents

Trump's Stance on Cryptocurrencies and its Impact on XRP

Trump's often unpredictable approach to policy affected investor confidence across various sectors, including the cryptocurrency market. His statements, whether directly about crypto or regarding broader financial regulations, indirectly influenced XRP's trajectory.

Positive Statements and Their Ripple Effect

While Trump never explicitly endorsed XRP or Ripple, his generally positive outlook on technological innovation and deregulation had a ripple effect on the crypto market's overall sentiment.

- Example 1: Mention of blockchain technology as a potential tool for improving financial systems (cite specific source if available). This kind of statement could generally boost investor confidence in the crypto space.

- Example 2: Statements advocating for less stringent regulations (cite specific source if available). This could be interpreted as positive for the crypto market, reducing fear surrounding potential government crackdowns.

- Example 3: Tweets expressing interest in innovative technologies (cite specific source if available). Such tweets, even without directly mentioning crypto, could generate excitement and lead to increased investment in altcoins, including XRP.

These positive sentiments, however indirect, could have spurred increased demand for XRP, contributing to its price increase. Positive news coverage linking Trump's statements to a rise in crypto market capitalization further supports this correlation.

Regulatory Uncertainty and XRP's Volatility

Conversely, the Trump administration's fluctuating stance on cryptocurrency regulation created significant uncertainty. This volatility impacted investor sentiment and XRP's price.

- Example 1: Periods of heightened regulatory scrutiny (cite specific example and its impact on XRP price).

- Example 2: Announcements regarding potential tax implications for cryptocurrencies (cite specific example and its impact on XRP price).

- Example 3: Statements from government officials expressing concern about the use of cryptocurrencies for illicit activities (cite specific example and its impact on XRP price).

This regulatory uncertainty often led to sharp price swings in XRP, making it a volatile asset during the Trump presidency. The lack of clear regulatory frameworks created a climate of fear and uncertainty, influencing short-term trading decisions.

Market Sentiment and the Trump Factor

Trump's pronouncements significantly influenced investor psychology, impacting risk appetite.

Trump's Influence on Investor Psychology

Trump's unpredictable nature fostered a climate of risk-on/risk-off sentiment. His surprising actions and statements often led to short-term market volatility, benefiting traders seeking quick gains.

- Risk-On Sentiment: During periods of perceived positive sentiment towards the economy or deregulation, investors tended to move towards riskier assets, including XRP.

- Risk-Off Sentiment: Conversely, periods of uncertainty or negative news surrounding Trump's actions could trigger a risk-off response, leading to a drop in XRP's price.

This unpredictability arguably made XRP an attractive option for short-term traders, who could profit from these rapid price swings. Statistical analysis (if available) could further demonstrate the correlation between Trump's public appearances/statements and XRP's price movement.

Comparison with Other Cryptocurrencies

To isolate the "Trump effect" on XRP, it's crucial to compare its performance with other cryptocurrencies during the same period. Did XRP experience a proportionally larger price increase than Bitcoin or Ethereum during periods of positive Trump-related news? Charts comparing XRP's performance against major cryptocurrencies could illustrate whether the impact was unique to XRP or a general market phenomenon.

Technical Analysis and XRP's Price Action

Technical analysis helps identify key price levels and trading patterns influenced by Trump-related events.

Identifying Key Price Levels and Support/Resistance

Analyzing XRP's price charts reveals key price levels that coincided with Trump-related news. (Include charts illustrating support and resistance levels impacted by Trump-related events). These charts should clearly show how specific price points acted as support or resistance following significant Trump announcements or actions.

Trading Volume and Market Liquidity

Analyzing trading volume during periods linked to Trump's actions shows a correlation between high volume and price surges. (Include charts illustrating trading volume patterns during Trump-related events). High trading volume often indicates increased market activity and investor interest, potentially driven by responses to Trump’s actions or pronouncements.

Conclusion

This analysis suggests that while many factors influence XRP's price, former President Trump's actions and statements demonstrably shaped investor sentiment and market dynamics. The "Trump effect" highlights the cryptocurrency market's susceptibility to political influence and the interplay between regulatory uncertainty and investor psychology.

Call to Action: Understanding the complex relationship between political events and cryptocurrency prices, including the impact of the "Trump effect" on XRP, is crucial for making informed investment decisions. Stay informed about political developments and market trends to effectively navigate the volatile world of XRP and other cryptocurrencies. Continue to monitor Ripple and XRP developments to make educated decisions about your investment strategy.

Featured Posts

-

Ukraine Conflict How Spring Weather Impacts Russias Military Campaign

May 01, 2025

Ukraine Conflict How Spring Weather Impacts Russias Military Campaign

May 01, 2025 -

Retailers Warn Temporary Reprieve On Tariff Price Hikes

May 01, 2025

Retailers Warn Temporary Reprieve On Tariff Price Hikes

May 01, 2025 -

Miss Samoa Claims Miss Pacific Islands 2025 Crown

May 01, 2025

Miss Samoa Claims Miss Pacific Islands 2025 Crown

May 01, 2025 -

Priscilla Pointer Amy Irvings Mother And Carrie Star Passes Away At 100

May 01, 2025

Priscilla Pointer Amy Irvings Mother And Carrie Star Passes Away At 100

May 01, 2025 -

Eagles White House Celebration Jalen Hurts Absence And Trumps Tush Push Comment

May 01, 2025

Eagles White House Celebration Jalen Hurts Absence And Trumps Tush Push Comment

May 01, 2025

Latest Posts

-

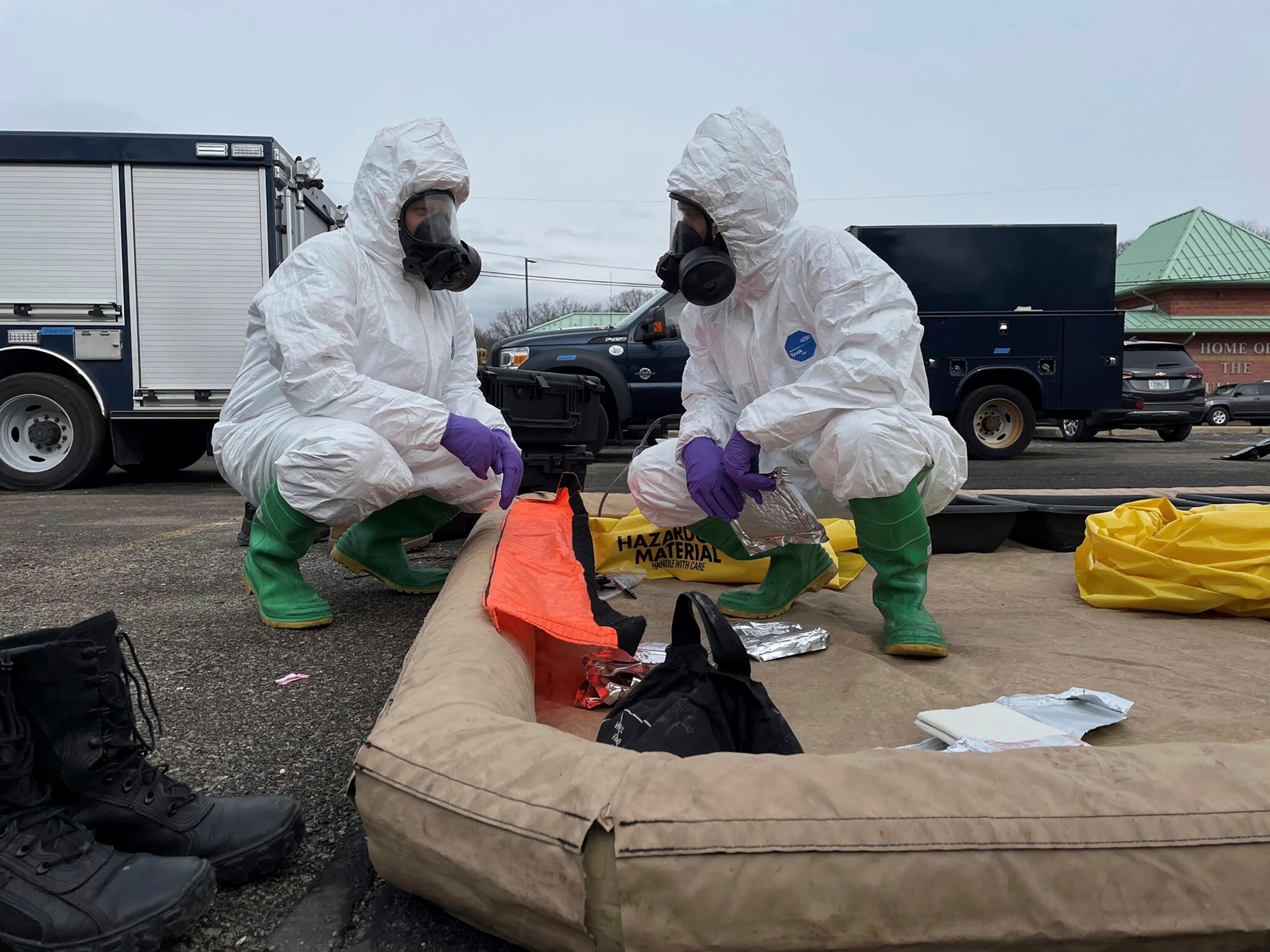

Investigation Reveals Lingering Toxic Chemicals In Buildings Months After Ohio Train Derailment

May 01, 2025

Investigation Reveals Lingering Toxic Chemicals In Buildings Months After Ohio Train Derailment

May 01, 2025 -

Ohio Train Derailment Toxic Chemical Lingering In Buildings

May 01, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings

May 01, 2025 -

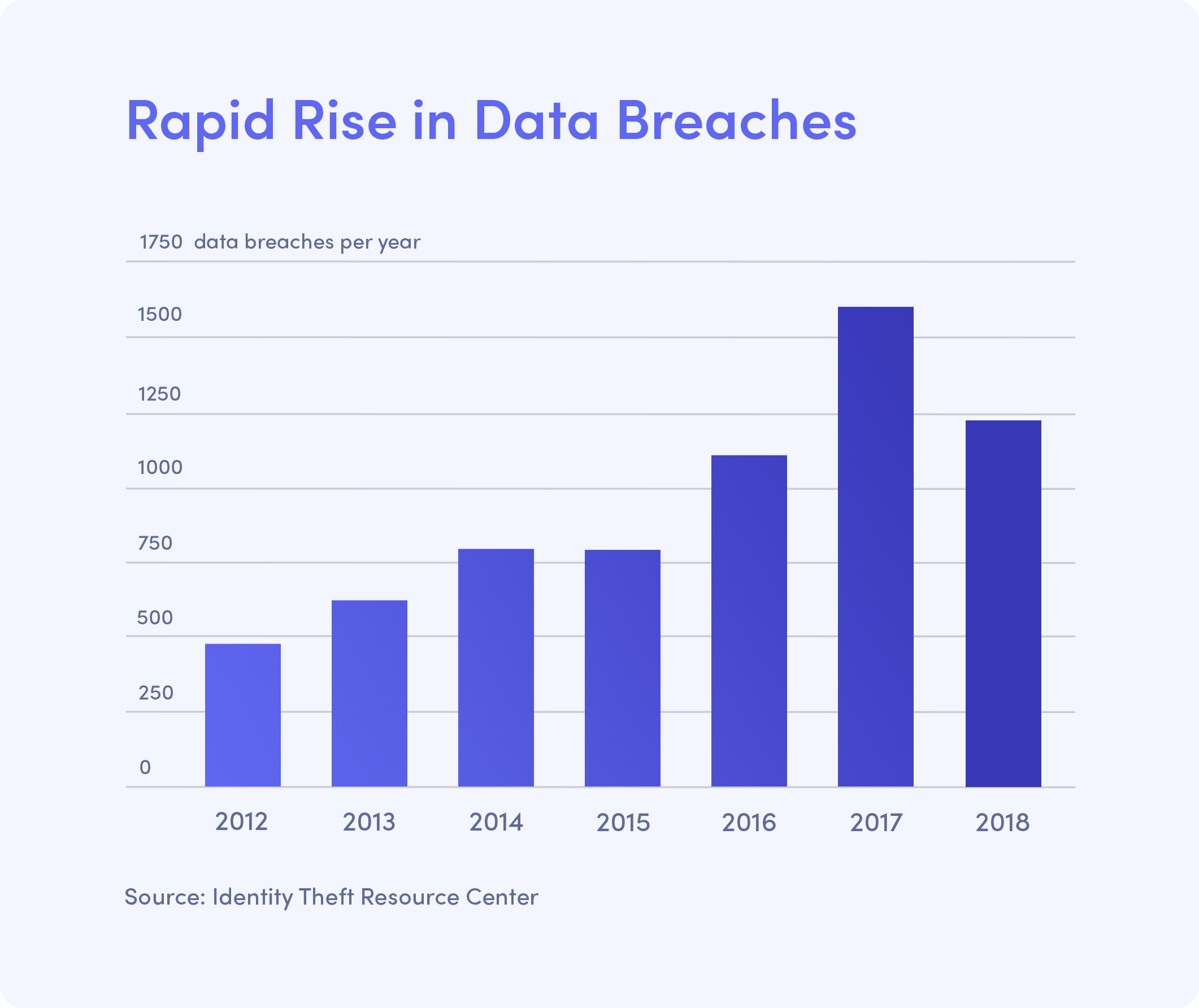

Corporate Email Hack Millions Lost In Office365 Data Breach

May 01, 2025

Corporate Email Hack Millions Lost In Office365 Data Breach

May 01, 2025 -

Office365 Security Breach Leads To Multi Million Dollar Theft

May 01, 2025

Office365 Security Breach Leads To Multi Million Dollar Theft

May 01, 2025 -

Federal Investigation Millions Stolen Via Office365 Executive Email Compromise

May 01, 2025

Federal Investigation Millions Stolen Via Office365 Executive Email Compromise

May 01, 2025